Can The Gold Market’s Uptrend Begin Without The USDX’s Breakdown?

The recent connection between gold, silver, and mining stocks can help predict their next moves. So, given also the USDX’s performance, what is the outlook for the precious metals market?

Based on the comments below yesterday’s regular analysis and on yesterday’s intraday follow-up, you know that yesterday’s post-CPI rally in gold is unlikely to trigger a bigger rally, and it’s much more likely to be one of the final steps in the topping formation.

Here’s how it looks on the charts after the closing bell.

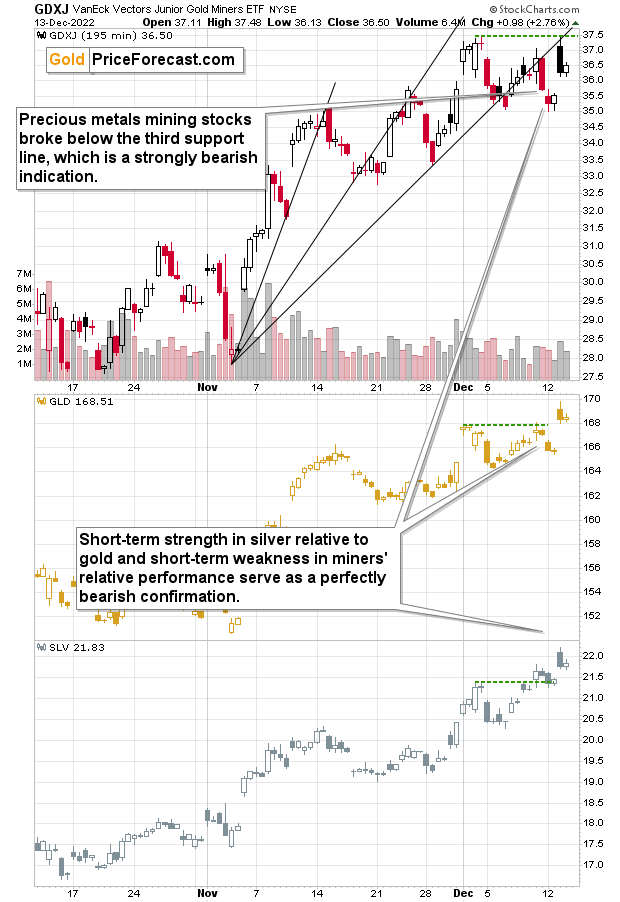

Junior miners tested their previous December high, and then they declined visibly once again. They even moved below the very recent intraday highs.

At the same time, gold moved to new December highs, and silver moved even higher. Precisely, it too moved to new December highs, but in the case of silver, the short-term uptrend is even clearer.

I’ve written quite a lot about what this kind of relative performance implies for the outlook, but I think it would be a good idea to re-state it once again. After all, it's the most difficult to remain calm and analytical at the tops and bottoms—when emotions are at their highest.

On Monday, I wrote the following:

The key thing that you can see above is that the way in which those three parts of the precious metals market behaved on Friday differed considerably.

While gold was more or less neutral, silver moved much higher, while gold miners moved… Visibly lower. In particular, it was the final few hours of Friday’s session (the last candlestick) that made the difference.

If used horizontally, green lines make it easier to compare the most recent performance to the early-December high. And:

- The GLD ended the previous week very close to that high.

- The SLV ended the week above that high.

- The GDXJ ended the week well below that high.

This means that silver was just particularly strong relative to gold, and miners were just particularly weak relative to gold.

Gold miners tend to be early in a given move, while silver prices tend to lag / catch-up in the final parts of the move. That’s what we’ve been able to see in the precious metals market for many years. Naturally, there were exceptions, but the above rule still holds for the majority of the time, especially when it’s both silver-gold and miners-gold links that point to the same thing.

Now, the miners-gold link suggests that a new downtrend is starting, because miners were weak relative to gold to a big extent.

The performance of the silver price, on the other hand, suggests that the rally is coming to an end, as it is clearly playing catch-up.

Yesterday’s price action is a continuation of the above-mentioned indications.

Meanwhile, the USD Index appears to be forming a double-bottom pattern close to its 2016/2017 and 2020 highs.

While it might not be obvious based on the above chart, yesterday’s close in the USDX was higher than the highest daily close in 2016, 2017, and 2020.

There was no important breakdown whatsoever.

And without an important breakdown in the USD Index, there’s little to no reason to think that the precious metals sector has broken higher and that a new uptrend is beginning.

No.

It’s quite the opposite, in my view. The corrective upswings in the markets appear to be ending.

More By This Author:

A Major Top Is Forming, Not Only In Gold

Have Miners Decided Gold’s Next Move?

Will Santa Claus Save Gold From Bearish Prospects?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more