AgMaster Report - Tuesday, June 13

JULY CORN

(Click on image to enlarge)

It’s not July “hot & dry” – it’s June “cold & dry” but still it’s been inordinately dry since April – and traders are building in a sizeable weather premium into the July Corn contract as a result! Exacerbating this scenario are the historically tight carryovers! The forecast 3 million acre planting increase may well be neutralized by substandard yields! Also, the Corridor Deal is on shaky legs – as Russia is unhappy with the current agreement and once again threatens not to renew after the mid-July expiration! Demand is still quite lackluster but this current rally is all about supply or lack thereof! Corn is the upside leader with pollination coming in July! If it stays dry until then, we’re way too cheap!!

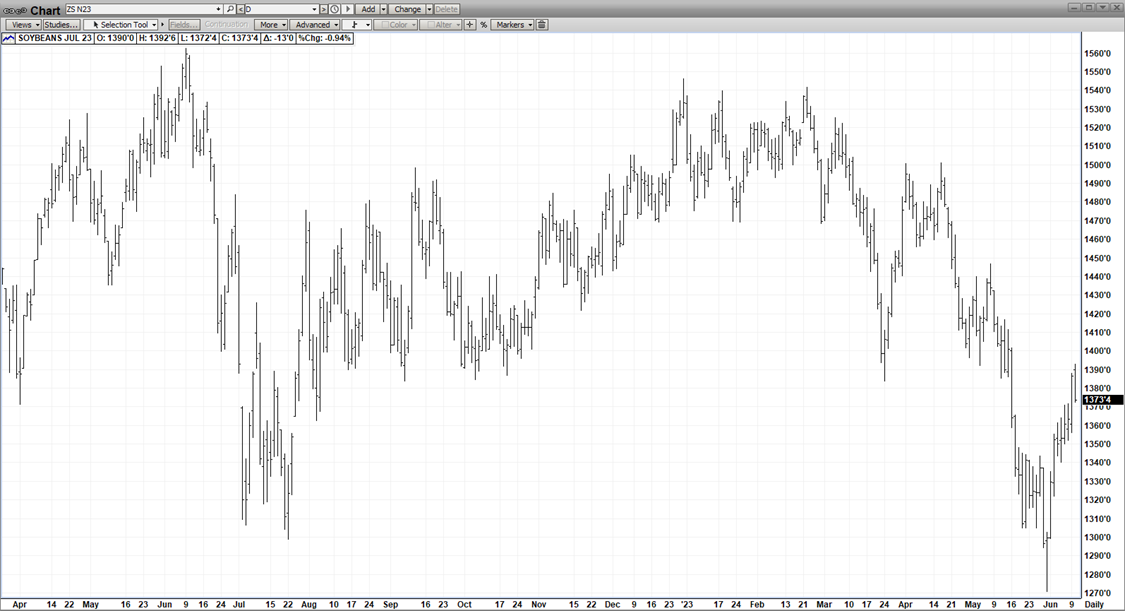

JULY BEANS

(Click on image to enlarge)

July Beans have not responded as much as corn to the dry weather or the Corr Deal with good reason! Beans don’t set pods until August & the deal impacts corn & wheat – not really beans! Nonetheless, a “rising tide floats all boats” so the “early dry this year has managed to rally July Beans $1.20 in the past 9 trading days (1270-1390)! And bean acres were projected to be unchanged from 2022 – at a time when carryout took a hit from the Argentine drought -so this provided additional support! The June WASDE was neutral to a little negative with US & global stocks higher than May 2023 – but with total production – 4.510 BB & yield – 52.0 the same as last month! The crux of the upside argument is that bean acres were not increased from 2022, carryout took a hit due to the South American crop woes & and we’re starting out with a very dry pattern! We really can’t afford the luxury of anything but an above average crop or current prices are too low!

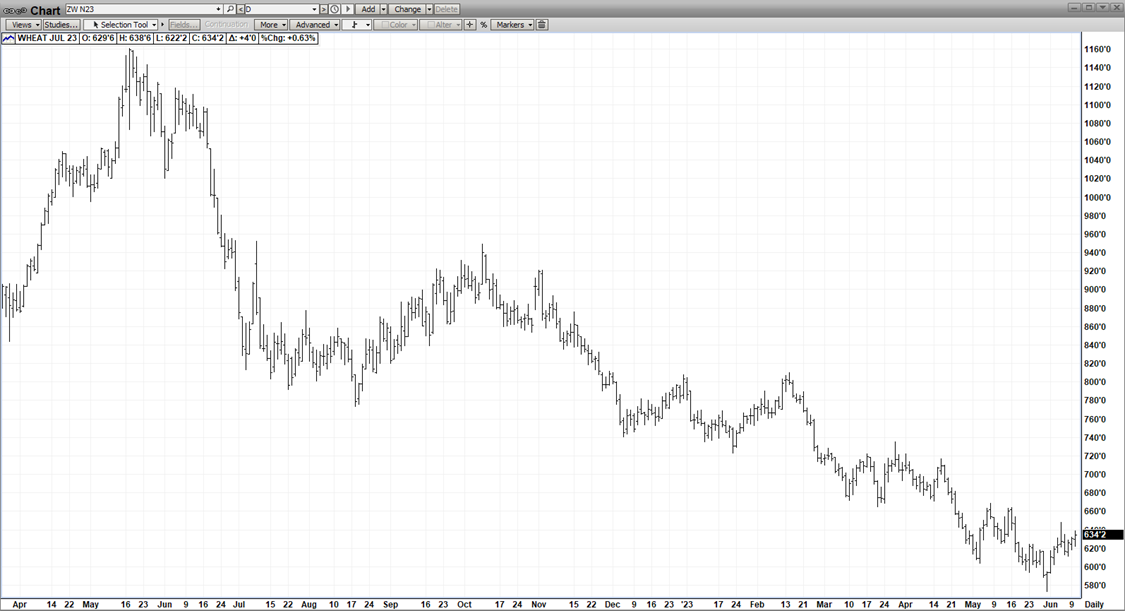

JULY WHT

(Click on image to enlarge)

Quite obviously, July Wht is the weak sister at the BOT & has been for a long time! The simple explanation – that nefarious Super Power RUSSIA!Not only are they laying waste (or at least trying)) to Ukraine, they are killing the Global Wht Mkt with their cheap exports from their record harvest – in effect keeping prices “under wraps” – as no one can compete with them! This has totally stifled US Wht Exports – keeping prices at bargain basement levels! Even occasional bullish news like the potential cancel of the Corridor Agreement could not sustain price rallies! Wht needs help from the dry weather & spiller-over support from corn/beans to mount any upside with staying power!

AUG CAT

(Click on image to enlarge)

The unrelenting, unstoppable Bull Mkt that is Aug Cat finally developed a “chink in the armor” breaking $7.00 ($178-171) in just a week’s time – off an exceptionally overbought condition! So the natural question would be – is this a top or just another correction? Definitely a reasonable query at the current record-high price levels! However, the Bull Argument is still quite strong! Very tight supplies (6% lower in 2nd Qtr & 4.5% in 3rd), firm cash mkts & demand being injected from the strongest period of the year (the outdoor grilling season)! As well, pork is much cheaper & offers a very viable “meat alternative” in the grocery store! In our mind, the “jury is out” as to whether strong seasonal demand will sustain the mkt at current levels! Recession fears also play a big part in the mkts upcoming direction!!

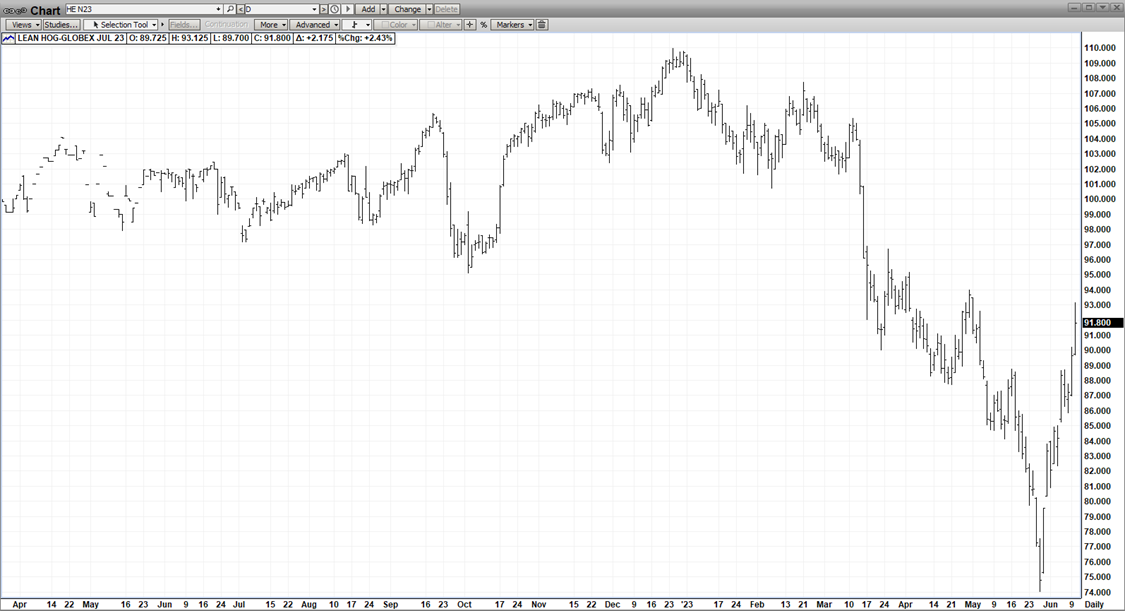

JULY HOGS

(Click on image to enlarge)

WHOLLY MACKERAL!! When the old hog mkt decides to turn – FINALLY – it doesn’t mess around, does it?Doing a sensational “180”, July Hogs went nearly vertical – rallying almost $20 ($74-93) in just 2 weeks time! Most of the spectacular move was due to massive short-covering – them shorts had to be pretty nimble not to avoid giving everything back! As well, the average weight & daily slaughter have come down! Finally, we’re in the best demand period of the year – and the extreme disparity between pork chops & steaks in the supermarket is not lost on the consumer! It all adds up to a welcome turn-around in the hog mkt – which has been bludgeoned for too long a time!

More By This Author:

AgMaster Report - Thursday, June 8

AgMaster Report - Tuesday, May 23

AgMaster Report - Tuesday, May 16