AgMaster Report - Thursday, Oct. 27

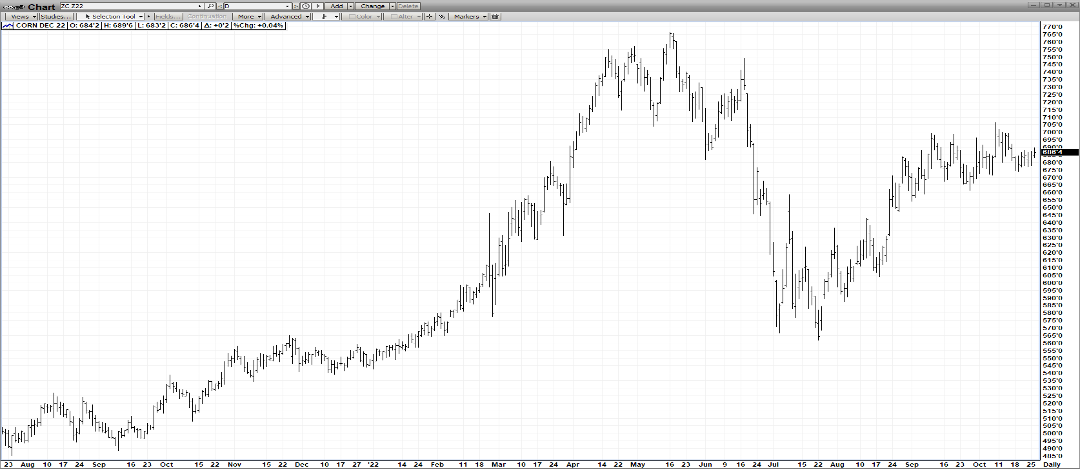

DEC CORN

(Click on image to enlarge)

The Dec Corn chart above is a perfect microcosm of the CBOT commodities – a supply Bull facing off a Demand Bear – resulting in a tight congestion pattern – a range-bound (670-700) since Labor Day! The bullish feature of course is the short 2022 crop – pegged at 10% under last year – with beginning stocks already on 6-7 year lows! The bearish feature is the paltry exports of late – due to a non-competitive US price, a sluggish China economy and transportation issues on the historically low Mississippi River! The Ukraine Grain Corridor is on-again/off-again! The Macros have been very supportive – with DJI rallying 3000 points & the US $$ dropping 400 points on the perception the Fed will take their “foot off the gas”! The S/A crop is reputed to be record large – but anything less could well rally the mkt!!

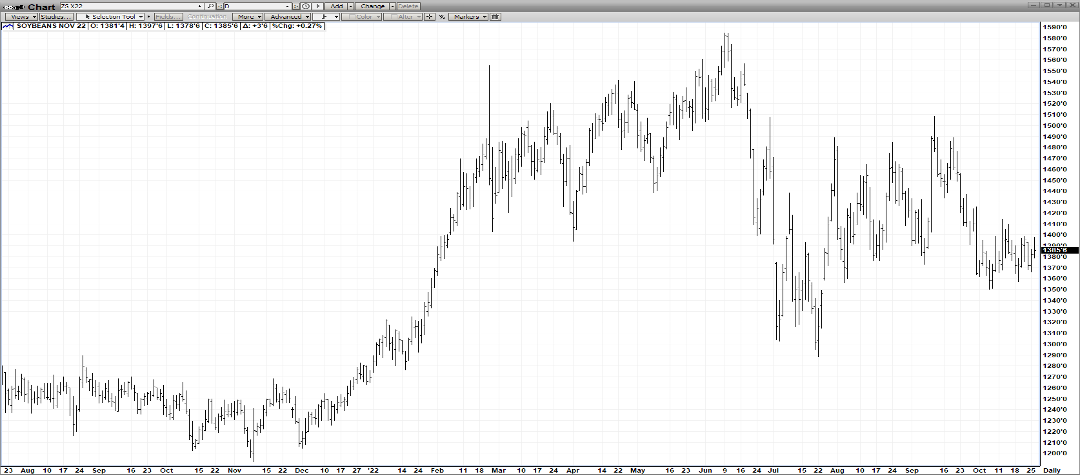

NOV BEANS

(Click on image to enlarge)

Nov Beans, likewise, are caught in a tight trading range (1350-1410) since Oct 1 – albeit $1.00 over its recent highs – unlike Dec Corn – which is snugging right up to its recent highs! The difference is the 800 pound Gorilla in the room – a forecast record bean crop in Brazil the worlds’ largest producer! The US harvest is 80% done & probably 95% next week – so the mkt focus will shift to South America’s crop & the weekly weather during its planting! The plummeting US Dollar has been a major supporter of the mkt on breaks – as it falls off from 20 year highs – on the feeling the Fed will ease off IR increases in early 2023! Once US Bean prices become more competitive & China’s economy recovers from its zero-Covid policy, bean exports should pick up! There are early indications of that as the Monday Inspections were nearly 3 MMT! Should the US $ continue to free-fall, The Ukraine Corridor Deal fall apart & The S/A bean crop, disappoint, Bean futures will get a solid upside bolt!

DEC WHT

(Click on image to enlarge)

The chart patterns are bearish! And validating that was Dec Wht’s inability to rally yesterday after a sharp drop in the US Dollar! Winter Wht planting is 79% in (avg-78). The mkt needs a production shortfall somewhere or an export increase to turn it around! Australia is having some rain issues & should the Ukraine Grain Corridor Pact not be renewed in late November, wht futures will soar! Stay tuned!!

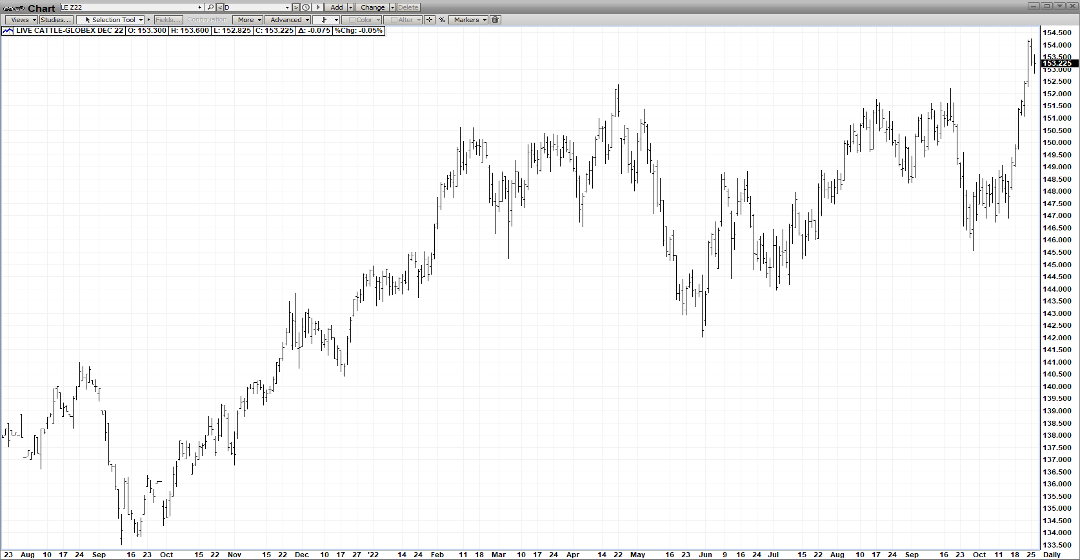

DEC CAT

(Click on image to enlarge)

Yesterday, Dec Cat posted new contract highs before key-reversing from an overbought position to close lower! Probably just a correction given the strong cash & boxed beef mkts! The supply/demand fundamentals are quite strong! Production in each of the next four quarters is forecast to drop 3-8%! YTD exports are up 11%! Feed cost for meal & corn are quite high! And most importantly, demand has been stellar – as the consumer – despite looming recession fears, continues to cut back on everything but food!

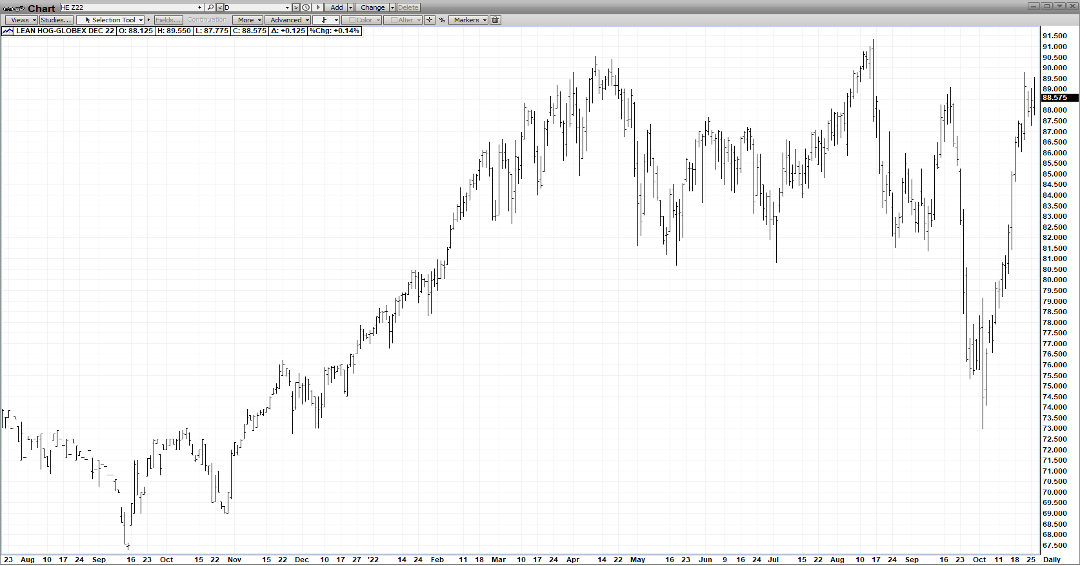

DEC HOGS

(Click on image to enlarge)

The improbable, nearly vertical $17 rally (73-90) in Dec Hogs since Oct 4 may correct very soon from its overbought condition as slaughter is likely to increase in the weeks ahead & the USDA pork cut-out came in at 97.07 – down $3.34 from Monday & its lowest level since Sept 30!Still, the upsurge – mostly sans China imports – is remarkable & is a testament to the domestic demand – which despite a looming recession – remains stalwart!!

More By This Author:

AgMaster Report - Wednesday, Oct. 19

AgMaster Report - Thursday, Oct. 6

AgMaster Report - Thursday, Sept. 1