AgMaster Report - Friday, Aug. 18

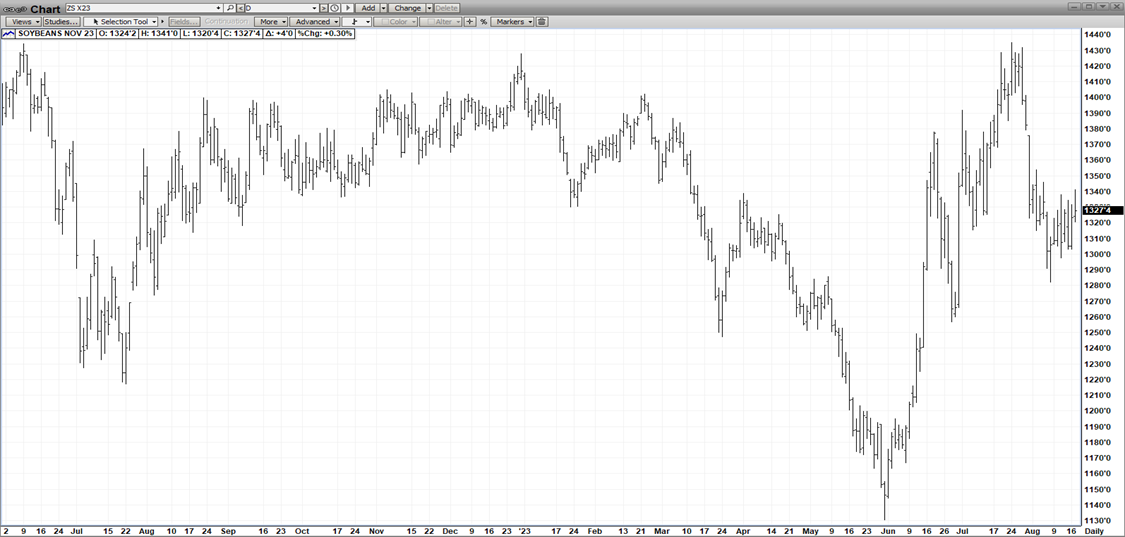

NOV BEANS

(Click on image to enlarge)

The $1.50 break in Nov Beans established a $12.80 low on 8-8-23 – that we feel will hold thru harvest! The last 2 major USDA Reports seem to support the mkt – starting with the June 30 Acreage Report reflecting 4 million aces less beans planted over 2022 – and most recently the Aug 8-11-23 WASDE predicting both production – 4.205 (ly-4-276) & yield – 50.9 (ly-52.0) UNDER 2022! And 8am flash sales have begun appearing weekly with 5 such sales in the past 7 trading days! So, less production, improving exports & 6 yr low stocks seem to be a recipe for higher prices! The geopolitical issues in RUSS/UKR are still very much alive & hot & dry is predicted for late August thru Labor Day!

DEC CORN

(Click on image to enlarge)

Bearish weather – cooler & wetter – has driven Dec corn down to new lows for the year – exacerbated Monday by improved Crop Ratings – corn up 2% & beans up 5%! Also, the mkt has become numb to increased drone strikes in the Russ/Ukr – which previously were interpreted as bullish! But a re-emergence of 8am flash export sales has injected some much-needed optimism into the mkt – which has been almost totally void of exports all year! But also hanging over the mkt is proposed acreage increase of 5.5 million acres in corn planting! However, that has been in the mkt for a while & is pretty well dialed in!

This morning’s export sales nearly 1 MMT coupled with a hotter, drier forecast thru Labor Day have produced a 2nd consecutive up day!

DEC WHT

(Click on image to enlarge)

The old commodity cliché applies perfectly to Dec Wht – currently! LOW PRICES CURE LOW PRICES! The plethora of cheap Russian wht has kept prices at bargain basement prices but that can’t last forever! And production issues are popping up globally with dryness issues in the central US, India, Argentina & Australia! But mostly is the simple fact that wht is the cheapest grain commodity in the world – a fact not lost on exporters! An potential rallies in corn & beans due to disappointing yields & improving exports will filter over into wht – establishing a low from current levels – which are amazingly $4.00 cheaper than a year ago!

OCT CAT

(Click on image to enlarge)

Oct Cat hasn’t made new highs in over a month but it really hasn’t gone down much either- maintaining a $4-5 consolidation pattern since the spike high! But the record high prices may be finally inhibiting consumer demand & the record long open interest makes the mkt very vulnerable to a sharp sell-off! But still supplies are woefully short! Stay tuned!

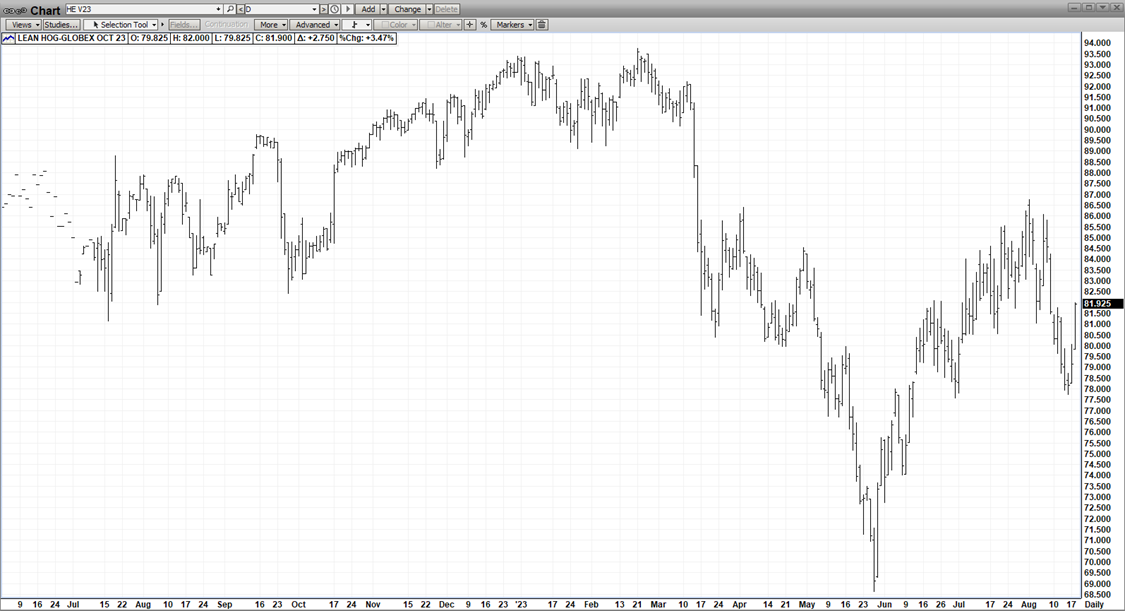

OCT HOGS

It’s common knowledge, pork demand wanes after the Labor Day W/E – which explains the recent $8 sell-off! But what stopped the break in its tracks was a sharp increase in weekly exports & the extreme discount Oct Hogs hold to cash – leading to its $3.00 rally this week! These factors could well hold the mkt in a tight range – offsetting weaker demand!

More By This Author:

AgMaster Report - Thursday Aug. 10

AgMaster Report: Wednesday, August 2

AgMaster Report - Wednesday, July 26