AgMaster Report - Thursday, Aug. 18

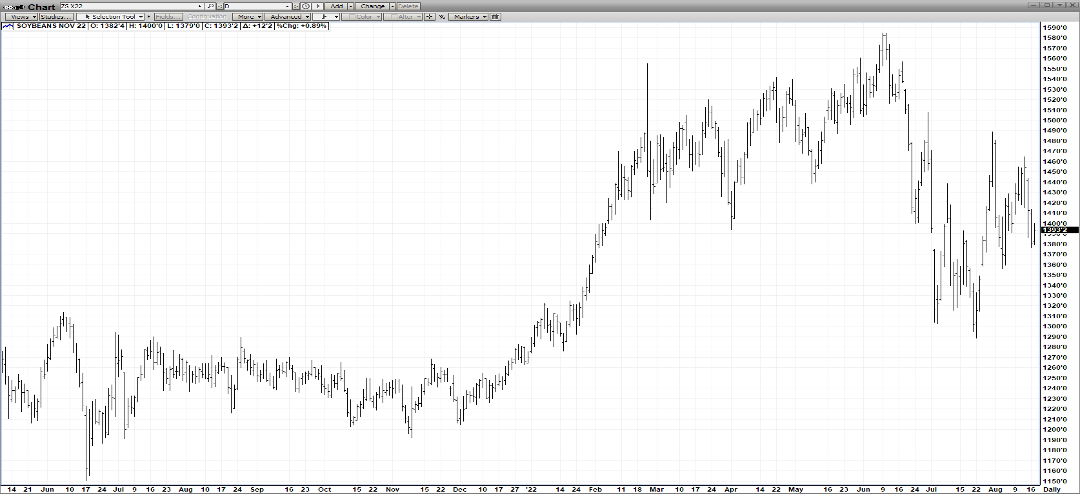

NOV BEANS

(Click on image to enlarge)

The rollercoaster ride continues with Bean Futures buffeted about by the USDA, weather & Macro factors! First, last Friday, the August WASDE report was unfriendly for soys with a 51.9 yield (est-51.0) but Nov Beans were pulled up to a higher close by the bullish corn yield 175.4 (est-175.8)! But then rain & cooler weather over the W/E – coupled with a surprise cut in Chinese interest rates (reacting to bad economic #’s) sent the mkt reeling on Mon & Tues – only to see it stabilize today! Of course, Beans are an August Crop & therefore very sensitive to August moisture! The mkt awaits crop tours this wk & next!!

DEC CORN

(Click on image to enlarge)

The USDA issued their August Crop Report and the corn #’s were quite friendly across the board! Total corn production – 14.359 (LY -15.115), yield – 175.4 (LY – 177.0) new crop US stocks – 1388 (July – 1470) & new crop Global – 306.7 (312.9)! This led to a 15 cent higher close last Friday! But the gains were short-lived as cool, wet weather invaded the farm belt pushing mkts sharply lower on Mon! Exacerbating the losses was news that China had lowered their IR’s in response to sluggish economic #’s! Finally, grains shipments out of the Ukraine Grain Corridor are going better than expected! As a result, the mkt has fallen into the 570-640 congestion area – as it awaits the upcoming crop tours -Ag Resource & Pro Farmer – as well as new 6-10 day weather reports! The Monday Crop Ratings report was down 1% in corn & beans – less than expected – however, Iowa’s dropped 7% (73-66)! The rising US Dollar has inhibited US Exports! The economy has received an injection of hope from last week’s CPI at 8.5% – under June’s 9.1 – and fostering optimism that the Fed might back off its IR increases a bit! Overall, US stocks are on 6-yr lows & production is under 2021!

DEC WHT

(Click on image to enlarge)

After a precipitous $5 drop off its highs (12.80-7.80) & with the Winter Wht Crop 90 % harvested, the Dec Wht has stubbornly stayed entrenched in a tight trading range when one would think harvest lows would kick in – especially after the severe break in price! But extenuating circumstances have intervened – including the resumption of the Ukraine grain corridor shipping, a ratcheting up of the Russian Wheat Crop estimates (now 94.7) & just today a cancellation of a 50,000 MT tender by Iraq!

A potential wht rally might need a little coaxing from the Corn & Bean mkt’s resurgence due to disappointing yields!

OCT CAT

(Click on image to enlarge)

Oct Cat has seemingly taken over the upside leadership in the meat complex rallying $8.00 (138-146) since mid-July! They have been the beneficiary of several factors – one being the expectation of tightening supply over the next three quarters. Second would be the sharp rise in pork prices – making the beef-pork spread not so great. And finally, the $1.00 decrease in gas at the pump has put more disposable income in the consumers pocket!

However, the mkt might well pause its up– awaiting the August Cattle on Feed Friday at 2pm CST! Placements– 98.5% Marketings– 97.1% Cattle-on-Feed – 100.7%!

OCT HOGS

(Click on image to enlarge)

The charts are only half the equation when trying to analyze mkts but it would be difficult to ignore the huge “Key Reversal” in Oct Hogs Tues after failing a test of contract highs but the major caveat in assuming that this KR signifies a top is the huge discount ($21)Oct Hogs already hold to cash (normally $11)!So the mkt may have run its course, but the downside sure looks limited – given the contracts massive discount to cash!

The barbeque season still has a month or so left & the consumer has a little more $$ in his pocket due to the gas price plummet of late! So, the mkt may well consolidate at current levels as it sorts things out!!

More By This Author:

AgMaster Report - Tuesday, July 26

Ag Master Report -Tuesday, April 27

AgMaster Report - Thursday, April 8