AgMaster Report - Thursday, April 8

MAY CORN

The USDA has a bent toward “surprise reports” and their latest offering on Mar 31 the Acreage & Qtly Stocks – was no exception! While the trade was universally leaning bearish as evidenced by a 25 cent sell-off into the report, the actual #’s were a bullish shocker – 91.1 MA – 2MA under the estimate & even under the expected range (92-94.5)! The mkt’s next act was arguably even more surprising – as the day after, the mkt gave up more than half the report gains! The funds reasoned the report gains offered a perfect profit-taking opportunity – especially in front of a 3-day W/E! And some were skeptical the actual planting numbers would come in that low! But the S/Dremains positive with tight stocks & uncertain US pltg

MAY BEANS

The Bean acres were equally surprising – coming in at 87.6MA – also 2MA under the estimate & under the expected range (88.9-91.3)! Both corn & beans wasted no time going up the allowable limit (25 cents in Corn & 70 cents in Beans)! The extreme reaction was totally due to the acreage numbers as the Qtly Stocks were in line estimates! The subsequent night session saw these limit gains extended even further before massive profit-taking by the funds ensued! So the focus is now shifting hemispheres from South American harvest to the US planting season! With carry-over pared to 6-7 year lows in Corn & Beans due to massive China demand & production issues in S/A, there is absolutely NO MARGIN FOR ERROR it’s not that it would be nice if we had an adequate crop in the US – it’s that we absolutely NEED one to replenish severely depleted stocks! So the mkt stands to move sideways to higher until much more is known about US yield & production! Further, if the low-ball acreage estimates hold, then we’ll need record yields -for sure! There is no weather premium!

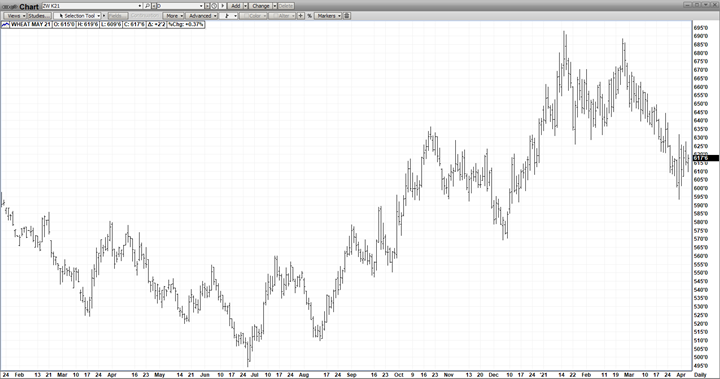

MAY WHT

May wht had broken $1.00 off its highs (695-595) – heading into the 3/31 acreage report – mostly based on adequate moisture in the Central Plains & record global ending stocks! And now the most recent Egyptian Tender disappointingly included Russian wheat when the trade thought tax issues had side-lined the Ruskies! Sowht clearly continues to be the weak link at the CBOT! But rest assured, should corn & beans rally sharply this summer off the inevitable “weather scares”, wht will gladly jump on board!!

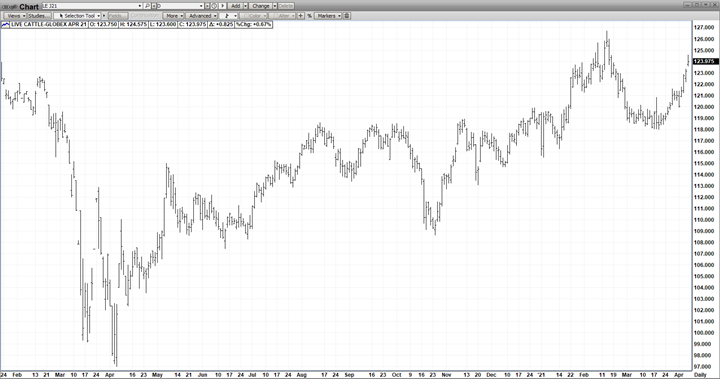

APRIL CATTLE

A changing of the guard in the meats occurred as Apl Cat – after being dormant for over 3 weeks – locked in a tight range – suddenly broke out upside and now is on pace to challenge the mid-Feb highs! Even today, the contract highlighted its ascent with a “gap higher & go” opening! Of course, the fundamentals behind this sudden upside move are easily understandable! The economic rebound spurred by stimulus checks, widespread vaccinations & massive restaurant re-openings – coupled with thestrong barbeque season have demand surging at a torrid pace!

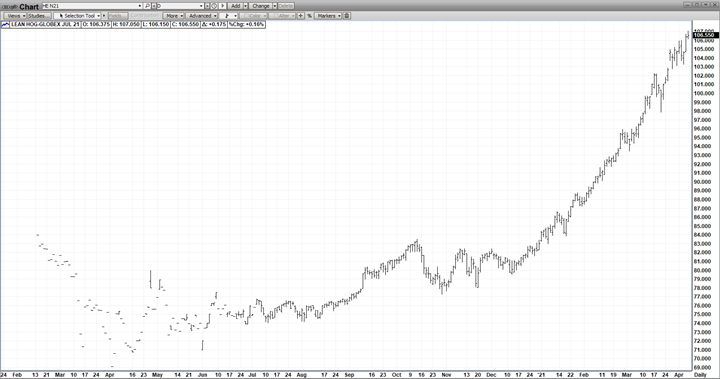

JULY HOGS

July Hog have been nothing short of a mkt juggernaut relentlessly marching $30 higher (77-107) since last November – fueled mostly by insatiable demand for our pork by China! Then came the US Economic Recovery – which featured a DJI reaching a historic high of over 33,000! Restaurant & food Services became more active, people started traveling again & attending sporting events! It all added up to enormous domestic demand on top of the prodigious China imports! So when the July Hog Contract key-reversed down a few days ago, naysayers were proclaiming a top – but alas the prediction was short-lived as the mkt scored new highs the last two days! Indeed, The BULLis alive & well!!