AgMaster Report - Monday, May 8

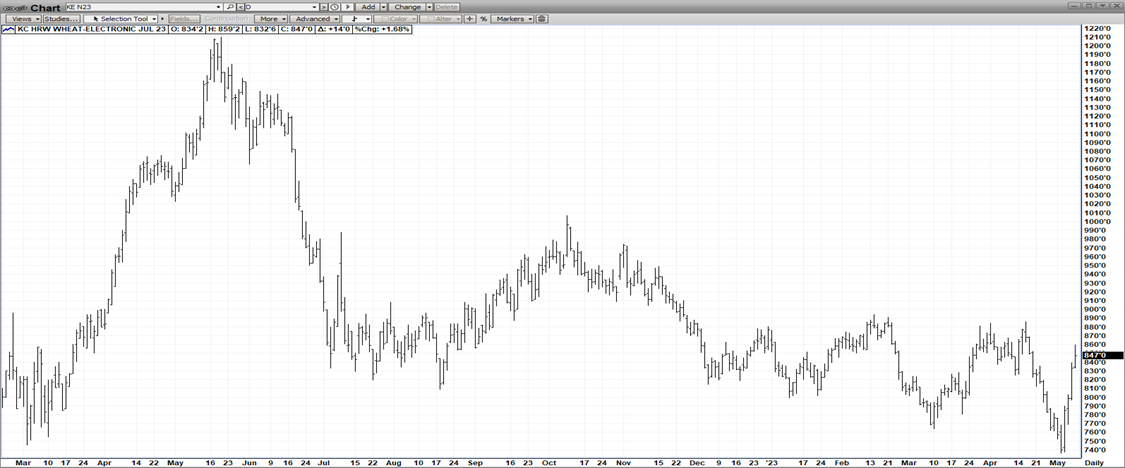

JULY WHT

(Click on image to enlarge)

In a mere 4 trading days, KC July Wht has catapulted up $1.60 (7.40-8.60) – primarily on the back of Macro events & weather! The likelihood of the Russian/Ukraine Corridor Deal being renewed seems remote ahead of the May 18 expiration! And the ongoing drought in the Central Plains seems to be intensifying – further damaging the emerging Winter Wht crop! And recently released data indicate a substantial short position of 126,000 contracts! This all adds up to massive funds “short-covering” – which accounts for the nearly vertical 4-day rally!Plus, the recent drop in cash Wht has attracted some export interest! Finally, the macro mkts have supported with the DJI rallying over 500 points Friday & Crude Oil up $2.00 today!

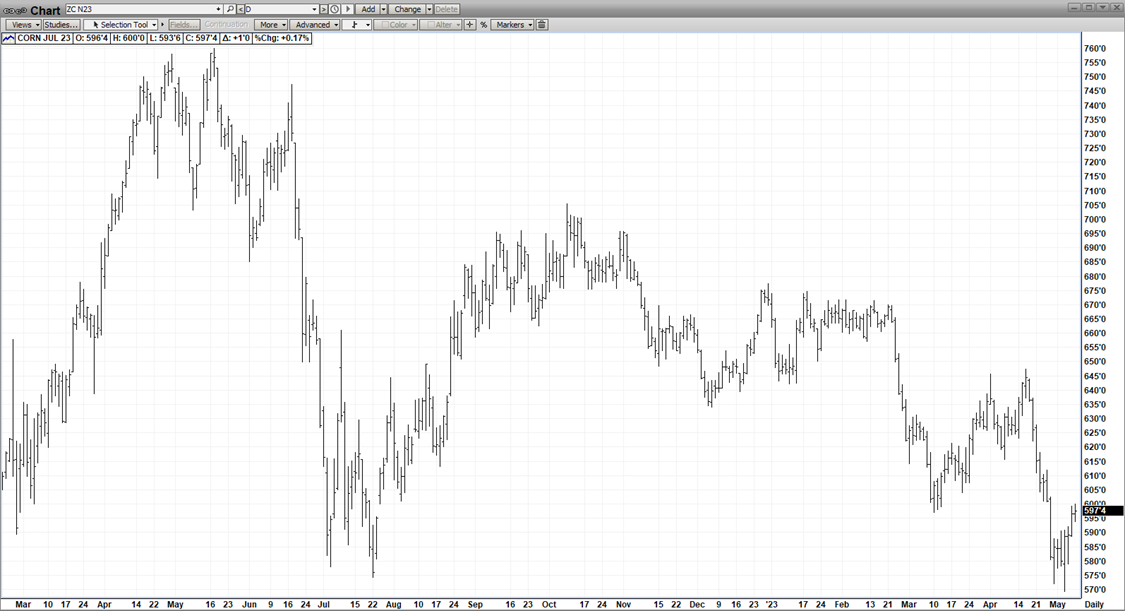

JULY CORN

(Click on image to enlarge)

July Corn rallied for similar reasons – a Corridor Deal that looks very shaky, dryness in the plains that possibly could spread to the corn areas & an onerous net short of 150,000 contracts – which could lead to an explosive up – should a mass exodus occur! Two cancellations of US Corn to China – but no more – seemed to crater the mkt last week! The DJI reacted very positively to favorable employment #’s issued Friday & last Wednesday, fed chairman Jerome Powell announced a .25% rate increase & also a PAUSE until year end!As well, Crude Oil has rallied nearly $10 since last week – augering an increase in ethanol demand! And, of course, underpinning the entire CBOT is our still very tight global stocks – currently on 6-year lows – having NOT been replenished by the South American harvest!

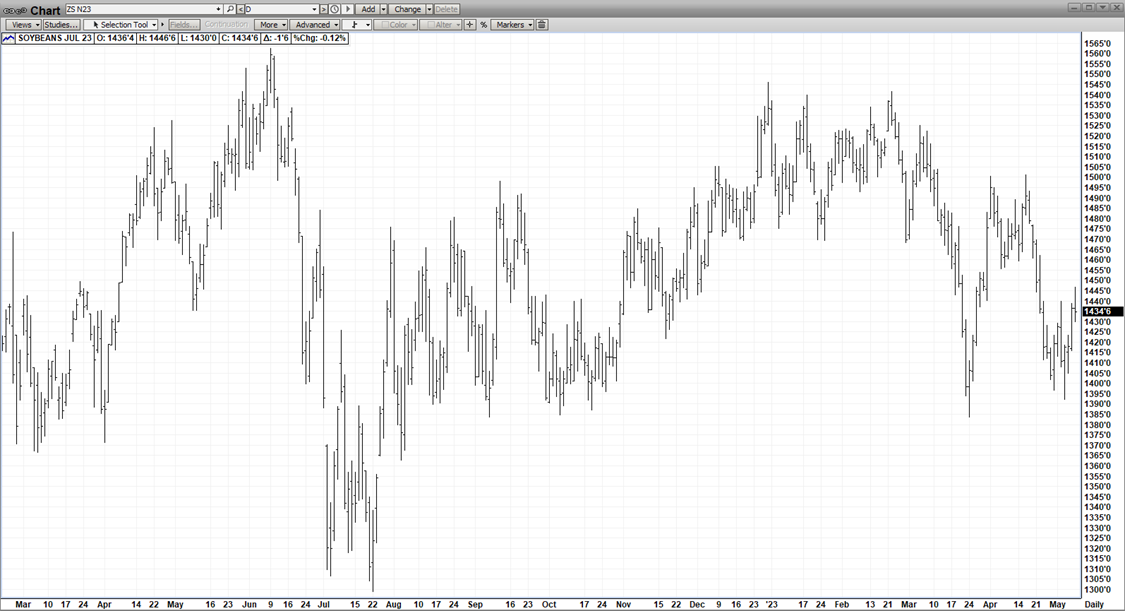

JULY BEANS

(Click on image to enlarge)

Much like KC Wht & Corn, Beans have benefitted as well from the Corridor Deal uncertainty, the spreading dryness in the Central Plains & a rising short open interest! As well, a surging Palm Oil mkt has underpinned the bean complex! The huge discount of Brazilian Beans to US Beans will come to an end as their harvest winds down & they sell out of supplies – which should enhance US Bean Exports! And with still, tight global bean stocks and 2023 acreage reportedly the same as 2022, there is significant pressure on the US to produce a solid bean crop – otherwise, current prices are too low!

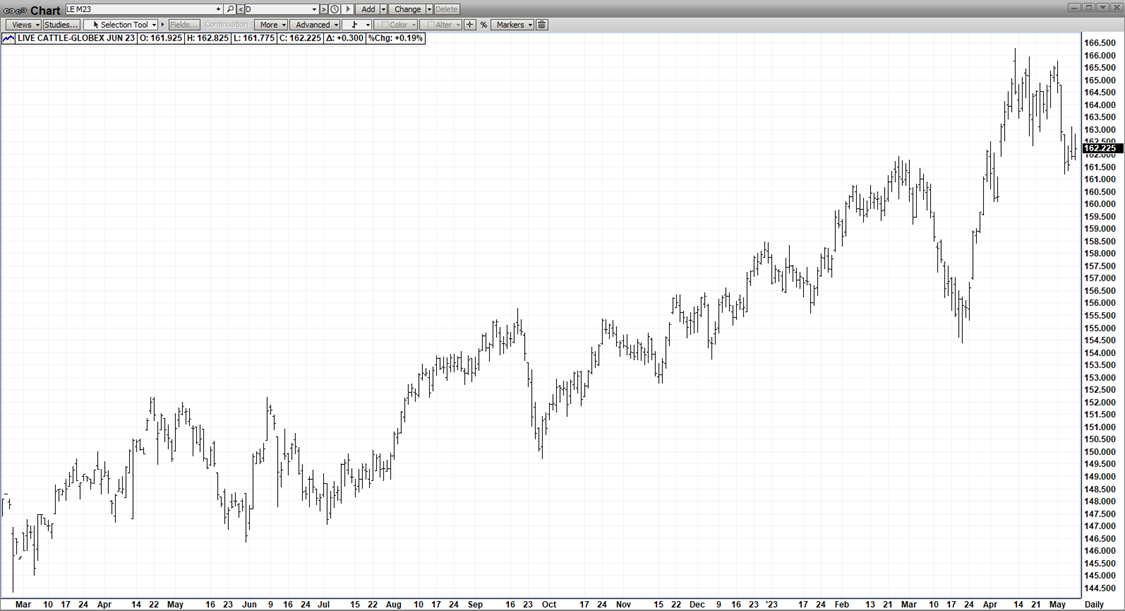

JUNE CAT

(Click on image to enlarge)

Even with lower cash & an ultra-high prices, it’s how to make an argument that cattle have topped out for the year! Last week, beef production was down 508 MP – 6.5% under 2022 and cattle slaughter was 623,000 head last week – down from 661,000 last year! As well, June Cattle are at a $12 discount to cash (5-yr avg $9). Finally, we recently entered the strongest demand period of the year – the “grilling season”! So, the mkt seems more likely to consolidate & eventually take out its highs – rather than go down!

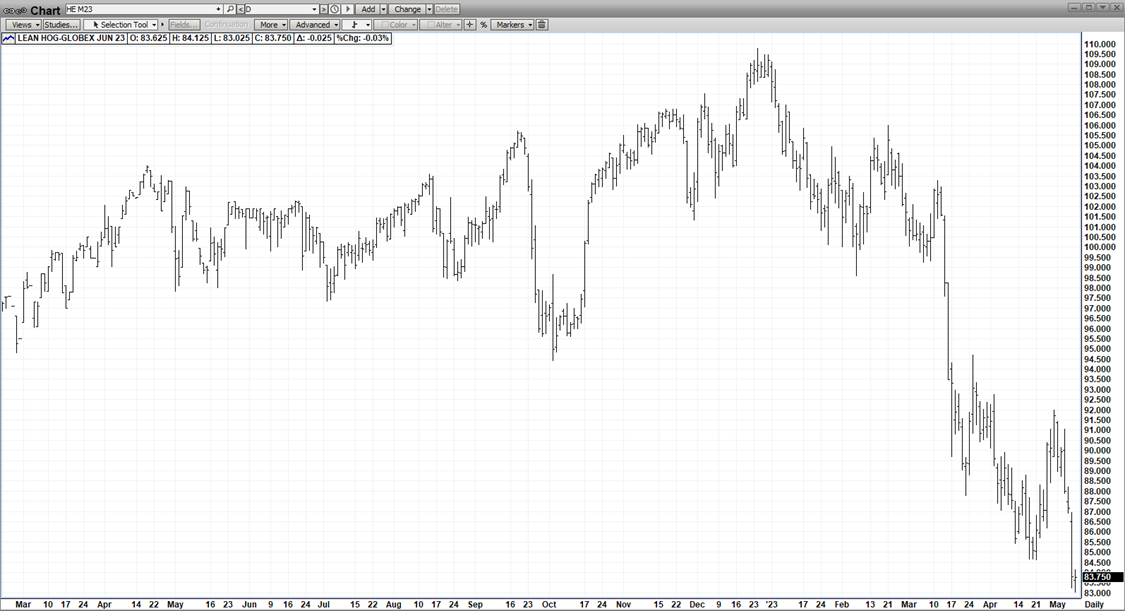

JUNE HOGS

(Click on image to enlarge)

Once again, what looked like a solid low in June Hogs was wiped out by a $9, four-day plummet in June Hog futures to make new contract lows -ONE MORE TIME! The culprits were increased slaughter over last week & year! And a massive premium to cash – $14 ($4 – avg)! This premium severely limited the follow-thru buying on the rally! We need a strong cash mkt turn-around to carve out a low in June Hogs! Even the best pork exports in 2 years weren’t enough to “stop the Bleeding”!

More By This Author:

AgMaster Report - Monday, May 1

AgMaster Report - Tuesday, April 25

AgMaster Report - Tuesday, April 18