FOMC Day The Low For Gold

A major inflation cycle has well-defined stages. To prosper, investors need to allocate capital to the dominant theme of each stage.

(Click on image to enlarge)

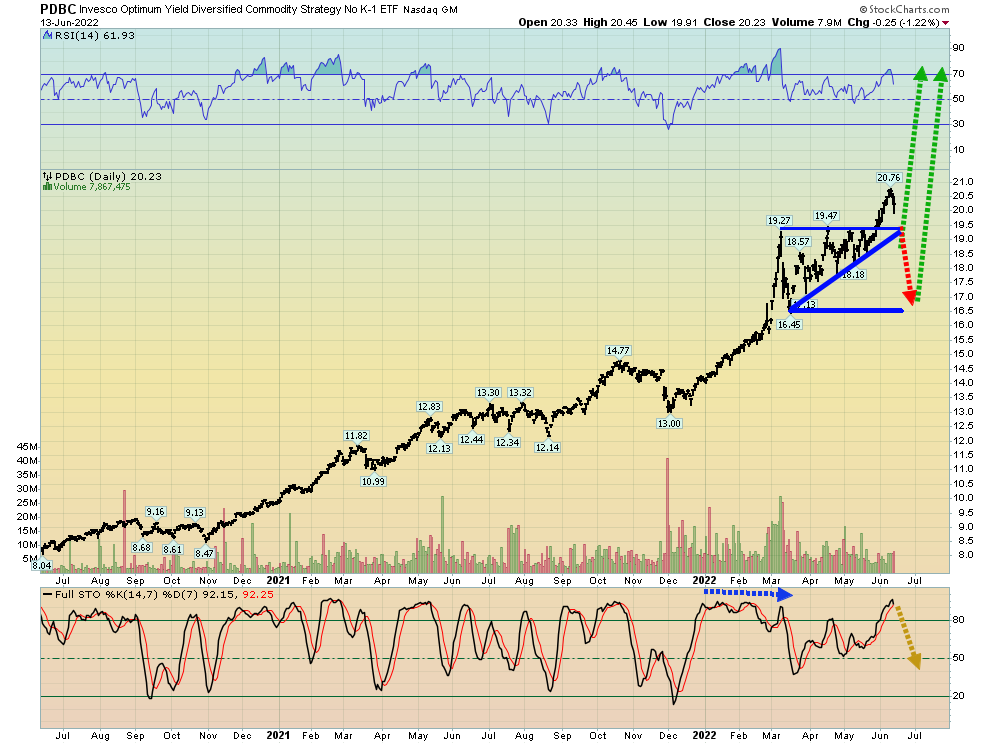

PDBC general commodities ETF chart

In the first inning of the inflation cycle “game”, commodities fare well. Gold and silver tend to trade sloppily against fiat.

The PDBC ETF features no K-1 reporting for US investors.

(Click on image to enlarge)

TBF bear bonds chart

The second inning of the game sees central banks and governments begin to admit there’s a problem.

Commodities can still rise in this stage, but investors fare best by betting directly on rising rates. I’ve been adamant that TBF (and investments like it) should be a core investor holding and a 50basis point hike looks like a “done deal” for the FOMC decision tomorrow.

The only question now is whether it will be 50basis points or 75. A full point hike is possible in July if there’s another red-hot CPI report.

Gold market volatility rises as the Fed comes into the picture, and more if governments launch price controls.

(Click on image to enlarge)

key US stock market chart

The Dow has arrived at the outskirts of the 30,000 round number zone and there’s significant support here.

If Jay Powell announces a 75basis point hike tomorrow, a substantial “all the bad news is in” rally is likely. That would see failed safe-haven bitcoin stage the biggest rally of the “risk-on” markets, with tech stocks also surging.

Jay is likely to hint strongly at more rate hikes ahead, and so any bond market rally is likely to be muted.

(Click on image to enlarge)

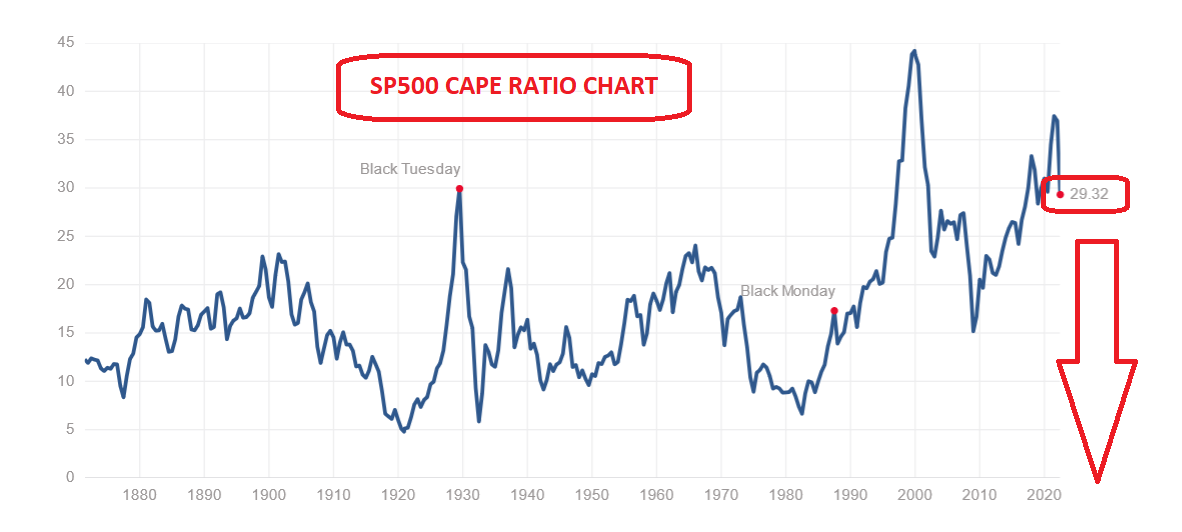

The US stock market is still massively overvalued and will remain so until the CAPE ratio drops under 10.

(Click on image to enlarge)

China (FXI) versus America (DIA) stock market chart

Unlike the overvalued markets of America, the Chinese markets offer relative value to investors.

Disturbingly, and childishly, Western analysts view rising US stock markets, GDP, and general good times as a sell signal for gold. In contrast, Chinese citizens view both good and bad economic news as a reason to buy gold. The Western view is clearly barbaric and as China becomes the dominant empire, this barbarism will fade.

(Click on image to enlarge)

GDXJ chart

Unlike the faltering stock market, most gold stocks did not make a new low yesterday… and there’s a possible bullish RSI non-confirmation with the price that is developing.

What about the senior miners?

(Click on image to enlarge)

Unlike the Dow, S&P500, and Nasdaq. GDX has held above its May lows.

Some gold bugs are worried about “2008 again”.Are these concerns valid? I think it’s a bit of an apples and oranges comparison.

To help understand why the comparison is invalid, please see below.

(Click on image to enlarge)

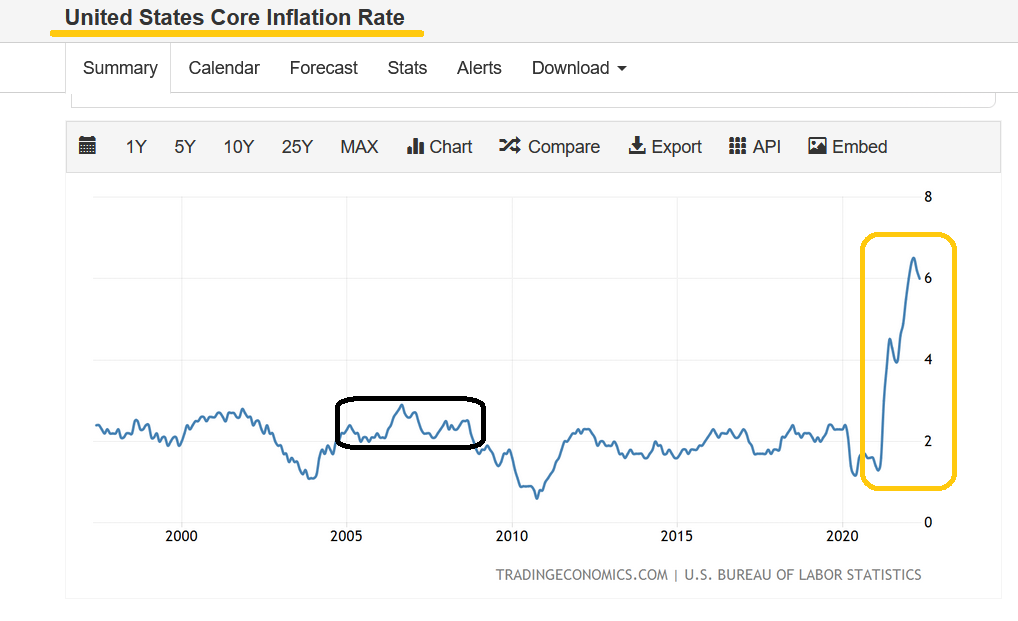

The Main Street inflation of 2007 was minimal, demand-oriented, and paled compared to financial markets inflation.

The current inflation is related to supply problems and a huge war cycle that’s in its infancy.

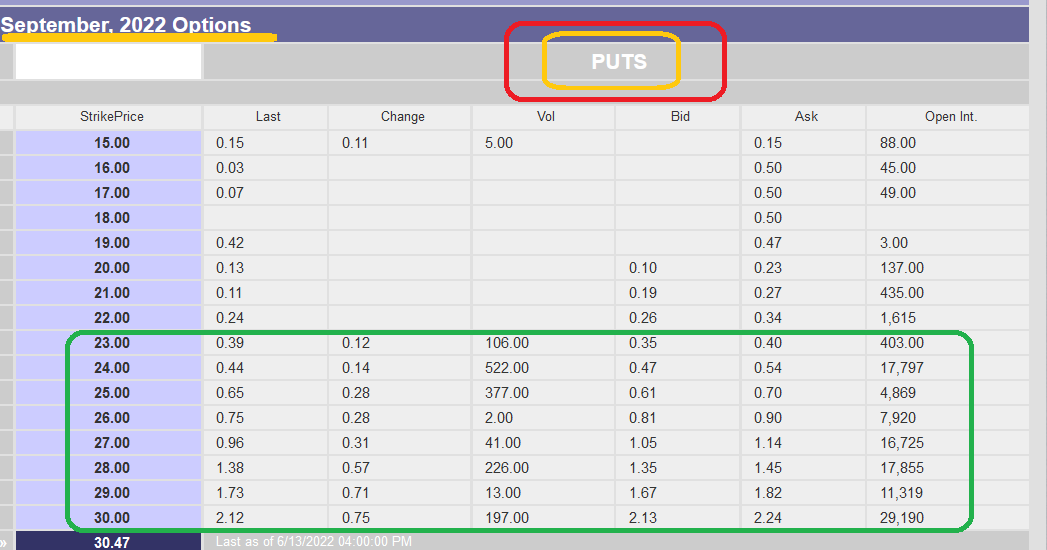

Regardless, gold stocks do get buffeted by stock market and rate hiking winds… in the early innings of a major inflation cycle. In addition to owning general “commods” and bear bond funds, stoplosses or put option insurance may be ideal for nervous investors.

On that note...

(Click on image to enlarge)

GDX put options soared in value yesterday

The gold stocks house is not on fire, but for investors who failed to buy my key price sale zones of gold $1778, $1671, $1577, $1450, $1228, $1033, $728, $580, $300, and chased price instead, put options are a solid “saving grace” strategy.

Investors can view gold market put options as fire insurance, and unlike regular house or car insurance, these options can be bought not only pre-emptively but also during a fire!

(Click on image to enlarge)

stunning long-term chart for Barrick

A huge “pitchfork” pattern is in play. It suggests that in the coming decades Barrick GOLD (and most senior miners) could rise to hundreds of dollars or even thousands of dollars per share.

For many years, I’ve been adamant that the “big show” for gold stocks begins only after not just one aggressive series of Fed hikes, but numerous bouts of them, and only when it becomes obvious that the hikes are failing to tame inflation.A mini version of the “big show” lies directly ahead, and while the target is not the moon, a very nice rally… is coming soon!

Special Offer For Website Readers: Please send me an Email to freereports4@gracelandupdates.com and I’ll send you my free “Get Jacked With Gold!” report. I cover key ...

more