AgMaster Report - Wednesday, April 12

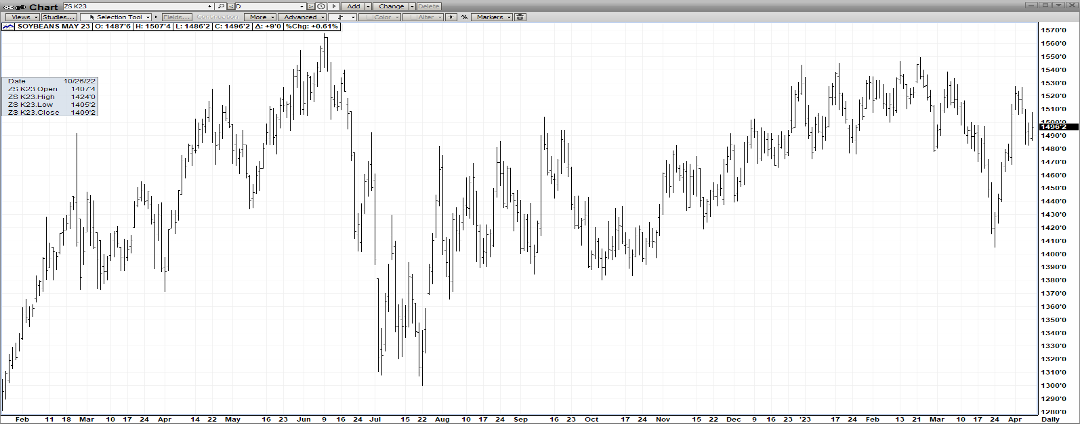

MAY BEAN

(Click on image to enlarge)

Since late March, May Beans have staged a $1.20 rally (1410-1530) – on the back of one of the worst droughts in Argentine history – today reported as 27.0 MMT bean crop (last year – 43.9)! In addition, the 3/31/23 Acreage & Qtly Stocks Report – surprisingly reflected US bean acres unchanged from last year with lower carryout than expected! The supply/demand #’s are definitely friendly – going into the US growing season – putting a lot of pressure on the US crop to be at least adequate -or the 6-year low stocks will drop even further! Outside markets have been favorable with crude oil $16 higher than a monthago – buoyed by the OPEC 1 million barrel drop in daily production & the DJI has rallied 2000 points since the banking crisis! The US $ is 10% lower than last Fall! We NEED a good US crop!

MAY CORN

(Click on image to enlarge)

Corn has been the beneficiary of amazing export demand from China – which has bought US Corn almost every day for the last 3 weeks! And then, a week ago, OPEC announced it was cutting daily production by over 1 million barrels a day – immediately spiking up crude oil by $5.00 and greatly enhancing ethanol demand! The USDA has forecast corn acres to rise by over 3 million acres but many analysts are quite skeptical of that big of an increase! US corn – with the help of a much depleted US Dollar remains the “low bid” on the global mkts and that advantage should keep exports flowing & prices on the rise!

MAY WHT

(Click on image to enlarge)

The chart action isn’t too impressive but Russia’s recent remarks about global wht prices being too cheap were! And that coupled with the severe drought in the Central Plains should be enough impetus for a turn-around! The Gd/Ex rating on Winter Wheat is currently at 27% – one of the lowest readings in recent memory! A strong rally from current price levels is highly likely – given the supply/demand fundamentals – especially if wht is able to coat-tail a similar updraft in corn & beans off tight stocks/strong exports!

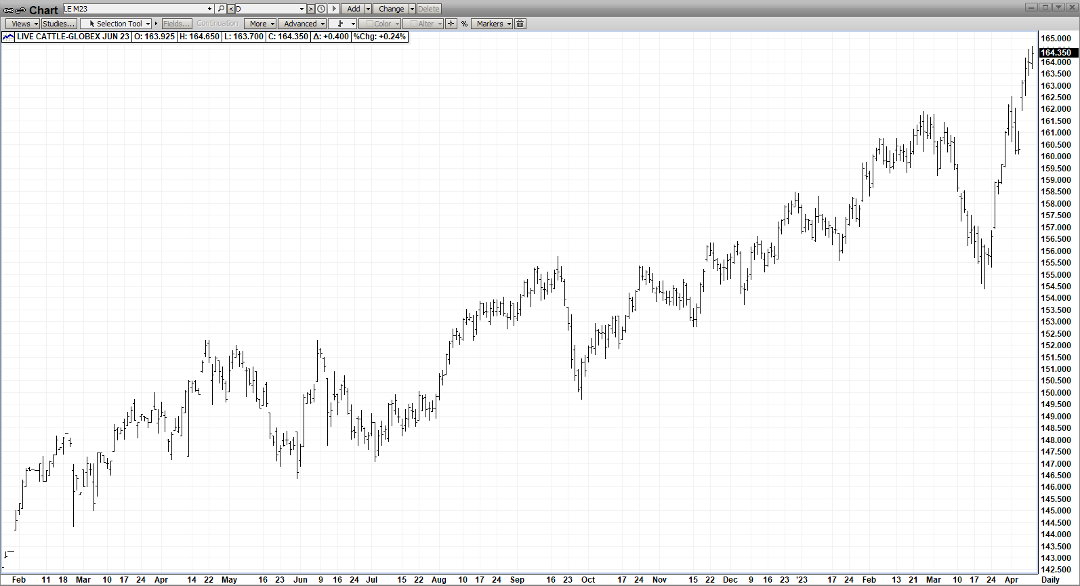

JUNE CAT

(Click on image to enlarge)

An unrelenting Bull Mkt keeps on chugging upward toward record highs -energized by soaring cash & very tight supplies – but, amazingly, still at a discount to cash! Waning 2nd Qtr production is under last year & also under the 1st Qtr & is also fueling the up! A rare, gaping unfilled gap (161-162) – acts as upward catalyst – the longer it remains unfilled! Exports were higher in last Thursday’s report! And this incredible run is taking place while the competitor – Pork – hugs its lows! You’d think the consumer – sooner or later – would make the switch between high-priced steaks & very cheap pork chops but not yet! Finally, the best demand period of the year – the outdoor barbeque season is upon us – which should further bolster the mkt!

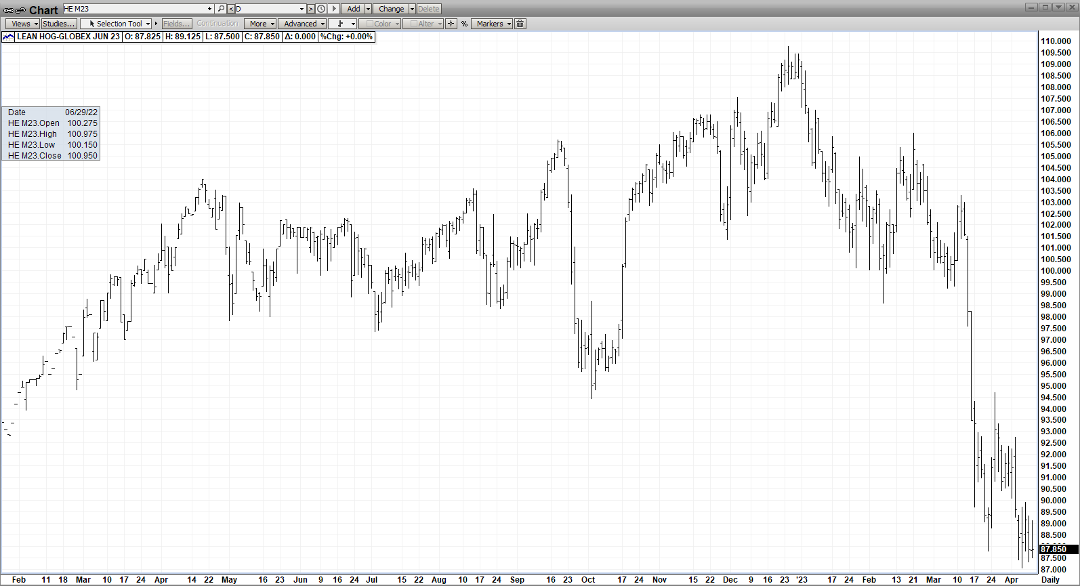

JUNE HOGS

(Click on image to enlarge)

Pick a low at your own peril! The mkt seemingly has the supply fundamentals to crater out – with 2nd Qtr Production is under last year & also the 1st Qtr – & last week came in 3.7% under a year ago. Also, pork cut-out seems to have stabilized, weekly export sales came in the highest since Dec 15 & traders hold a near-record short position! But still, the mkt Stubbornly grinds out new lows every 3rd or 4th day! And the best demand period is dead ahead!The mkt will tell us when it has bottomed & it should be soon! Look for “bullish divergence” where June Hogs are unable to make new lows off of bearish news!

More By This Author:

AgMaster Report - Tuesday, April 4

AgMaster Report - Wednesday, March 29

AgMaster Report - Tuesday, March 21