AgMaster Report - Tuesday, May 23

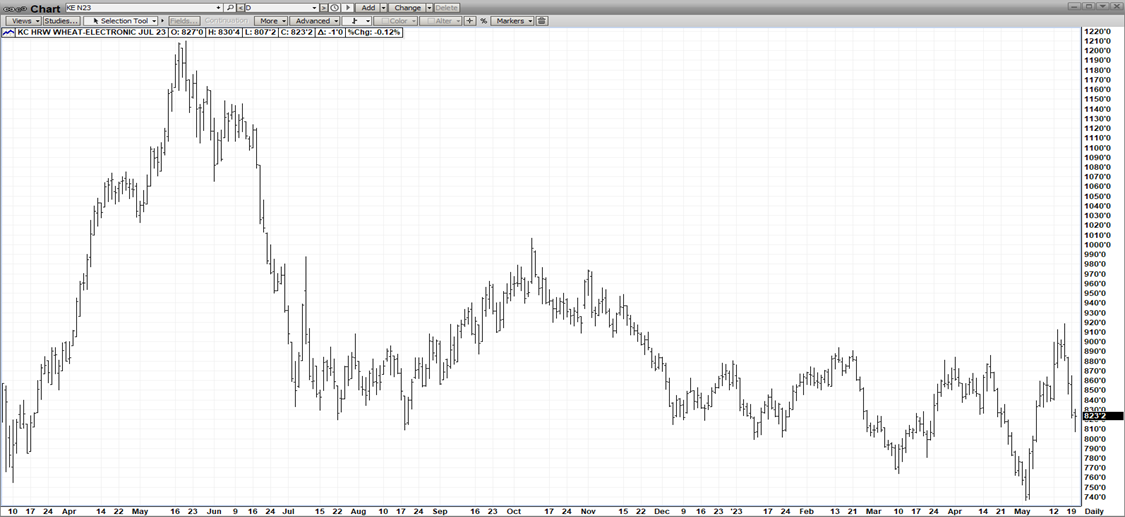

JULY KC WHT

(Click on image to enlarge)

The unpredictable Russian-Ukraine Corridor deal has propelled the mkt on an amazing roller-coaster ride – starting with a near-vertical $1.80 rally (740-920) off indications the deal wouldn’t be renewed & then a sudden $1.10 freefall (920-810) after last-minute negotiations producing a 60-day deal! And now, we’re back to good old supply/demand fundamentals as demand remains fragile & rains are forecast for the Central Plains – keeping wht under pressure today while beans & corn are enjoying double-digit gains!

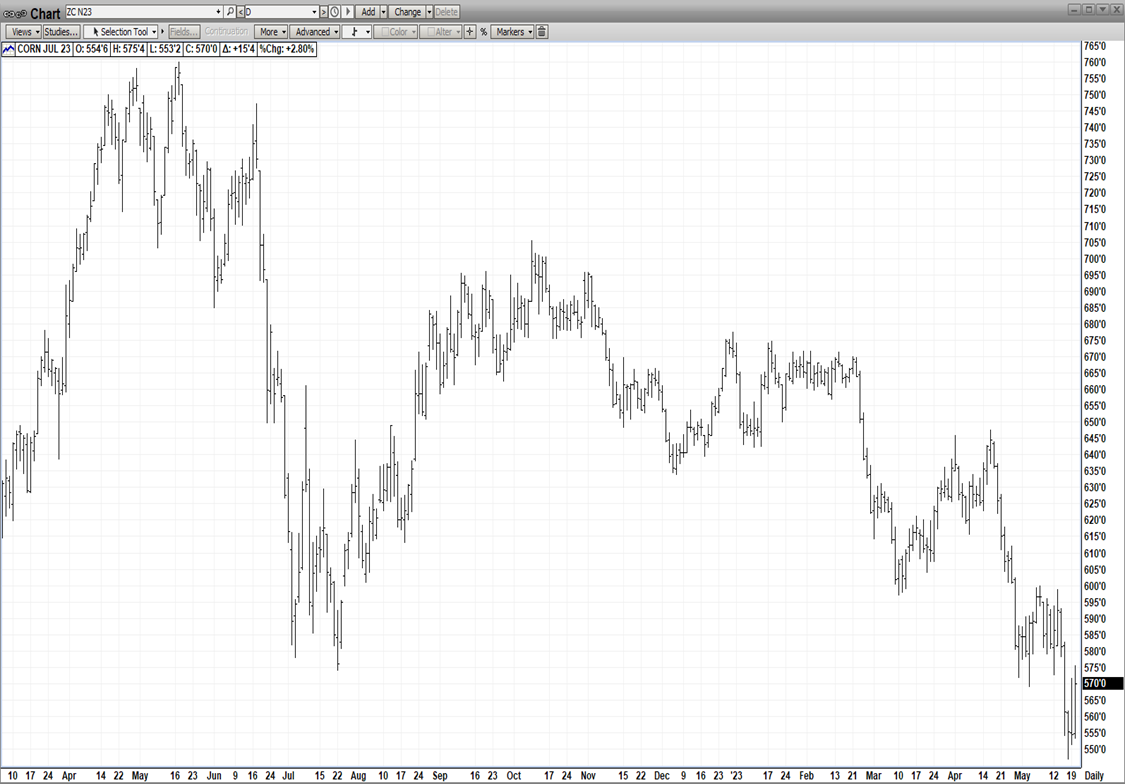

JULY CORN

(Click on image to enlarge)

A perfect storm of negatives descended upon the corn mkt in the past 2 weeks driving prices down 55 cents (6.00-5.45) – including a bearish WASDE REPORT on 5-12, weak economic data out of China, another Chinese cancellation of corn imports, a great start to planting, net negative export sales last Thursday, a last-minute Corridor Deal renewal & macro jitters about the debt ceiling & recession! But “enough is enough” as the mkt became radically oversold – with the crop just getting 50% or more in, it’s way too early to write an obit on the grains! There’s a lot of water to pass under the bridge before the crop is made! Already, there are early reports of dryness creeping into the corn belt in early June.

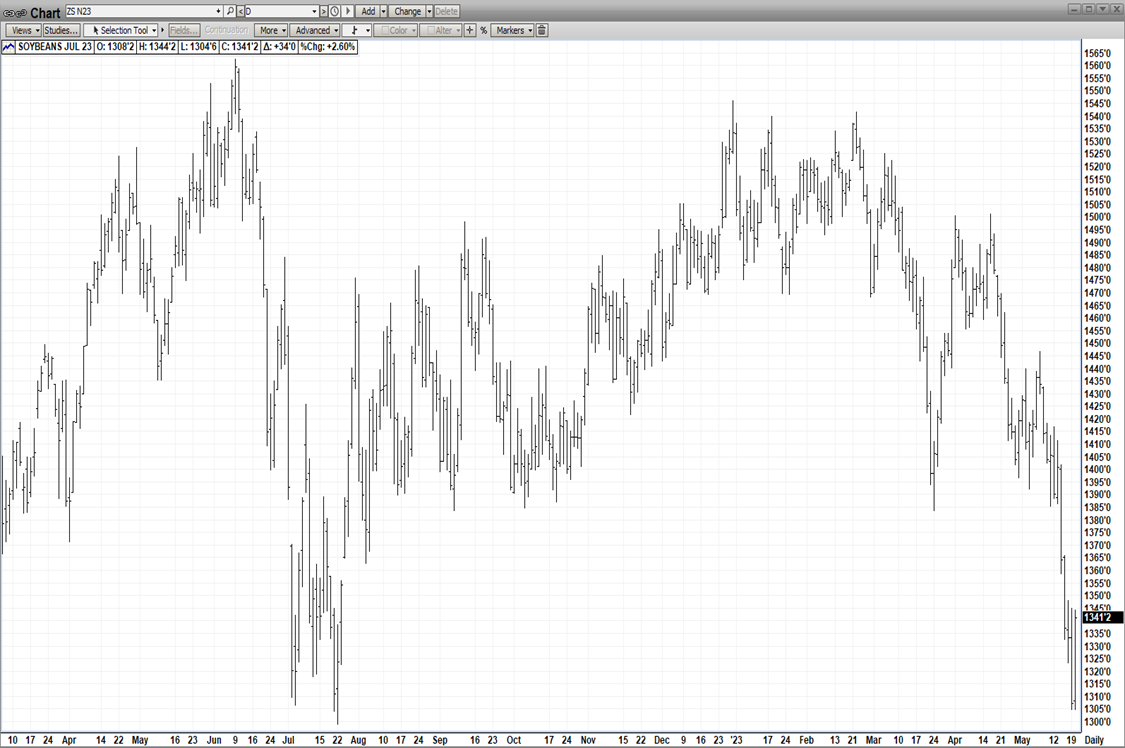

JULY BEANS

(Click on image to enlarge)

July Beans was pressured down to the 2022 lows – $13.00 – off a plethora of bearish fundamentals including a bearish weather forecast, weak demand & negative macros as Washington continues to try to hammer out a debt ceiling deal! The mkt was extremely oversold coming in this morning & has responded with a 35 cent rally off last weeks lows! So far, July Beans have broken over $2.00 off the March highs & that may be enough – as the crop is barely one-half planted & its only mid May! The break in price may make beans much more competitive on the world mkt – helping to bolster sagging exports! And there is some dryness predicted for early next month! When a mkt rallies over 30 cent for no ostensible reason, that’s a good sign!!

JUNE CAT

(Click on image to enlarge)

Looks like the old ‘BUY THE RUMOR – SELL THE FACT” grabbed the cattle mkt this morning – on the heels of Friday’s Cattle-On-Feed Report – announcing 3.4% fewer cattle on feed & 4.2% fewer placements! Bullish #’s to be sure but widely expected by the trade! So, the premium built into the price structure was stripped out today but the correction is anticipated to be minimal because of the extreme discount June Cat holds to cash & the lighter supplies expected in the 3rd Qtr!

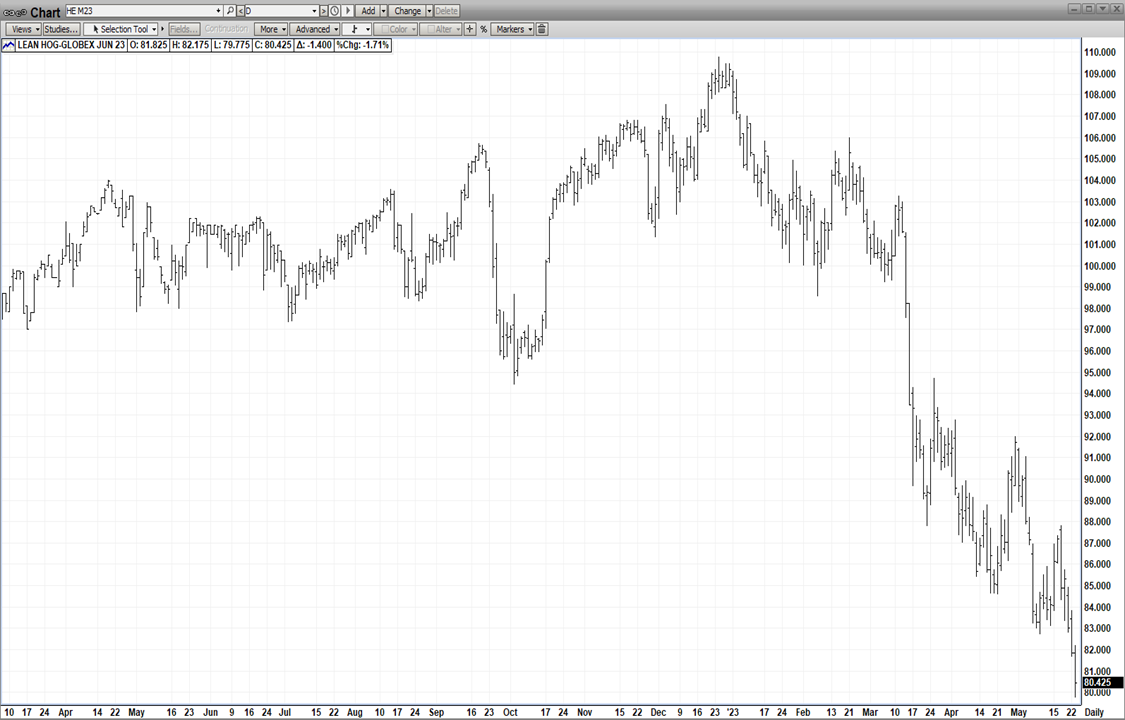

JUNE HOGS

(Click on image to enlarge)

Bottom-picking is a dangerous endeavor– as many analysts have painfully discovered – trying to call a low in the Jun Hog contract – that unmercifully keeps stair-stepping lower – despite being amidst the grilling season – the best demand period of the year & also being historically cheap! In juxtaposition to the sky-high cattle mkt & its expensive steak offerings in the supermarket! The culprits continue to be too-much-supply, lackluster demand & and an inordinately high premium to cash! and add high feed costs to that nasty combo of negatives! We’re probably need major bullish divergence – where the mkt is unable to go down on significant bearish news – to finally confirm a low!

More By This Author:

AgMaster Report - Tuesday, May 16

AgMaster Report - Monday, May 8

AgMaster Report - Monday, May 1