Ag Master Report -Tuesday, April 27

MAY CORN

When you combine a “flash drought” in Brazil with cold, dry climes in the central US and throw in 6 year-low ending stocks – both here in the US & globally, you have the recipe for an explosive upside market! And that’s exactly what we’ve had in the month of April – with May Corn already up $1.15! Yes, the mkt is grossly overbought & carrying record fund length, but the corrections are short-lived as traders are afraid to take on the short side! And justifiably so! What if our crop delivers just a mediocre yield? And what if the our acres indeed come in at 91.1 MA – some 2MA under the expectations? Then, anyone shorting in late April will be hurting big-time by June/July! We see steady to higher until we get a handle on the US!

MAY BEANS

May Beans have advanced $1.36 this month – despite exports declining markedly! But there is more than one way to whittle away ending stocks – either exports or waning production globally – and the latter is what has kicked into gear! With continued dryness in Brazil & a cold, dry snap in the Central Midwest, the mkt is beginning to build in a weather premium – just in case! Plus Bean Oil has been on an upside tear – feeding off the global vegetable shortage – and helping to push beans higher! And China is buying a little bit here & a little bit there! With stocks on 5-6 year lows, there is absolutely no margin for error for the US Crop! Weather scares like we’ve seen this month will continue to elevate the mkt until we know much more about the US corn & bean crops just now going in the ground!

MAY WHEAT

May Wht has gladly jumped on the CBT “bandwagon” gaining $1.25 this month with still 4 days left! A lot of the strength is the mkt simply coat-tailing corn & beans per usual! But some is derived from the bitter cold snap that recently enveloped the M/W & the persistent dryness in the Dakotas! As well, in China, corn is higher than wht & has encouraged end-users over there to substitute wht for corn – which should enhance US export prospects!

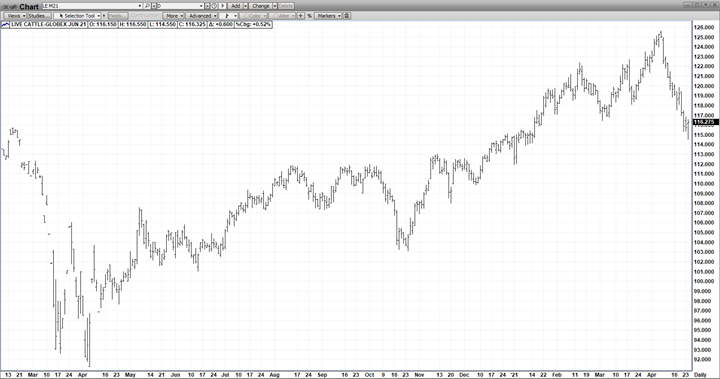

JUNE CATTLE

June Cat is between a “rock & a hard place”! On one hand, a resurgent US economy energized by widespread vaccinations & Covid relief checks will lead to beaucoup restaurant re-openings – & help to rachet up beef demand! But on the other, soaring corn & meal prices have inversely impacted feeder prices – sending them into a downward spiral & pulling fats with them! So these two offsetting fundamentals have kept “cattle under wraps”! But eventually renewed US beef demand coupled with the grilling season will rally cattle back to their highs!

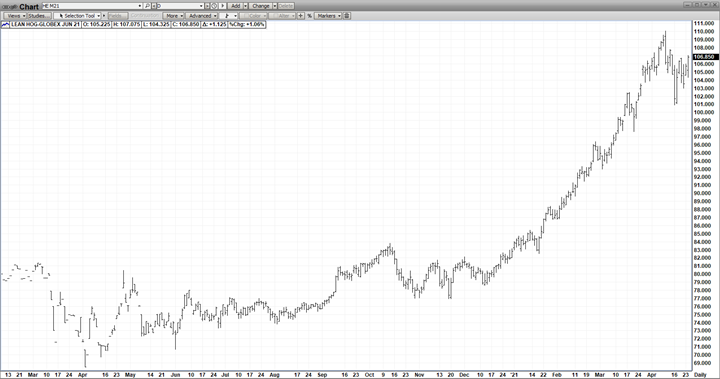

JUNE HOGS

Hogs continuing “ace in the hole” remains the elusive China Pork Import Demand! Many pundits predicted it would fall sharply in 2021 but that hasn’t happened – as ASF has once again reared its ugly head in China! So better than expected China imports coupled with the imminent re-opening of many US restaurants is currently canceling surging feed costs and pushing June Hog Futuresback to their highs.