AgMaster Report - Monday, May 1

Image Source: Unsplash

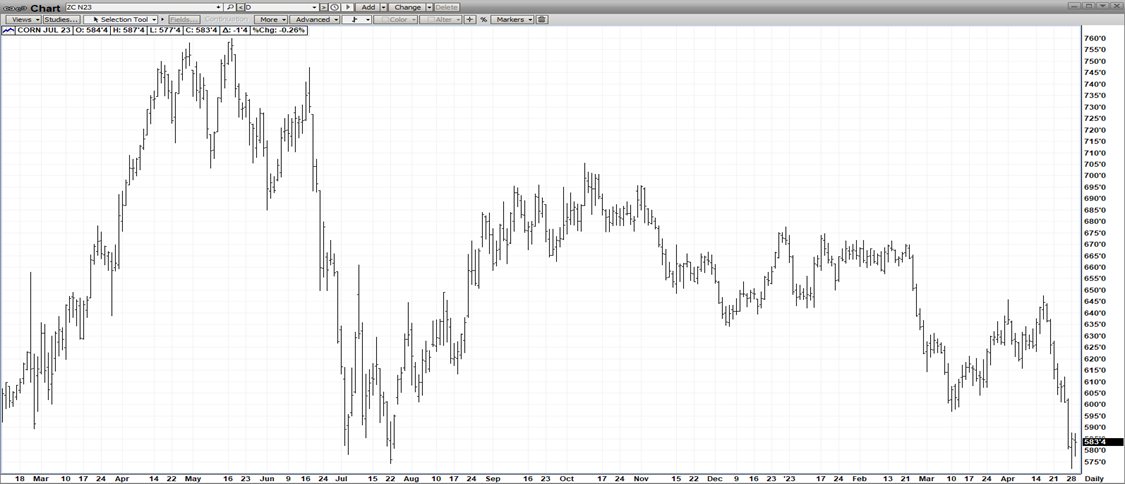

July Corn

Two cancellations from China -- 327,000 MT on Monday and 233,000 MT on Thursday -- sparked a massive sell-off in corn futures (610-570) as fears mounted that there would be more to follow. There haven't been more so far, but that negativity coupled with excellent planting progress and favorable weather ahead this week were all the catalysts the market needed to plummet.

Just a few weeks ago, China was buying from us nearly daily, but now they are “reversing.” The culprit seems to be the flooding of the world market with cheap South American corn – which removes the US export incentive. The market is also nervous about the Fed’s interest rate increase on Wednesday (.25%) and the final outcome of the Corridor Deal. However, it’s way too early for an obituary.

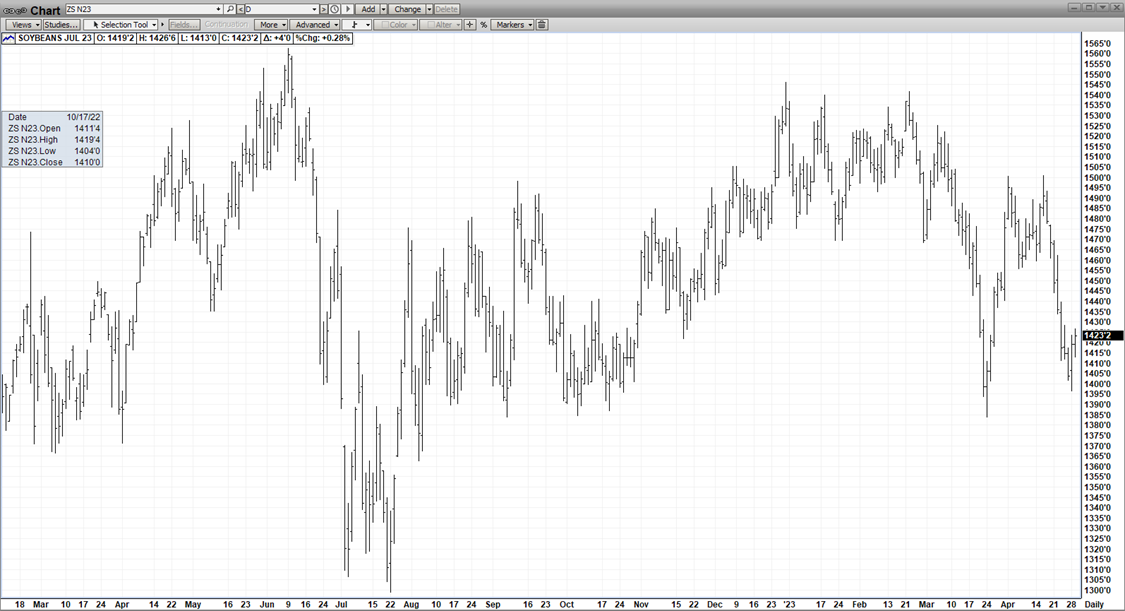

July Beans

July beans was not immune to the downward pressure generated by the Chinese corn export cancellations, and that downward trajectory was additionally exacerbated by planting pressure - as early planting is off to an excellent start. In the past 10 days, the contract has lost a dollar (15.00–14.00).

Still, $14.00 is quite a good price for this time of the year, and it has been holding on to this level due to a brutal Argentine drought which nearly halved the crop from 2022, as well as the historically low carry-out at six- to seven-year lows.

The market eagerly awaits the Fed’s interest rate increase this Wednesday, as well as the May World Agricultural Supply and Demand Estimates (WASDE), which is due out next Friday, May 12. The bottom line is we need a good US crop to refill the global pipelines, and any serious weather scares will rally the CBOT this summer.

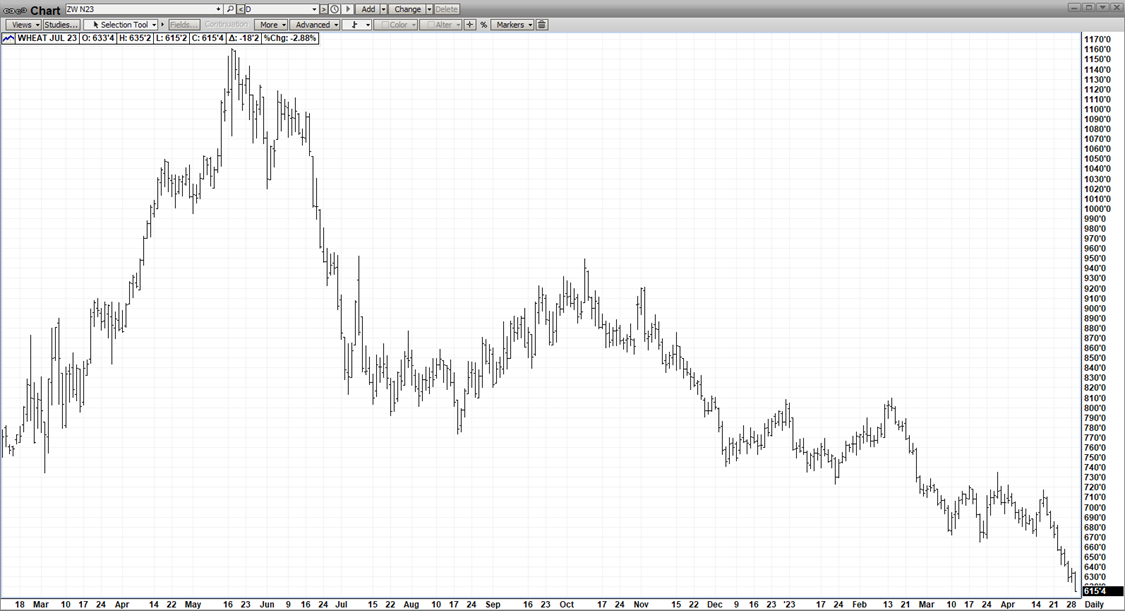

July Wheat

Rain in the plains, slack exports, and bearish pressure from corn and beans have kept July wheat under wraps last week. The Ukraine Corridor Deal seems to be faltering, with an expiration date of May 18. There have been complaints about the restrictions of the deal.

However, the market hasn’t been responding in a positive way, as you’d expect, as it has been more swayed by the drought-easing rains in the Central Plains. The market needs a bullish impetus to move up from the low $6.00 area – either from exports or continuing dry weather.

June Cattle

June cattle has been on a remarkable “bull run,” rallying over $20 since early 2022, mostly due to short supply concerns. It’s currently sustaining that rally off a very strong beef market, with boxed beef cutout reaching the highest level since September 2021.

Additionally, the huge discount June futures holds to cash continues to underpin the market. Finally, the grilling season, which is now underway, is the best demand period of the year and it will continue to supply a fresh infusion of consumer spending.

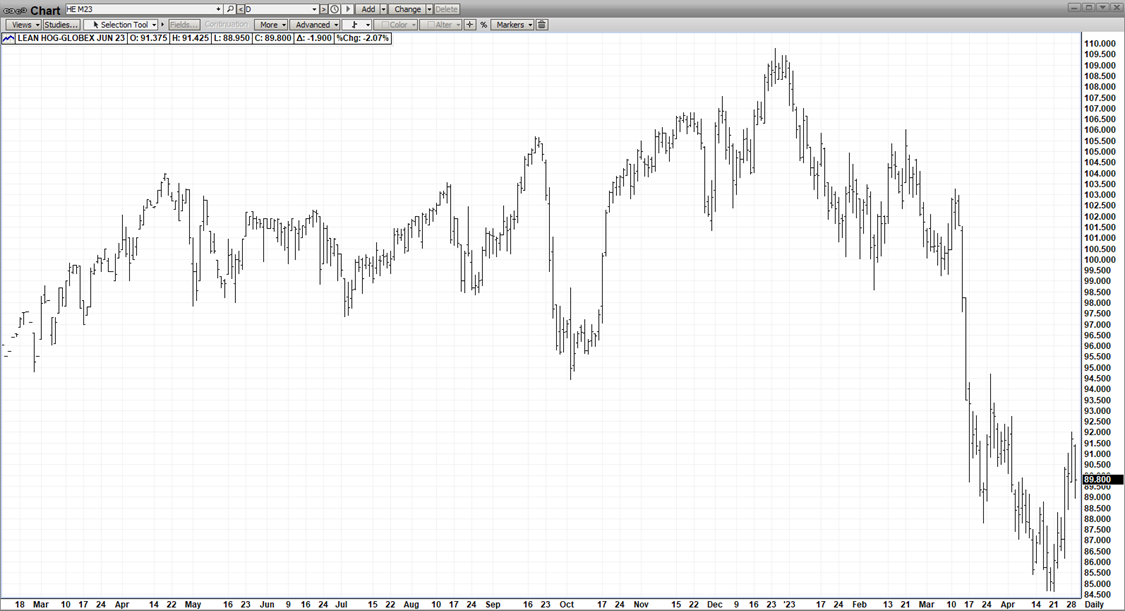

June Hogs

After many “false starts,” June hogs finally seems to have carved out a low on April 18-20. A combination of a tightening outlook for supply, an improved export outlook, stronger pork prices, and fresh demand from the grilling season has finally cratered the market.

We’ve had several incidences where we thought the market had bottomed only to be disappointed. But the timing of this low – coinciding with the grilling season – has convinced us this time is the “real deal.”

More By This Author:

AgMaster Report - Tuesday, April 25

AgMaster Report - Tuesday, April 18

AgMaster Report - Wednesday, April 12