AgMaster Report: Wednesday, August 2

SEPT BEAN

(Click on image to enlarge)

Make no mistake -one of the oldest & truest “grain mkt cliches” RAIN MAKES GRAIN once again was at the fore in the past week – as widespread rains inundated the farm belt during the critical pod-setting time – potentially enhancing yields! But – there was also positive demand news – as 8 flash sales of beans to China/unknown in the past 7 mkt days seemed to indicate China was once again in the mkt for US beans! Also, the $1.30 break certainly made our beans more attractive on the global export mkt! But the biggest feathers in the Bulls Cap are still the shocking 4 million acre reduction in planting from 2022 & the critically low global stocks – already on 6 yr lows! And beans are a long way from being made!

SEPT CORN

(Click on image to enlarge)

Well-timed rains arrived in the corn belt – right in the middle of pollination & sent prices tumbling – as you’d expect! This coupled with a projected 5.5 million acre increase in corn planting for 2023 & very slack demand added the downward pressure! However, the crop is a long way from made & in! And exports most probably will resume in the Fall! A hiatus in the Russian bombing of the Ukraine grain infrastructure has also been a negative! The US economy has been remarkably resilient – despite frequent interest rates increases to multi-decade highs and the DJU has recently scored new 2023 highs! A positive for all commodities!

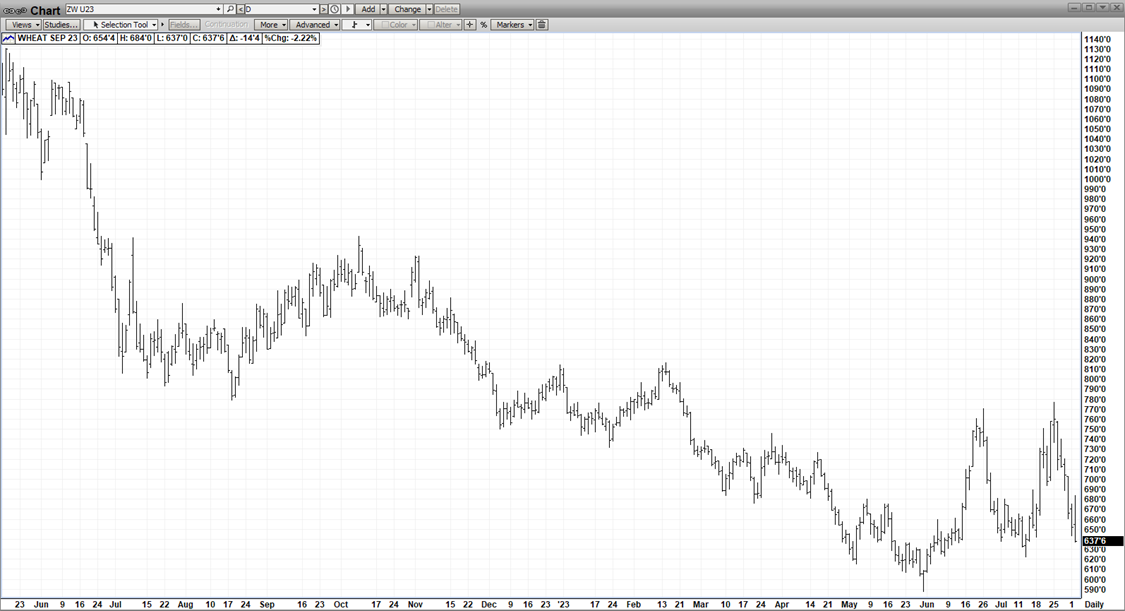

SEPT WHT

(Click on image to enlarge)

A new drone attack on a Danube port briefly rallied Sept Wht 30 cents higher early this morning but bearish weather forced the mkt to do a “180” & the mkt promptly broke 50 cents – now registering double-digit losses! It clearly demonstrates that weather trumps all – especially this time of the year as the crops develop! The silver lining is that the severe break in the past fortnight may well uncover some much needed demand!

OCT CAT

(Click on image to enlarge)

The Oct Cat contract rallied $2.00 yesterday off stronger cash & a larger-than-avg $5.00 discount to cash but today the mkt is surrendering half of that gain! With record prices in the stratosphere – albeit supported by continuing supply tightness – pundits are wondering how much longer consumer demand will support this mkt at these levels – especially with pork being so much cheaper! This past summer, “so-called tops” have succumbed to even higher levels two different times! The jury is out as to whether the spike-high of 185.70 made on 7-20-23 will hold! Ultimately, the consumer will decide!

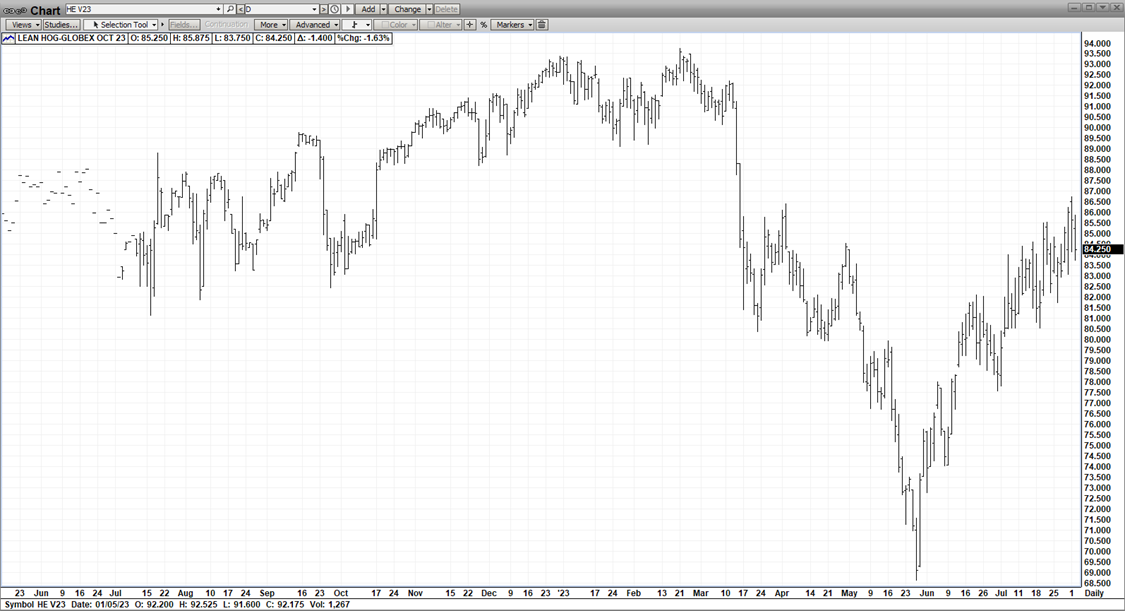

OCT HOGS

(Click on image to enlarge)

The new upside leader of the “meat complex” Oct Hogs has forged a near-vertical rally since late May – lately enhanced by a seasonal strength in pork prices & seasonal declines in national hog weights! But, a sharp rally in the US Dollar could undermine US exports – providing substantial headwinds to the mkt – particularly after its robust rally! However, on the plus side, cheaper feed costs have helped the mkt support on breaks!

More By This Author:

AgMaster Report - Wednesday, July 26

AgMaster Report - Wednesday, July 19

AgMaster Report - Tuesday, June 13