AgMaster Report - Wednesday, Feb. 15

MAR WHT

(Click on image to enlarge)

The Mar Wht contract was the beneficiary of an escalation of the Russian-Ukraine conflict – as fears mounted the increased bombings could jeopardize the Ukr Corridor Deal! The mkt – in response – added a “war premium”! Additionally, the mkt received spill-over aid from corn & beans as they reacted to continued dryness in Argentina! The net result was the mkt rallying to the top end of a 3-month range (720-800)! Further advances will be dependent upon an increased export flow – recently crimped by Russia’s relentless export of its surplus wheat at bottom-basement prices!

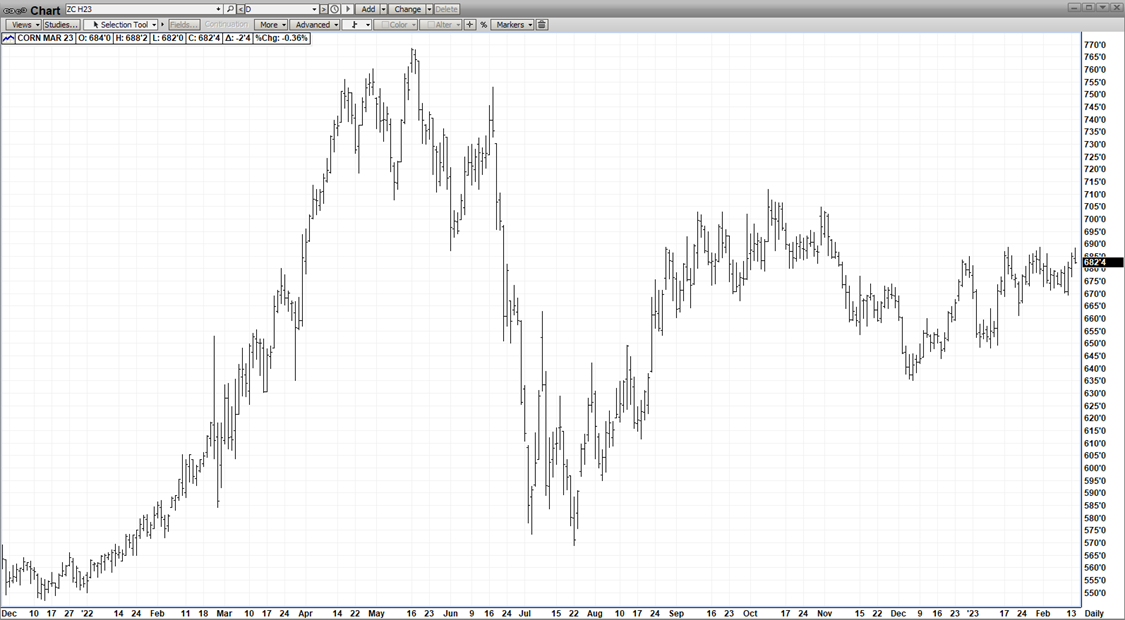

MAR CORN

(Click on image to enlarge)

Mar Corn was also able to rally to the highs of their 3-month range (735-688) on the back of continuing dryness in Argentina – where production losses are being estimated upwards of 30%! And the crop is reaching the point where the drought-damage is deemed irreversible! Exports are incrementally better with the recent plummeting dollar and the re-opening of China after their recent easing of Covid restrictions!A negative today comes from the Macro arena – when the CPI was announced at 7:30 am at 6.4% – under last months 6.5% but above the expectations of 6.2%! This implies the Fed may have to keep rates “higher for longer” in order to bring inflation down to their target 2%!

In the “big picture scenario”, the mere fact Mar Corn is holding just under $7.00 in Feb with a record Brazilian crop currently in harvest – is quote impressive and speaks to the underlying support provided by 6-7 year low global carry-out!

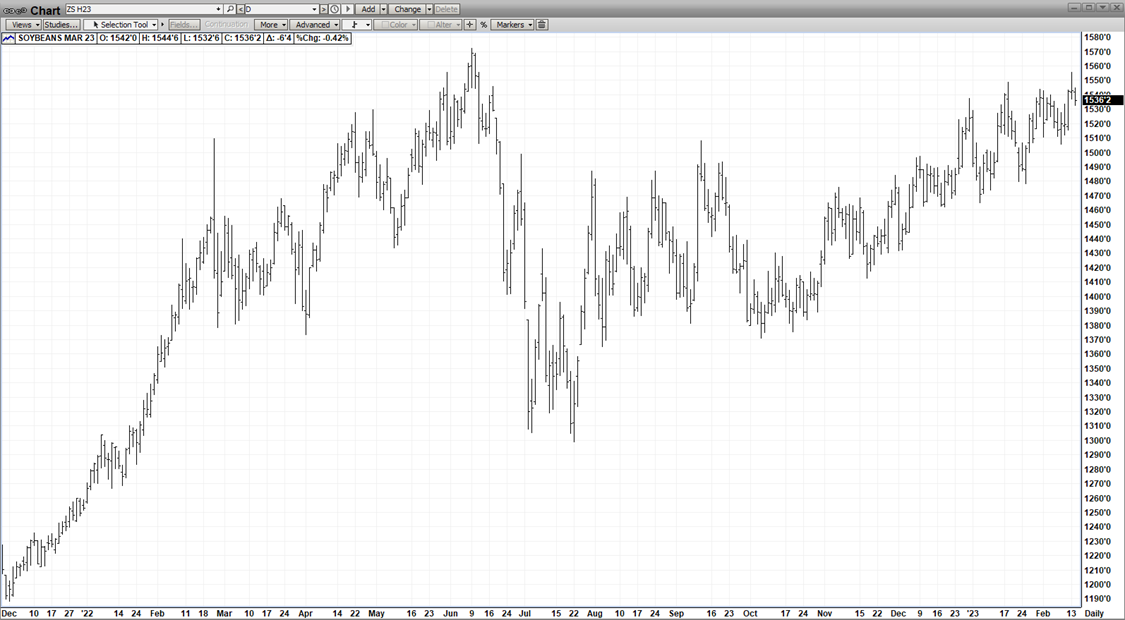

MAR BEAN

(Click on image to enlarge)

The largest beneficiary of the continuing Argentine drought was Mar Beans – as they soared to 6 month highs – last Friday! And this impressive mkt action in spite of an expected record Brazilian Bean Crop – at 154mmt – currently 20% complete! A plus $15.00 mkt in mid-Feb speaks to a mkt – already buoyed by tight stocks – that is anticipating a marked improvement in exports! Should somehow the Brazil bean crop not fully blossom, the Argentine dryness get worse and exports ratchet up as expected – current levels will not hold the mkt!

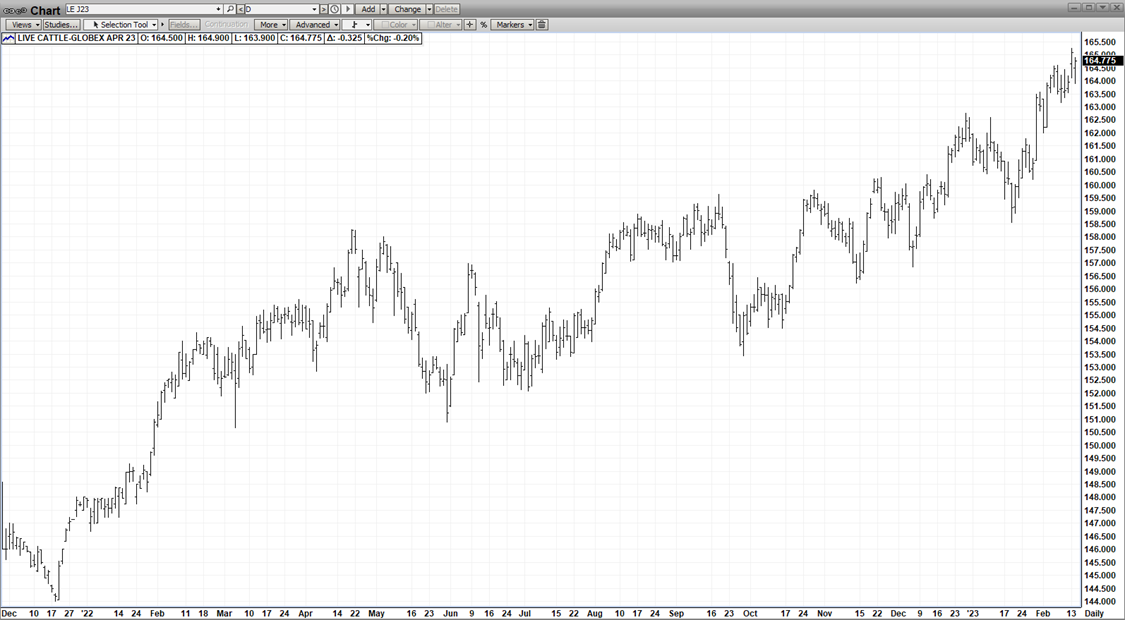

APL CAT

(Click on image to enlarge)

A relentless Bull – both technically & fundamentally – just keeps on chugging – with no top in sight!Fed by a tight supply with 1st Qtr supplies dropping way off from the 4th Qtr, lower slaughter weights than a year ago & more-than-adequate demand, the mkt achieved levels this week not seen since Jan 2015! Occasionally, the mkt gets overbought & stalls out for a while – before resuming its up! However, its eventual Achille Heel could be the cheap-as-dirt Hog mkt! Many days, while the cattle punches out new contract highs, the hog mkt is simultaneously scoring contract lows! This dichotomy can’t last as eventuall the consumer will turn the tide – opting for cheap pork chops over expensive steaks!

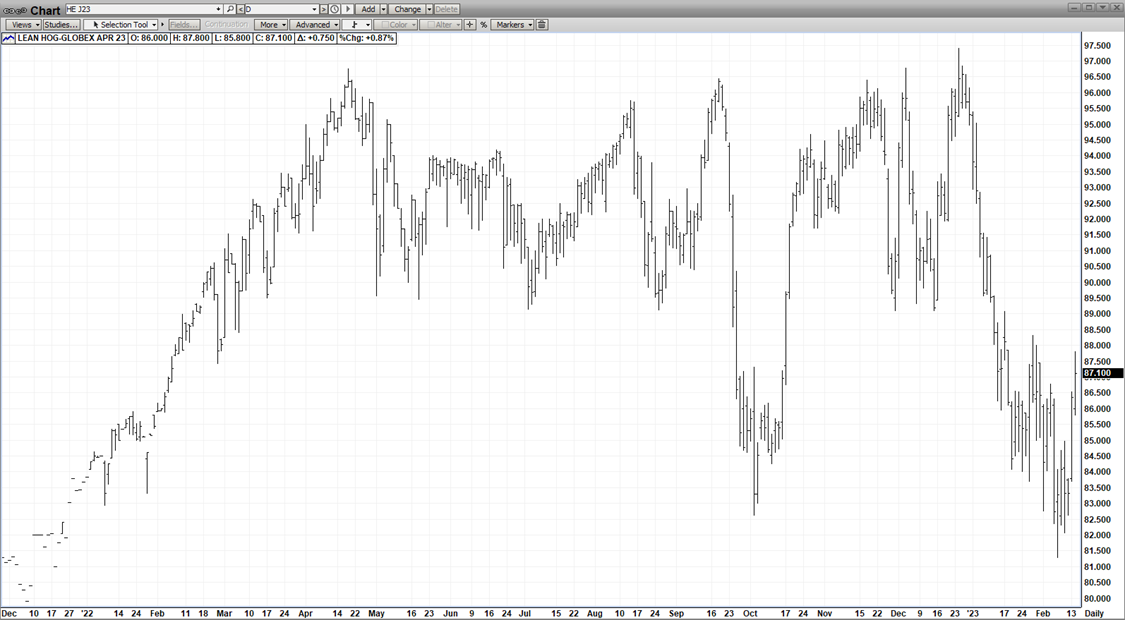

APL HOGS

(Click on image to enlarge)

It appears “the worm has finally turned” for the woebegone hog mkt – which after a spike low last week, has rallied $6.00 in just a few days (81.50-87.50)! The widely publicized reason for the turn-around was the re-emergence of Asian Swine Flu in Hong Kong & China – jeopardizing the global pork supply! But the sheer cheapness of the product had to be very enticing for bargain-hunters on the board & shoppers in the grocery stores! Whatever it takes, it appears the mkt has finally bottomed! The ASF may not sustain the rally but the relative cheapness of pork chops vs steaks at the meat counter =- most probably will!

More By This Author:

AgMaster Report - Thursday, Dec. 29

AgMaster Report - Thursday, Oct. 27

AgMaster Report - Wednesday, Oct. 19