AgMaster Report - Wednesday, Feb. 22

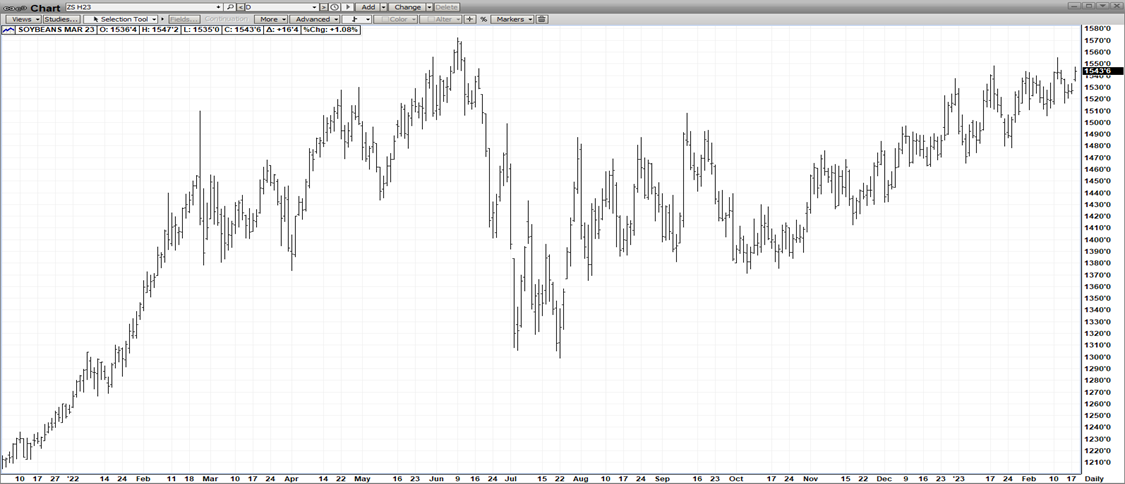

MAR BEANS

(Click on image to enlarge)

A continuing drought in Argentina opened the mkt higher – but macro concerns about the Fed's ongoing program of raising interest rates to combat decades-high inflation pared the gains – however, the mkt has clawed its way back to just a few cents from the highs! A short but busy week ahead – with the Fed releasing its minutes from the recent FOMC on Wed, the USDA AG OUTLOOK FORUM on Thur & the annual 1-year anniversary of the Russian invasion of Ukraine on Fri! The mkt will continue to key on the Arg drought, the record crop in Brazil, the potential renewal of the Corridor Pact at the end of this month, and the potential of improved exports with a cheaper dollar & a re-opening China!

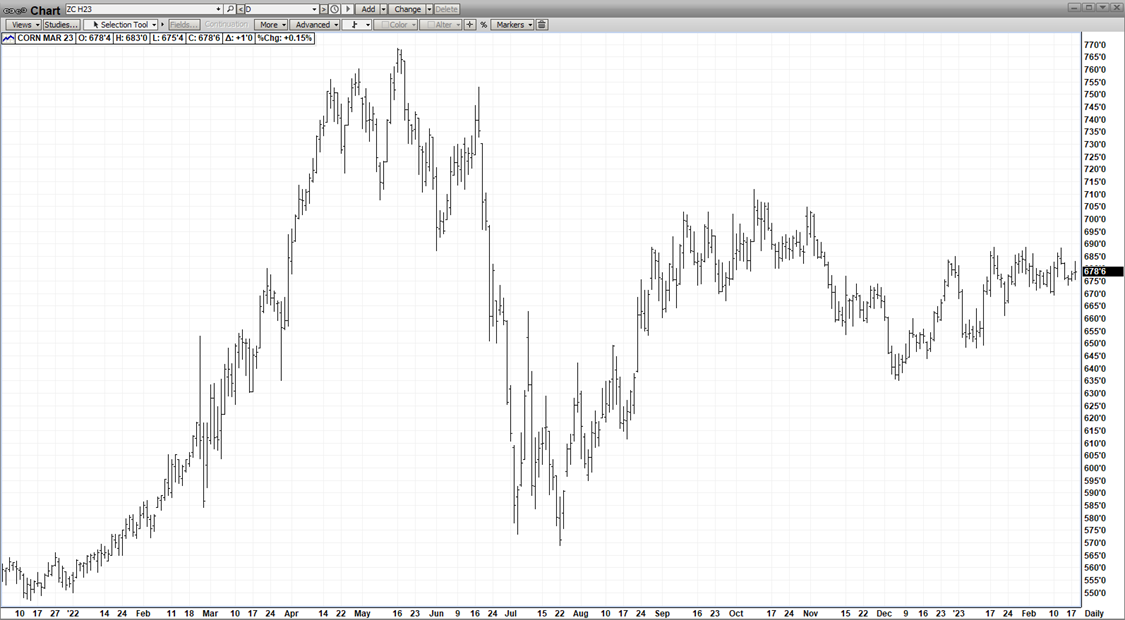

MAR CORN

(Click on image to enlarge)

As you can see, the mkt is locked in a tight congestion pattern – positive & negative forces are perfectly offsetting each other! Today is a perfect example as a dry Argentine forecast opened the mkt higher after the 3-day W/E – then a sharply lower DJI & a higher US $$ sold the mkt off – it has since recovered to trade 2-3 higher! From a “big picture” scenario, the sheer fact that the mkt is able to hover just under $7.00 for this time of the year is quite impressive! A shaky economy & a record Brazil crop are providing headwinds but the Arg Drought & the improved export likelihood are supplying tailwinds! The 6-7 year low global stocks that were NOT enhanced by disappointing crops from both hemispheres – continue to underpin the mkt! The annual USDA AG OUTLOOK FORUM starts on Thur & is projecting 90.9MA (ly – 88.6) & production at 14.888BB (ly – 13.730). Soy acres are pegged at 88.6MA (ly – 87.5) & soy production at 4.510 (ly – 4.276).

MAR WHT

(Click on image to enlarge)

Today’s disappointing mkt action in the wheat – against positive gains in the Beans & Corn is a perfect example of how the Russian Wheat Export dominance is insulating the wht mkt from everything else! Their record crop followed by the inundation of their cheap wht onto the export mkt has kept the lid on wht futures – regardless of any positivity from its sister mkts – corn & beans! Even dry pockets in France, Algeria & Morocco weren’t enough today to nudge the Mar Wht into positive territory!

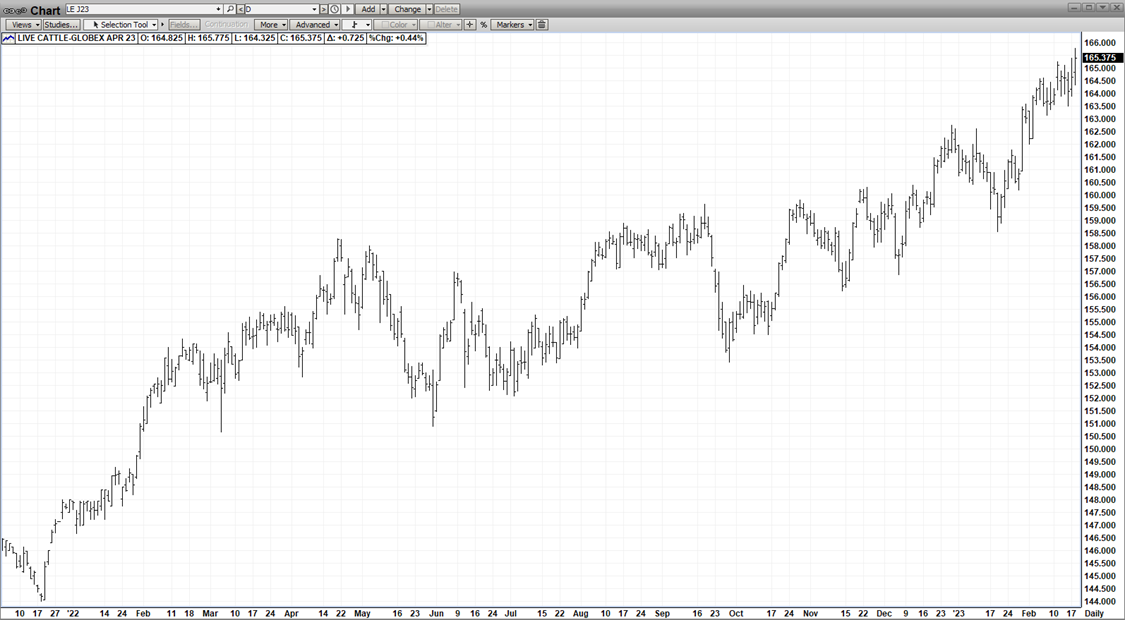

APL CAT

(Click on image to enlarge)

The relentless “supply bull” that is Apl Cat keeps on chugging – fed by 8% lower beef production last week over 2022, a strong beef mkt, strong exports from last Thursday’s report & good-enough demand! Once again, the dramatic reduction in production from the 4th to the 1st Qtr has set the stage for continuing this Bull! Given the historical high level, the corrections are frequent but mostly consist of tight consolidation – which are able to relieve the “overbought condition”!

On Friday at 2 pm, two major livestock reports – a Cattle-on-Feed & a Cold Storage report will be issued – which could force some profit-taking & and back-and-forth as the mkt awaits fresh info from the USDA!

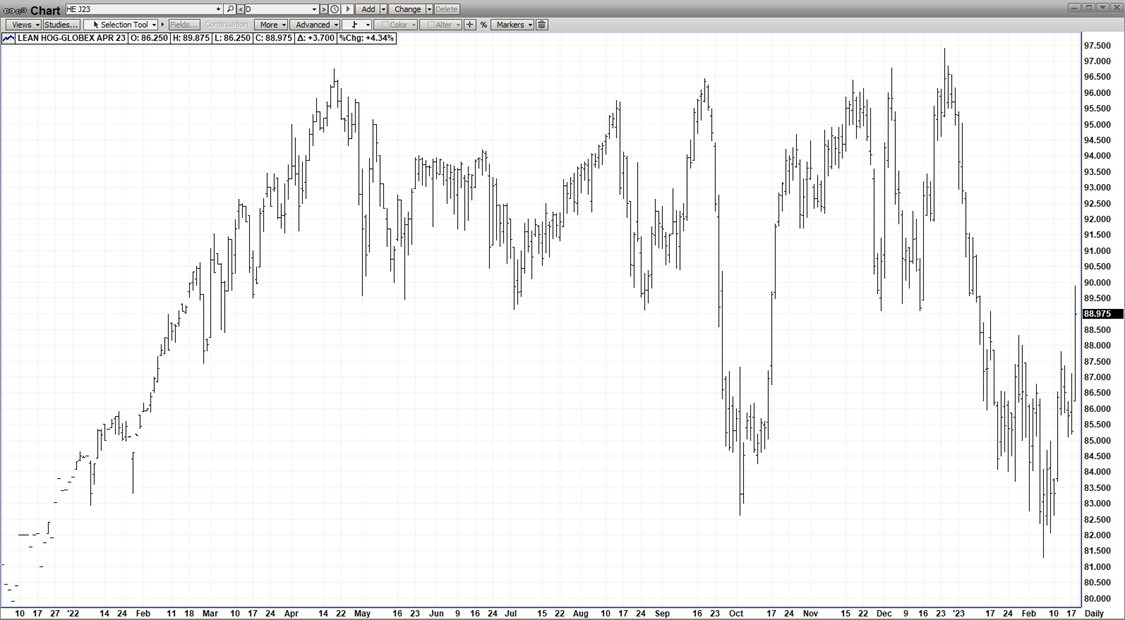

APL HOGS

(Click on image to enlarge)

Enough really is enough! After getting absolutely decimated for the past two months, April Hogs scored a “spike low” on 2-7-23 at $81.00 and since then have rallied a whopping $8.00! Today, the mkt has soared on the strength of last weeks jump in pork cut-out! The “supply bear” that has been April Hogs looks to have run its course – as the heavy supplies have been dialed in! Ultimately, the consumer triggered the turn-around – opting for very cheap pork chops versus high-priced steaks! The mkt might well take a breather after today’s action – in advance theCold Storage & Cattle-on-Feed Reports due out Friday!

More By This Author:

AgMaster Report - Wednesday, Feb. 15

AgMaster Report - Thursday, Dec. 29

AgMaster Report - Thursday, Oct. 27