Gold Is A Precious Metal, Other Times Not So Much - The Business Cycle Helps You Decide - Part 2

< Read Part 1: Gold Is A Precious Metal, Other Times Not So Much - The Business Cycle Helps You Decide

Summary

- Gold is a precious metal.

- Sometimes it acts as a metal.

- This model helps you decide when to invest in it.

On 12/23/2020 I published the article Gold Is A Precious Metal, Other Times Not So Much - The Business Cycle Helps You Decide. The article examined the relationship between the price of gold and the business cycle and other commodities.

Throughout the centuries gold has been the premier investment to protect a portfolio from the ravages of inflation. For this reason, it has been historically considered a store of value.

There are times, however, when gold prices suffer a prolonged decline. The above chart shows gold prices going from 2007 to March 2020. Gold moved from $600 to $1,900 from 2007 to 2012. It stands below $1,700 as of this writing (March 17, 2021). Gold did not show any appreciation for more than 9 years. This performance challenges the concept of gold as a store of value.

The concept of store of values is further challenged by the performance of gold compared to the S&P 500. The above chart shows the relative performance computed as the ratio of gold prices to SPY. The decline in the lines in the graph says SPY has outperformed gold from 2012 to 2020. Gold has outperformed SPY – the lines in the graph were rising – from 2009 to 2012.

The point I am trying to make is investing in gold is not as easy as reported by the passionate and often biased sponsors of the metal. And it does not necessarily outperform the S&P 500 all the times. Gold, however, has an interesting and possibly profitable pattern when compared to other metals.

There are times gold is a good investment. Other times investors should accept the idea it is not. Gold is a commodity – a metal. In the article mentioned above I showed how the price of gold has some distinguishable cyclical and profitable patterns when compared to other metals.

The business cycle drives the investment opportunity in gold and greatly improves the returns of an investment portfolio. The business cycle drives the timing of the strategy. The business cycle is the outcome of business decisions focused on meeting demand for their goods. To do so, manufacturers must make sure there is enough inventory to meet the demand for their products.

When demand is improving business must purchase raw materials, hire workers, and increase borrowing to organize the process of producing more goods. The increased income is followed by higher demand which forces business to increase the purchases of raw materials, to hire more workers, and raising more capital. This positive feedback eventually places upward pressure on commodities, wages, and interest rates.

There is a point when this positive momentum of the business cycle is reversed. The strong economy forces inflation to rise and reduces consumers’ purchasing power. At first business managers do not recognize the business cycle has peaked and continue to ramp up production.

Eventually inventories are too high, and they begin to affect profits. This is the time when production is cut. Purchases of raw materials are slashed, workers are laid off, and borrowing is reduced. The business cycle slows down until inventories are brought in line with sales and profitability stabilizes. In the meantime, commodity prices decline, wages slow down, interest rates head lower, and inflation subsides.

This is the time when purchasing power improves and consumers’ demand rises. Managers are forced to increase production to replenish inventories and the business cycle starts all over again.

During the phase of the business cycle investors should expect rising commodities, rising inflation, and rising interest rates. During the slowdown phase of the business cycle commodities, inflation, and yields decline.

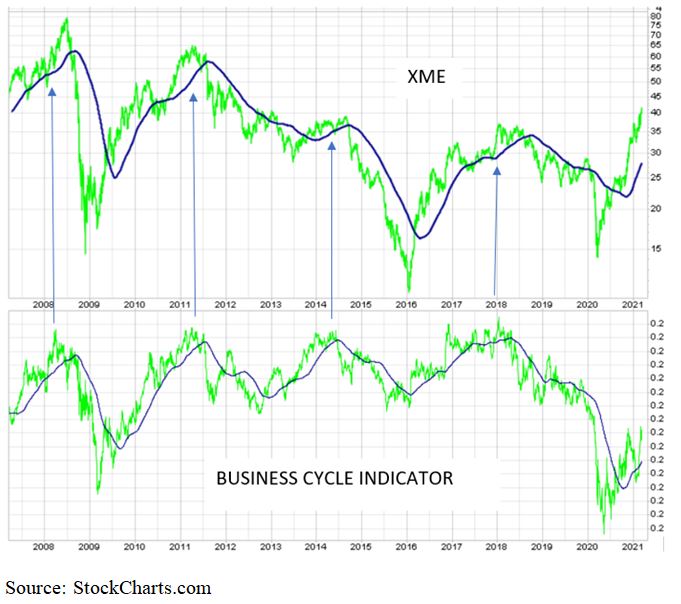

The above chart shows in the upper panel the price of the metals and mining ETF (XME) with its 200-day moving average. The lower panel shows the business cycle indicator as updated in each issue of The Peter Dag Portfolio Strategy and Management (a complementary subscription is available to readers of this article at peterdag.com).

As discussed in detail in my article “The Inventory Cycle - Boring But Important Market Setter,” the main reason for this relationship is commodities depend on the purchasing activity of raw materials as business attempts to control inventory levels in a rising or weakening economic environment.

The relationship between XME and the business cycle indicator reflects the strengthening of the economy and the decisions of business managers to replenish inventories. Commodity prices rise or decline depending on whether the business cycle rises or declines. For this reason, XME, a commodity sensitive ETF, rises when the business cycle indicator rises. XME declines when the business cycle indicator declines.

What is particularly interesting is when gold is compared to other metals it has very specific turning points closely related to the turning points of the business cycle indicator.

My article published on 12/23/2020 showed XME outperforms gold when the business cycle rises and the economy strengthens. What has been happening since then has followed the historical pattern.

This approach tells you whether you should own gold or XME – a basket of metals and mining stocks.

The above chart shows a remarkably interesting pattern. The upper panel shows the ratio XME to gold prices. The lower panel shows our real-time business cycle indicator.

The relationship between the two sets of indicators suggests investors should buy XME when the economy strengthens, and our business cycle indicator rises. The reason is the rising line reflecting the ratio XME/Gold is moving up. Note how XME has outperformed gold since early 2020 when the business cycle started rising.

Gold, however, outperforms XME as a defensive play when the economy slows down and our business cycle indicator declines. During such times, the ratio XME/Gold declines reflecting the weakness of XME relative to gold prices.

Key takeaways

Gold has cyclical patterns which become clear when its price is compared to the price of other metal commodities.

Gold, furthermore, is particularly attractive compared to other commodities when the economy slows down.

The model published on 12/23/2020 correctly suggested XME would outperform gold as long as the business cycle rises, reflecting a strengthening economy.

Subscribe to The Peter Dag Portfolio Newsletter by clicking here.

Good read, thanks.

I am pleased you liked it. Thank you. Reminder: Complimentary subscription available on www.peterdag.com

Interesting and a bit contrary to most gold bugs who tend to discuss gold as a hedge against inflation and currencies rather than as an investment in a commodity such as copper, silver, wheat or soybeans.

Thank you!. Most commodities move in the same direction at the same time becasue of the effect of the business cycle. Reminder: Complimentary subscription available on www.peterdag.com