What Will Trigger The Second Phase Of Inflation?

Two months ago, I wrote that the entry of the United States into recession would be difficult to anticipate: “The entry of the United States into recession is likely to be much less predictable if one refers solely to the analysis of employment figures.”

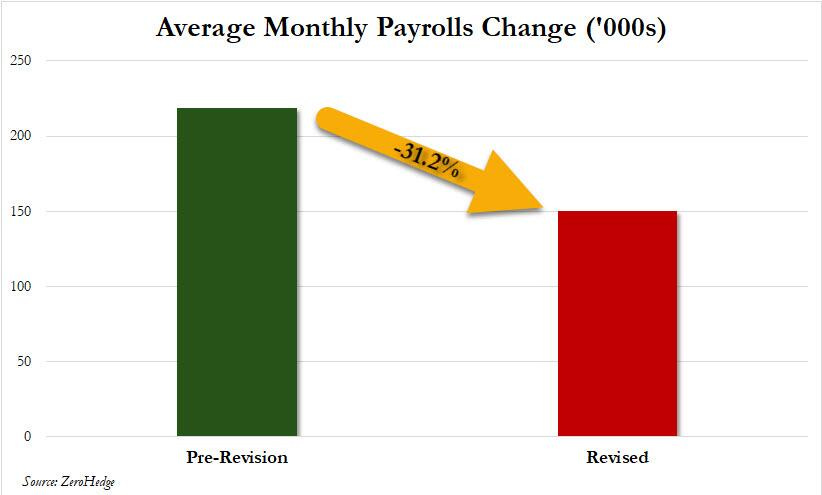

I never would have imagined that these employment figures would be revised to such an extent!

In March, when the majority of economists were still trusting the data published by the Bureau of Labor Statistics under the Biden administration, analyses revealed that the actual employment figures were overstated by at least 800,000 jobs. Recent revisions confirm this overestimation, particularly in high-paying sectors such as professional services, leisure and manufacturing.

This manipulation of the figures was intended to present an economy stronger than it actually was, thereby distorting public perception. In truth, job growth in 2023 was much more modest than initially announced. This revision of the figures is the second largest in American history!

The imprecision of US employment figures adds a further difficulty to the analysis of the real economic situation.

Under these conditions, how much credence can we give to the next employment report due next week? Should we expect a further revision of the figures?

Inflation figures could also be manipulated in the run-up to a crucial US election.

However, all the indicators pointing to the start of a new inflationary phase are in the green.

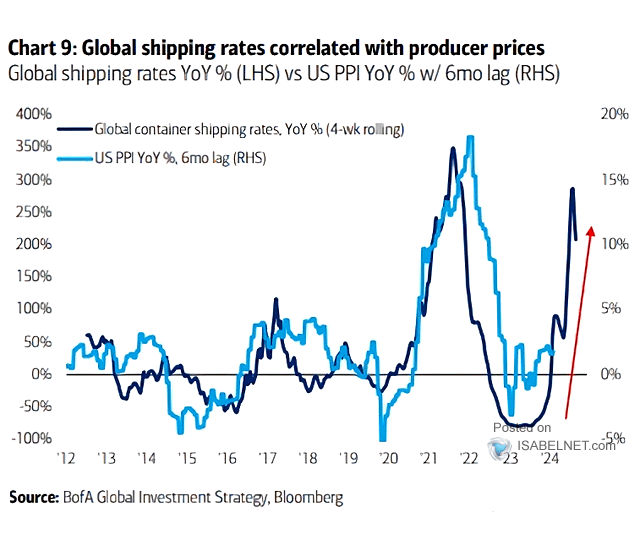

Rising global shipping rates are heralding a recovery in the US Producer Price Index (PPI):

In 2020, the spectacular surge in these rates preceded the sudden reawakening of inflation by six months.

The battle against inflation is still far from won!

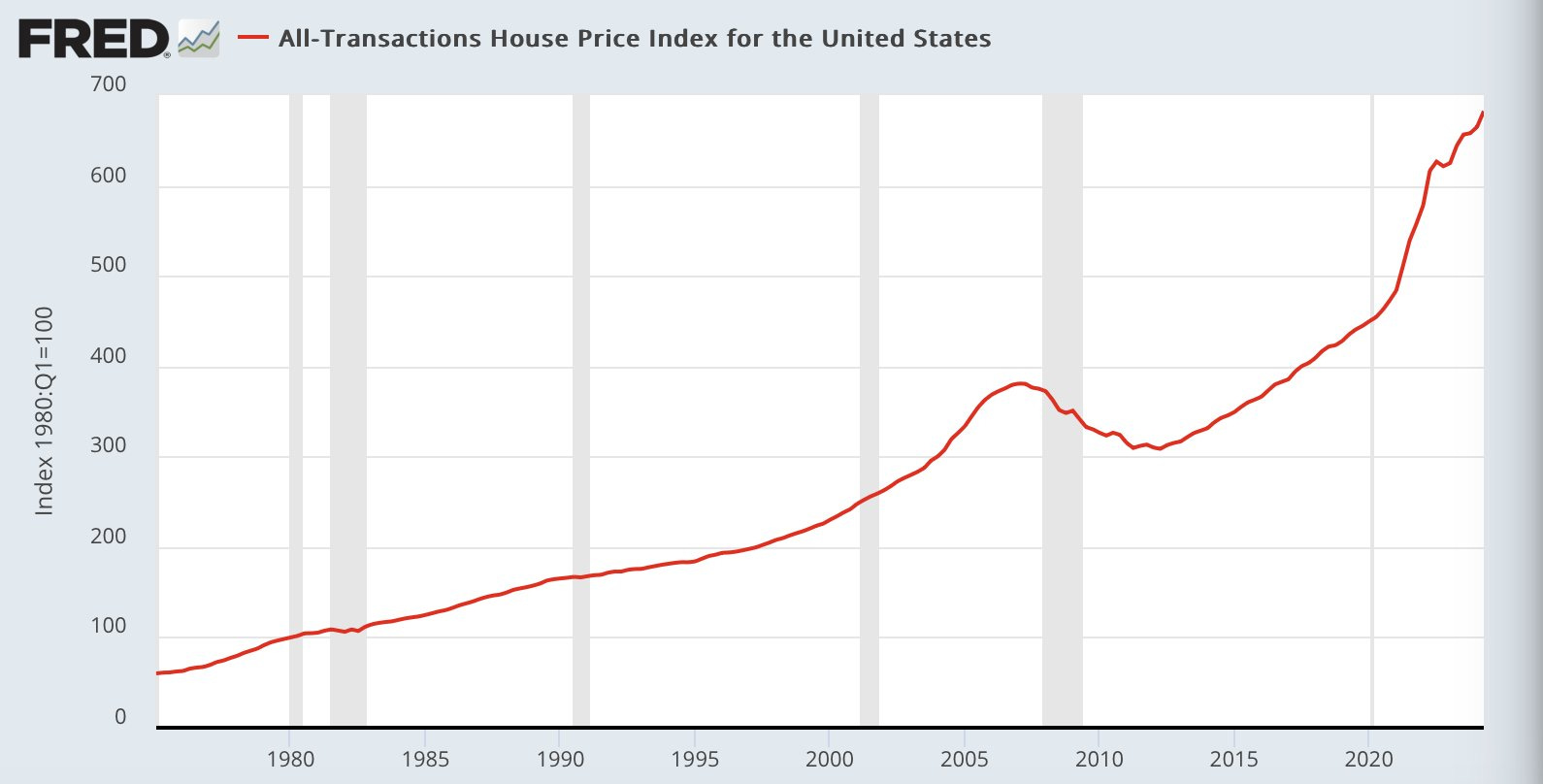

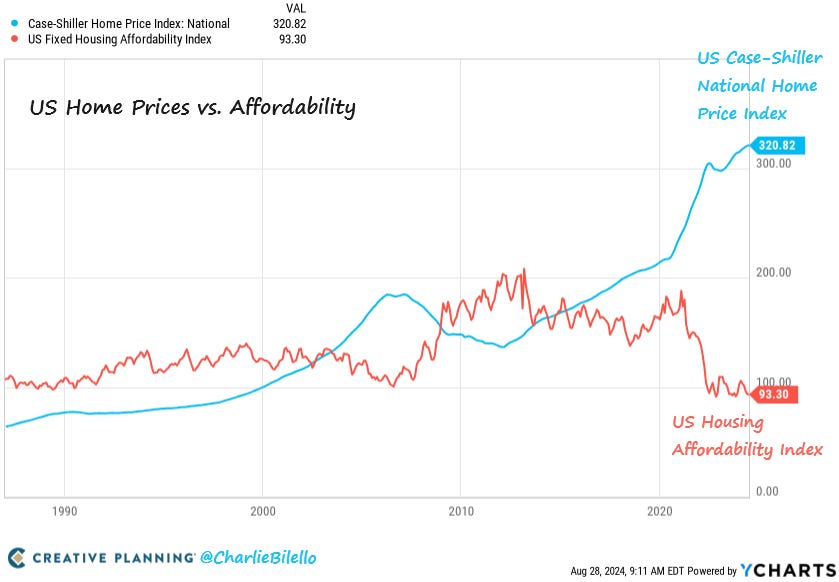

The latest figures for single-family home sales show no significant fall in prices:

House prices are at an all-time high in the U.S., while home ownership has never been more difficult:

The latest survey from the Fed's Dallas office reveals that the construction sector remains under pressure. No price declines have been observed in this area; on the contrary, prices continue to rise. For example, a door that cost $3,000 about a year ago now sells for $10,000. Competition in the market has diminished. There are fewer local businesses, many having closed due to difficulties in maintaining a workforce or because their owners were close to retirement. Others have been bought out. Supply lead times remain long for items such as transformers and generators.

Some agricultural commodities are also continuing their meteoric rise.

One example is coffee, whose price has risen fivefold since 2020:

(Click on image to enlarge)

Inflation remains at its highest level in forty years, but the market is now anticipating a Fed rate cut at its next meeting.

The period of high rates seems to be over, at least according to the bets of many investors. US money market funds recorded around $90 billion in inflows in the first half of August, the highest amount since November 2023:

Total money market fund assets reached a new all-time high of around $6.2 trillion.

Never before has so much money been invested in these products. Money-market fund yields are expected to return several hundred billion dollars to their holders this year, further increasing the amount of liquidity available! The tedious work of central banks to withdraw liquidity from the markets is being cancelled out by this self-perpetuating liquidity bubble.

The supply of liquidity is increasing, while the quantity of real assets available is decreasing. We have all the ingredients for a resurgence of inflation. The conditions are already in place; all that's needed is a trigger to get the ball rolling again. The first wave of inflation was triggered by the Covid crisis.

What will trigger the second inflationary phase? Is it really wise to think about cutting rates in the face of such a risk of renewed inflation?

The gold price, with its string of record highs, tells us that we are on the verge of seeing the detonator of this new inflationary phase. Gold is warning us that we are on the brink of another Fed monetary policy error.

More By This Author:

Money Printing Contributes To Growing InequalitiesGold Beats New Records As US Bankruptcies Rise

AI Confirms That Gold Is A Good Investment

Disclosure: GoldBroker.com, all rights reserved.