Gold: A Way To Optimize Your Savings

Image Source: Pixabay

If gold were a stock, it would be the world's largest market capitalization, with the highest trading volume!

Gold is world-renowned for its physical properties, but it is also in great demand for its financial qualities. Most of the world's major asset managers and central banks hold gold, while a large proportion of the public remains unaware of the benefits of the golden metal. In financial theory, gold appears to be indispensable for portfolio diversification. However, its appeals varies from person to person.

So, how much gold should you have in your portfolio? 5%, 10%, 15%, 20% or even 40%? Do the massive gold purchases by central banks and other investors confirm the benefits of owning gold?

Gold, a unique asset

What is the advantage of owning an asset that provides no rent, interest or dividends? Unlike many investments, gold is defined by its extreme simplicity, which makes it a legal and financial asset.

Unlike shares or financial investments, gold has no counterparty. In other words, it cannot go bankrupt or default. What's more, unlike real estate or many other investments, gold is not subject to depreciation, i.e. it doesn't require expenditure to refurbish or replace.

Gold is therefore independent of the financial and political system. What's more, gold is liquid and internationally recognized, as it can be easily traded in any country. The chart above shows that gold is more widely traded than short-term US Treasury bonds. Gold is also an asset that is not affected by geopolitical tensions or wars. The golden metal generally tends to benefit from crises...

Finally, gold's high value makes it easy to hold or store. Several tens of thousands of euros fit into a single pocket of clothing... As a result, gold is a singular asset in the culture of different countries and in the financial system. Gold is even the “first asset” of central banks, whose gold purchases and stocks roughly follow the expansion of their balance sheets.

Managers who own gold

In 2023, a dozen international money managers clearly stated their intention to maintain or increase their exposure to gold. A major reason for this is that portfolios traditionally exposed to equities and bonds have become less attractive. Numerous managers, both financial and billionaire, hold gold and seem to be accentuating this strategy in recent years. These include, for example:

- Ray Dalio: Bridgewater's Pure Alpha fund has allocations to gold, although the specific proportion may vary over time depending on market conditions. Ray Dalio generally recommends a portfolio exposure of between 5% and 10% to gold.

- Jim Simons: Renaissance Technologies, known for its quantitative approach, has included gold in its diversified portfolio, although the exact proportion is part of its proprietary strategy. Jim Simons, who died recently, was famous as one of the most successful managers in the history of finance.

- Paul Tudor Jones: The billionaire is known for allocating a significant portion of his portfolio to gold, particularly in times of economic uncertainty and inflationary concerns.

- John Paulson: The American billionaire is known to have made his fortune during the 2007 crisis and to have held significant positions in gold, particularly after the 2008 financial crisis.

Gold's protective qualities are another reason why top financiers are interested in it. Indeed, gold is also an anti-crisis tool, as its price generally tends to rise when panic grips the financial system. Gold performed from +5% to +50% during the crash of 1987, the Kuwait-Iraq war in 1990, the internet bubble in 2000, the financial crisis from 2007 to 2009, and most recently during COVID. This considerable capacity to protect portfolios makes gold less risky in the long term than most other assets. What's more, its attractive returns linked to rising prices make gold one of the assets with the best risk/return ratio.

The benefits of gold in your portfolio

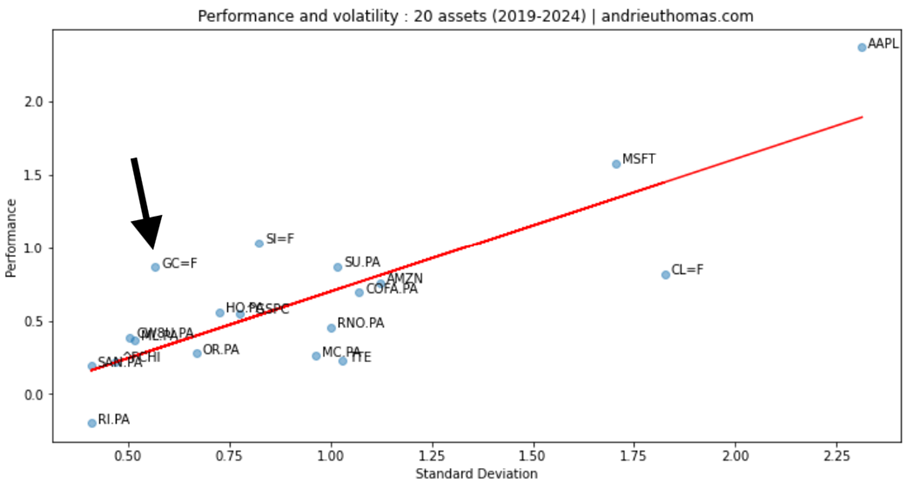

Gold is sometimes shunned by investors who see no “interest” in the eternal metal. Nevertheless, the most elementary financial theory clearly shows the optimal nature of gold in a portfolio. Historically, gold's performance has been quite decent for a generally limited risk. The chart below shows the performance of various assets from 2019 to 2024 in relation to the level of risk (volatility). In this chart, a point at the top left is said to be optimal, as it achieves higher performance for lower risk.

This chart includes most assets, such as the MSCI world index (“CW8” on the chart), high-performing French and US equities (such as Apple, Microsoft, Amazon, etc.), as well as gold (“GC=F”) and silver (“SI=F”). Gold appears to have been the most “optimal” asset over the last five years, with a performance of almost 100% for a risk that is only slightly higher than that of the MSCI world, for example. Silver also appears to be an optimal asset in recent years, but the associated risk is greater.

All in all, gold is one of the assets with the best risk/return trade-off compared to most stock market indices or high-performing US tech stocks. Even NVIDIA, which significantly outperforms almost all global equities, has a risk/return close to the red line on the chart. This means that gold has been more optimal than stocks like Nvidia in recent years for a financial portfolio.

In other words, gold, (but also silver), is the best-performing asset, thanks to its low risk, which stabilizes the portfolio. What's more, gold's lower correlation with most assets makes it particularly interesting from a portfolio diversification point of view, providing at least as much return for less risk. This dual quality of gold's risk/return optimality, combined with its low dependence on other markets, makes it a central asset in the financial world.

How much gold should be part of your wealth?

Financial theory teaches us that gold is “optimal”. It would therefore be easy for an investor to deduce that he should expose his entire wealth to gold. Nevertheless, gold goes through bullish and bearish phases, which can affect an investor in need of liquidity at the wrong time. What's more, many other high-risk stocks can deliver higher returns. As a result, gold is seen primarily as a means of diversification.

The need to have gold in the portfolio will not be the same for the investor who is fully exposed to real estate, or one who is fully exposed to technology stocks or even cryptocurrencies.

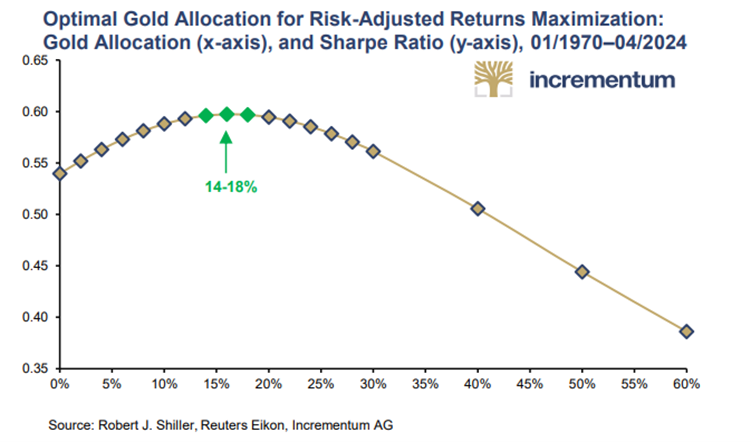

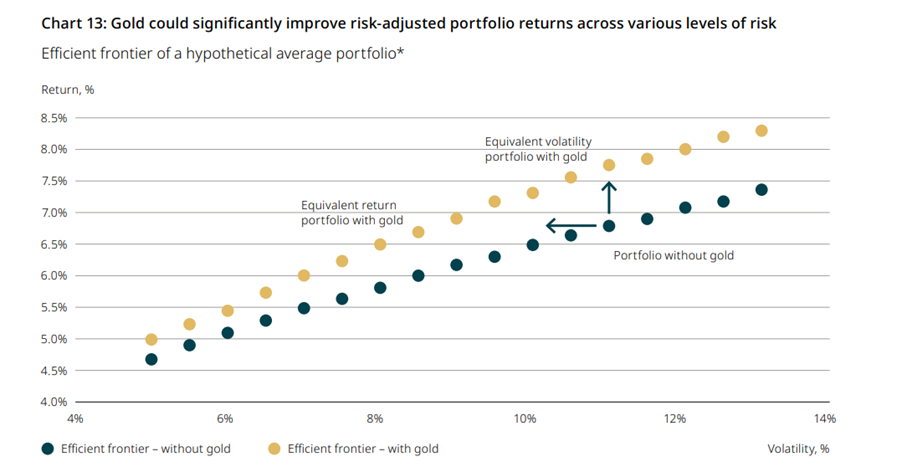

According to the World Gold Council, for a traditional financial portfolio with about half exposure to bonds and equities, “the estimated optimal allocation to gold for the investor with a portfolio duration of 10 years is around 13%. Investors with a higher tolerance for interest rate risk may find greater diversification benefits in gold than investors with lower duration portfolios [...] The range of gold allocations suggested in studies is between 10% and 19%, depending on the investment period and the other assets held in the portfolio”.

Nevertheless, this proportion of gold is the one that maximizes portfolio performance while reducing risk. It is also possible to use gold solely to maximize performance, which entails higher risks. However, a very long-term investor who is relatively optimistic about the gold price trend should rationally increase the proportion of gold in his portfolio, up to 40% according to the World Gold Council. Such a high proportion of gold in the portfolio would, however, lead to portfolio underperformance if the price of gold were to fall sharply.

It's worth noting that gold has outperformed bonds by almost 6.5% a year since the end of the gold standard, and is almost equivalent to equities. All in all, for a risky and fairly volatile portfolio (around 15%), including just 5% gold in a traditional financial portfolio can gain up to two performance points a year. That's almost 50% extra performance over twenty years.

How much gold should the average French buy?

For most French people, savings boil down to money “sleeping” on current accounts, passbook savings accounts or life insurance policies. What's more, unpaid current account savings are directly exposed to the risk of inflation. In the space of a few decades, these savings are subject to the risk of almost total annihilation of purchasing power. What's more, a large proportion of French people's wealth is concentrated in real estate, for immediate housing needs, investments or even second homes.

In 2021, median gross wealth was close to €200,000 per French person. It's also worth noting that the French will have €6.185 trillion in financial savings by 2023, according to the Banque de France. This represents more than €90,000 in financial savings per French person on average. However, it appears that these financial savings are largely sub-optimal, and consequently misdirected.

French financial investments are largely concentrated in fixed-income products (60%), a large proportion of which is represented by bank deposits (21.5%), as well as euro-fund life insurance and retirement savings (24% of the total). The remaining 40% is made up of equities and unit-linked life insurance. As we can see, the savings profile of the French corresponds to a traditional portfolio made up of 60% fixed-income products and 40% equities. At the same time, however, less than 4% of French financial savings are held in gold. The French financial portfolio is therefore clearly sub-optimal.

What's more, if we consider real estate as a fixed-rate investment (rent) with a net yield close to 4%, for example, then the French would need to hold even more gold than financial savings simply suggest. Assuming a 15% allocation to gold, with a gross wealth of almost €200,000, each French citizen would need to hold almost €30,000 in gold, or the equivalent of a 500-gram bar today. Even from the point of view of financial savings alone, a 15% allocation would imply an investment of almost €14,000 in gold for each French person.

Conclusion

If gold were a share, it would be the world's leading stock. But unlike equities, real estate or bonds, the precious metal is unaffected by the risk of default or bankruptcy. Gold appears to be an investment without counterparty, capable of offsetting economic and political risks. This liquid asset is widely favored by many asset managers and billionaires.

In effect, gold appears to be a quasi-indispensable portfolio asset. In fact, it is more optimal than most stock market indices and global equities. In other words, gold delivers a relatively high return for its level of risk. This unique characteristic of gold makes it a central tool in portfolio management, in addition to its low correlation to other indices, which makes it a diversification tool.

In traditional finance, financial theory suggests that the ideal proportion of gold is probably between 10% and 20%. What's more, an investor confident about the dynamics of the gold price, and with a very long-term exposure, could find an optimal allocation of up to 40% gold in his portfolio. Financial theory therefore suggests a clear trade-off in favor of gold.

Finally, the French appear to be largely underexposed to the eternal metal. While most central banks are buying gold, private individuals are struggling to change their financial behavior. For the average French person, €10,000 to €40,000 in gold appears to be a theoretically optimal allocation for a traditional portfolio. The French, despite being among the richest countries in gold per capita, probably don't have enough gold in their portfolios.

More By This Author:

What Will Trigger The Second Phase Of Inflation?

Money Printing Contributes To Growing Inequalities

Gold Beats New Records As US Bankruptcies Rise

Disclosure: GoldBroker.com, all rights reserved.