A Smaller US Crop Has Cut Demand, But Stocks Lowest Since 2013

Image Source: Pexels

Market Analysis

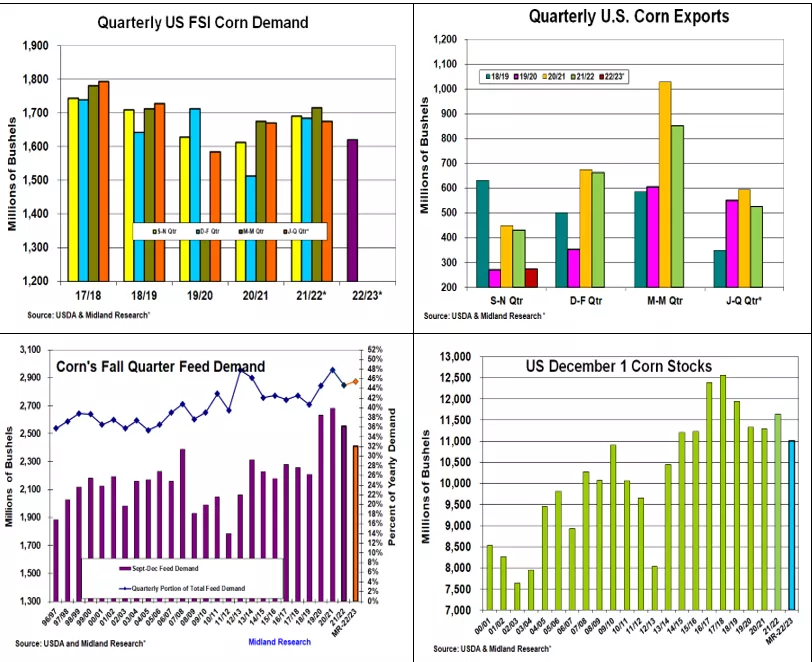

This year’s smaller US crop and higher country prices have curtailed both the US & overseas demand for corn during the 1st quarter of the 2022/23 crop year. Russia’s invasion of Ukraine produced record gasoline prices & China’s zero Covid policy curtailed last fall’s US ethanol and export demand. Despite limited alternative feed sources (wheat & sorghum), last fall’s high prices & lower supplies also reduced the livestock & poultry industry’s seasonal purchasing of US corn for their rations.

High energy prices and moderating ethanol processing margins reduced corn’s industrial demand. Increased usage of public transportation because of reduced Covid concerns & reduced longer distance car travel because of its higher cost impacted gasoline & ethanol’s demand. Last fall’s ethanol corn usage was down by 4% or 70 million bu to 1.62 million bu. This is similar to ethanol’s 2020 demand, the first fall quarter after Covid arrived in the US.

Like soybeans, China’s limited demand posture because of their restrictive covid policies & a dry Midwest weather pattern limited the US Mississippi River barge loading capacity & movement during the first 5-7 weeks of the export season. China’s apparent desire to open a new corn import channel with Brazil by quickly approving import rules & taking test shipments this fall limited their purchases. With corn’s quarterly US exports at just 275 million bu, the low- est since Trump’s tariff conflict with China in 2019, reduced Argentine supplies & a recent Black Sea shipping insurance issue should boost US overseas demand prospects.

Because of avian bird flu, high corn prices impacting feed costs, and this year’s reduced corn supplies, 2022’s fall US corn feed purchases were also likely reduced vs recent buying levels. This suggests a 6% lower level for this residual demand (2.41 billion bu) given our projection of a December 1 corn stocks level of 11.01 billion bu. This will be 630 million lower quarterly stocks vs last year. However, given this year’s 1 billion bu smaller beginning US supplies, corn demand has held its own so far this crop year.

What’s Ahead:

The upcoming US quarterly corn stocks will show significantly lower supplies than in 2021 on January 12. However, current S. American weather and the US final 2022/23 ending stocks are the market’s focus. Argentine & S Brazil's first crop of corn is vulnerable, but Brazil’s potentially large safrina corn crop still has 6-8 weeks before plantings. Up old-crop March by 15% at $6.70-80 & begin Nov sales by 15% at $6.12-15.

More By This Author:

US Fall Exports Dip, But December Stocks May Slip On Lower 2022 Crop

Pre-January Snapshot: 2022 US Corn & Soybean Output

December US/World S&D Reports - Ending Stocks Had No To Little Changes This Month

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more