Gold Is A Precious Metal, Other Times Not So Much - The Business Cycle Helps You Decide

Summary

- Gold has a historical mystical halo as a store of value.

- But it must be timed correctly to make money.

- A successful approach is to think of it as a commodity.

This article wants to show the price of gold has some distinguishable cyclical and profitable patterns when compared to other metals.

The above chart shows gold prices going from 2007 to recently. Gold moved from $600 to $1,900 from 2007 to 2012. It stands at $1900 as of this writing in December 2020, showing no gains since 2011 – for 9 long years.

As an investment gold has outperformed the S&P 500 until 2011. However, as shown in the chart below, it has underperformed the market average since 2011. (The chart shows the ratio of the ETFs GLD and SPY.)

The point I am trying to make is gold does not necessarily outperform the S&P 500 all the time. Gold, however, has an interesting and possibly profitable pattern when compared to other metals.

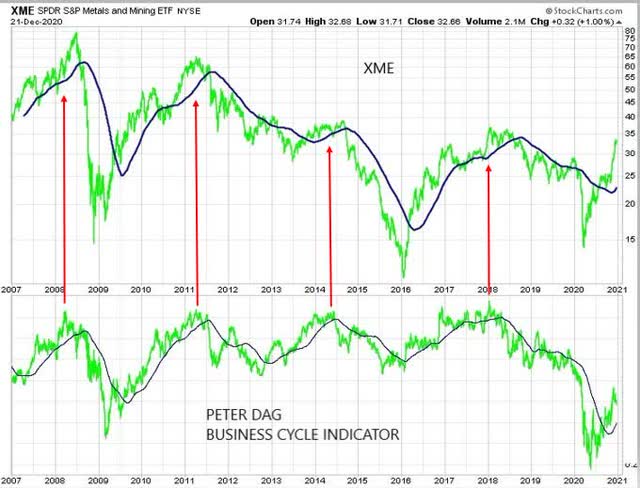

Metal stocks or commodities do not have a price pattern like gold as shown in the above chart (upper panel). The metals and mining stocks ETF (XME) strengthens when the business cycle rises as shown in the above chart. It declines when the business cycle indicator declines – a proprietary indicator published regularly in The Peter Dag Portfolio Strategy and Management.

As discussed in detail in my article “The Inventory Cycle - Boring But Important Market Setter,” the main reason for this relationship is commodities depend on the purchasing activity of raw materials as business attempts to control inventory levels in a rising or weakening economic environment.

What is particularly interesting is when gold is compared to other metals it has very specific turning points closely related to the turning points of the business cycle indicator.

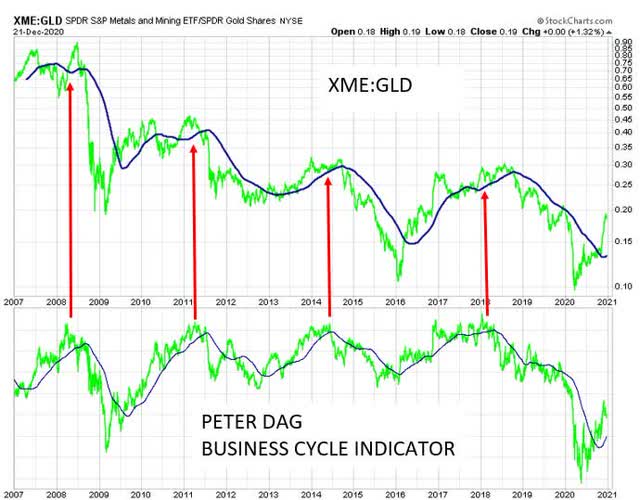

This approach tells you whether you should own gold or XME – a basket of metals and mining stocks.

The above chart shows a remarkably interesting pattern. The upper panel shows the ratio XME to gold prices. The lower panel shows our real-time business cycle indicator.

The relationship between the two sets of indicators suggests investors should be invested more in XME when the economy strengthens, and our business cycle indicator rises. Gold, however, outperforms XME as a defensive play when the economy slows down and our business cycle indicator declines.

The point. Gold has cyclical patterns which become clear when its price is compared to the price of other metal commodities. Gold, furthermore, is particularly attractive compared to other commodities when the economy slows down.

The objective of the article has been to show a portfolio allocation/strategy between gold and other metals such as XME depending on the pattern of the business cycle. At this particular point of the business cycle, for instance, XME has been outperforming gold according to what indicated by past history.

< Read Part 2: Gold Is A Precious Metal, Other Times Not So Much - The Business Cycle Helps You Decide - Part 2

Subscribe to The Peter Dag Portfolio Newsletter by clicking here.