AgMaster Report - Thursday Aug. 10

NOV BEANS

(Click on image to enlarge)

The mid-July $1.50 break (1430-1280) of course happened due to widespread rains & moderating temps across the Farm Belt – particularly beneficial to beans in their critical pod-setting stage! However, it also enhanced the beans export value in the global mkt – as a cheaper bid attracted 8-10 flash sales in the past fortnight! As well, the August WASDE report due out Friday at 11am is predicting a 4.238 billion bushel crop – UNDER last years 4.276 BB! And that with a backdrop 6-7 year low stocks – being exacerbated by the severe Argentine drought! It spells out easy price-rationing even with an average crop – any weather issues, and current prices are woefully too cheap!

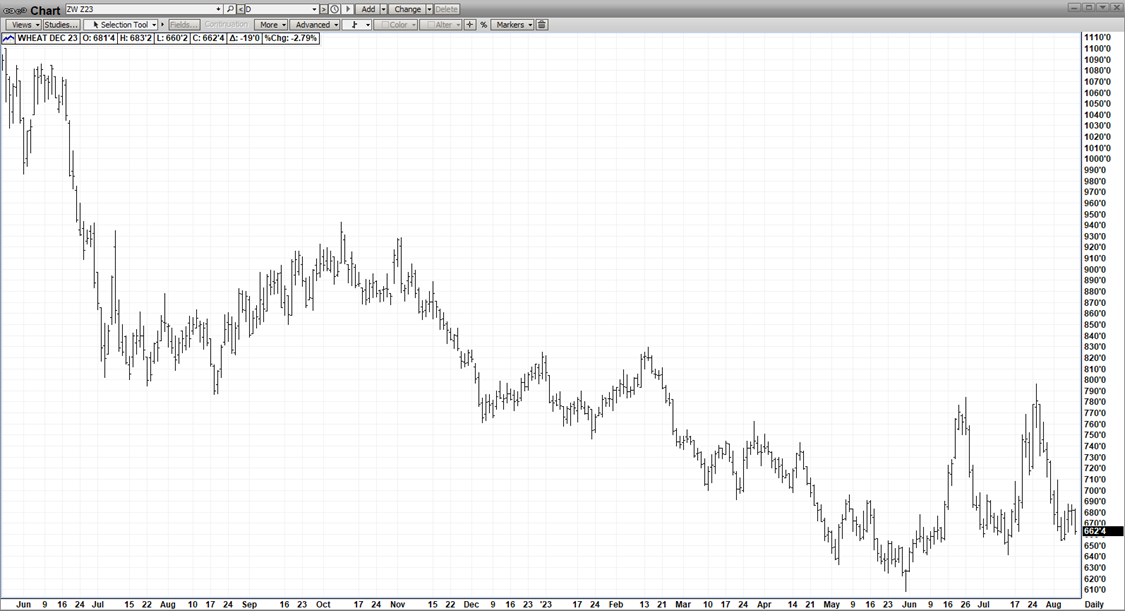

DEC WHT

(Click on image to enlarge)

Once the drone strikes stopped in the Russian-Ukraine conflict, Dec Wht reverted back its “bearish demand scenario” – where Russia’s record wht crop enabled them to inundate the global mkt with their cheap wheat supplies! However, wht prices are historically cheap & Russian won’t be able to continue its low-ball export program forever, and ultimately LOW PRICES WILL CURE LOW PRICES!

DEC CORN

(Click on image to enlarge)

Dec Corn has been twice pummeled by both the USDA & Mother Nature this summer – finding support just under 5.00! First was the off-the-wall June 30 Acreage Report which predicted corn acres would increase a whopping 5.5 million acres over 2022 – second was a complete 180 turn in weather when early drought conditions morphed into plentiful rain & cooler temps! And just in time for corn’s pollination! Tomorrow comes the August WADSE REPORT – with early guesses at 15,126 BB (2022-13,730) & 175.4 BPA (2022-173.3)! Exports are beginning to return – nearly 1 MMT today at 7:30am & a flash sale Monday to Mexico! A lot of “bad news” has been dialed into the price already – we’d be very surprised to see much down from here – even with a bearish USDA tomorrow at 11am!

OCT CAT

(Click on image to enlarge)

Oct Cat continues to be the beneficiary of extreme tightness & solid consumer demand even at current record levels! The July Inventory Report announced the lowest cattle #’s since 1961 & demand has been energized by the grilling season – still with 3-4 weeks to go – and despite the much cheaper pork alternative! Although the mkt hasn’t made new contract highs in 3 weeks, it hasn’t fallen too much off those highs either! Eventually the all-important consumer will balk – maybe after Labor Day W/E but so far he hasn’t backed off! Another supportive factor is Oct Cat’s big discount to cash with cash holding very firm at current levels!

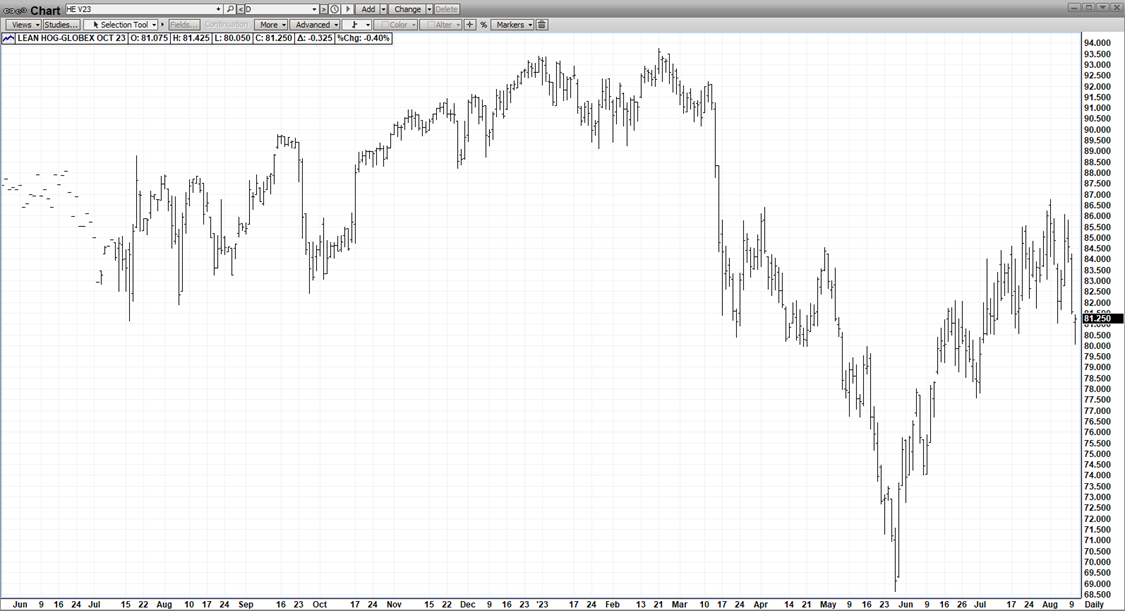

OCT HOGS

(Click on image to enlarge)

Oct Hogs seemed to have lost their “upside MOJO” due to a variety of factors – weaker cash & pork cut-out, higher avg weights & growing global production out of Europe & Brazil – squeezing exports! Even with pork the much cheaper meat alternative in the supermarkets, demand has been unable to hold the mkt up – as it slides to lower end of its 6-week range!

More By This Author:

AgMaster Report: Wednesday, August 2

AgMaster Report - Wednesday, July 26

AgMaster Report - Wednesday, July 19