AgMaster Report - Tuesday, July 26

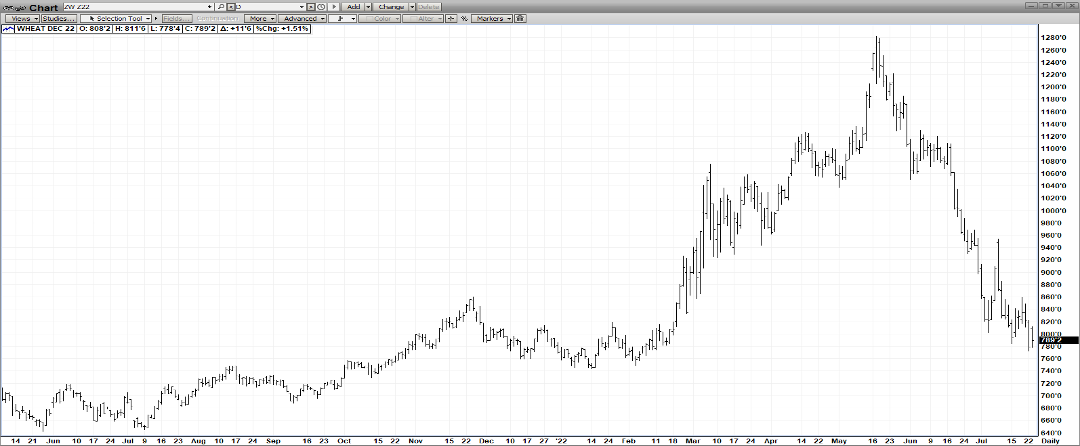

DEC WHEAT

(Click on image to enlarge)

Remarkably, Dec Wht has surrendered its entire Russia-Ukraine war premium ($5.00) established since early Feb as the Ukraine Grain Corridor Pact was signed on Friday – theoretically opening the export channels out of war-torn Ukraine! But over the W/E, the mkt said “not so fast” as Russia launched a missile attack on the port city of Odessa – which cast extreme doubt on exports moving anytime soon! It's clearly one thing to sign an agreement but quite another to implement same agreement amid the chaos of a Russia-induced war! We see the low forged by the dubious grain corridor deal coinciding with a seasonal harvest low & also falling in line with a 40% correction off the highs!

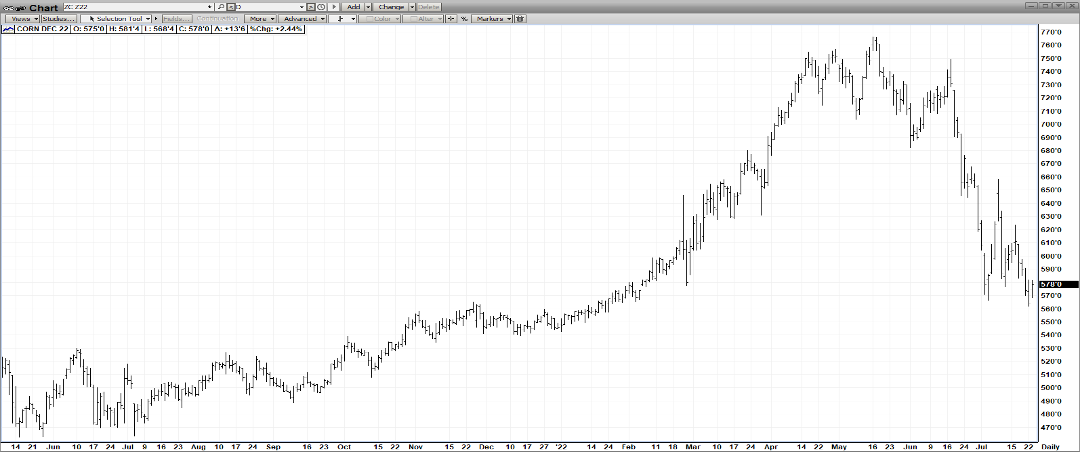

DEC CORN

(Click on image to enlarge)

A plethora of fundamentals/events has caused a $2.00 correction in Dec Corn since mid-May (7.70 to 5.70). The primary factor was a moderating weather forecast – followed by two macro events – a restart of the Nord Stream 1 natural gas pipeline & the signing of a Ukraine-Grain-Corridor deal! The crop is hardly made with pollination now occurring – and dry, hot weather & harvest still ahead! Even today, Dec corn is up 15 cents as Russia bombed a key city in Ukraine on Sat – which could easily delay the implementation of the recently sign grain deal! And the 800 pound gorilla overhanging the grain complex are the 6-7 year low stocks! The USDA’s recent estimates pegged corn production at 14.505 BB – well under last years 15.1! That’s not enough to replenish the pipeline!!

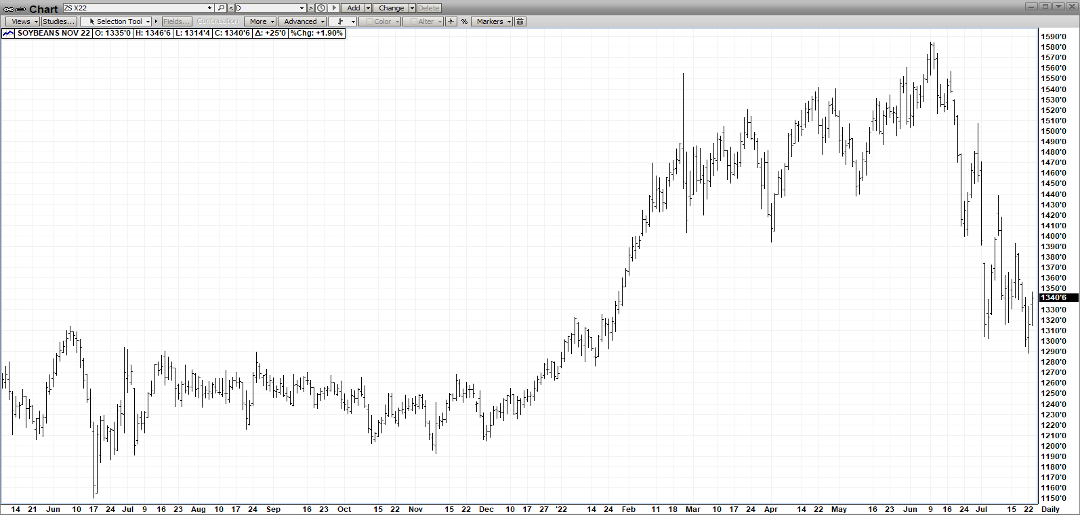

NOV BEANS

(Click on image to enlarge)

Nov Beans have ridden the “down wave” of corn & wht – even with the all-important pod-setting not expected until August! With the pipeline re-opening pressuring crude oil & corn and the Ukraine Corridor Deal depressing wht, beans have coat-tailed them down for a $3.00 break (1580-1280)!

With the critical bean maturation coming in the next 3-4 weeks & after a substantial break, we see Nov Beans falling into a congestion pattern with any stressful weather moving the mkt to a sideways-to-higher pattern!

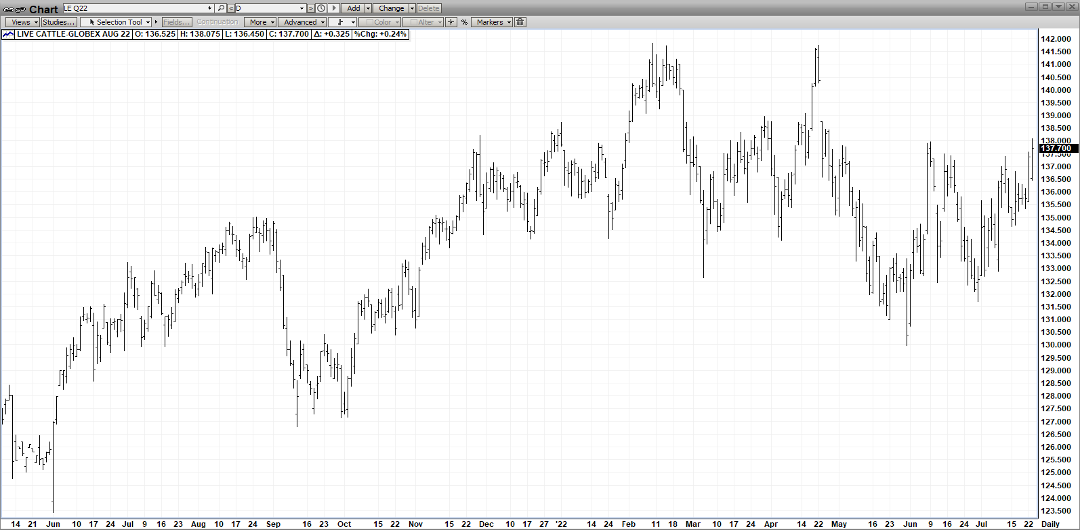

AUG CAT

(Click on image to enlarge)

Three USDA reports were issued Friday at 2 pm – a July Cattle-On-Feed, a Semi-Annual Cattle Inventory Report & a Cold Storage Report – and all were basically neutral – coming in line with expectations! Impressively, today Dec Cat advanced off the neutral reports & in spite of a down day in Aug Hogs! It seems the mkt is responding better to the grilling demand period and the recent heat which as pared the cattle population & reduced the average weights! Finally, the high cost of corn & meal is prompting some to lighten their cattle #’s!

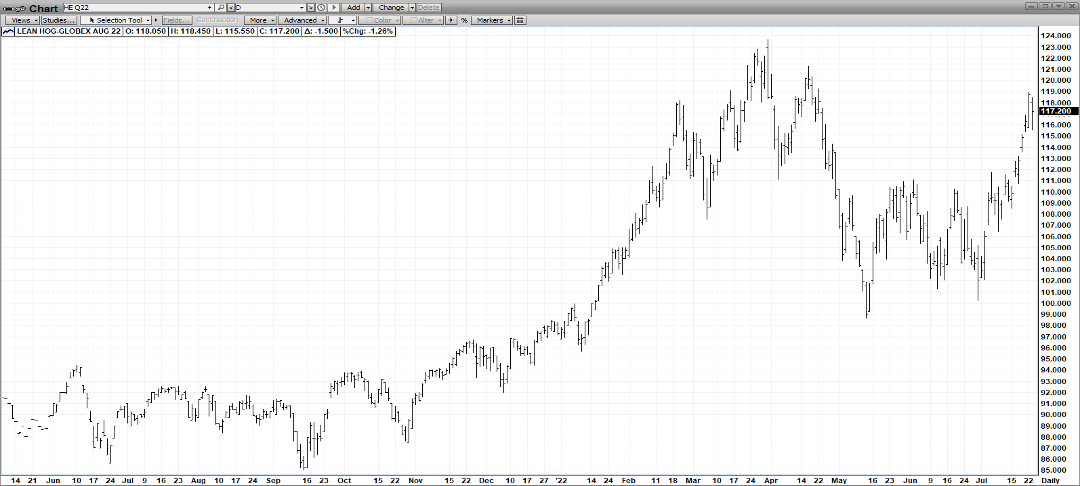

AUG HOGS

(Click on image to enlarge)

In the last 6 trading days, Aug Hogs have gone nearly vertical – advancing $10 (109-119) off a surging cash mkt, heat-induced death loss & stellar US & Mexican demand! But “enough is enough” as the mkt became exceptionally overbought & the funds took profits Today after the trio of neutral meat reports issued on Friday after the close! The forte behind the pork mkt strength is domestic demand – given the relative cheapness of pork vs beef! And with the barbeque season strong thru Labor Day W/E, we see the advances in hog futures continuing after some consolidation!

More By This Author:

Ag Master Report -Tuesday, April 27

AgMaster Report - Thursday, April 8

AgMaster Report - Wednesday, March 3