AgMaster Report - Tuesday, April 25

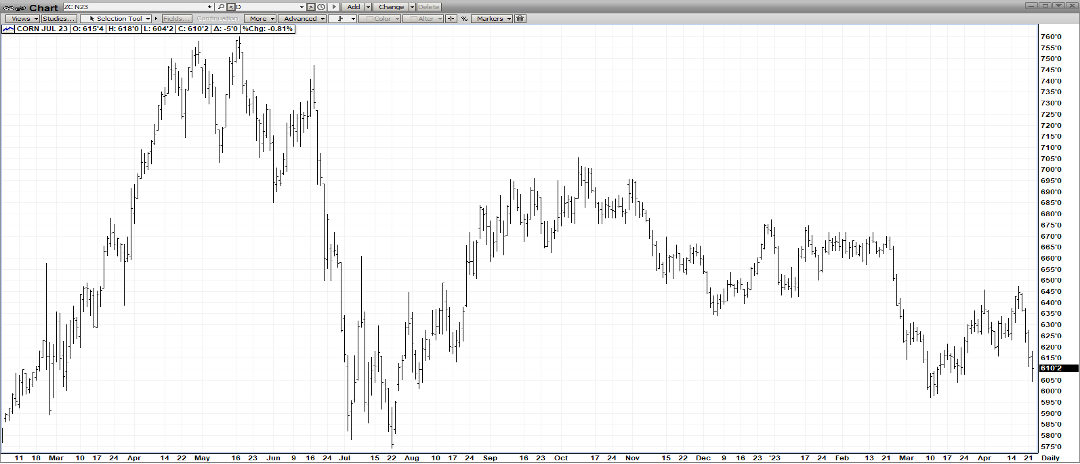

JULY CORN

(Click on image to enlarge)

Even though US Corn is the cheapest on the world mkt, exports seemed to have dried up – with no 8 am flash sales in the past 6 mkt days & exports sales last Thur at 734,000 –on the low end of the range of estimates. As well, Brazil is inundating the global mkt with its recently harvested corn – further pressuring prices & planting is off to a better-than-avg start here in the US! The mkt is also skittish in front of the Feds expected .25% IR hike next tues – albeit probably the last of 2023! The net result has been a mass fund liquidation of July Corn (645-605)! However, carry-over is still historically tight at 6-7 year lows! We feel exports will resume & the mkt will react sharply to inevitable weather scares ahead!

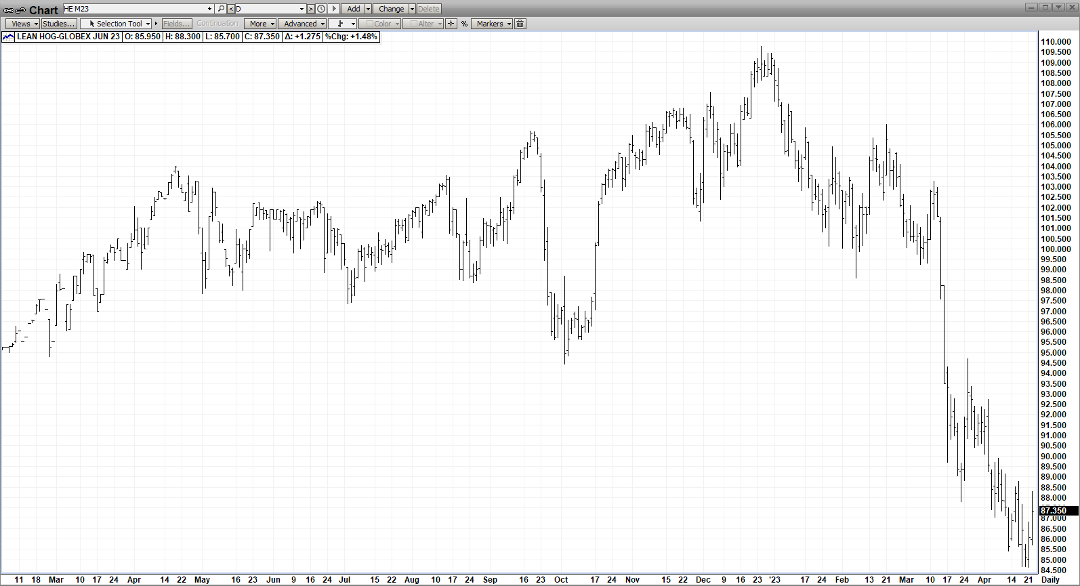

JULY BEANS

(Click on image to enlarge)

July Beans followed July Corn down last week (1500 – 1445) – also due to meager exports (Thur sales 103,000MT) as Brazil’s record bean crop is weighing on global prices –allowing Brazil Beans to trade at a $2.00 per bushel discount to the US mkt! Also, a stretch of unseasonably warm weather has allowed Spring planting to get off to a fast start! But old-crop stocks are still very tight – as they were NOT rejuvenated by South America due to the brutal drought which ravaged Argentina – leaving them with ½ a crop! The simple fact that May Beans are trading in the high $14.00 area speaks volumes about the underlying supply/demand fundamentals! We need a good crop out of the US to refill the pipelines!

JULY WHEAT

(Click on image to enlarge)

July Wht followed suit at the CBOT – drifting lower last week – as the Ukraine Grain corridor news flip-flopped from no-renewal to a possible one after the May 17 expiration! Rains hit the drought-stricken plains – pressuring wht prices – & exports remained soft at 305,000 MT last Thursday! As cheap as wht is, it’s hard to imagine prices going much lower but the mkt needs an upside catalyst & some help from its sister mkts – corn & beans!

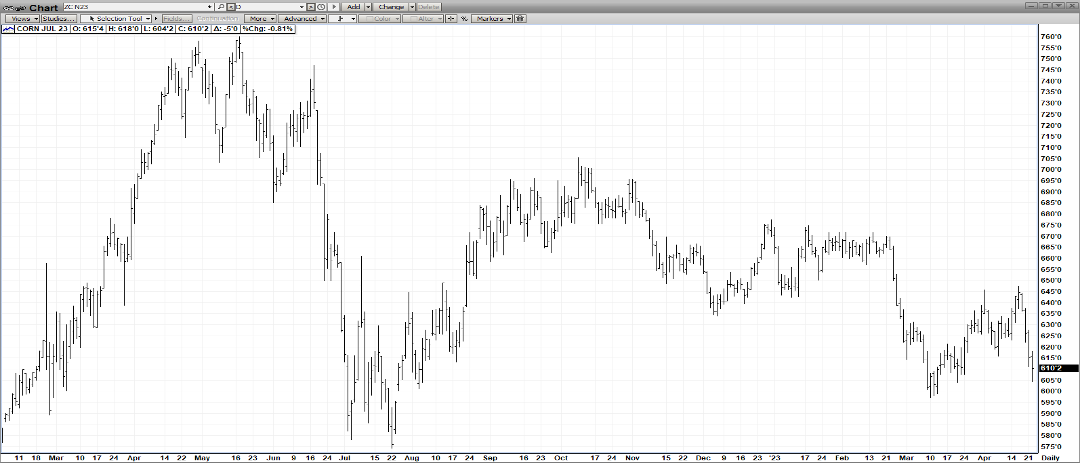

JUNE CAT

(Click on image to enlarge)

June Cattle has shown remarkable resilience trading higher today – even after a bearish Cattle-on-Feed Report Friday – that showed total on-feed at 96% (est-96) & placements at 99% (est- 94.9)! This speaks to its impressive supply/demand fundamentals –with 2nd Qtr production under 1st Qtr & also under 2022 – and with the best demand period of the year (the outdoor grilling season) upon us! As well, the June Cattle’s large discount to cash continues to make any price corrections very shallow!As long as the consumer doesn’t balk at the near-record prices, the mkt should continue to move sideways to higher!

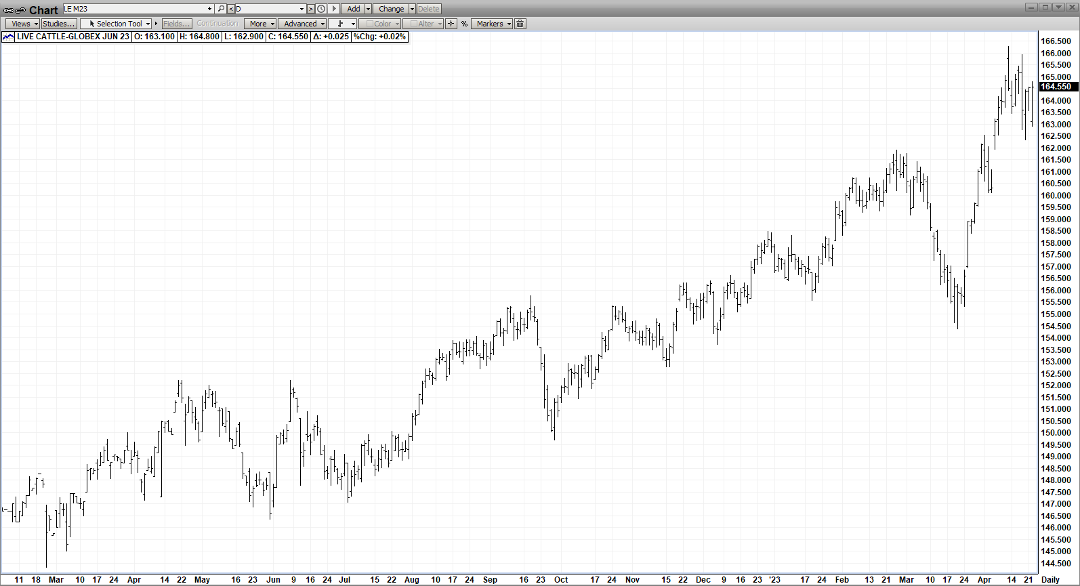

JUNE HOGS

(Click on image to enlarge)

Once again, June Hogs have given some hope for a turn-around – rallying $3.00 off its lows the past two mkt days – off a higher pork cut-out & a solid export report last Thursday showing an increase over 2022! Plus, we’re amidst the best demand period of the year – the barbeque season! Finally, should the consumer finally embrace the tremendous price disparity between the very inexpensive pork chops & the expensive steaks, demand should get a big boost! But the caveat is that several times before, the hog mkt appeared to make a low – only to negate that sometime later – due to excessive supply! Maybe this time??

More By This Author:

AgMaster Report - Tuesday, April 18

AgMaster Report - Wednesday, April 12

AgMaster Report - Tuesday, April 4