AgMaster Report - Tuesday, March 14

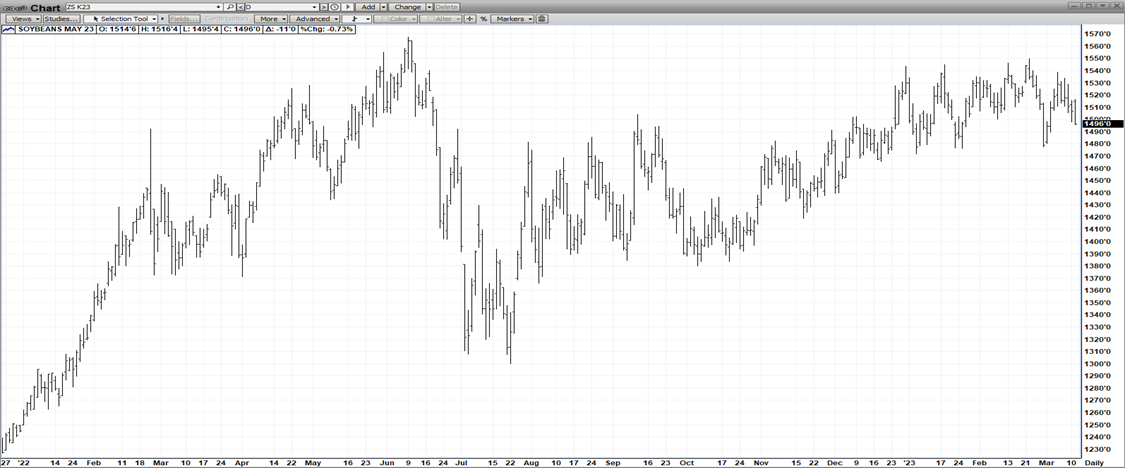

MAY BEANS

(Click on image to enlarge)

This morning, the mkt witnessed a classic confrontation between bearish Macro events & bullish fundamentals – which opened the mkt sharply lower but saw it rebound up & stabilize after President Bidens reassuring talk at 8 am! After 2 California banks went under over the W/E, he assured the nation the Fed would support the depositors & that a mass financial contagion wouldn’t evolve! At the same time, Argentina’s drought worsened over the W/E – with crop estimates being ratcheted down – Beans 24-26 MMT (USDA – 33) & Corn 33-36 MMT (USDA – 40)! The combination of the big drop last week, the historic drought in Argentina, the cheapening US $ & a reopening China – bodes well for 2023 exports!

MAY CORN

(Click on image to enlarge)

May corn’s 65 cent drop (680-665) since mid-Feb has improved corn’s competitiveness on the World Export Market -and that coupled with a US Dollar 1000 points off it Sept highs, the severe Argentine drought – now with losses exceeding the gains from the record Brazilian crop & finally the re-emergence of China on the World Export Mkt – all point to a very improved export picture going into our planting season! The global stocks are already on 6-7 year lows & and any production hiccup in the Northern Hemisphere will send prices back over $7.00!

MAY WHEAT

(Click on image to enlarge)

Sometimes, a mkt “looks so bad, it’s good”! That would be the case with May Wht which has been battered down to 2-yr lows by a relentless flow of Cheap Russian wht – which has effectively put a cap on recent rallies! So, from an extreme, oversold position with a large, short open interest, the mkt is susceptible – at any time – to sharp short-covering rallies – due to any production issues worldwide such as the possible heat wave in India or the failure of the Russia-Ukraine Corridor Deal to be renewed! The inability of the mkt to make new lows this morning off the bank closures demonstrates solid “bullish divergence”!

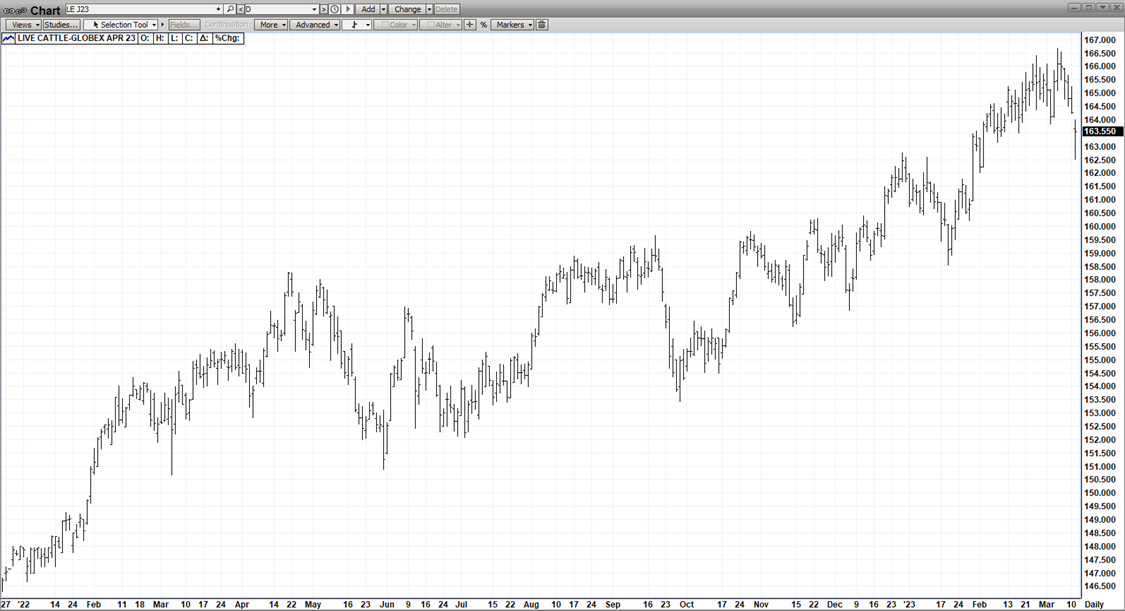

APRIL CAT

(Click on image to enlarge)

After congesting for 6 weeks in a tight range (163.50 – 166.50), Apl Cat dropped to new 6-wk lows at 162.50 – although, it closed just off its daily highs! The downside impetus was provided by the macro sector -as two California banks closed over the W/E – creating some financial chaos yesterday! The DJI has since stabilized as President Biden gave a 8 am news conference Mon– reassuring depositors! The cattle mkt continues to be a supply bull as beef production last week was down 5.2% from a year ago – and weight remain low enough to keep producers current. But slow exports, a sluggish beef mkt & some technical damage have traders on alert as to a possible top in the mkt! But we feel, it’s just a correction with supplies very tight & the Spring Barbeque Demand just around the corner! The USDA will provide further info this Friday at 2 pm with their March Cattle-On-Feed Report!

APL HOGS

(Click on image to enlarge)

April Hogs had a solid 4-day $4.00 rally rudely interrupted by two California bank closures over the W/E sending financial mkts into a tailspin – and creating a general risk-off environment for all commodities! So, the mkt has relinquished one-half of that rally! Still, they are promising signs the mkt scored a spike-low back in Feb as the massive supply is being priced in & the mkt’s much-higher-than-normal premium to cash of $6.29 is very encouraging! We feel the coming Spring Demand will rally this mkt out of its recent consolidation pattern!

More By This Author:

AgMaster Report - Wednesday, Feb. 22

AgMaster Report - Wednesday, Feb. 15

AgMaster Report - Thursday, Dec. 29