The Inventory Cycle - Boring But Important Market Setter

Summary

- Government and Fed stimulus may help to keep business going.

- But what is on the shelves has immediate impact on the markets.

- Inventory trends …boring but profitable for money managers.

More than 100 years of British economic thinking was turned upside down by Keynes in early 1900. Until then it was believed production created demand and wealth. Keynes proposed it is government spending that stimulates the economy. I am oversimplifying but this is the jest of the issue.

In my article “Yields, Economic Growth, And Stock Prices – A New World For Investors” I discussed the huge problems created by Keynes’ ideas. They are the main reason behind aggressive government spending and a deluge of debt.

In this article I review how decisions made to manage the manufacturing process have major consequences for investors. These decisions show the business cycle is alive and well and cannot be repealed despite Keynes ideas.

The reason is the business cycle is the result of myriads of decisions made by business managers. They drive the business cycle. In fact, they all make the same decisions at the same time, considering the perfect correlation between the global business cycles (see my article “Investing In Foreign Markets Sounds Exciting – But Isn’t Always”).

Stimulus programs designed to stimulate demand may be useful in the near term. But eventually it is the business managers who must produce the goods needed by consumers and deliver them to the marketplace at a profit.

Governments and central banks create distortions to favor specific segments of the population or industries. Business managers must deal with these distortions and must figure out what to do about them. The bottom line is they must run a business and make money if they want to survive.

The decision to have the right level of inventories seems to be the most relevant decision having important consequences for the financial markets. Let me explain.

At the end of a slowdown period or recession, inventory levels are cut to the bone. When business worsens, most businessmen (and investors) become very conservative even if sales manage to expand albeit at a slow pace.

It is this mismatch of inventories compared to sales that triggers a bottom in the business cycle and a new pickup in growth. Do the markets agree with this narrative? Let’s look at what happened during the most recent business/inventory cycle going from 2016 to now.

The economy went through a period of strengthening from 2016 to 2018. Beginning in mid-2018 business activity slowed down until March 2020. Business activity picked up again in March 2020. I have documented in detail these events in my The Peter Dag Portfolio.

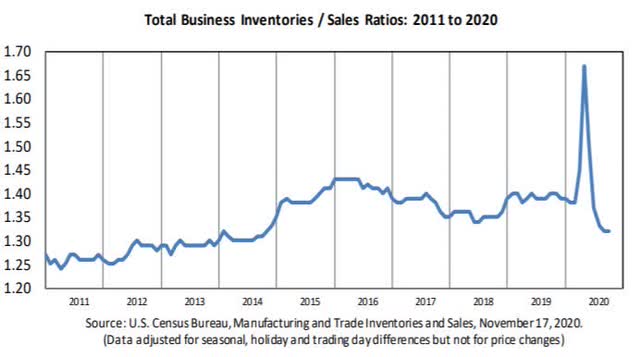

The inventory-to-sales ratio published monthly by the Bureau of Labor Statistics provides all the information one needs to know about how business is reacting to the most recent developments (see graph).

The decline in the I/S ratio beginning in 2016 was triggered by sales growing faster than inventories. This was a good sign because business managers realized they had to increase output to build-up inventories in line with the growth in sales.

The economy started to slow down in 2018. The rise of the inventory/sales ratio meant inventories were rising too rapidly compared to sales. Business had to reduce production to cut costs. But cutting costs means hiring fewer workers (income), buying less raw materials and energy, and borrowing less. The slowdown continued until inventories were cut too much relative to current sales.

In March 2020, the I/S ratio started to decline. This decline reflected sales rising faster than inventories. Business responded in the same way as it did in 2016 – orders and production had to increase to replenish depleted inventories. The alternative was to miss sales because of inadequate inventories relative to demand.

To do so more people had to be hired, more raw materials had to be purchased, and more money had to be borrowed. It should not come as a surprise, therefore, to see commodities and commodity sensitive sectors strengthen and outperform the market.

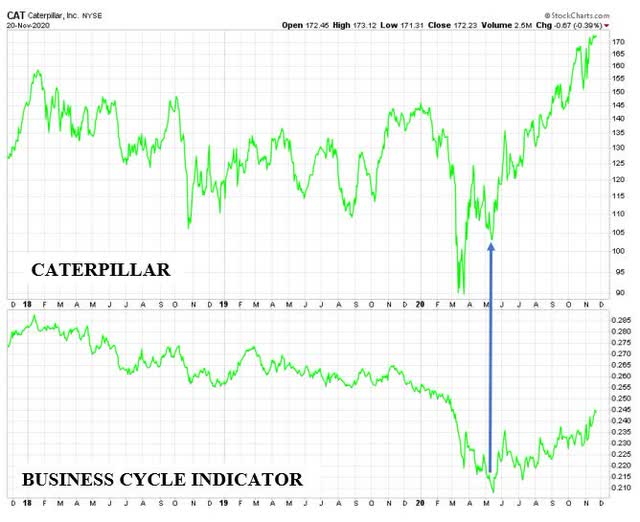

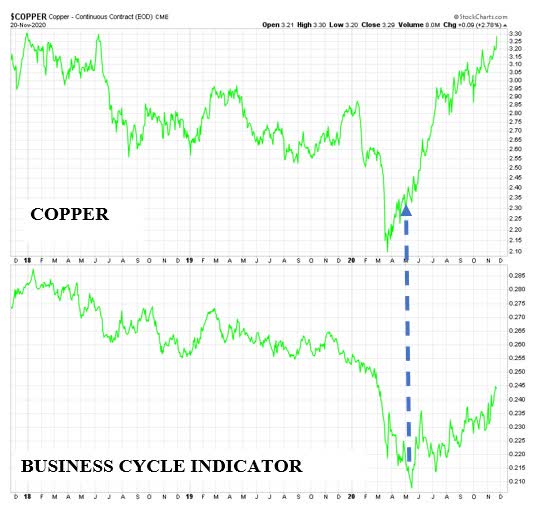

These trends are confirmed by the rise in our proprietary business cycle indicator. Its decline was accompanied by weak copper prices from 2018 to March 2020. Beginning in March 2020, copper prices rose when our business cycle indicator increased to reflect a strengthening economy. The time to worry about the trend of commodities and commodity sensitive stocks is when our proprietary business cycle indicator starts to decline as it did in 2018.

The bottom line is the inventory cycle is a major force behind the business cycle and it drives the price of commodities (XLB, XME) and commodity sensitive stocks such as Caterpillar (CAT) or Freeport-McMoRan (FCX). It should be noted they all have been outperforming the S&P 500 since March 2020 - which is the important strategic message of the inventory cycle.

Subscribe to The Peter Dag Portfolio Newsletter by clicking here.