Gold & The Dollar Rally Time For Both

It was a June swoon for the metals and miners. Can they fly in July?

(Click on image to enlarge)

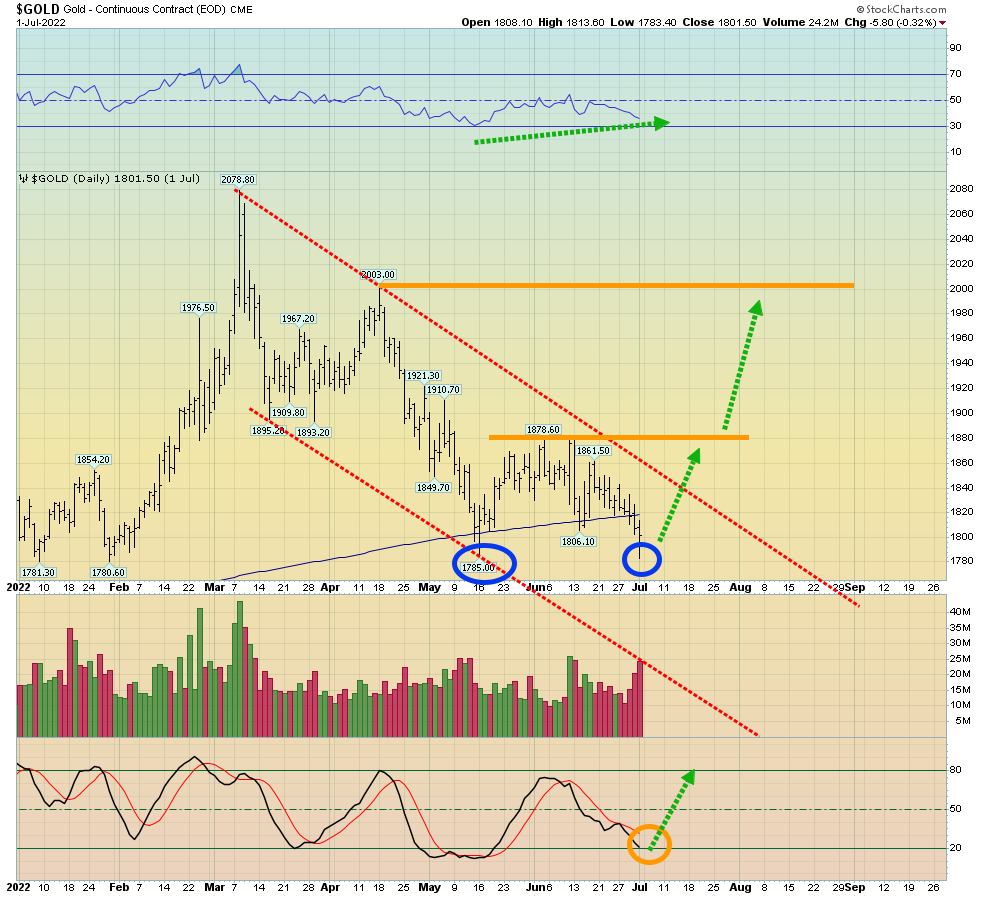

daily gold chart

A double bottom pattern is in play. The initial target is about $1880, and a breakout over that price targets $2000!

(Click on image to enlarge)

From a technical perspective, both the daily and weekly charts look like it’s either “rally time” now or very soon.

The fundamentals are also positive, and on that note, please see below.

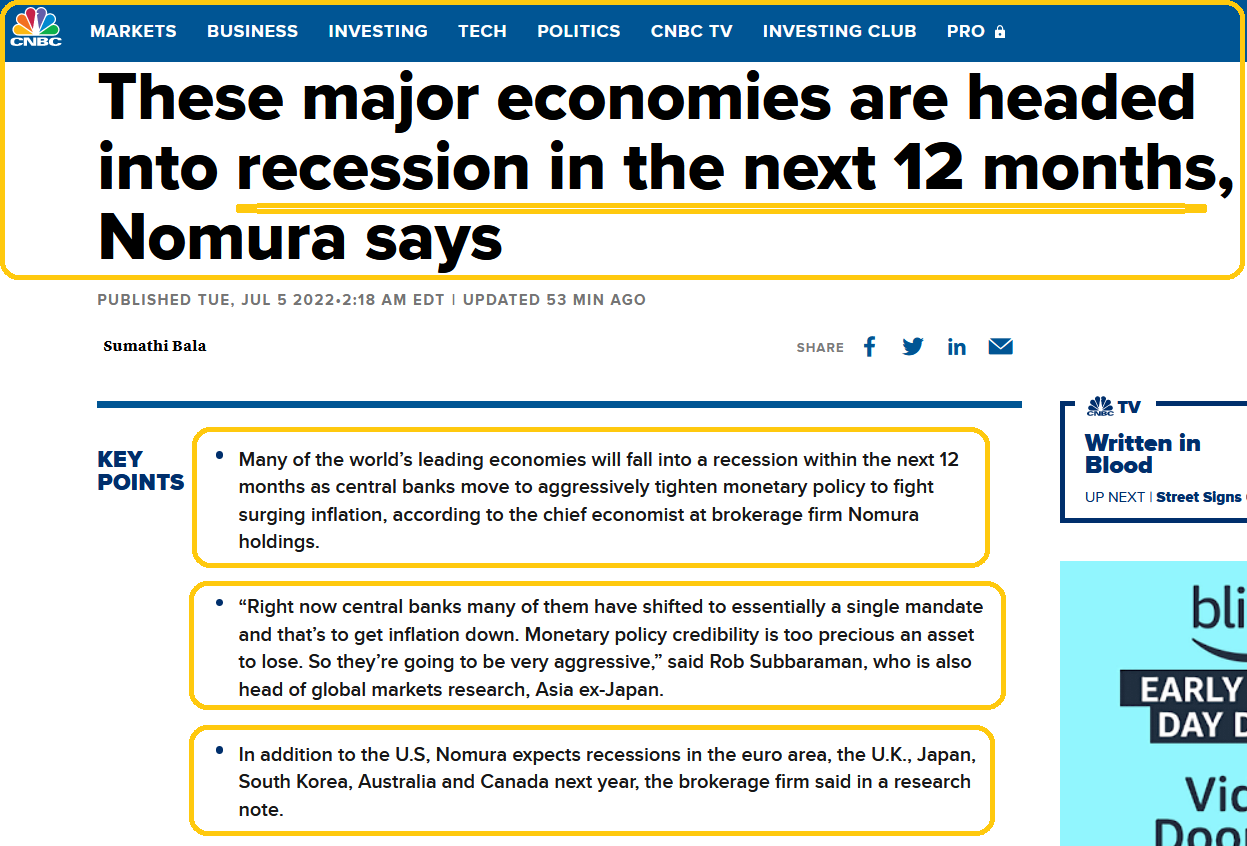

Economists and money managers are growing concerned that central bank rate hikes will create recessions in many countries…

And may do little to tame supply-themed inflation.

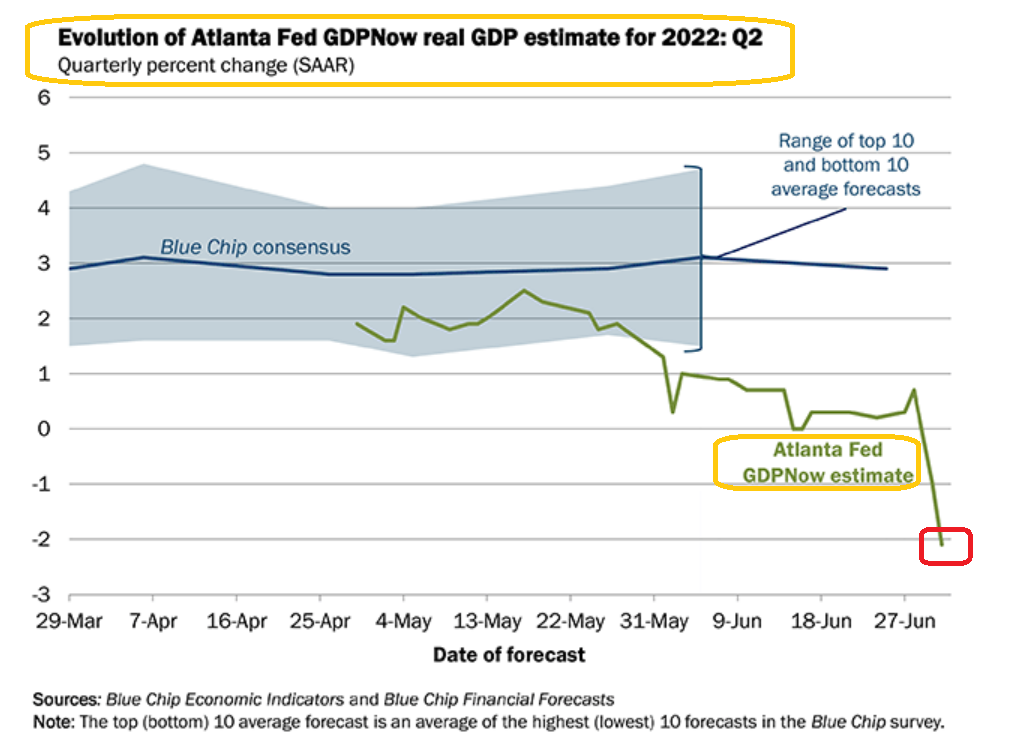

The Atlanta Fed’s “GDP Now” chart suggests America is already in recession.I warned investors that this would happen as the Trump handouts during the Corona crisis got spent.

The Biden “gun control” platform is mainly about spending tens of billions of dollars on a horrifying array of guns to prolong the Ukraine war.

The sanctions are already turning the already-severe supply chain problems into a potential nightmare of food and fuel riots, and they could cause the starvation of tens or even hundreds of millions of African citizens.

Led by “Jackboot Joe” Biden, Western governments have been bragging that wrecking the economy of Russia and ruining citizen lives there would be “awesome”.

Now, the citizens of Western Europe are at risk of no heat in the winter and perhaps not enough food on the table.

(Click on image to enlarge)

The Ukraine war horror reached a crescendo in the February to March period, and both gold and the USDX rallied together then… with gold as the leader.

That’s likely about to happen again, as the Russian government begins to “return fire” in the proxy war that Western governments launched with their sanctions.

As US GDP slides, is it possible that the Fed becomes a “chicken hawk”, and kills or reduces the aggressive hikes it has scheduled?

(Click on image to enlarge)

US rates are in a resistance zone and there’s a negative divergence of the RSI oscillator on this weekly 10year yield chart.

The most likely scenario is that the Fed hikes into September as scheduled, but “blowback” from Russia with gas and oil creates much bigger supply-oriented inflation… one that Fed man Jay can’t fix with his hikes.

Rather than the Fed turning chicken hawk, arbitrage brings down long-term rates modestly while the Fed Funds rate gets hiked. The bottom line:

Credit card and mortgage rates will rise, hitting the average citizen hard, but US T-bond rates should decline, allowing more war mongering and reckless spending from the government to occur.

(Click on image to enlarge)

Gold bugs dream of a day when the Fed and the government lose control of the dollar, and it plummets into the abyss against gold.

That’s likely several years away but it’s coming. Rates will skyrocket as it happens… and may not come down for many decades.

(Click on image to enlarge)

The XAU gold miners index is roughly at the same price it was when it started almost 40 years ago, while gold has risen to six times its $300/oz price.

Clearly, a buy-and-hold approach is AOK for gold and significantly “less than OK” for the miners.

(Click on image to enlarge)

GDX daily chart

Technically, Friday was a day of key reversals for an array of mining stocks. Note the strong position of RSI and Stochastics.

All signs point to a rally beginning “about now” and lasting into late August or even September. The next Atlanta Fed update for US GDP is Thursday and the jobs report is on Friday. US GDP for Q2 is likely to come in around minus 2% (or worse) and the jobs report could be shaky.

Will Friday morning mark the official start of the summer rally for the miners? I think so. Investors eager to participate could use any day before Friday to get positioned… for some very enticing upside action!

More By This Author:

Bullion & Miners: Winning Plays Now

A Stock Market Surge With Miners In Tow

FOMC Day The Low For Gold

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Get Jacked With Gold!” report. I cover key ...

more