AgMaster Report - Thursday, Oct. 6

DEC CORN

(Click on image to enlarge)

The numbers don’t lie – the last two USDA Reports – the Sept WASDE – 9-12-22 & the Qtly Stocks – 9-30-22 both corroborate the Supply Bull that is the current Corn Mkt! Total production – 13,944 BB (Ly-15,115), yield – 172.5 BPA (Ly- 177.0) & Qtly Stks 1377 (June -4346). Imagine, if we had some decent demand! But the mkt doesn’t trade in a vacuum! The DJI has officially entered “bear mkt territory” with a 20% break off its recent highs – the US $$ is trading on 20-year highs – harvest is in full go-mode with over 20% of the crop in – the Russ/UKR war has escalated – threatening its grain corridor! Yet when all the smoke clears, the mkt is only .15 off its 7.00 high! Impressive action to say the least!!

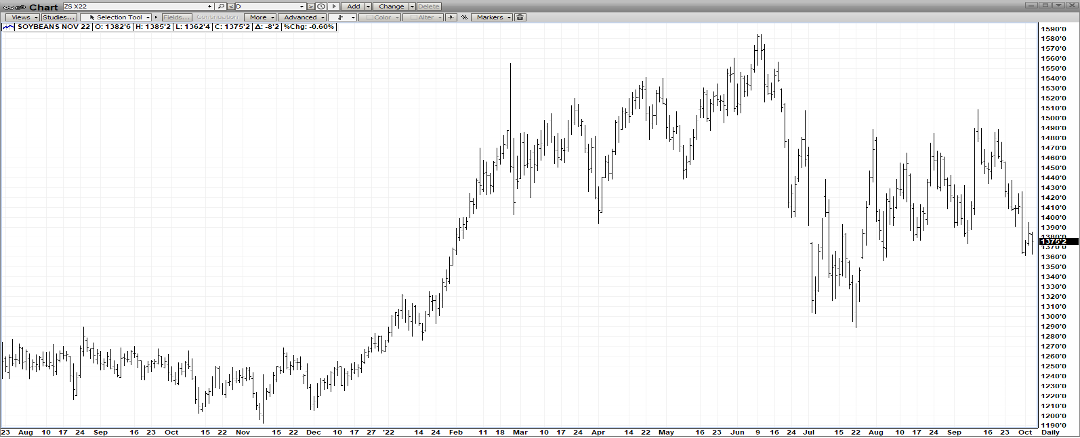

NOV BEANS

(Click on image to enlarge)

The outlook for the Bean mkt is not nearly as sanguine -and the chart reflects that! The crop is the same as last year 4,378 BB (Ly-4,435) & yield is close 50.5 (Ly-51.9)! Plus, the Quarterly Stocks 274 MB (220-275) was on the high end! Chinese demand has been lackluster & Brazil is reputed to be planting a record bean crop! The USDA October Supply & demand is due out next Wed at 11 am – and is expected to be friendly with avg to disappointing yield results so far! Still, nearly $14 beans at harvest time is nothing to sneeze at! Thinking back 3-5 years, we would have gladly taken that price many times! The harvest lows seasonals kick in today! The old wives tale says the HL’s form about half-way thru harvest – with the “open harvest window” we’ve had, that’s not too far away!

DEC WHT

(Click on image to enlarge)

Dec Wht has been the beneficiary of several supply/demand & macro factors leading to a rousing rally up to $9.40 last week! Dryness in the plains during the winter wht planting has been problematical – prior to today, the US $$ has plummeted 500 points & the russ/UKR grain corridor deal is on thin ice as Putin has escalated the war! As well, harvest lows from the Spring Wht harvest have been kicking in! Even today, with the dollar up 120 points, the Dec Wht managed a higher close – asolid indication of bullish divergence!

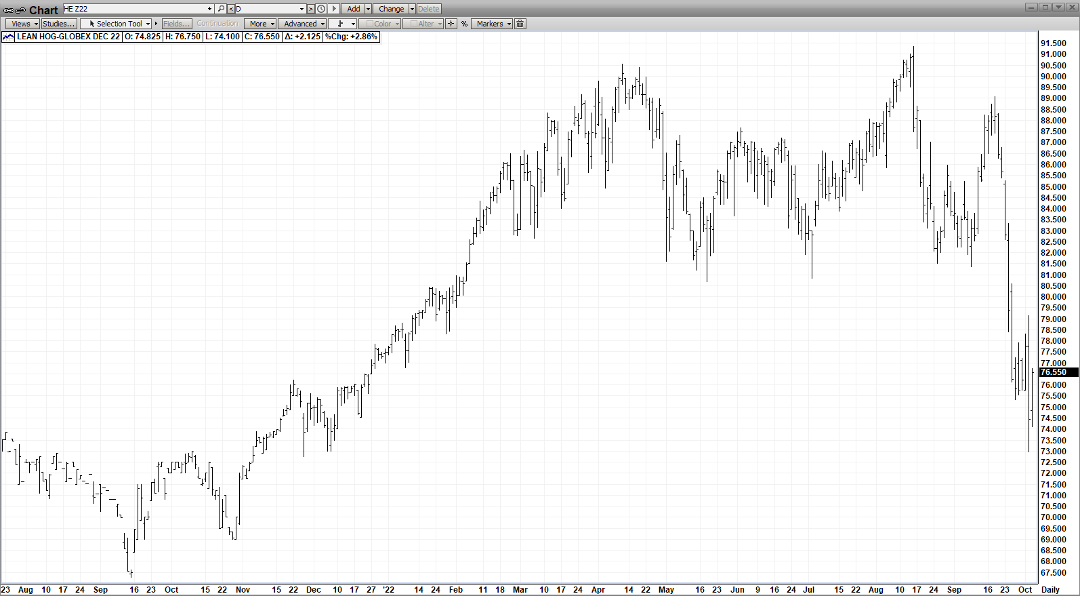

DEC HOGS

(Click on image to enlarge)

Dec Hogs have experienced some inexplicable volatility the past two days – but after some wilds swings – closed today 30 cents higher on the week! The biggest feature of the week is the enormous discount to cash that Dec Hogs holds! Which means a lot of bearishness due to the macros has already been dialed in! So any kind of decent demand or supply news coming the contract’s way could rally it sharply!

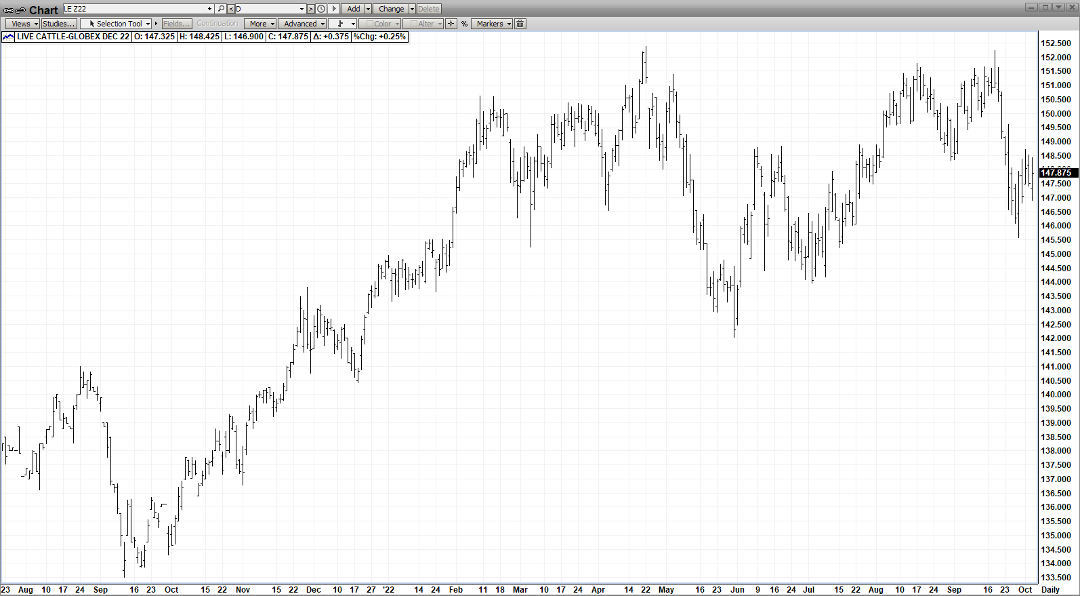

DEC CAT

(Click on image to enlarge)

Dec cat is caught between a rock & a hard place – with friendly macros this week including a 1600 point 2-day rally in the DJI & a sharp plummet Tues in the US $$ offsettin marginal consumer demand due to a faltering economy! Should the Fed take its “foot off the gas” with fewer & smaller IR increases into 2023, beef demand could recover enough to rally this mkt!

More By This Author:

AgMaster Report - Thursday, Sept. 1

AgMaster Report - Thursday, Aug. 18

AgMaster Report - Tuesday, July 26