AgMaster Report - Thursday, June 8

Image Source: Unsplash

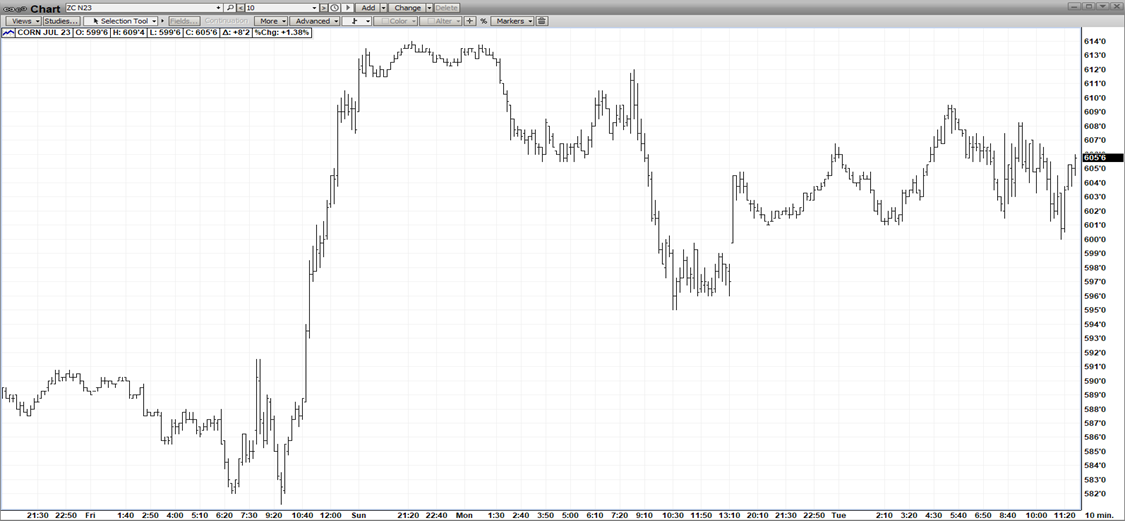

JULY CORN

(Click on image to enlarge)

Conventional wisdom says “hot & dry” doesn’t really impact corn until its pollination in July but that is definitely not the case in 2023! We feel the scenario has been exacerbated by the extremely tight 6 year-low global stocks – and that the extremely dry conditions from Mid-May until early June – should it extend to mid-June will begin to reduce corn’s yield potential! And this would negate the increased acreage going in this year – leaving just an average crop – which is far less than is needed to refill the pipelines! Corn is 96% in (avg-91) but the gd/ex rating dropped 5% to 64%! Also, the Ukraine Dam Explosion has helped to rally the mkts! And exports will improve! Sideways trade until the Friday WASDE.

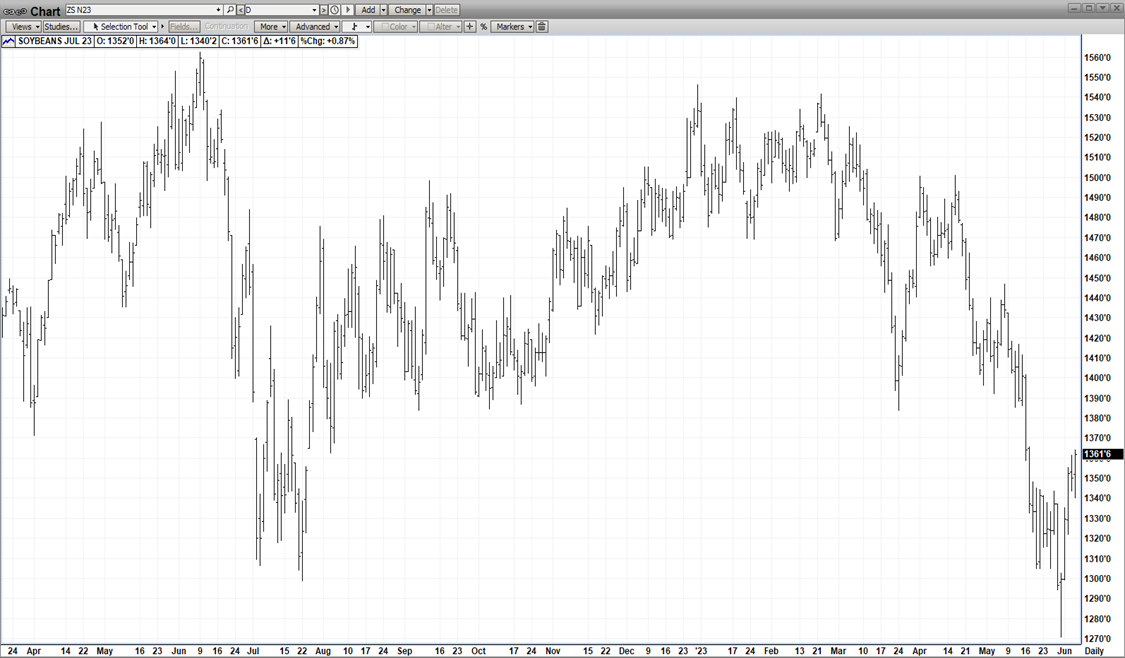

JULY BEANS

(Click on image to enlarge)

This morning, Spain bought 165,000 MMT of US Beans – a good sign! And even though beans don’t mature until August, the “hot & dry” assaulting the M/W since mid-May is getting their attention – due to the acreage staying unchanged from 2022 & the historically low global stocks! We need a robust bean crop – not just a mediocre one – to replenish the carry-over! And while export demand is lackluster due to the US prices being over Brazil, domestic demand has ratcheted up so far in 2023! Infrequent showers might cause minor corrections, but a major weather change is needed to stave off yield loss – a drought doesn’t mean NO RAIN but NOT ENOUGH RAIN! Weather premium will be added & subtracted over the coming weeks but the mkt should grind its way higher unless substantial rains come soon!

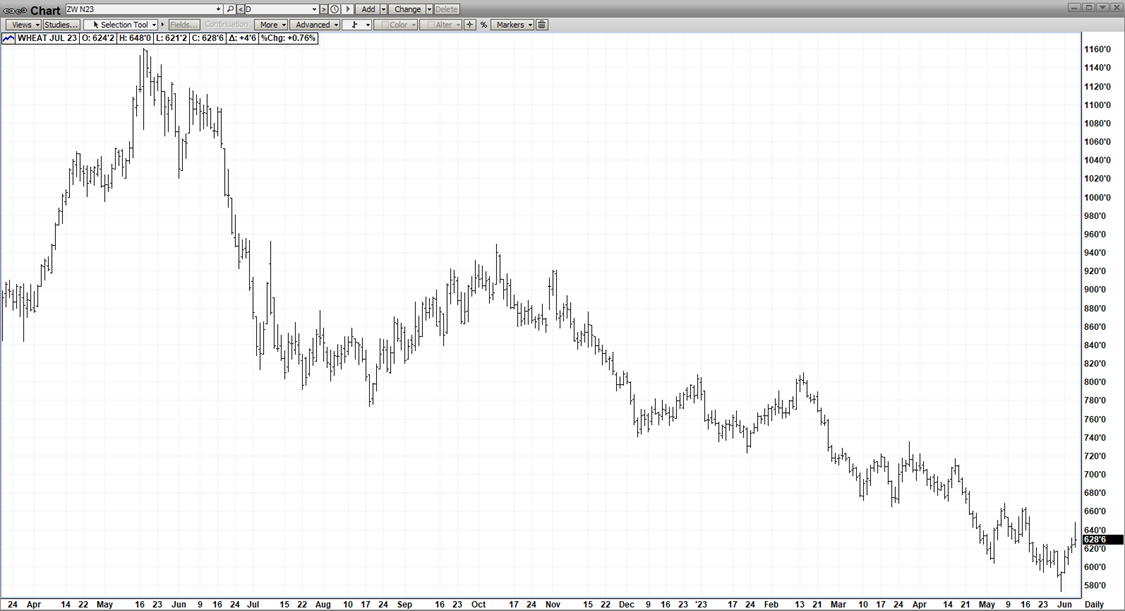

JULY WHT

(Click on image to enlarge)

Geopolitical factors along with spill-over from the corn/bean weather rally have catalyzed the Wht mkt to a 70 cent surge (570-640) in the last 6 mkt days! The ever-volatile Ukraine Corridor Agreement is still on shaky ground – as Russia continues to grouse over “this & that” & once again is threatening not to renew in Mid-July! But we’ve “seen this movie” before – so it may just be posturing on their part! Also, the Russia/Ukraine War continues to escalate – further jeopardizing grain flow out of UKR! And the ongoing drought in the Plains continues to endanger our wht crops! But mostly, Wht needs help from its sister mkts to extend its rally!

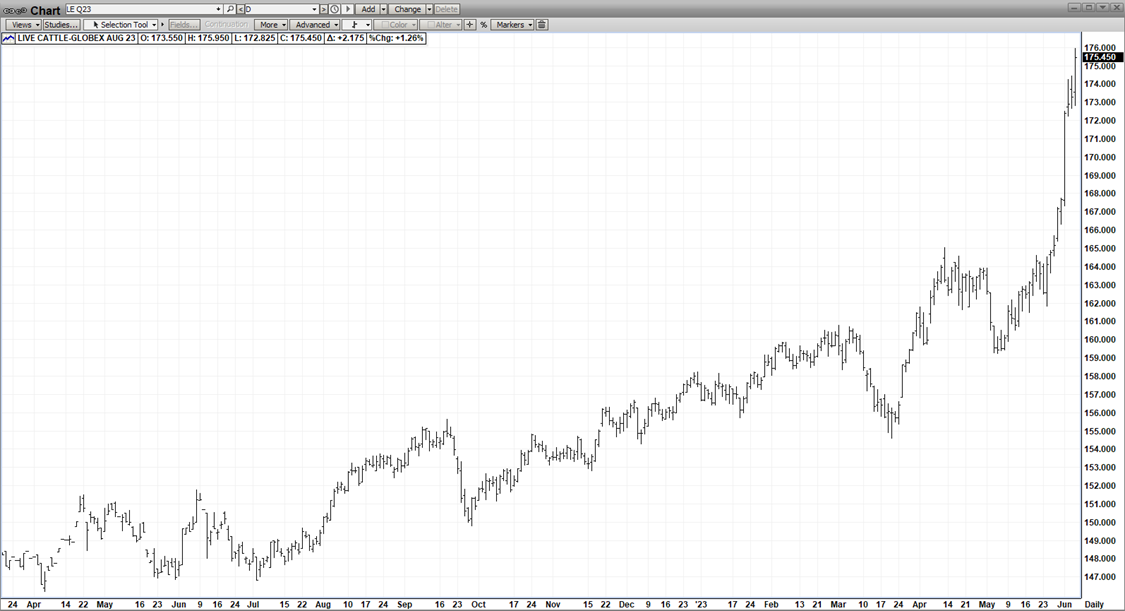

AUG CAT

(Click on image to enlarge)

The unstoppable Bull juggernaut that is Aug Cattle continues its relentless march to the upside – scoring new contract highs in each of the last 7 trading days! Its supply/demand fundamentals are exemplary – less product in the next two quarters than 2022 & amid the best demand period of the year – the outdoor grilling season! However, the mkt is severely overbought – which in the past has meant only a mild correction due to its discount to cash! Last week, the cash rallied $9.00! But sooner or later, the consumer might begin balking at the high prices in the grocery store – but it certainly hasn’t happened yet!

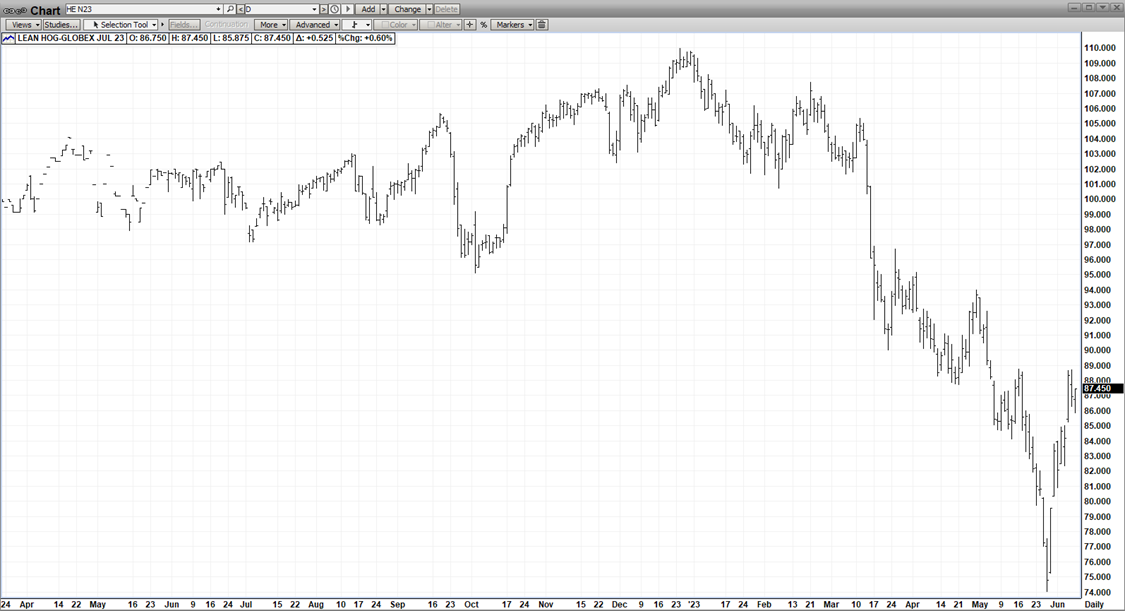

JULY HOGS

(Click on image to enlarge)

In classic mkt fashion, the mkt scored a low in violent, dramatic fashion – racing up vertically – gaining $14 in just 6 mkt days! The mkt was ridiculously cheap – especially in contrast to the record high cattle mkt & supermarkets started featuring pork! Average weights are coming in lower than 2022, exports are solid, the funds are big-time short & we’re amidst the best “demand period” of the year! In short, LOW PRICES CURE LOW PRICES! However, the mkt quickly became extremely overbought – so today’s correction is alleviating that condition!

More By This Author:

AgMaster Report - Tuesday, May 23

AgMaster Report - Tuesday, May 16

AgMaster Report - Monday, May 8