AgMaster Report - Tuesday, May 16

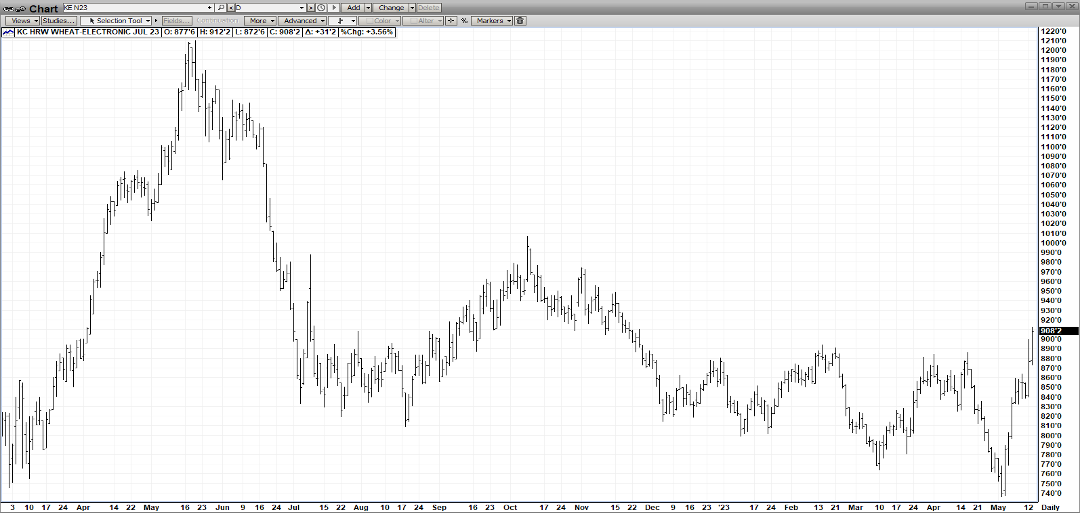

JULY KC WHT

(Click on image to enlarge)

Since May 3, July KC Wht has staged a meteoric $1.70 rally (740-910) off several, favorable fundamental & geopolitical events! Starting with the severe drought in the Central Plains that has the good/excellent rating on Winter Wht at an historic low of 27%! Then, the inability (so far) of Russia & Ukraine to extend the Corridor Agreement (expires 5-18-23)! Finally, the May Wasde – out Friday at 11 am predicted US wht inventories at a 16-year low! The net effect has been an upside chart explosion to 6 month highs! The mkt – previous to the price surge – was already plenty cheap – some $5.00 off its 2022 highs – so it was primed!

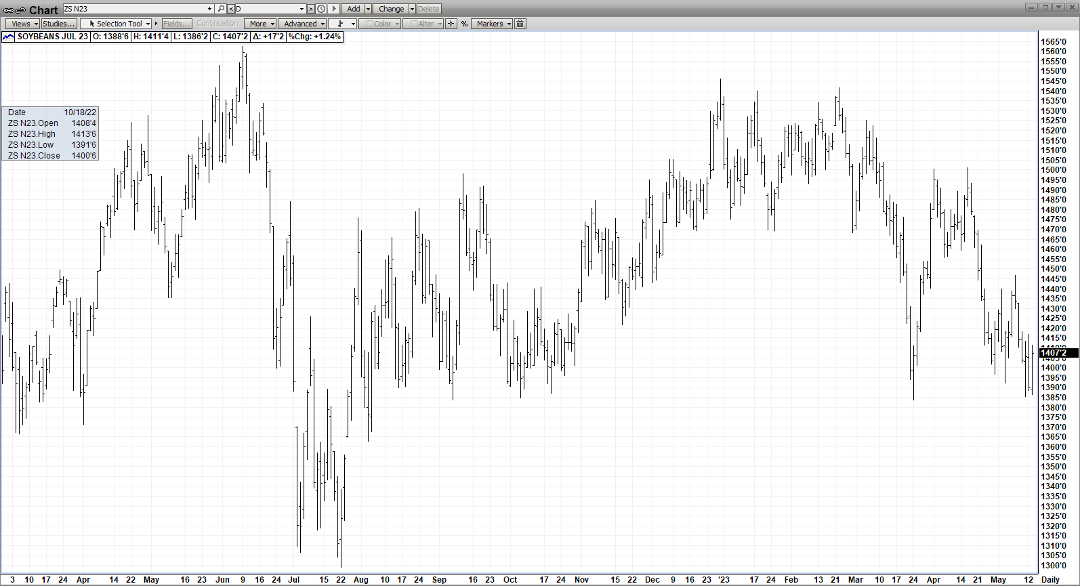

JULY BEANS

(Click on image to enlarge)

Sometimes, enough is enough! July Beans had been hammered down in the 2 weeks prior to the May 12 WASDE so when the report came out bearish – as expected, the news was already dialed in – so that – plus the help of 16-year low stocks in wht – combined to rally July beans 20 cents off its lows!Given that the USDA has predicted a record crop at 4.510 BB & record World Stocks at 122MMT, this rally is quite impressive! But such lofty estimates need to be taken with a “grain of salt” this early in the planting & growing season! Of paramount importance is the extreme shortage of inventory – as bean global stocks are on 5-6 yr lows – having NOT been replenished due to the severe Argentine drought!

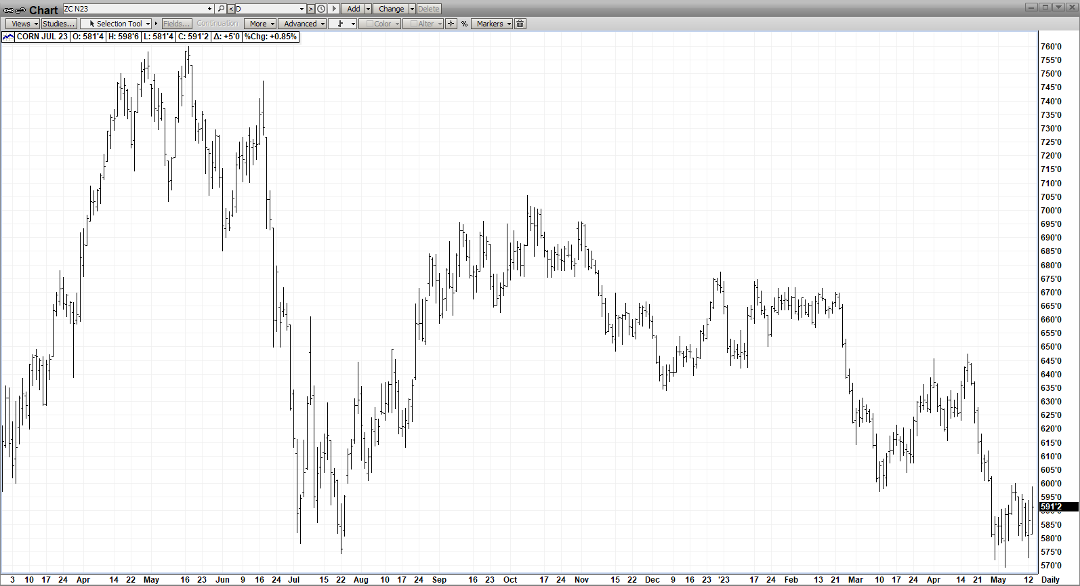

JULY CORN

(Click on image to enlarge)

July Corn has been confined to a 3 wk trading range (570-600) but impressively was not able to break down thru the low end – even with a bearish USDA Report issued Friday! The production of 15,265BB was over the estimate (15,098) & 2022’s 13.730BB! Old Crop stocks were 1417 BB (1356) & new crop were 2222 BB (2034)! Slack demand has been the culprit of late as the China buying has dried up – after being an everyday affair – only a few weeks ago! But we see it resuming & that coupled with tight stocks will require a substantial crop to refill the pipelines! Anything less, and current prices are too low!

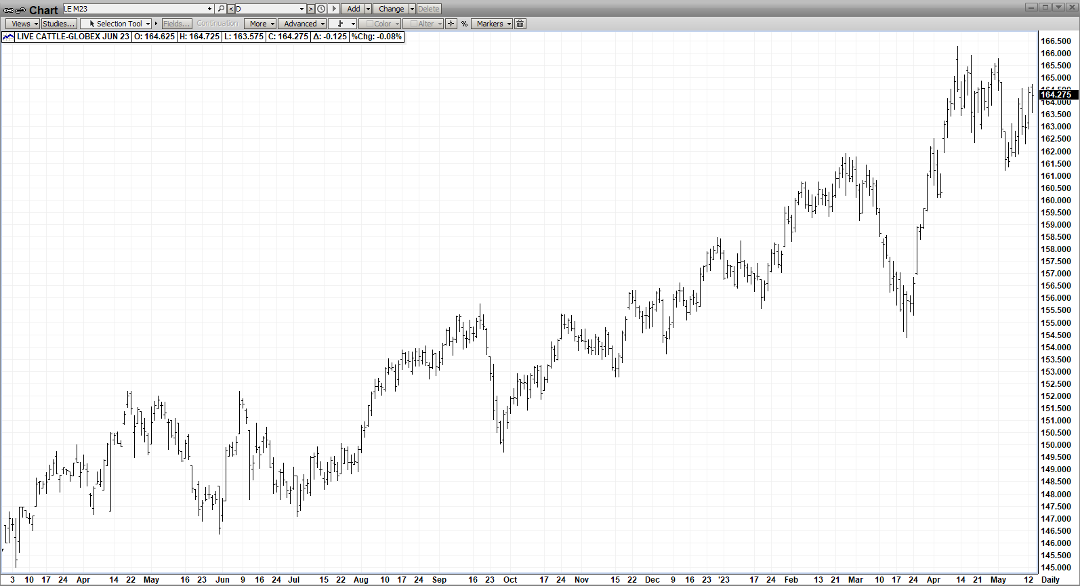

JUNE CAT

(Click on image to enlarge)

For the past 6 weeks, June Cat has been caught in a $5.00 range ($161-166)! The mkt has been supported by the sizeable discount June Cat holds to cash & also the 6% reduction in beef production from this Quarter to the last one! Headwinds are being provided by a sluggish beef mkt & a tentative demand due to high beef prices & low pork prices in the local supermarket! We feel the “saving grace” will be the current “grilling season demand” that will eventually push prices over the top end of their current range!

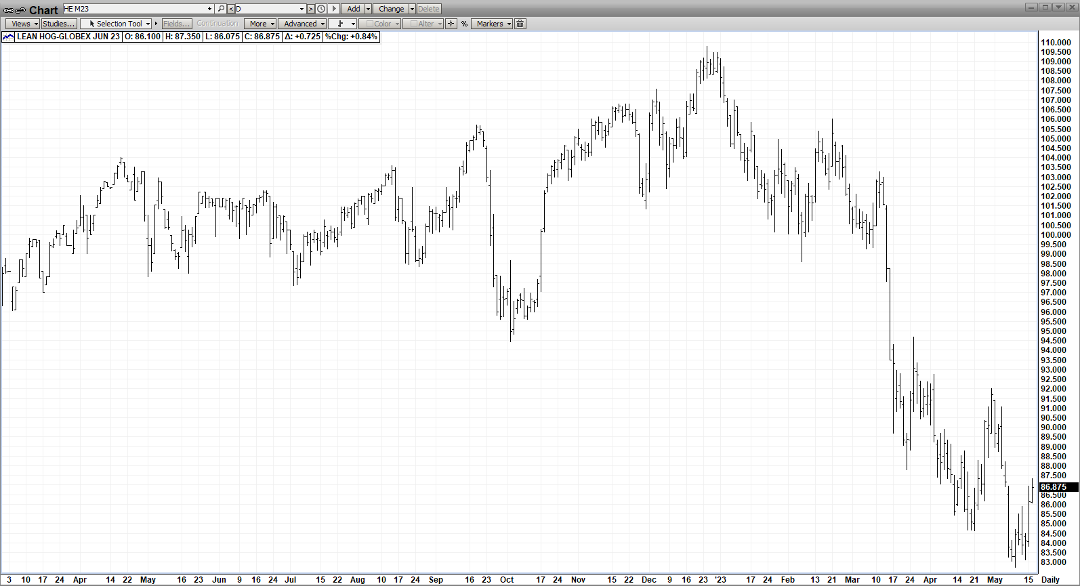

JUNE HOGS

(Click on image to enlarge)

After many false starts, June Hogs appears to be making a serious effort to carve out a low – as evidenced by the above chart action, a strong rally in the pork cutout (highest since Mar 15), a seasonal decline in supply & the fortuitous timing of the best demand period of the year – THE GRILLING SEASON – currently underway! The “fly in the ointment” is June Hogs premium to cash – which recently has capped rally attempts! But this time, we feel is different – THE WORM HAS TURNED!

More By This Author:

AgMaster Report - Monday, May 8

AgMaster Report - Monday, May 1

AgMaster Report - Tuesday, April 25