Money Printing Contributes To Growing Inequalities

Image Source: Pexels

Monetary printing has been part of the financial landscape for several decades now. Quantitative easing (QE), commonly known as the "printing press", has been an essential tool for central banks to stabilize the economy in times of crisis. However, its impact on economic inequality is increasingly being debated. We will analyze how money printing can exacerbate wealth and income inequalities, and how to get back in the game legitimately.

How does quantitative easing work?

Quantitative easing involves a central bank buying financial assets, mainly government bonds and asset-backed securities, to inject money directly into the economy.

This policy aims to lower long-term interest rates, stimulate investment and consumption, and thus support economic growth.

One of the most recent examples was the Covid crisis in 2020, which paralyzed the global economy for several months. To kick-start economic activity, the world's leading central banks injected money.

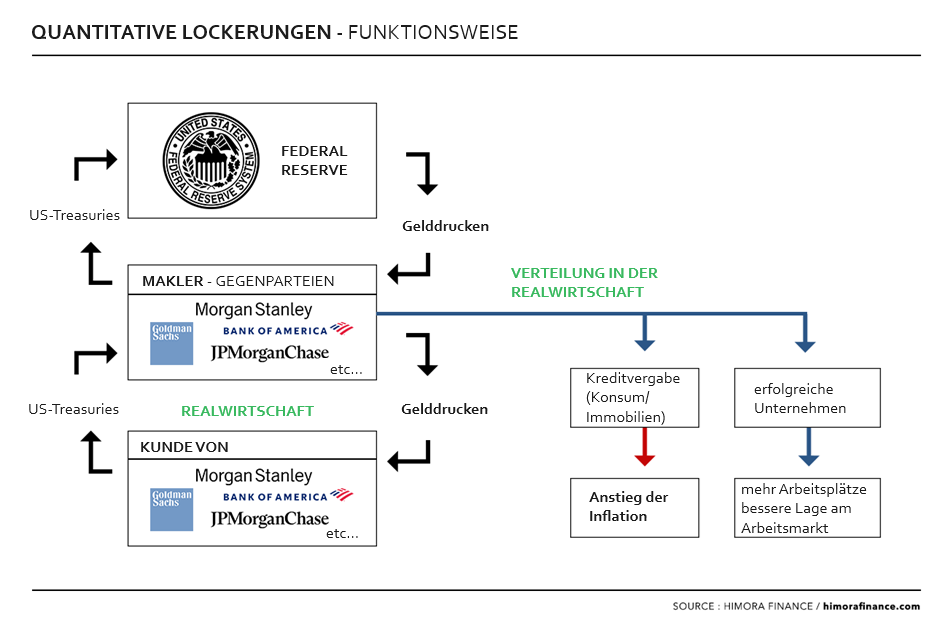

How it works is quite simple:

- Quantitative Easing (QE) is a monetary policy in which the Federal Reserve (Fed) and the US Treasury expand their balance sheets by creating assets and liabilities out of thin air.

- The Treasury issues securities (Treasuries) which it sells at regular auctions.

- These securities are purchased by primary dealers using bank reserves.

- The Fed then buys these securities from primary dealers by creating new bank reserves, thereby increasing its assets (the securities) and liabilities (the bank reserves).

- This injects liquidity into the financial system, lowers interest rates and stimulates the economy by encouraging borrowing and investment.

Here is an explanatory infographic:

Infographic explaining how QE works

This infographic explains how a seemingly simple system (the money printing press) works, but is in fact far more complex than our collective consciousness might imagine.

Our system is currently based on debt-money, which allows money flows to circulate and stimulate investment, but has many perverse effects for the less well-off social classes.

The impact of quantitative easing (QE) on inflation

The increase in the quantity of money on the market contributes negatively to the scarcity effect: the more abundantly a good is issued, the more its value falls. This law applies to any object or financial security, including currencies, the supply of which has risen sharply since the Covid crisis in 2020 to prevent the economy from remaining in recession for too long.

We observed during the Covid crisis that monetary injection leads to relatively abrupt demand shocks, with the obvious effect of inevitably boosting inflation.

Why does QE accentuate inequality?

Unfortunately, money printing is not without consequences. While they stabilize the economy in the short term, they also accentuate inequality.

Despite the objectives of supporting the real economy, the injection of liquidity via QE does not necessarily translate into a proportional increase in wages.

In effect, asset price inflation does not directly lead to higher wages, particularly for low-skilled jobs.

As a result, middle and lower class workers may see their purchasing power stagnate or decline in real terms, while holders of financial assets, such as stocks or gold, see their wealth increase. From March 2020 to October 2021, the wealth of France's big money jumped by 86%, representing a gain of 236 billion euros, more than has been accumulated in 10 years.

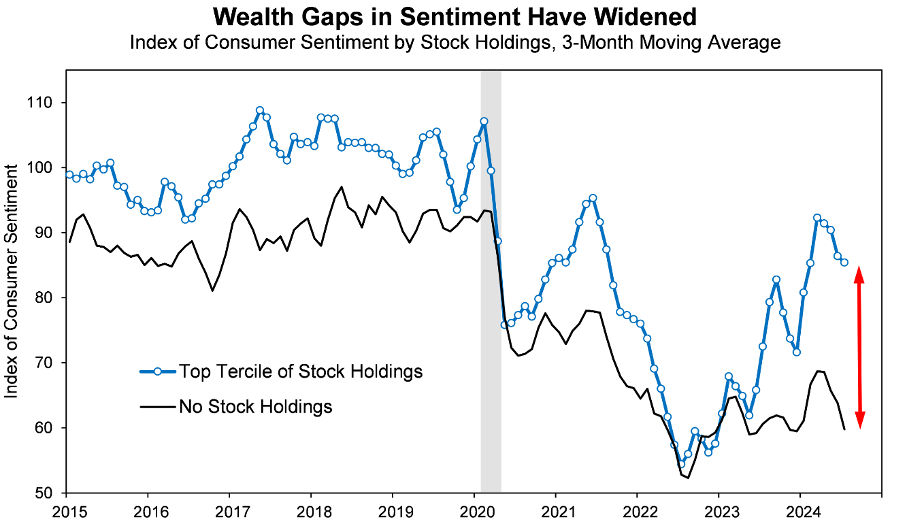

In fact, the wealthiest households are benefiting most from the effects of QE, due to their greater exposure to stock markets.

Households owning stocks or physical gold are seeing the value of their assets rise, while those relying mainly on income from work are seeing only a slight improvement in their financial situation. They are often the victims of the negative effects of QE, notably rising inflation.

According to the University of Michigan, consumers who own top-tertile stocks have seen their confidence rise by 71% since June 2022, while those who don't have seen only an 11% increase.

Conclusion

QEs tend to accentuate inequalities, as many households do not have the opportunity to benefit from the capital income generated by financial markets or high-performance assets such as gold.

The only solution for a modest household to counteract these inequalities is to gradually build up wealth through equities, bonds and precious metals, which represent an interesting and particularly high-performing alternative.

Inequalities will continue to grow, in a context where central banks are making increasing use of these monetary policy tools.

More By This Author:

Gold Beats New Records As US Bankruptcies RiseAI Confirms That Gold Is A Good Investment

The Worrying Chinese Slowdown

Disclosure: GoldBroker.com, all rights reserved.