December US/World S&D Reports - Ending Stocks Had No To Little Changes This Month

Market Analysis:

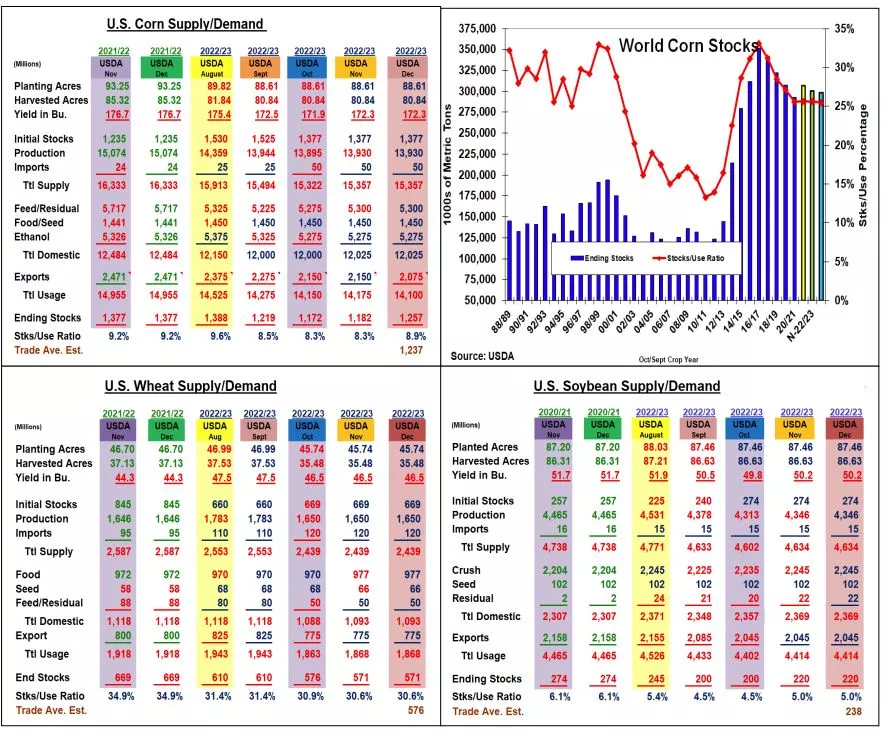

The USDA again followed its past approach to their December US supply/demand updates. With the USDA not updating their 2022 final production data until January, the World Board left their US soybean and wheat balance sheets unchanged. This wasn’t the case for corn’s US and world balance sheets.

Given this past fall’s slow US sales and shipments, the Ag Department sliced their 2022/23’s exports by 75 million. With no other adjustments in corn’s feed or ethanol demand, corn’s ending stocks were upped by a similar amount to 1.257 billion. This was above the trade’s average estimate, but the USDA also sliced their world stocks by 2.36 mmt to 298.4 mmt and down 8.7 mm from last year’s level. Interestingly, the USDA slashed Ukraine (-4.5 mmt) & Russia (1.0 mmt) outputs, but left Brazil and Argentina’s crop outlooks unchanged this month. The current La Nina weather pattern remains a wild card for S America’s production prospects.

Despite some concern about US wheat exports, the USDA left their 2022/23 export outlook & US stocks unchanged this month. However, the World Board did adjust their forecasts for some major Western Hemisphere competitors. Because of the current La Nina, they dropped Argentina’s crop outlook by 3 mmt to 12.5 mmt. This is closer to other S Am forecasts. They also slipped Canada’s crop by 1.2 mmt to match Stats Canada’s recent update. The USDA also upped Australia’s crop 2 mmt to 36.6 mmt, a new record, but the recent rains have also upped the feed portion of the crop. No changes were made in this month’s Black Sea crops. Overall, December’s world stocks were shaved 490,000 tons keeping them at 267.4 mmt, the lowest level since 2016/17.

Even with a strong October US soybean crush pace & a recent surge in Chinese & unknown export purchases totaling 1.46 mmt this month, the USDA left their December’s US supply/demand levels unchanged. This kept US stocks at 220 mil bu. They also didn’t adjust their Argentina & Brazilian soybean crop forecasts either. However, world stocks did increase a minor 540.000 tons to 102.7 mmt.

What’s Ahead:

The latest US & World S&Ds didn’t change the major crops supplies this month. Escalating Black Sea drone attacks hitting port facilities, South American weather and China’s loosening of covid restricts on their commodity purchases will be market factors the remainder of 2022.

Hold 2022/23 corn and soybeans sales at 65% and Chicago & KC wheat marketings at 45%

More By This Author:

US Dec S&Ds Don’t Change Much, But Slow Exports May Up Corn Stocks

Slightly Larger US Soybean & Corn Crops Prompts Small Stocks Changes

Slightly Smaller US Corn & Soybean Crops Impacted By Varying Exports

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more