Forget The Fed And Load Up The Truck With Gold

Image Source: Pexels

Fundamentals

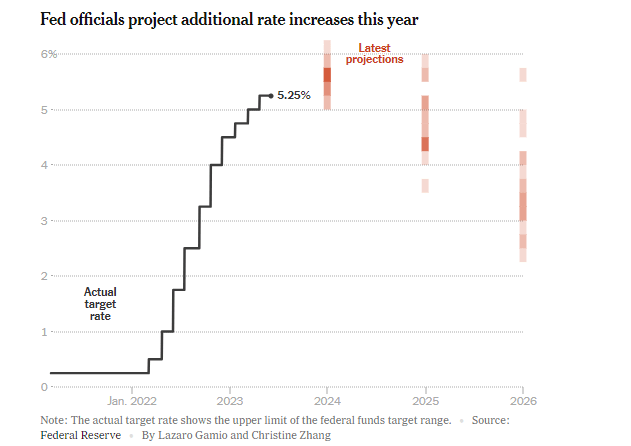

The Federal Reserve has decided to maintain the current interest rates, pausing after a series of ten consecutive hikes since March 2022. Despite this, officials indicated the possibility of two more increases this year, as they remain concerned about persistent inflation. They are allowing themselves time to assess the economic response to their aggressive inflation control strategy. Currently, rates are between 5 and 5.25%, but this could potentially rise to 5.6% by the end of 2023.

interest rates (Federal Reserve)

These projections have sent a clear signal of the Fed's concern over persistent inflation and their intent to continue efforts to curtail it. However, Chairman Jerome H. Powell stated that the move to maintain current rates does not mean the Fed is giving up on its inflation control initiative. There are expectations of one more rate increase later in the year, but not as many as Fed policymakers predict.

The effect of interest rate increases is to make loans more costly, ideally leading to reduced spending and price increases. Yet, despite the Fed's measures to slow growth and inflation over the past 15 months, the economy has shown resilience. Even as consumer spending and wage increases have moderated, companies continue to hire. Inflation persists, although there has been a notable slowing of overall price increases, particularly in fuel costs and grocery prices.

New economic projections reflect growing concern over inflation. These forecasts, released every three months, predict inflation could reach 3.9% by the end of 2023, excluding food and fuel prices. This is a higher projection than the 3.6% forecast in March.

Despite these challenges, the Fed is attempting a delicate balance, aiming to control inflation without causing a sharp economic slowdown that could result in job losses. Powell emphasized that the ultimate goal is to control inflation, which is crucial for the economy's stability. He further stressed that July's meeting could potentially see an interest rate hike.

The challenge is to manage inflation without causing a recession. Fed officials believe there's a pathway to achieve this, even though it's narrow. The focus remains on controlling inflation, which Powell highlighted as a priority for generations of Americans.

The relationship between interest rates and gold prices is complex and can vary depending on various factors. Generally, an increase in interest rates can have both positive and negative effects on gold prices.

In our report published on Seeking Alpha back in April 2023, we accurately predicted a seasonal top in the market, calling for a 20% correction into the fall of 2023. Since then, we've seen the market make a high of 2085 on May 4th, only to come down to a low made at 1919.5 on June 22nd. That's a significant $155 price move since the beginning of May.

At the Equity Management Academy, we understand that the gold market has its own unique patterns and cycles that repeat themselves year after year. It doesn't necessarily react immediately to changes in interest rates or the Federal Reserve's actions. That's why we use the Variable Changing Price Momentum Indicator (VC PMI AI), a cutting-edge market intelligence tool, to identify extreme fluctuations in price based on standard deviation analysis in the Mean Reversion Trading section.

Let's take a look at next week's standard deviation analysis and see what short-term trading opportunities we can identify.

GOLD: Weekly Standard Deviation Report

Jun. 24, 2023, 2:34 PM ET.

Summary

- The weekly trend momentum of 1942 is bearish.

- The weekly VC PMI of 1944 is bearish price momentum.

- A close above 1944 stop, negates this bearishness neutral.

- If short, take profits 1916-1901. If long, take profits 1958-1986.

- Next cycle due date is 6.30.23.

Bearish Momentum Confirmed

Introduction:

This report provides an analysis of the gold futures contract, focusing on the weekly standard deviation price levels. The objective is to assess the current market conditions and identify potential trading strategies.

Weekly Trend Momentum:

The gold futures contract closed at 1930, indicating a downward movement. Furthermore, the market closing below the 9-day Simple Moving Average (SMA) of 1942 confirms the bearish short-term trend momentum. A close above the 9 SMA would be required to shift the trend from bearish to neutral, suggesting a potential change in market sentiment.

Weekly Price Momentum Indicator (VC PMI):

The VC Weekly Price Momentum Indicator at 1944 serves as a crucial price indicator or mean. With the market closing below this level, the price momentum is confirmed as bearish. Similar to the SMA, a close above the VC PMI would negate the weekly bearish short-term trend, suggesting a possible shift towards a neutral market.

Weekly Price Indicator Cycle:

Based on the analysis, the next cycle due date is projected to be on 6.30.23. Monitoring the price behavior leading up to this date may provide insights into potential market movements and trading opportunities.

Proposed Strategy:

To capitalize on the current market conditions, the following strategies are recommended:

- If holding a short position, consider taking profits within the range of 1916-1901.

- If holding a long position, consider taking profits within the range of 1958-1986.

These profit-taking levels are based on the assessment of standard deviation analysis, aiming to maximize gains within the given market context.

Conclusion:

In conclusion, the gold futures contract is currently experiencing a bearish trend momentum, as confirmed by the market closing below both the 9-day SMA and the VC PMI. Traders should monitor the market closely, paying attention to potential reversals or shifts in the price momentum. The proposed strategies provide guidance on profit-taking levels depending on the trading positions. However, it is essential to conduct thorough analysis and consider other relevant factors before executing any trades.

More By This Author:

Gold: Prepare For A Summer Rally

Gold: Debt Ceiling Deal Is Done - Here's Why A Recession And Stock Market Drop May Follow

Gold: U.S. Debt Surpasses $31 Trillion

Disclosure: I/we have a beneficial long position in the shares of GDX either through stock ownership, options, or other derivatives.

Disclaimer: The information in the Market Commentaries was ...

more