AgMaster Report - Tuesday, March 21

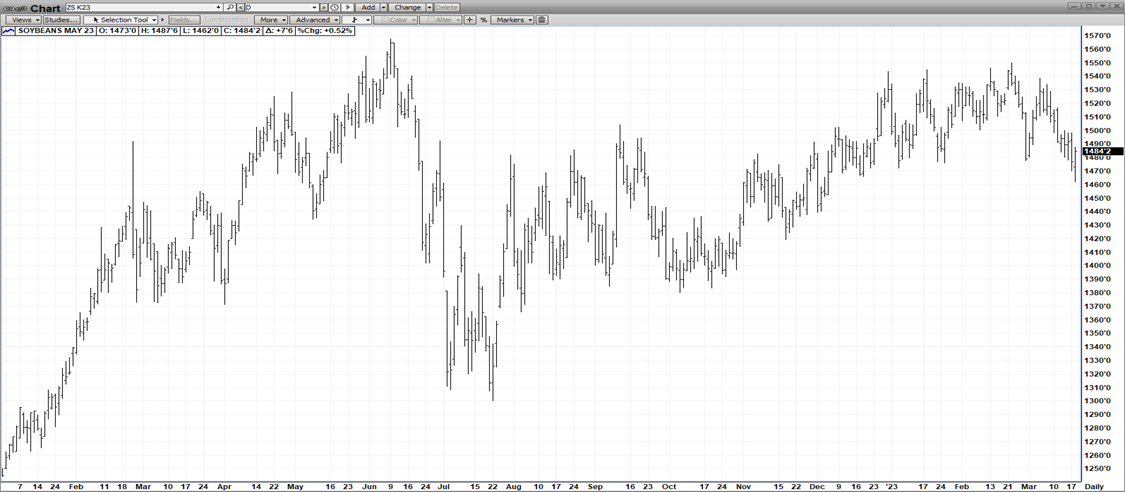

MAY BEANS

(Click on image to enlarge)

Once again, bearish Macro events have pressured beans – however, losses have been mitigated by positive supply/demand fundamentals! The Banking Crisis from last week which saw two banks – Silicon Valley Bank & Signature Bank – close – forced a knee jerk down in all commodities but positive exports & the ongoing extreme drought in Argentina softened the loss as today, May Beans have recovered to just $.65 off its February highs! The losses in Argentine bean production have now surpassed the surplus from the Brazilian record crop meaning still tighter supplies into the US growing season! Exports have picked up as China has slowly re-opened – & the US Dollar has dropped in the last 6 months! The US needs to be OK!

MAY CORN

(Click on image to enlarge)

China is back! In a big way! In a nearly unprecedented buying spree, they bought US corn last week 4 consecutive days in a row –613,000, 667,000, 641,000 & 192,000 for an aggregate of 2.2 MMT! We felt this was coming – what with the recent 70 cent break in May Corn futures & the precipitous fall of the US Dollar in the past 4 months, but of course needed actual confirmation which we got in spades last week! With the ongoing decades worse Argentine drought & improving exports, the supplies are snug – putting a lot of pressure on the upcoming US growing season! Plus, Corn futures did not make new lows when the banking chaos hit a week ago – an impressive sign of Bullish Divergence! The mere fact that May Corn is still hanging in the low-to-mid 6’s – despite paltry exports until last week – speaks to the 6-7 year low global stocks – which could be even lower once the “dust settles” from the South American weather woes!

MAY WHT

(Click on image to enlarge)

May Wht has been buffeted about by 3 major factors – but staying range bound in the past 2 weeks – the inundation onto the global mkt of cheap Russian exports, the on-again/off-again status of the Russian-Ukraine Grain Corridor Deal & the banking crisis from last week! All three can be considered headwinds for the mkt but it hasn’t made new lows of any significance – meaning the current price level has discounted many of the bearish factors!The mkt will look to guidance from its Sister Mkts – Corn & Beans – & the upcoming planting & Qtly Stocks due Friday 3-31-23 at 11 am – going forward!

APL CAT

(Click on image to enlarge)

Looks like a top in the cattle after a magnificent “Bull Run”? Not so fast! Even with slumping beef & cash mkts & the bearish bank crisis, supplies are still very tight – as validated by Fridays Cattle-on-Feed Report– showing 93% placements & 95% on-feed! Plus, the mkt is trading discount to cash during a period of declining supply! Also, exports have been very impressive with China importing 190,000 MT of beef in Feb – up 24.2% from last year! Finally, the futures action was one of consolidation even with the 2 US bank failings! And Spring Barbeque Demand is right around the corner! The “supply bull” has corrected a bit but still appears to be “alive & well”!

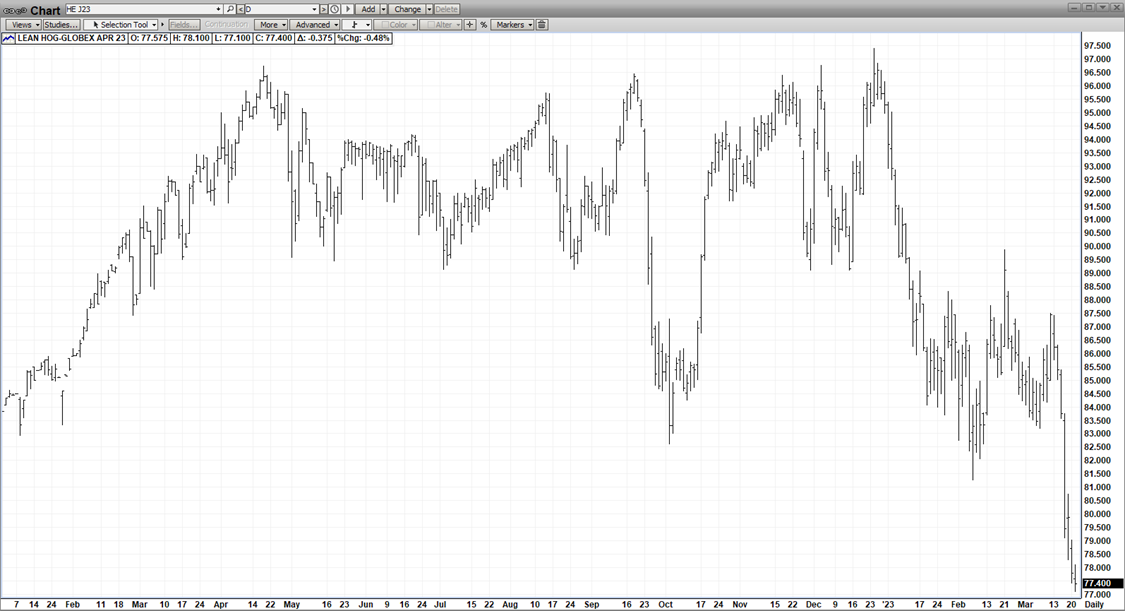

APL HOGS

(Click on image to enlarge)

The carnage continues unabated as Apl Hogs have dropped $10 (87 – 77) in just 7 trading days! It appeared for a long time the early Feb lows would hold but when they didn’t, the “flood gates” opened! The funds staged a mass exodus – exacerbated by the banking chaos – and the supply-laden hog mkt’s “path of least resistance” was down! But now – is enough enough! We feel the mkt’s precipitous drop will certainly attract some demand – as we approach the Spring Barbeque Season! And the mkt is grossly oversold & holds an extreme discount to cash! Look for some bullish divergence ( holding or rallying on bad news) to confirm a seasonal low!

More By This Author:

AgMaster Report - Tuesday, March 14

AgMaster Report - Wednesday, Feb. 22

AgMaster Report - Wednesday, Feb. 15