AgMaster Report - Thursday, Sept. 1

DEC CORN

(Click on image to enlarge)

Who saw that coming? 168 BPA from the Pro Farmer Tour!! A whopping 7 BPA under the USDA Aug Estimate! Conventional wisdom said the Eastern yields would compensate for the below-average Western yields but it didn’t happen! Now, the $64 question is “will the Sept WASDE corroborate the PF #’s”? In addition, the crop ratings issued Mon at 3 pm dropped the gd/ex another 1% to 54% – the lowest in 10 years for the current date! These stats coupled with production losses in Europe & China reinforce a strong bullish case for corn! But with the end-of-month Wed & harvest soon, the expected profit-taking is underway today!

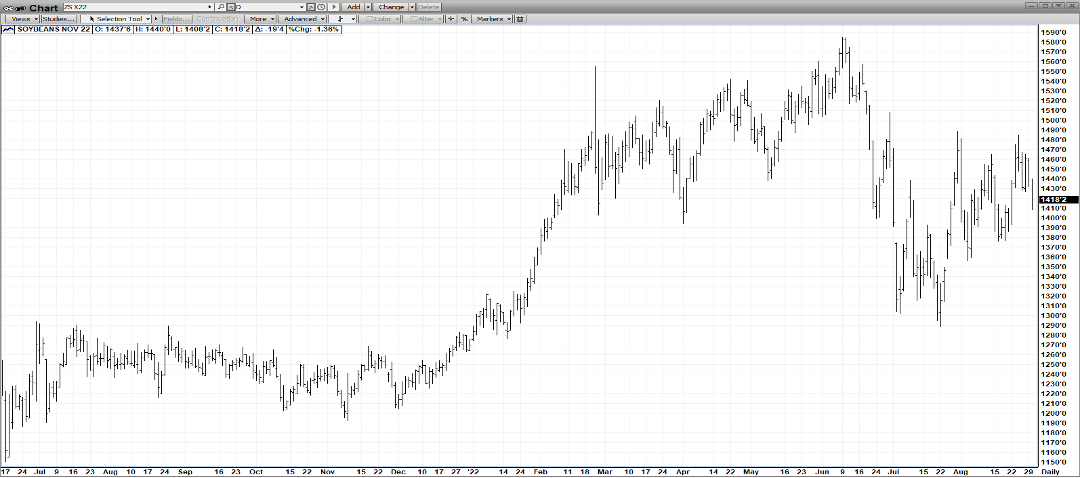

NOV BEANS

(Click on image to enlarge)

Contrary to the Corn’s bullish #’s, August rains have enhanced the bean yield from Pro Farmer to a 51.7 (USDA – 51.9) – establishing the bean complex as the bearish component of the grain complex! As well, the gd/ex crop rating Mon came in unchanged at 57% while the trade was expecting lower! This yield might translate to a record crop! As well, macro concerns are weighing on the beans! Fed Chairman Jerome Powell last Friday issued some quite hawkish remarks – saying he would aggressively attack 40-year high inflation by continuing to ratchet up IR’s – regardless of the short-term discomfort! This has forced a sharp 1500-point 3-day plummet in the DJI! A negative for all mkts! As well, the US Dollar has reached a 20 yr high – plus harvest is right around the corner! So there are substantial headwinds facing the bean mkt going forward!

DEC WHT

(Click on image to enlarge)

After a false break-out on the downside, Dec Wht did a “180” rallying a full $1.00 & temporarily breaking out upside before month-end profit-taking forced the mkt back into its congestion area! Fundamentally, improving spring wht crop conditions, a larger than expected Canadian crop & a sizeable Australian crop all contributed bearishness to the mkt correction! Dec Wht will receive solid spill-over support from Dec Corn – the clearly bullish Stalwart of the CBOT!

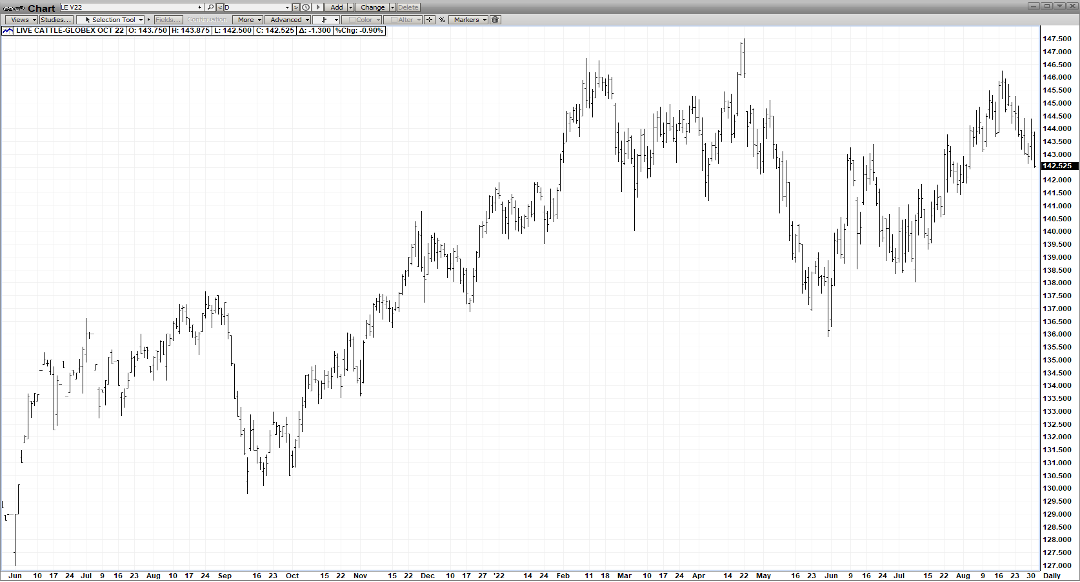

OCT CAT

(Click on image to enlarge)

Weaker cash & cheaper corn have fueled a downslide in futures – as well, global macro concerns about rising inflation & interest rates have muted demand potential! However, traders see tightening supply into the 4th Qtr & lower-than-average lower weights – both suggesting short-term production won’t be as high as expected! So the current correction may crater out soon!

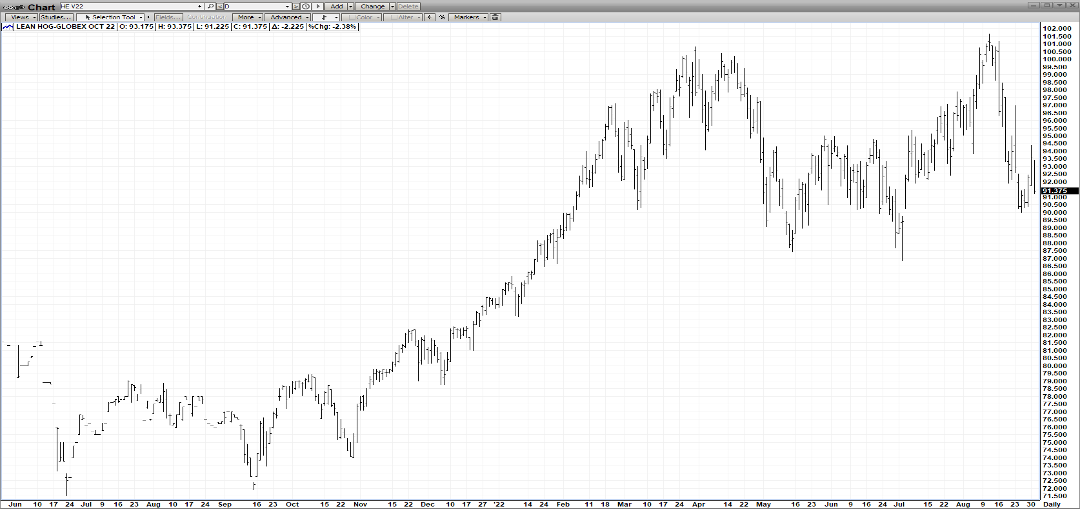

OCT HOGS

(Click on image to enlarge)

The mkt action is clearly skewed by the extreme discount in the price structure! For instance, Dec Hogs are $28 discount to cash while the average is $11! So much of the bearish & cash news has already been dialed in!! Plus, 4th Qtr production is expected to bw down 1.5% from a year ago! So, the Aug lows may hold – barring a major economic collapse!

More By This Author:

AgMaster Report - Thursday, Aug. 18

AgMaster Report - Tuesday, July 26

Ag Master Report -Tuesday, April 27