AgMaster Report - Wednesday, Aug. 23

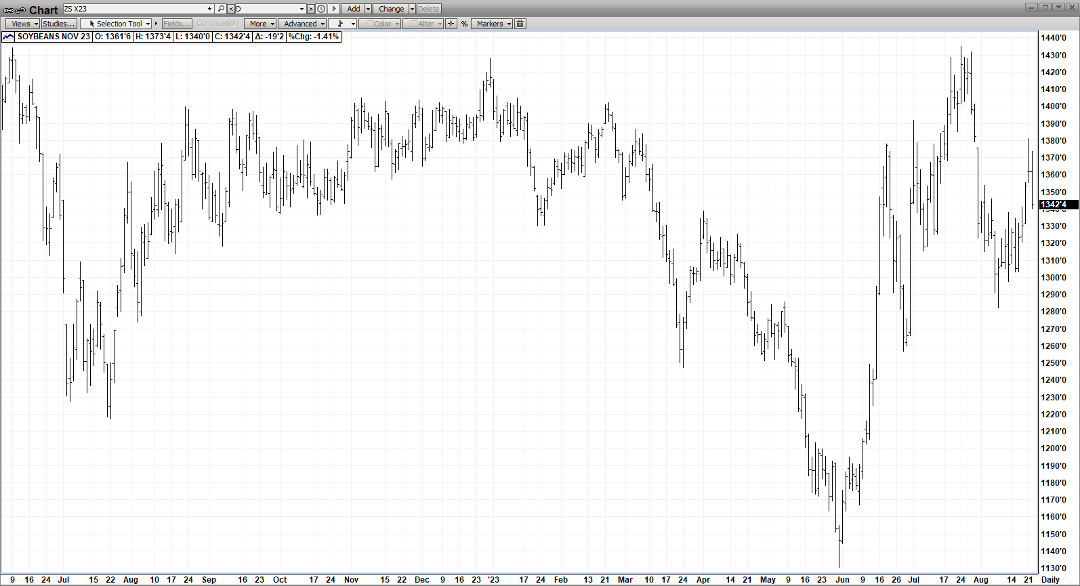

NOV BEANS

(Click on image to enlarge)

Nov Beans added a 50 cent weather premium – in advance of the brutal hot spell currently engulfing the Central Farm Belt – but then extracted part of that today when partial results of the Pro Farmer Tour surfaced! Early results from Ohio & South Dakota revealed higher pod counts than 2022 – as expected! Today, the tour covers W Iowa/Minn & Indiana where the results are expected to be under last year! The US Dollar has rallied 400 points in the past month – a negative for exports! However, we’ve had 19 flash export sales in the past month – as China has re-entered the mkt! And 4 million less acres is a bullish foundation!

DEC CORN

(Click on image to enlarge)

Dec Corn rallied 30 cents last week (475-505) – including Sunday night – adding premium due to the extreme heat descending on the Midwest this week – but then quickly extracted it Mon & Tues! The early Pro Farmer tour results from Ohio & S Dakota showed higher yields than last year & the US Dollar has rallied hard in the past 2 week – with both factors pressuring corn! However, the next leg of the PF Tour today is expected to show down yields from 2022! And Flash Sales have commenced in the past month with Mexico a steady buyer of US Corn! We feel seasonal lows are being carved out presently especially with a strong Bean mkt leading the way up – with sharply reduced acreage in beans & 6 year-low stocks underpinning the mkt on any breaks!

DEC WHT

(Click on image to enlarge)

Ukraine has said recently that they are working out a deal with some grain export insurers – to resume shipments thru the Black Sea in absence of the Russian-Ukraine Corridor Deal! This coupled with a strong dollar has kept Dec Wheat “under wraps” but its sheer cheapness – due to Russia’s continuing influx of cheap wht exports – will ultimately attract solid export demand & will subsequently establish a seasonal low along with corn!

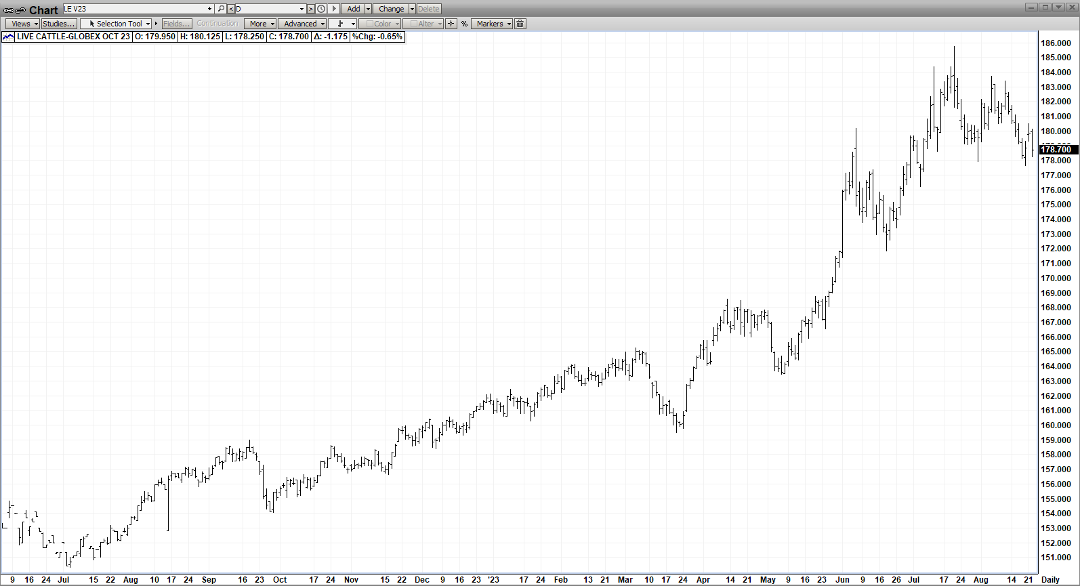

OCT CAT

(Click on image to enlarge)

A bullish Cattle-on-Feed issued last Friday at 2 pm – reflected a very bullish 8% fewer cattle-placed-on feed than last year – and temporarily rallied the mkt – but fears of slumping demand, post-Labor Day, once again surfaced – bring Oct Cat down to support some $8.00 off its Mid-July spike high of 186.00! Further rallies in cattle futures need to be led by the cash mkt!

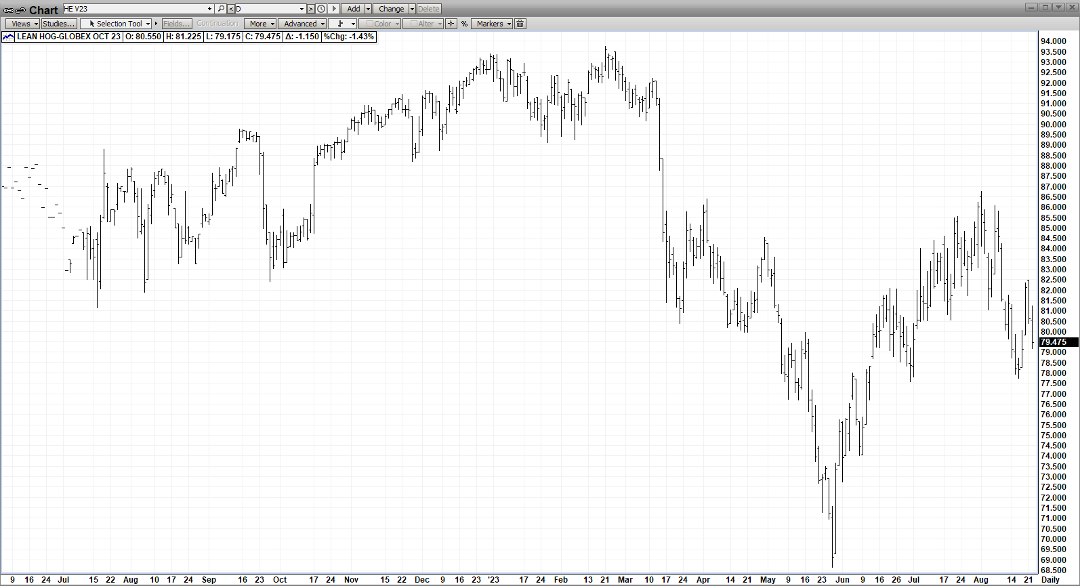

OCT HOGS

(Click on image to enlarge)

Oct Hogs have similar demand issues to Oct Cat as seasonally, Meat & Pork demand wanes after Labor Day! However, the large discount, the contract holds to cash tends to support the mkt on corrections! But like cattle, hogs need a resurgence in cash to lead the futures higher!

More By This Author:

AgMaster Report - Friday, Aug. 18

AgMaster Report - Thursday Aug. 10

AgMaster Report: Wednesday, August 2