Gold & The Intensifying War Cycle

The 2021-2025 war cycle is poised to intensify in the coming years… and perhaps in the coming months.

Did Nancy Pelosi visit Taiwan to deliberately create a war with China?

That’s unknown, but what is known is that war is more likely now than before she went there… and the current rumblings in the gold market are likely related to the disturbing ramifications of her visit.

Gold has broken through one trendline on this daily chart, and it could break through another after tomorrow’s important CPI report.

The world’s “mightiest metal” seems poised to consolidate for a few days in the $1750-$1785 zone and then race towards $1850.

For America, the 2021-2025 war cycle is civil as well as global. I’ve predicted significant tension (and bloodshed) will occur in 2023-2025… on US soil.

On that note, please see below.

The US Republican party’s rag-tag “insurrection” was a dismal failure, but another one could happen if their de facto leader Trump is jailed.

The first insurrection featured republican citizens with pepper spray and sticks facing off against government police with guns. Some police officers seemed eager to shoot citizens and showed little regret after doing so.

The next US civil war cycle event could be much more serious, involving millions of fully armed citizens, both republican and democrat, facing off in a much bigger show of force that could quickly become a real civil war.

One of my ongoing concerns is that many gold bugs are overwhelmed with greed and own no physical gold. They own millions of dollars of miners, which is AOK, but in a major war cycle intensification, stock markets would crash, and miners might crash (due to stock exchange closures).

This, while gold bullion would go ballistic against fiat.

Owning some bullion in a war cycle is essentially “mandatory” for all gold bugs of the world and on that note,

(Click on image to enlarge)

spectacular weekly close gold chart

A bull wedge breakout is in play, and after some whipsaw action around the CPI report, gold is likely to make a beeline for $1850, $1875, and $1915.

Gold also has a lot of support right now; oil may be ready for a short-covering rally, the Indian wedding season is underway, and China holds a lot of supply chain cards that it could play against the West if the Taiwan situation devolves.

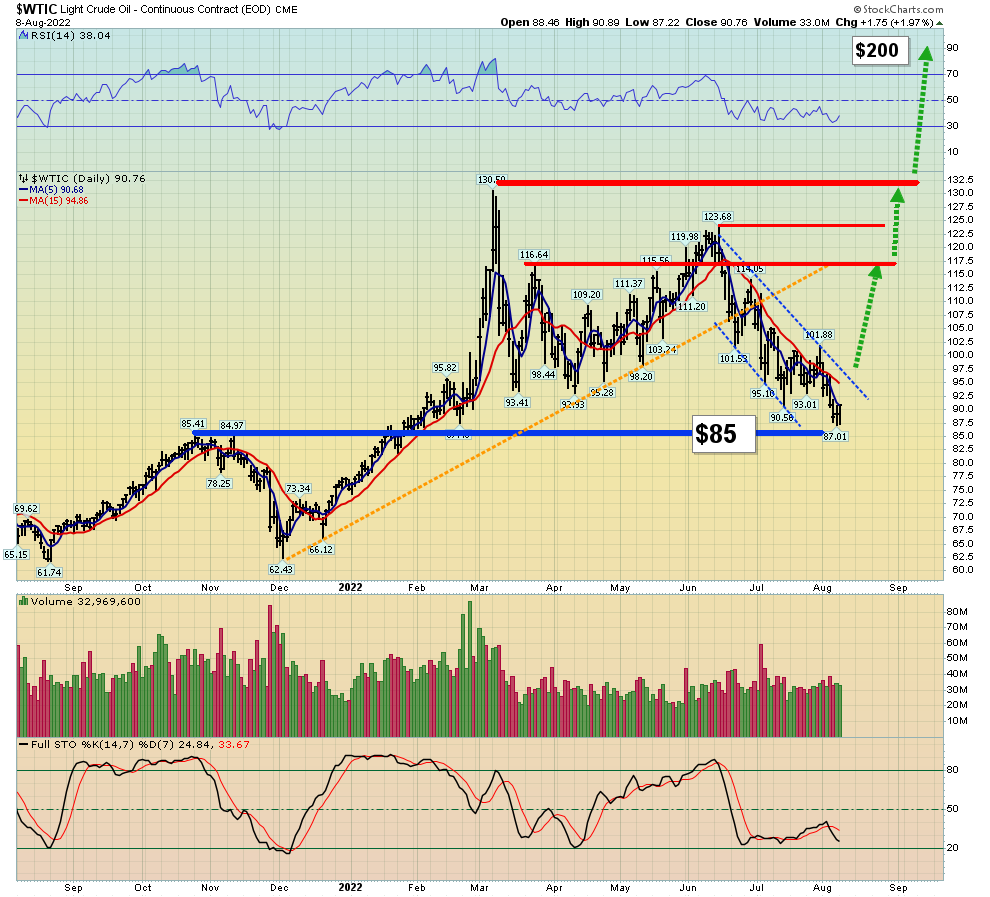

(Click on image to enlarge)

daily oil price chart

Oil has arrived at the outskirts of my $85 buy zone. Funds have implemented some short positions, and liquidity is drying up. That’s fuel for a short-covering higher priced fire.

Joe Biden’s “inflation reduction” plan (funded with debt, extorted citizen funds, and printed fiat money) will reduce prescription drug costs, but those drugs will see rampant demand if there is significant intensification of the US civil war cycle.

As the saying may go, all gold bullion work and no mining stock play is no fun

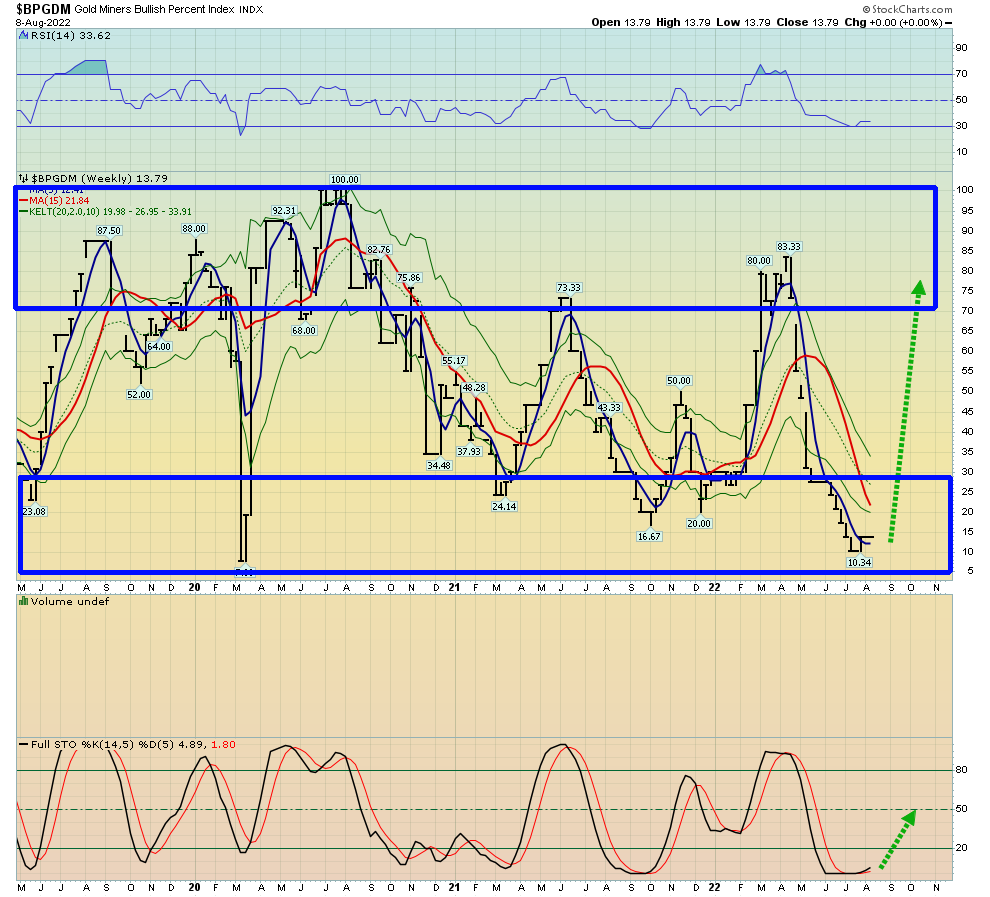

(Click on image to enlarge)

This important bullish percentage chart for the GDM gold miners index shows the miners are in fabulous buy zone.

As a rough rule of thumb, 30% or lower is the buy zone, and 70% or higher is for selling. Clearly, at about 15, the big action must now be… buying!

Next,

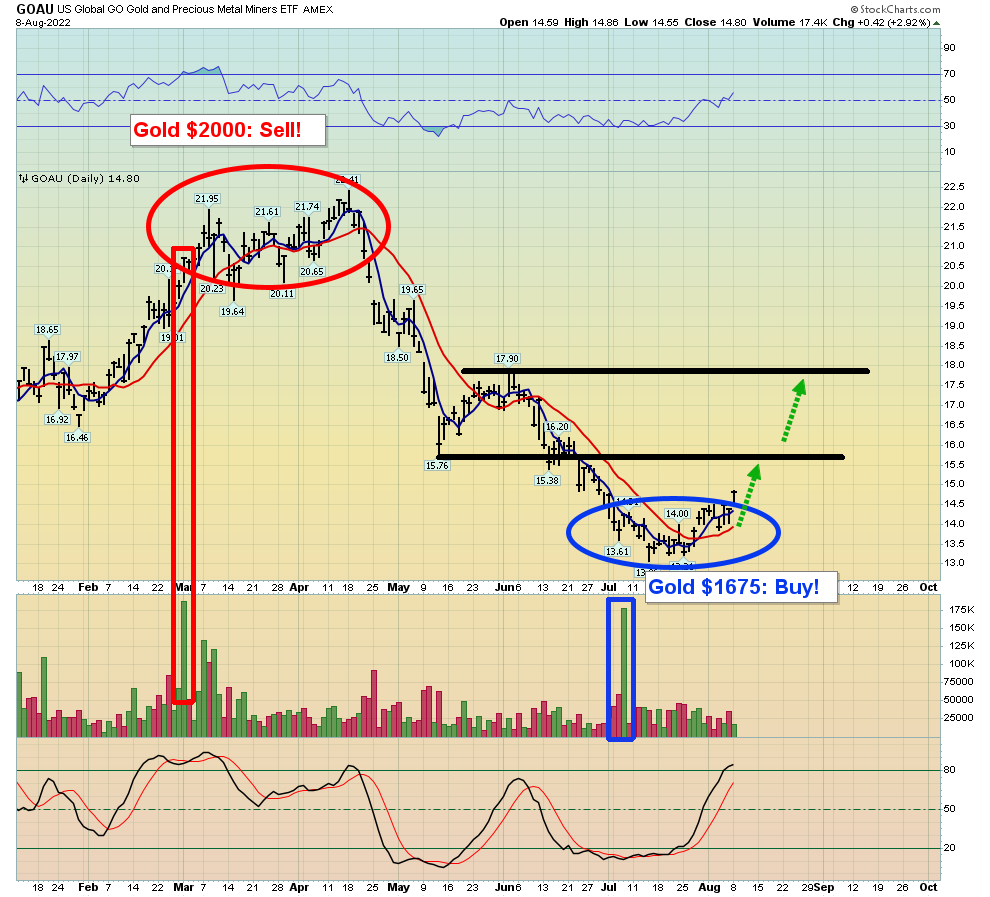

(Click on image to enlarge)

XME has performed spectacularly well from the $1675 buy zone for gold…

But it’s time to book partial profits and buy items like GOAU for a bigger surge, starting after this week’s CPI and PPI reports are done.

(Click on image to enlarge)

XME has done incredibly well against GOAU since the highs for gold in March were hit.

(Click on image to enlarge)

It’s now GOAU’s time to shine!

The next Fed meet is Sept 21 and GOAU has a solid chance of rallying in a big way into the Sept 7-14 period, when money managers will begin to focus on the Fed.

More By This Author:

Inflation 18% And Sticky

Gold & A Failed Oil Price Cap

Gold & The Dollar Rally Time For Both