The Story About Gold And The Fed’s U-Turn

Image Source: Pixabay

What can happen while investors so stubbornly believe in the Federal Reserve's dovish pivot?

No U-turn.

“Nah, he’s bluffing” – investors were initially overwhelmed by the irresistible urge to ignore the obvious.

It’s been many weeks – months in some cases – since the Fed started not only talking about hawkish action but actually taking it. Each time, investors assumed that it was all just smoke and mirrors. And who can blame them? Over the years, they learned to expect more money, more stimulus, and overall more dovish action, regardless of what happened temporarily.

“Yeah, right!” – investors scoffed.

“We can afford higher hikes, there’s too much debt, the interest payments will be too high, and nobody can afford a mass default.” – they argued in the first hours after Jay spoke.

No U-turn. – The thought echoed again, but nobody paid any attention.

Everyone saw that the Fed decreased the pace at which the rates were increased. It used to be 0.75% per hike previously, and now it’s just 0.5% - isn’t it a sign of the Fed getting dovish?

The markets even confirmed the above narrative. The USD Index declined, while the S&P 500 moved higher – at least initially.

As the closing bell rang, investors still felt confident in their dovish narrative, but deep underneath, they knew that something major had just changed.

The doubts began with “Could it actually be the case that he means, what we say?”, they progressed to “Wait a minute if the rates are to be higher throughout 2023, there really can’t be no dovish U-turn anytime soon – there’s no room for it…” and concluded, “Cutting the rates only after the inflation stabilizes at 2%? We’re nowhere close, it’s a long way up for the interest rates!”.

Investors went to sleep somewhat confused. Some – the most leveraged ones - actually had trouble falling asleep.

When they woke up, they woke up to a new reality.

The USD Index is up.

The S&P 500 futures are down.

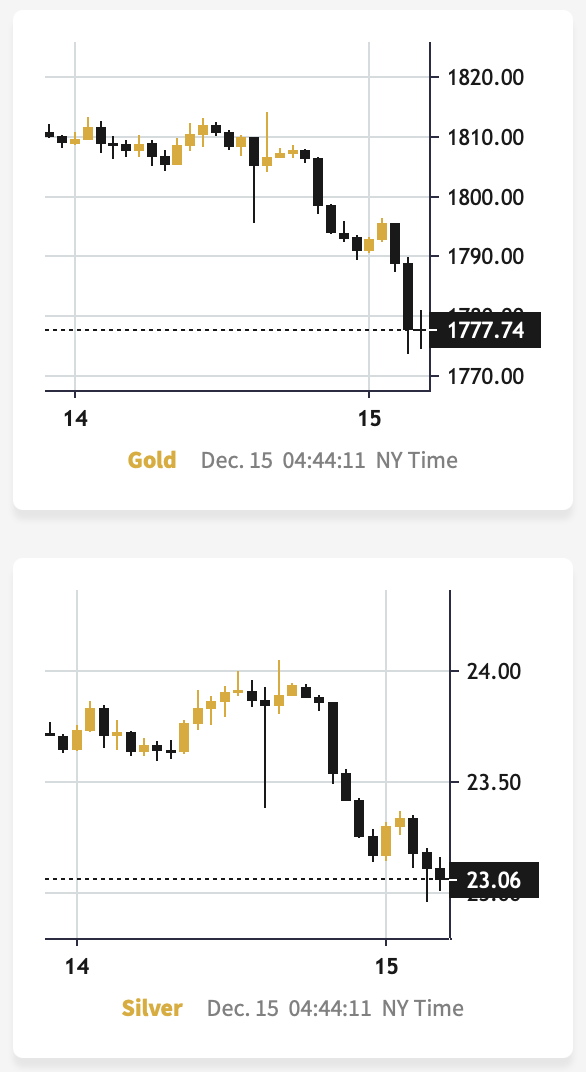

And gold… (chart courtesy by GoldPriceForecast.com).

Gold declined sharply below $1,800, while silver moved below $23 in less than 24 hours after trying to move above $24.

“OMG! It’s happening!” – investors felt as if they woke up not just after a night’s sleep, but after a yearly coma.

The U.S. markets were not open yet, but a quick glance at the GDXJ’s (proxy for junior mining stocks) prices in London trading revealed that the technical indications from the previous days didn’t lie. Juniors were down by more than 4%.

Then reality hit like Chuck Norris’ roundhouse kick.

“There will be no dovish U-turn anytime soon!”

“Wait a minute…” - neuronal connections speed up – “If the Fed is really hiking rates, and they are about to keep it up for the next year AND everyone was actually wrong to expect a U-turn, then…”

As the next thought emerged, some of the investors sharing it could feel the initial signs of characteristic cold sweat.

“Then the markets are really going to tumble big time.”

Suddenly, all previous reasoning for the U-turn started to look different.

“Yeah, the pace of rate hikes might have decreased, but the Fed is still hiking! The business conditions are getting tighter, and there’s no end in sight. There’s nothing dovish or bullish about that!”

Does the extreme level of debt matter? “Well, why can’t the politicians just continue to raise the debt ceiling, just like they’ve done previously? They can, and they will, because that will be the easiest thing to do, and nobody wants to take the blame for triggering the crisis in the country.”

And the interest payments… If things get really bad, they can always tax the rich, tax the imports, or come up with money in all sorts of ways. Sure, many people won’t like it, but many more people don’t like inflation even more. That’s what remains the voters’ top concern, so that’s what will be fought – it’s as simple as that.

Besides, maybe the above would provide The Powers That Be with a great opportunity to move to a gov’t cryptocurrency? You know, when things in the current economic system get bad enough, people will probably meet major changes (like a move to gov’t crypto) with a feeling of relief instead of meeting the decision with torches and pitchforks.

Some investors’ thoughts raced through the above-mentioned points immediately, and some needed more time.

After each realization, sell orders followed for many assets, including commodities, stocks, and gold. As more people woke up to the new reality, the flood of selling pressure intensified. And the pace at which they declined increased…

Some of the above has already happened. Some might have happened. And some might be waiting just around the corner.

How much of the above is fiction, and how much is reality? I’ll leave the decision up to you.

It will be very interesting to see how the story unfolds and is probably extremely profitable for those, who are positioned accordingly before the price moves really pick up.

You have been warned.

More By This Author:

Can The Gold Market’s Uptrend Begin Without The USDX’s Breakdown?A Major Top Is Forming, Not Only In Gold

Have Miners Decided Gold’s Next Move?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more