Pre-January Snapshot: 2022 US Corn & Soybean Output

Market Analysis

With the 2022 commodity markets winding down, the focus is on South America’s weather impact on their crop sizes and the intensifying Black Sea conflict’s effect on the region’s grain and oilseed export shipments. However, the final US 2022/23 crop report being released on January 12 will also be important to prices. The changes aren’t very large, but modest declines in US corn & soybean outputs may occur like in previous years.

Despite a wet spring that delayed both the N Plains & Midwest plantings, the Pacific Ocean’s cold currents returned the La Nina weather regime to the US for a 2nd year in a row. Heat & dryness build from the SW into S & C Plains hurting 2022’s hard red wheat’s output this year. By late summer, La Nina had impacted the W Midwest & parts of the Mid-South & SE curtailing crop yields. The ECB had some dry areas but overall rain events were more timely.

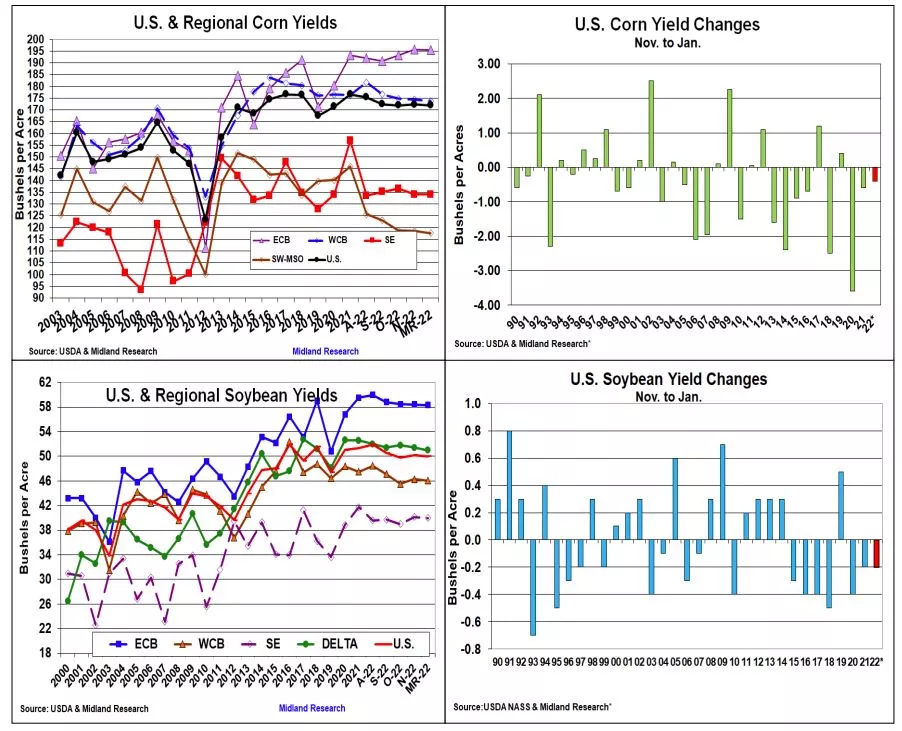

Because of wet soils delaying US planting by 30-40% below normal, the USDA started their 2022 US May corn yield at 177 bu. With the WCB experiencing significant drought conditions, the US yield was sliced 175.4 bu by August. The downward trend continued to 171.9 by Oct before a 0.4 bu rise in Nov. However, the US final corn yield has declined 7 of the last 9 years on the Jan report. We expect Jan’s final yield to be down 0.4 bu dropping 2022’s US crop by 60 million bu.

In soybeans, 2022’s growing season was also impacted by the La Nina weather from delayed seedings to dry growing conditions to fast fall moisture decline. After starting 2022’s yields at 51.5 bu, the US yield declined to 50.2 bu by Nov. With soybean’s final Jan yield dipping 6 of the last 7 years, 2022’s yield could slip 0.2 bu. to 50.0 bu which could drop 2022’s output by 22 million to 4.323 billion bu.

After last fall’s US Small Grains Report, no change in the US wheat crop is expected on the upcoming January 12 crop report. The USDA’s 2023 winter wheat seedings update will probably be the main market factor for this food grain that day.

What’s Ahead:

The USDA’s final major US crop sizes are always important to the markets. However, Argentina’s weather impact on its crops & the building Black Sea war concerns because of attacks on Ukraine’s infrastructure are the current market factors.

Reports that Black Sea food corridor shipping vessels could be losing their insurance coverage would be big blow to the world’s grain trade.

Hold Sales

More By This Author:

December US/World S&D Reports - Ending Stocks Had No To Little Changes This Month

US Dec S&Ds Don’t Change Much, But Slow Exports May Up Corn Stocks

Slightly Larger US Soybean & Corn Crops Prompts Small Stocks Changes

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more