AgMaster Report - Tuesday, April 18

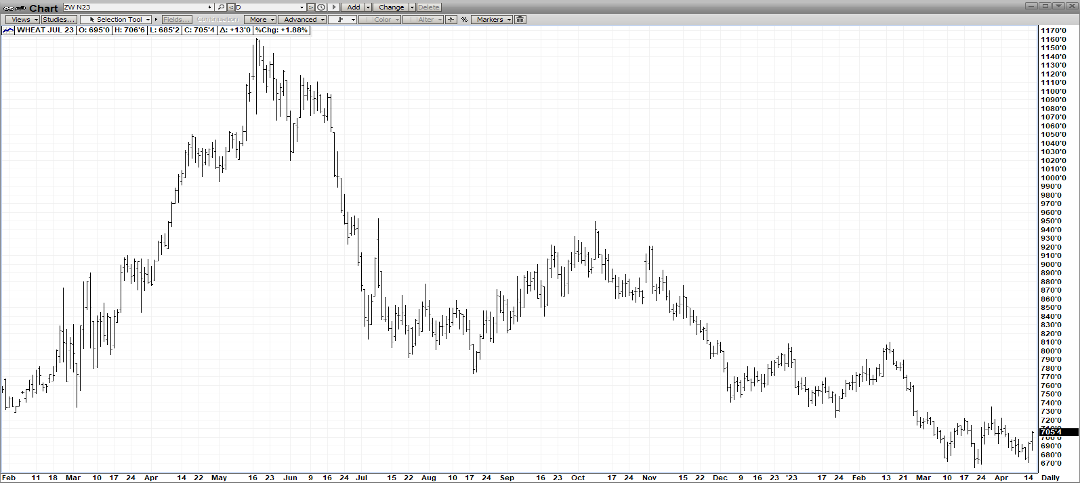

JULY WHT

(Click on image to enlarge)

Despite a sharply higher dollar, July Wht is punching out 2-wk highs -primarily drawing strength from perceptions the Ukraine Corridor Deal is on shaky ground – as Russia is unhappy with its restrictions! So, the expiration date of May 17 could mark the end & that would be very bullish to wht! Of course, we’ve heard this before but the latest issues may have legs this time! And this geopolitical along with the brutal drought ravaging the Winter Wht in the Central Plains is more than enough to support a wht mkt $5.00 off its 2022 highs! Add any spillover support from a corn/bean mkt feeding off renewed exports and tightening stocks & the wht mkt has solid “rally potential”!

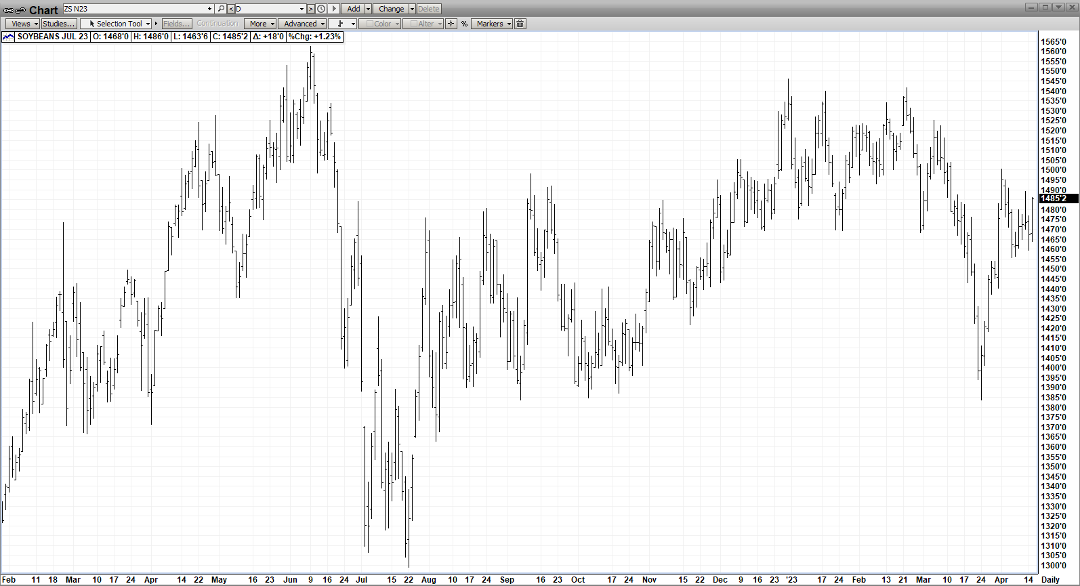

JULY BEANS

(Click on image to enlarge)

Record large global demand for soybeans is providing solid support for July Beans today! As well, The Rosario Exchange lowered their estimate of Argentine Beans to 23 MMT (27 -Feb) due to their decades-worse drought! And the Mar 31 Planting/Stocks report reflected lower carry-over stocks & the same acreage as 2022! That is NOT what’s needed to refill the pipeline! So even though near- $15.00 beans is quite good for this time of the year, it may not be enough should we have any weather issues with our US Crop!

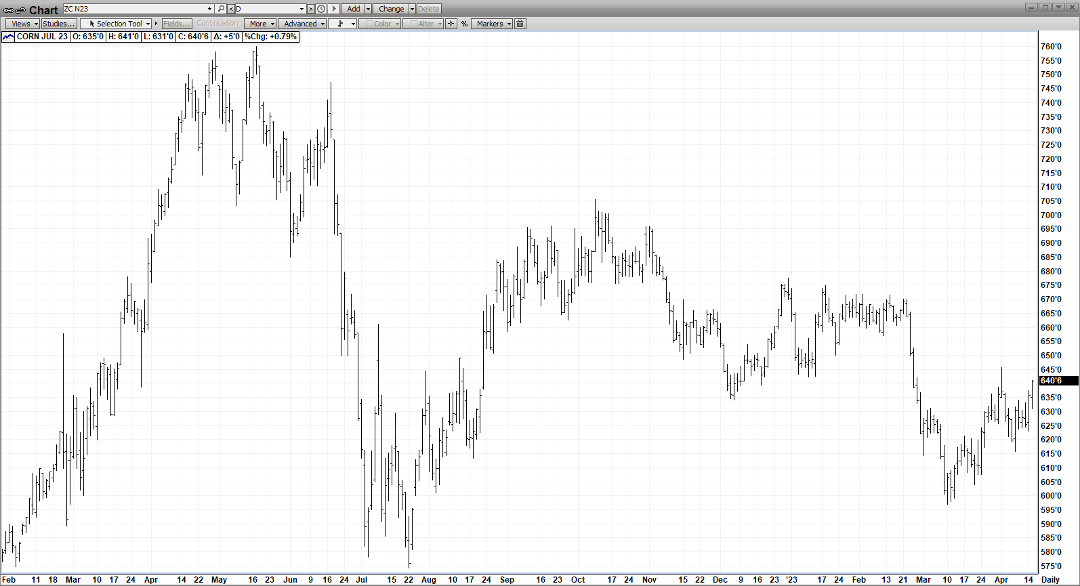

JULY CORN

(Click on image to enlarge)

Even though, the USDA is predicting 3 more million acres of corn planted this year, the mkt is more focused on the export infusion of corn to China – which for a while, happened most every day! Even last week, China bought 382,000 & 327,000 MT of corn on Thur & Fri! And analysts are skeptical that of “3 million more” number! Stocks are at 6-7 year lows, even less than they were before South America! Should the devastating Plains drought currently hurting our Winter Wheat Crop – spread into the corn & bean areas, prices would jump! Also, the macro-economic side is leaning more favorably to commodities – as last week's CPI & PPI came in lower than expected – implying the Fed’s program to combat inflation is starting to work – which is positive for all markets as a rising tide floats all boats!

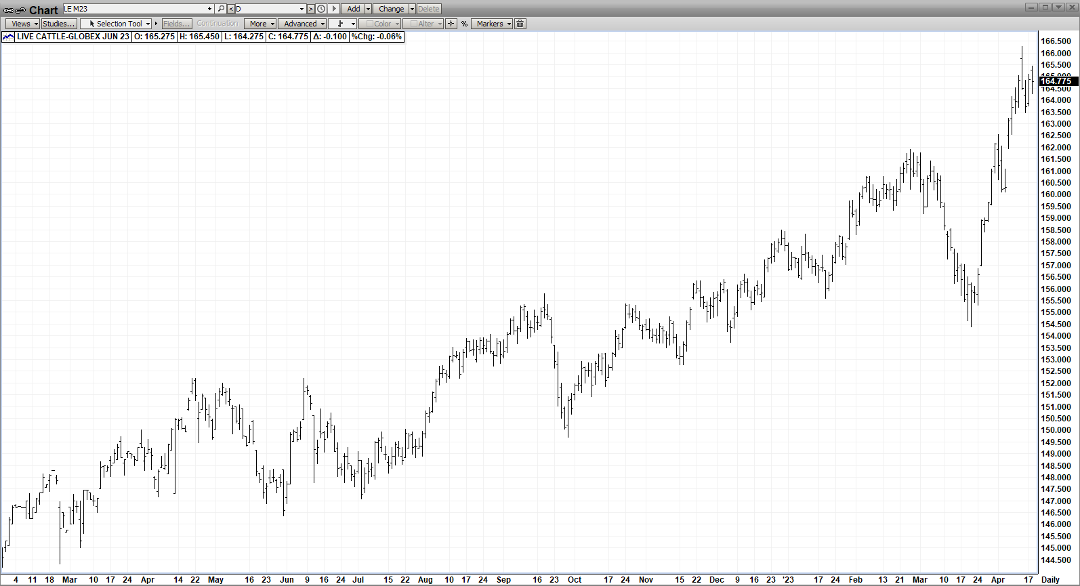

JUNE CAT

(Click on image to enlarge)

Alleviating an extremely overbought condition, June Cattle corrected $3.00 (166-50-163.50) – as the mkt prepares for the April Cattle-on-Feed Friday at 2 pm! Placements in keeping with recent reports – are predicted to show a decrease of 5.1%! The corrections remain quite shallow & deservedly so – as the June Futures is a whopping $15 discount to cash! The mkt is historically quite high but with the strongest “demand period” dead ahead, no top is yet in sight!

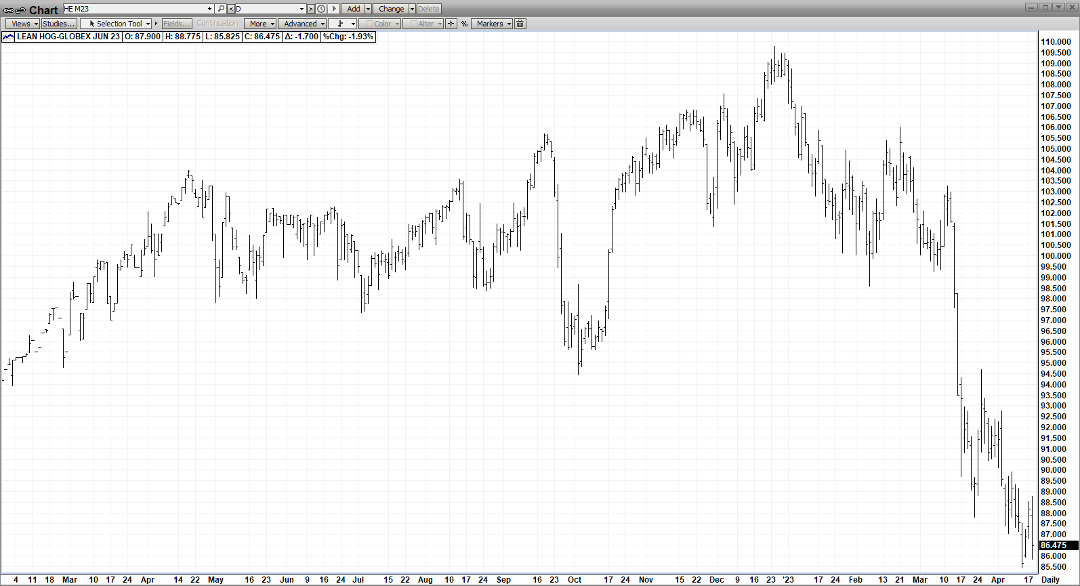

JUNE HOG

(Click on image to enlarge)

Just when you think it is safe ...! June Hogs had rallied $3.00 Friday & Monday on better cash but has given back 2/3 of that today as the mkt continues to struggle to hold a rally. Lesser production into the 2nd Qtr, better cash & declining slaughter seem to portend a turn-around but the mkt hasn’t been able to respond! The outdoor barbeque season may be just what the doctor ordered to turn the hog mkt around – with a fresh infusion of demand but, of course, we need chart confirmation!

More By This Author:

AgMaster Report - Wednesday, April 12

AgMaster Report - Tuesday, April 4

AgMaster Report - Wednesday, March 29