AgMaster Report - Wednesday, July 26

SEPT CORN

(Click on image to enlarge)

Extreme volatility was expected this Summer with the early dryness & geopolitical issues & indeed that has come to fruition – in spades! An early $1.50 rally off drought-like conditions & then $1.50 break after some rain relief! And then a .90 cent rally – catalyzed by the Corridor Deal cancellation, a return of “hot & dry” & an escalation of the Russian/Ukraine War!And the good/excellent crop ratings issued Monday at 3 pm – came in disappointingly unchanged at 57%! So, despite a reputed 5.5 million acre increase over 2022, Sept Corn stubbornly hangs tough within $1.00 of its 2023 highs – with final yields still a big questions mark – due to the weather & the increased Russian bombings of Ukraine!

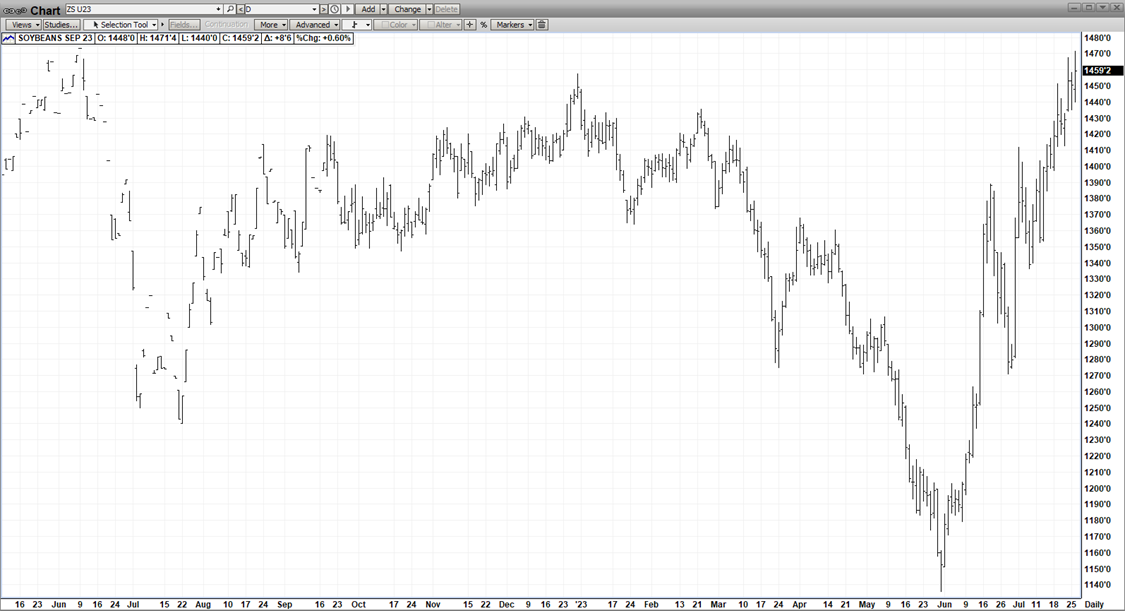

SEPT BEANS

(Click on image to enlarge)

Bean fundamentals changed in an instant – the moment the USDA June 30 Acreage report was released & the USDA revealed shockingly that the 2023 acres at 83.5 MA – a whopping 4 MA under 2022! The bean mkt reacted instantly with a 70 cent up day & really hasn’t looked back since! Even with the backdrop of meager exports, the extreme acreage shortfall on top of the Argentine drought have both established beans as the clear upside leader thru harvest! Stocks were already historically tight on at least 6-year lows – and this tightness will only be exacerbated by many fewer acres & possibly lower yields due to the potential “hot & dry” in the critical pod-setting month of August! Todays mkt action – with beans up 12 while corn is down 16 & wht down 45 – only serves to corroborate beans bullish leadership into the Fall!

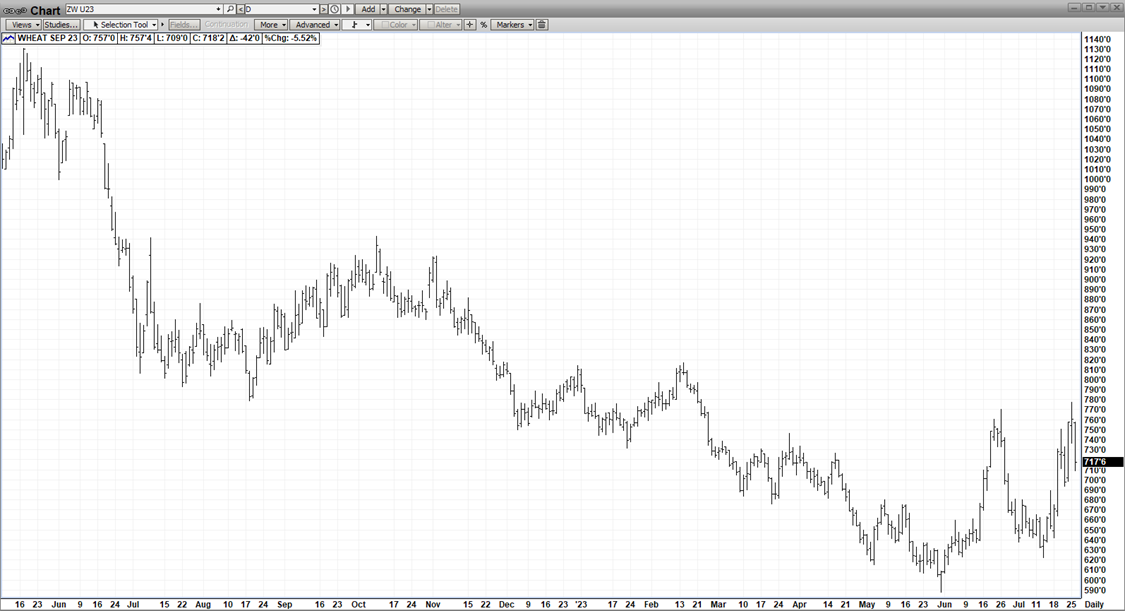

SEPT WHEAT

(Click on image to enlarge)

If any mkt exemplifies the current volatility of the grains today, it’s wheat! On Monday off the Russian bombing of Ukraine ports, Sept Wht went its 60 cent limit up & extended the gains Tuesday – only to give up 45 cents today – as the bombings have ceased for 2 consecutive days! Additionally, the 1st day of the HRS wheat quality tour has revealed better-than-expected yields & there is a little better chance for some rains in the Canadian wheat areas! However, wht is still up for the week & will probably be most affected by the spill-over from Corn & Beans – either up or down!

AUG CAT

(Click on image to enlarge)

The bullish juggernaut that is the Aug Cat as it soars to record high prices into the stratosphere was challenged last Friday at 2 pm – with the release of the July Monthly Cattle-on-Feed – which showed placements at 103% – well over the expected range of 96-100! This resulted in 4 consecutive lower closes in a correction stretching to $4.00! There have been several similar corrections that some mkt pundits proclaimed were a top – only to be rebuffed as the mkt ultimately made new highs! Especially with the record level of cattle prices & the still relative cheapness of pork alternatives! So, the jury is out on whether cattle has finally topped with the consumer finally deciding super-market prices were prohibitively high!!

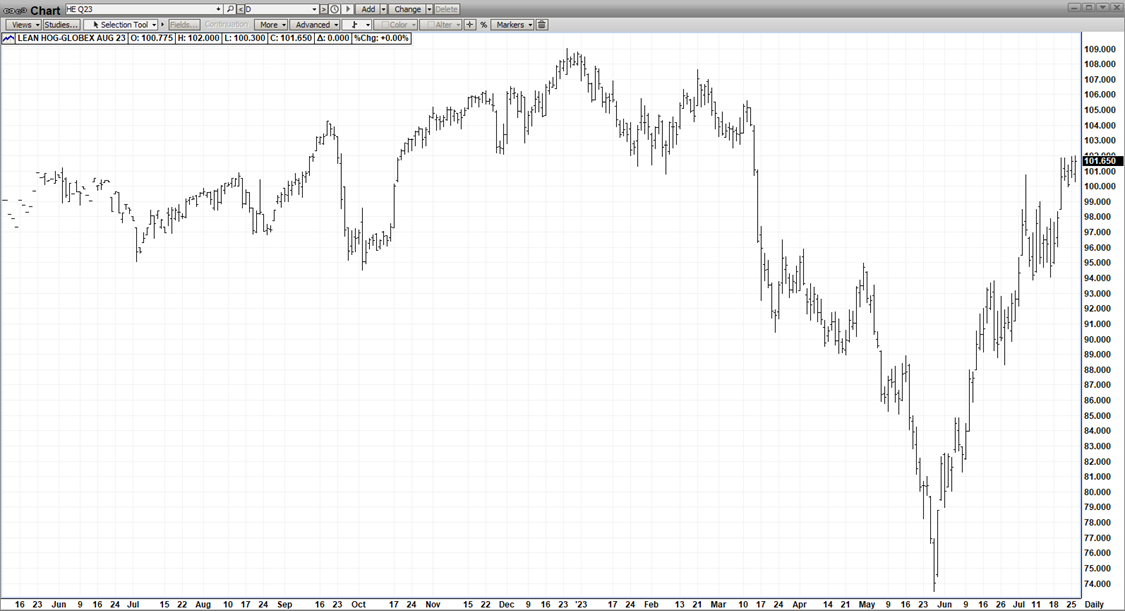

AUG HOGS

(Click on image to enlarge)

In a remarkable turn-around since late May, Aug hogs have exploded for a $27 rally – as the grocery stores started featuring pork – kick-starting demand! As well, recent quarterly production & slaughter have been lower! Furthermore, the Cold Storage Report issued last Friday reflected total pork stocks well under last month & last year! Clearly Aug Hogs are the new “upside leader” in the meat complex

More By This Author:

AgMaster Report - Wednesday, July 19

AgMaster Report - Tuesday, June 13

AgMaster Report - Thursday, June 8