AgMaster Report - Thursday, Dec. 29

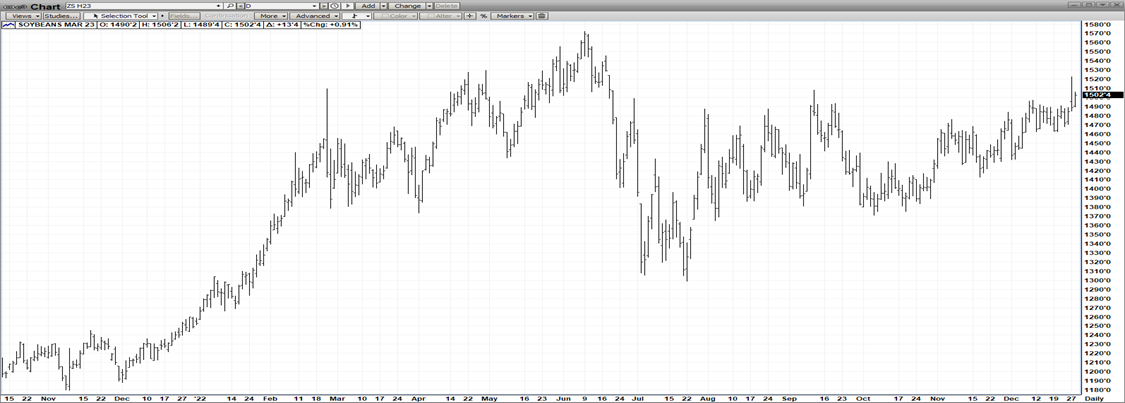

MAR BEANS

(Click on image to enlarge)

Mar Beans had a terrific start to this week’s trade Mon -rallying nearly 40 cents off a re-opening of China, Argentine dryness & the US Arctic cold blast! But alas, the rally didn’t hold, as the mkt closes off its lows – leaving an ominous “spike top”! But today, the mkt resumed its up – surging toward the 6-month highs scored yesterday! We feel a combination of bullish factors have developed – that could act as a springboard to higher prices in 2023 – even from the already historically high $15.00 level! A plummeting US Dollar & a re-opening of China should improve the export outlook, a drought-ridden Argentina could substantially reduce the South American Crop and a resilient economy might stave off a recession – giving a boost to all commodities! And the 6-year low global stocks continue to underpin the mkt!

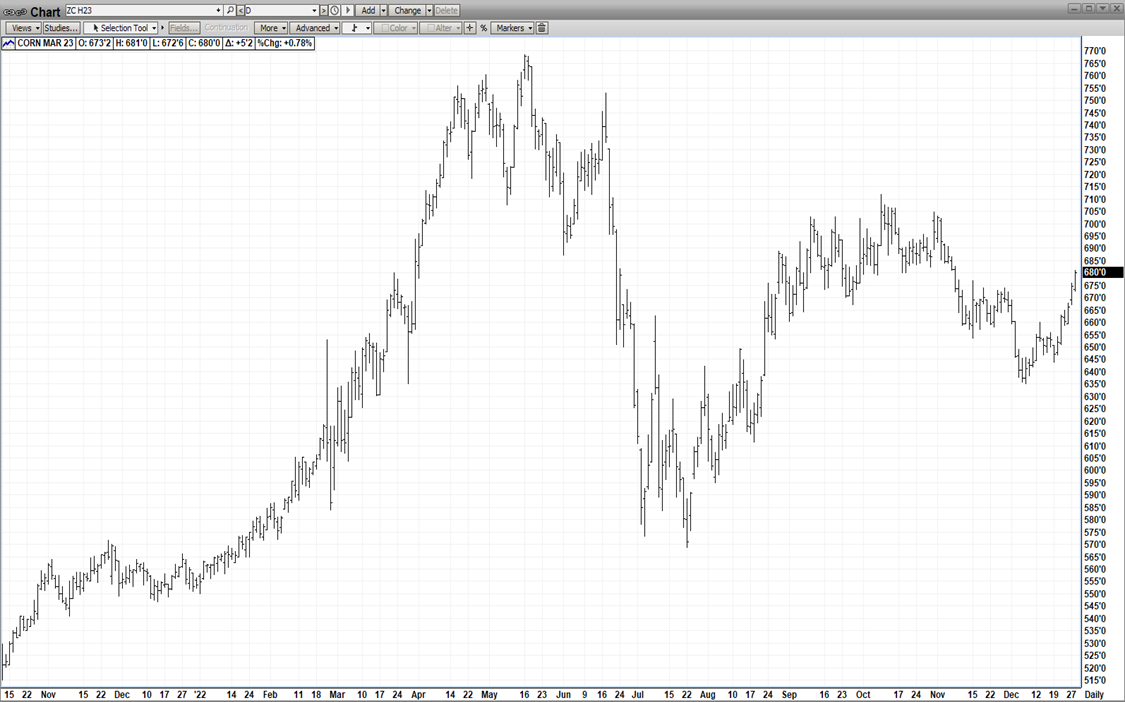

MAR CORN

(Click on image to enlarge)

Recent news out of South America has FOB premiums for Argentina, Brazil & the US Gulf at parity for Feb delivery! Apparently, the recent plummet in the US Dollar of nearly 10% since late Sept is already having a benign impact on the recent dismal US Corn Exports! That coupled with China’s easing Covid restrictions foretells a badly needed uptic in US grain exports in the 1st Qtr of 2023! That coupled with a depleted S/A crop due to Argentina’s extreme drought injects some positive supply/demand fundamentals into the corn mkt – which remarkably has held just under $7.00 despite almost non-existent exports & the re-opening of the Russian-Ukraine Corridor! Indeed, the 6-7 year low level of carry-out continues to support the mkt at historically elevated prices – and they may not be high enough entering 2023 should normal exports resume & the Argentine dryness worsen!

MAR WHT

(Click on image to enlarge)

Given the $5.00 drop in Mar Wht since Mid-May & considering the damaging weather with definite winterkill happening after the last week’s arctic blast & the ongoing drought in the Mid-Central plains, It certainly feels like the contract has cratered – looking to rally into the Spring – possibly coat-tailing a bullish move from corn & beans! Russia has had a vice grip on prices – with their record crop & their low-ball prices in the global export mkt! but they may have been factored into the price structure! And Egypt continues to active in the world mkt!

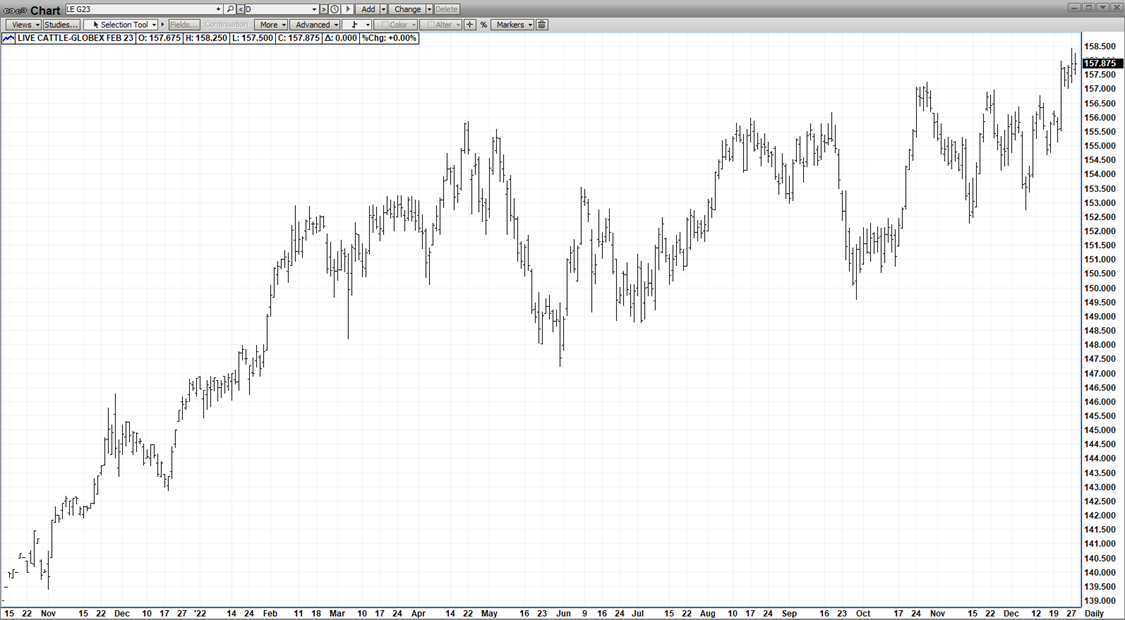

FEB CAT

(Click on image to enlarge)

A tightening supply outlook continues to underpin the mkt – a shift in US beef production from the 4th Qtr to the 1st Qtr of 2023 show a near-record decline – and this major fundamental continues to support the mkt on breaks! Plus, the spate of USDA reports last Friday – the Cattle-on-Feed Report & a Pig Crop Report both showed a pronounced decline in livestock populations – this combined with robust holiday demand has maintained the Feb Cat contractas the upside leader in the meats! Adding frosting to the cake was the recent Arctic Blast – that increased death loss & reduced weight gain in the cattle herds!

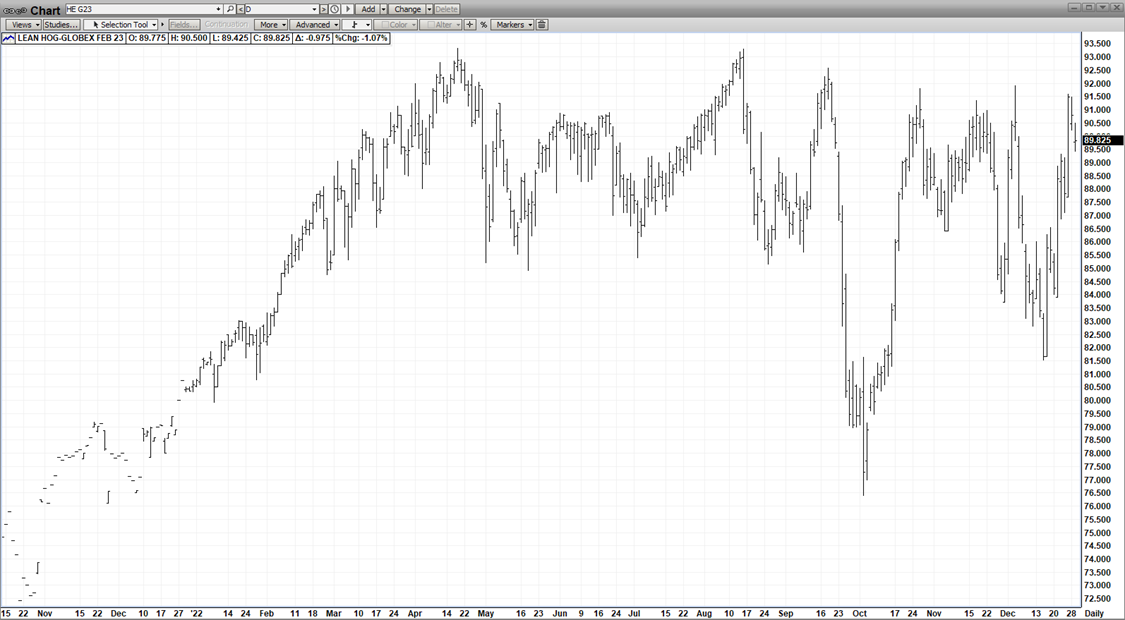

FEB HOGS

(Click on image to enlarge)

Oftentimes, what a mkt is unable to do when it should – is the most telling! Case in point Feb Hogs – which has had a remarkable surge to the very top of its recent range off two favorable USDA reports last Friday, an historic Arctic Chill & a raging new contract highs in it sister mkt Feb Cat! But disappointingly, follow thru was lacking as a weaker pork cut-out led the futures to $2.00 correction -off burdensome production increases – going into early 2023! In addition, robust Holiday Demand will certainly slack off into early January!

More By This Author:

AgMaster Report - Thursday, Oct. 27

AgMaster Report - Wednesday, Oct. 19

AgMaster Report - Thursday, Oct. 6