Will Santa Claus Save Gold From Bearish Prospects?

While gold’s sleigh is flying high, is a crash on the horizon?

With so many narratives floating around, bullish seasonality, recession fears and consumer resilience have combined to create a mixed picture on Wall Street. However, with the gold price running well above its fundamental value, investors’ game of hide-and-seek should end in substantial liquidations.

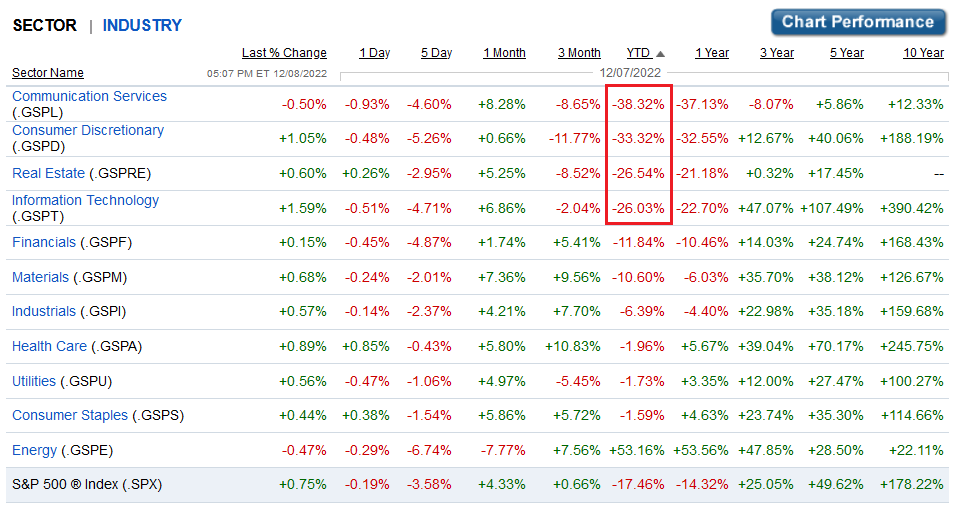

For example, the S&P 500 has fallen by more than 17% in 2022. Yet, the bulk of the decline has been driven by four sectors.

Please see below:

Source: Fidelity

To explain, the red box above shows how communication services, consumer discretionary, real estate and information technology have been the worst-performing S&P 500 sectors year-to-date (YTD). In contrast, financials and materials (where the PMs live) have endured low double-digit declines, while defensive sectors like utilities, consumer staples and health care have fallen modestly.

Now, the four laggards have largely suffered due to higher interest rates, while economically-sensitive sectors like financials, materials, industrials and energy have mostly escaped investors’ wrath. For context, their outperformance is another example of why positioning does not support the ‘imminent recession’ narrative.

But, the important point is that with recession winds poised to grow stronger in late 2023, economically-sensitive sectors should catch up to the laggards and decline substantially.

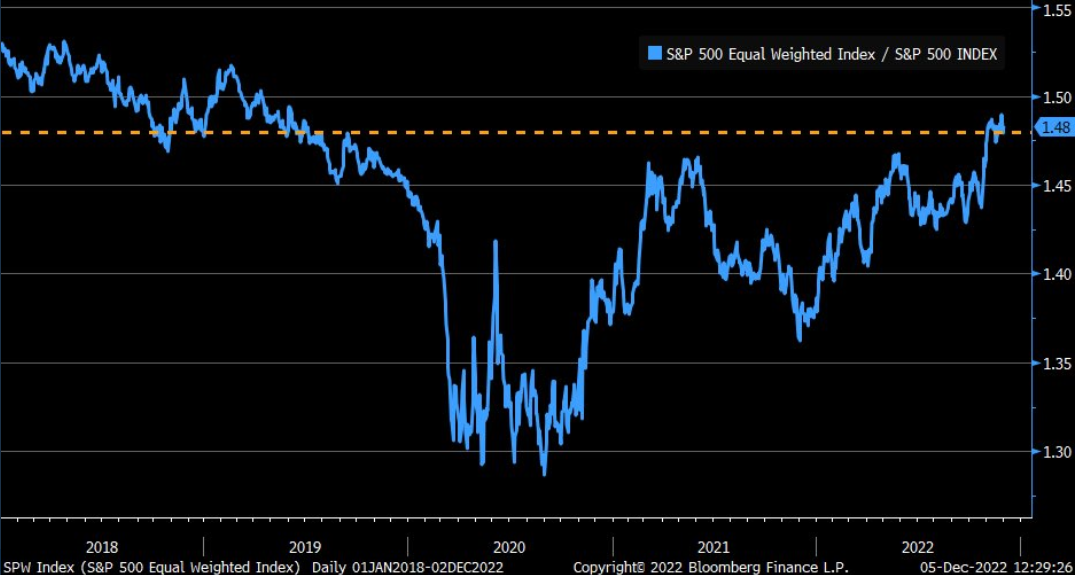

Please see below:

To explain, the S&P 500 is a market-cap-weighted index, so large companies like Apple, Microsoft, Amazon and Alphabet have an outsized influence on the S&P 500’s performance. Conversely, an equal-weighted S&P 500 index assigns the same weight to all companies, so smaller stocks have more say.

Therefore, if you analyze the blue line above, you can see that the S&P 500 equal weight/S&P 500 ratio has rallied sharply recently, and has largely been in an uptrend since mid-2021. This means the average stock is outperforming Big Tech, as investors rotate money into economically-sensitive sectors like financials, materials, industrials and energy.

However, while Big Tech suffered mightily and liquidity-fueled assets like the ARK Innovation ETF (ARKK) and Bitcoin slumped as the U.S. federal funds rate (FFR) rose, the ‘old economy’ stocks should be the next shoe to drop, and a realization is profoundly bearish for gold.

To that point, Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson said on Dec. 8:

“I don’t think there’s as much of a distinction between value and growth at this stage of the economic cycle unless you’re talking about the defensive parts of value [like] utilities and staples and health care.”

More importantly:

“The problem with the value stocks now is they’re probably is just as vulnerable to the economic slowdown as the over-earning growth stocks were six or 12 months ago.”

So, while resilient consumer spending and solid growth have investors hiding out in economically-sensitive sectors, they should suffer the same bearish fate as the pandemic winners. In a nutshell: it’s only a matter of time before the same slowdown that haunted technology stocks comes for financials, materials, industrials and energy. Likewise, while the gold price remains supported right now, that should change materially in the months ahead.

Furthermore, after retracing 38.2% of its preceding decline, the S&P 500 sunk below its late-June high; and combined with a similar development confronting world stocks, the S&P 500’s technical outlook also remains highly bearish. In addition, with the fundamentals and the technicals in sync, the index’s medium-term backdrop is highly ominous.

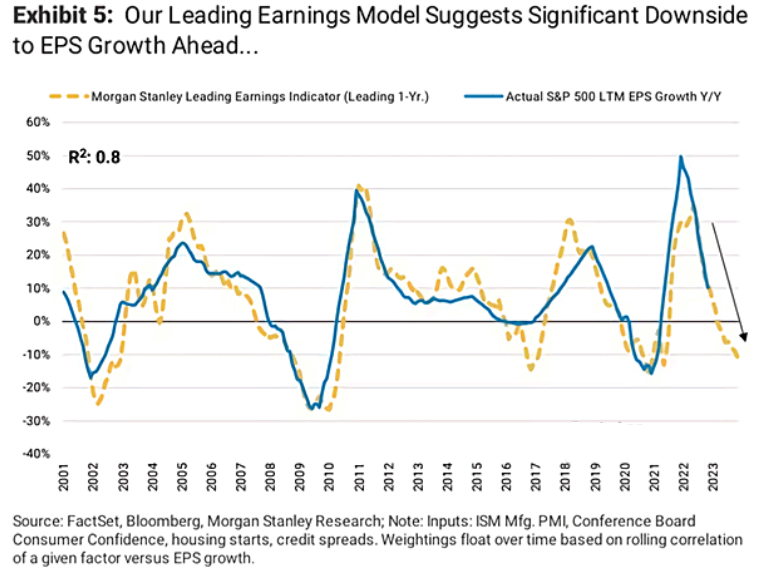

As further evidence, Morgan Stanley’s model predicts “significant downside” to S&P 500 earnings per share (EPS) growth in 2023.

Please see below:

To explain, the blue line above tracks the year-over-year (YoY) percentage change in realized 12-month S&P 500 EPS growth, while the gold dashed line above tracks Morgan Stanley’s model estimate.

If you analyze the relationship, you can see that the pair often move in the same direction, and the gap on the right side of the chart shows how the gold line signals material weakness ahead.

As a result, with the technicals screaming risk off and an earnings recession poised to spook the bulls in 2023, the S&P 500’s suffering should weigh heavily on the gold price.

On top of that, let’s not forget about the bearish ramifications of silver’s outperformance. We’ve noted repeatedly that silver often runs away from gold before major drawdowns occur; and with the white metal correcting 50% of its 2022 decline, its recent outperformance is an important sell signal.

Overall, there are a plethora of bearish indicators supporting lower gold prices. So, while seasonality keeps sentiment uplifted, don’t let the short-term strength cloud your medium-term judgment. As stated previously, every inflation fight since 1954 has ended with a recession, and this bout should be no different.

More By This Author:

Since The Gold Rally Has Stopped, Can A Reversal Be Expected?

Invalidations Across The Market Have Major Implications For Gold

The Gold Market: The Name Of The Game Is Invalidations

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more