AgMaster Report - Tuesday, April 4

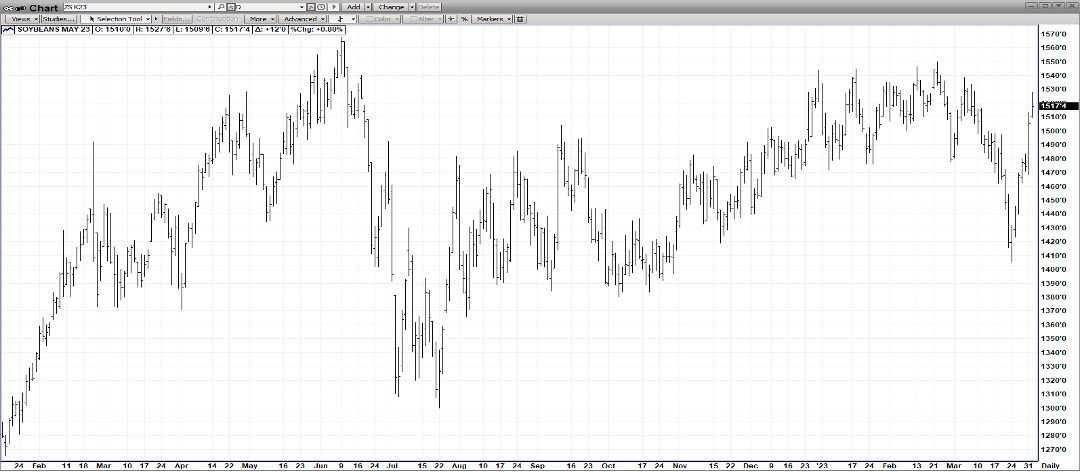

MAY BEAN

(Click on image to enlarge)

The worm seem to have turned in 2023 – as all of a sudden, the stocks have tightened further from the beginning of the season – as the surplus of Beans from the Brazilian record crop has been more than offset by a decades-worse drought in Argentina! And the USDA reported Friday that bean acres would stay at last years 87.5 MA & that carryout would be reduced to 1685MB (exp-1753). Finally, OPEC announced yesterday at 5pm – that they were lowing their output by 1 million barrels/day – beginning on 5/1/23 thru 12/31/23! Of course, this is very friendly to biofuel demand! And China has opened up – importing corn most every day! The result is a 7-day $1.20 rally – with pressure now put on the US Crop to be good!

MAY CORN

(Click on image to enlarge)

May Corn has been the welcome beneficiary of an amazing Chinese buying spree over the past 3 weeks that has totaled nearly 4 MMT – as they recognize how tight the stocks are, how they were further squeezed by the Argentine drought & that US Corn is the cheapest on the global mkt!Even a projected 3 million acre increase in corn planting – 92.0 MA – couldn’t blunt the rally as May Corn advanced 11 cents after Friday’s USDA Report! Many pundits were skeptical of the acreage #! Plus, the OPEC news over the W/E was very positive for ethanol demand!Now, as the market focus changes from South American harvest to US Planting, there is pressure on the US to come up with a decent crop to rebuild the carryover stocks! Finally, the Macro negativity spawned by the Banking crisis of Mid-March seems to have stabilized as no more banks have failed – in fact, since 3/15/23, the DJI has rallied 2000 points (31,400 -33,500)!

MAY WHT

(Click on image to enlarge)

Despite negative wheat #’s from the USDA on Friday, acres 49.8MA (ly-45.9) & stocks – 946 MB (exp – 928), May wht closed steady on the day – buoyed by higher closes in it sister markets – corn & beans! As well, there are weather issues for the Winter Wheat crop with drought conditions still prevalent in the central plains! Also, Russia has made noises a week ago that they felt Global wht prices were too low! There is a sizable short position held by fund traders that may get nervous – when Wht futures couldn’t go down on a bearish USDA Report!

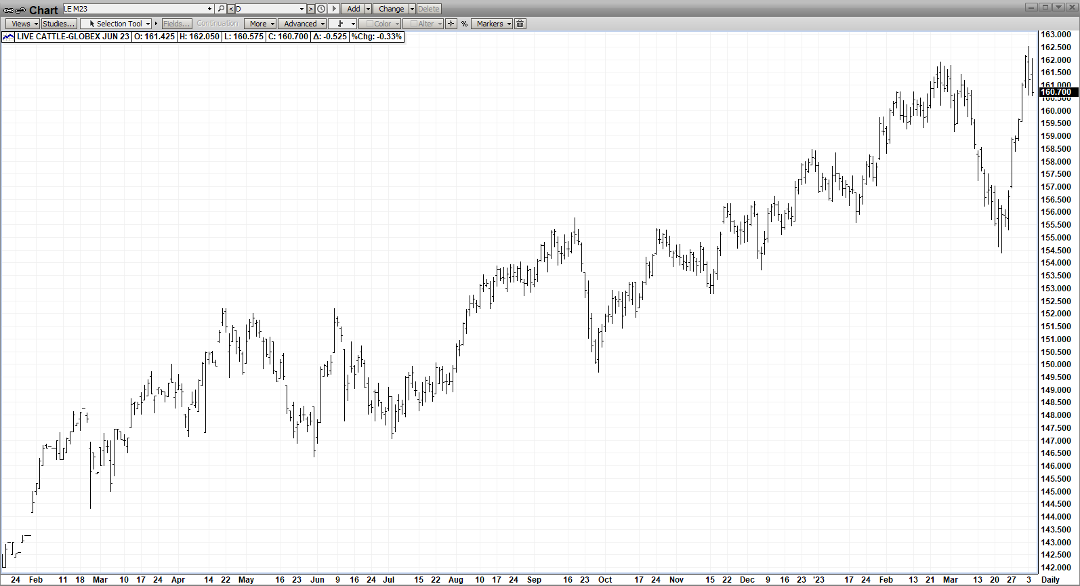

JUNE CAT

(Click on image to enlarge)

The “supply bull” keeps on chugging – emboldened by more friendly production #’s! The 2nd Qtr beef production is to be down 6.2% from last year & 210 million pounds from the 1st Qtr – when beef production normally increases into the second Qtr! However, despite the positive fundamentals, the mkt occasionally slips into “overbought mode” & needs to correct – which it has done the last 2 days!

The strongest demand period of the year is right around the corner – and should catapult the June futures to new contract highs by Memorial Day!

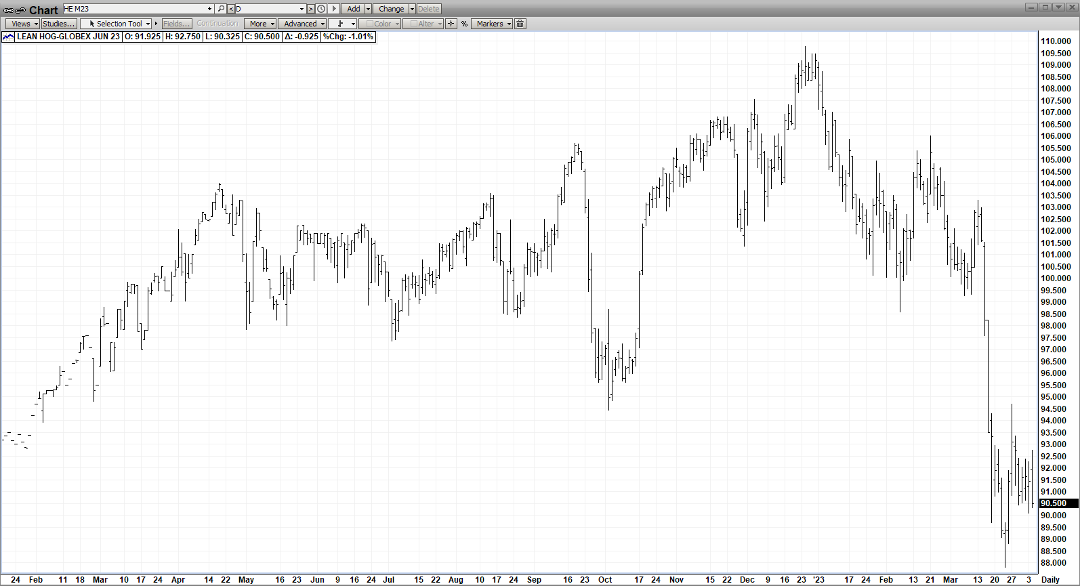

JUNE HOGS

(Click on image to enlarge)

Finally, it appears there is “light at the end of the tunnel” for the woebegone hog mkt that seems to have no bottom – even as it offers grocery shoppers an attractive alternative in the supermarket – WHY NOT CHEAP PORK CHOPS OVER EXPENSIVE STEAKS? But this psychology has not caught on yet! However, bullish production #’s from the USDA (2nd QTR production under 1st Qtr) & a friendly Pig Crop last week would seem to imply that bullish traders now have a supply argument to support higher prices! That coupled with the upcoming outdoor barbecue season could at-last spawn an upside turn-around!

More By This Author:

AgMaster Report - Wednesday, March 29

AgMaster Report - Tuesday, March 21

AgMaster Report - Tuesday, March 14