A Look At Offshore Drilling Day Rates

Once a month, leading offshore data and consulting provider IHS Petrodata publishes its Offshore Day Rate Trends report. This report is intended to provide information to investors, analysts, and industry insiders regarding the current day rates being paid to secure the services of various offshore rigs. As these day rates are generally a function of supply and demand, the trends can help give us information about how the industry is progressing with various offshore development.

As long-time readers are likely aware, the offshore drilling industry suffered a major decline back in late 2013 to 2016 as an oversupplied market and a collapse of crude oil prices caused upstream producers to reduce the amount that they are willing to pay to charter a rig and even their willingness to proceed with their offshore projects. That caused a wave of bankruptcies in the offshore drilling sector, such as Seadrill's (SDRL) high-profile bankruptcy in 2017.

The offshore drilling industry never fully recovered from that event. This is partly due to the reluctance of upstream companies to invest in production capacity and offshore projects. This is a problem that persists to this day, as Moody's Investor Service has stated that the energy industry in aggregate must invest at least $542 billion into new capacity or the world is at high risk of an energy supply shock. In addition to this, the growing importance of American shale oil has reduced the willingness of upstream companies to lock themselves into offshore projects, due to their much longer lifetime and higher required capital investment. Nonetheless, we have started to see some improvements in the offshore sector, which we will see in the next few paragraphs.

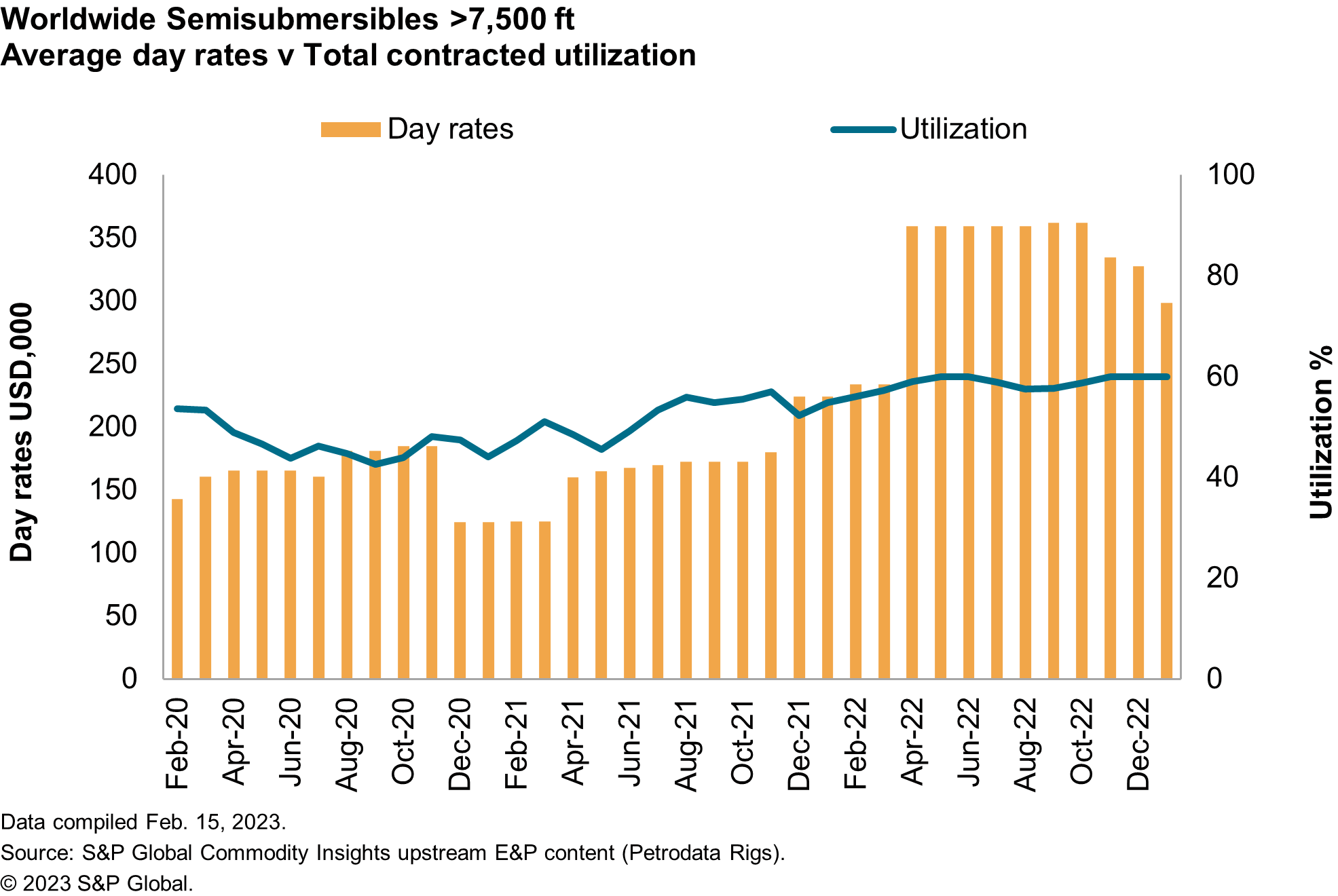

Semisubmersibles

The first type of offshore drilling rig whose price trends are tracked by the IHS Petrodata report are semisubmersibles that are capable of operating in more than 7,500 feet of water. These are generally among the most advanced, and therefore expensive, semisubmersible rigs operating in the world. These are one of two types of ultra-deepwater rigs and are obviously employed in areas where the water depths are very high, such as the North Sea and parts of the Gulf of Mexico.

Drilling Manual

These rigs are somewhat more stable than drillships during storms or choppy water so they are usually the choice for areas that are prone to such harsh conditions. In addition, these rigs tend to be employed for development drilling, in which the resources have already been discovered, rather than exploration drilling due to their stability and low average speed compared to other drilling units. Thus, the trends report could give us a sign of how much demand there is for bringing offshore wells to a full long-term production state.

Here are the leading contract day rates for these rigs over the past two years:

(Click on image to enlarge)

IHS Markit

As we can clearly see, the leading contract day rate has generally been rising since mid-2021, although it declined a bit during the fourth quarter of 2022. That was almost certainly due to falling crude oil prices. Globally, there have been growing fears of a near-term recession that would have a negative impact on crude oil demand. However, the day rate of these rigs has still not reached the elevated levels that we saw prior to 2014. However, it should still be possible for large offshore drilling contractors like Valaris (VAL) to be able to generate strong positive cash flow from new rig contracts at today's levels.

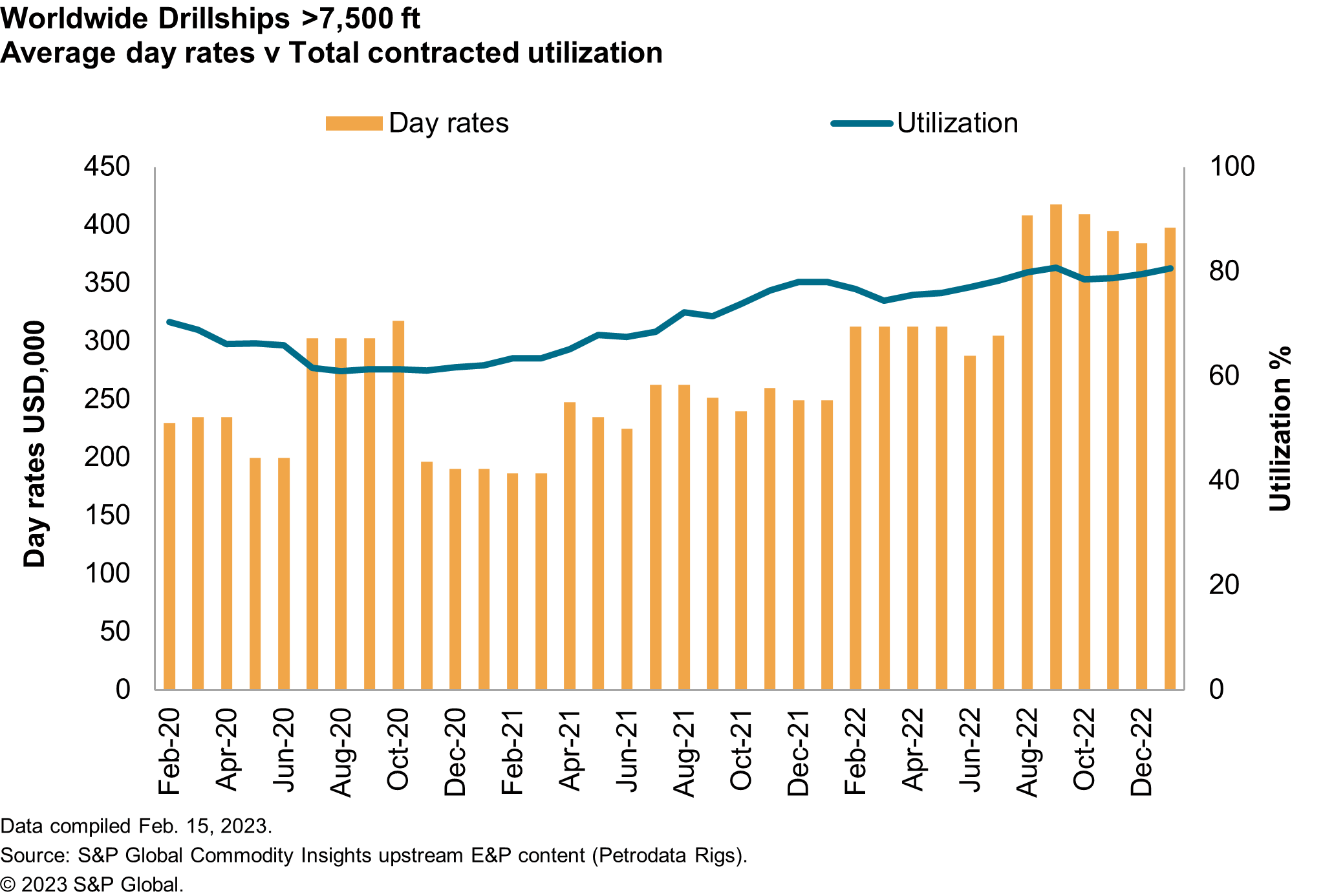

Drillships

The second type of offshore drilling rig whose day rate trends are tracked by the IHS Petrodata report are drillships. For the purposes of this report, these are defined as those vessels that are capable of operating in water depths of more than 7,500 feet. These would likewise be the most advanced and capable rigs of this type in the world. These vessels are frequently used in areas like Brazil's pre-salt deposits, in which their deep drilling ability is necessary.

Drilling Manual

As the name of the rig type implies, these rigs are actually vessels (several of them are converted oil tankers) that have been equipped with the necessary equipment to drill wells deep into the ocean floor. As these are ships, they are faster than semisubmersibles and can get to new drilling sites fairly quickly. As such, they are frequently used in situations where numerous wells need to be drilled over a wide geographic area for exploration purposes. They are not as stable as semisubmersibles in difficult conditions, however, so these vessels are not commonly used for Arctic drilling or in the North Sea.

Here are the leading contract day rates for these rigs over the past two years:

(Click on image to enlarge)

IHS Markit

As shown, these rigs have also been seeing their leading new contract day rates increase since mid-2021. As is the case with semi-submersibles, this is probably because the improvements in crude oil prices that began around that time spurred an increase in ultra-deepwater exploration. We also see the fears of an impending recession having an effect here as the price declined during the second half of the year. However, it has still generally held up better than we saw for semi-submersibles. That is likewise not particularly surprising as energy prices are high enough that it still makes sense for energy companies to search for crude oil in offshore environments.

As is the case with semi-submersibles, the current leading new contract dayrate far exceeds the costs of operating an ultra-deepwater drillship so companies like Transocean (RIG) should have no particular difficulty generating positive cash flow on new contracts for the drillships in their fleets.

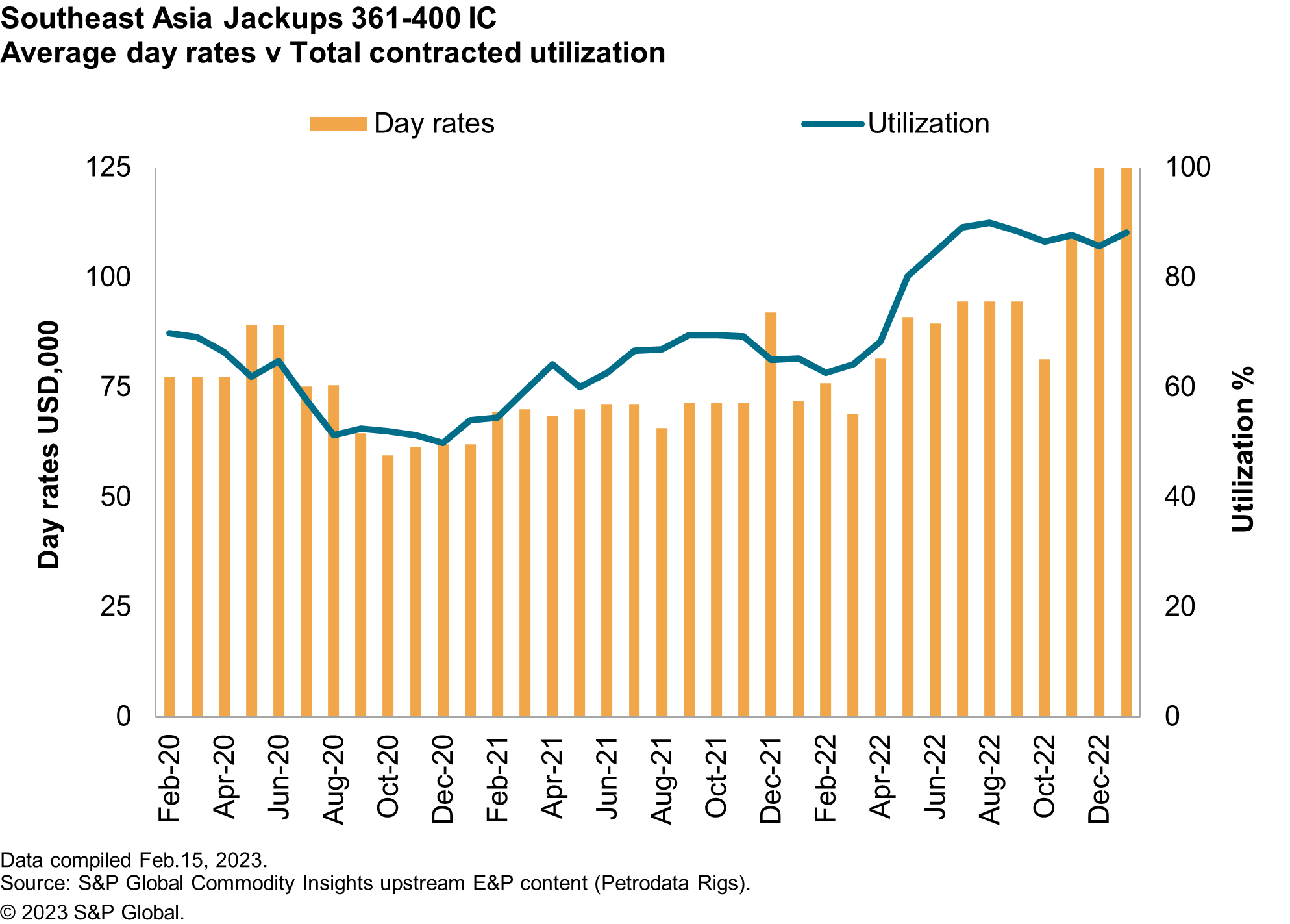

High-Specification Jack-Ups

The final type of rig whose leading contract day rate data is discussed in the IHS Petrodata report are high-specification jack-ups. These are defined as shallow-water rigs that are capable of operating in 361 to 400 feet of water. As such, these rigs cannot be used in deep water and are instead used to drill primarily offshore, such as in the various archipelagos around Southeast Asia.

Drilling Manual

These rigs are very different from the other two rig types that we discussed here as they do not float. Rather, these rigs have three or more legs that are lowered once the rig has been towed to a position. The legs touch the floor of the ocean in order to hold the rig in place. As these are among the cheapest rigs to both construct and put under contract, they will usually be the go-to choice unless the water is too deep for them to be operational.

Here are the leading contract day rates for these rigs over the past two years:

(Click on image to enlarge)

IHS Markit

As we can see, the IHS Petrodata report only provides information for those jack-up rigs operating in Southeast Asia. Thus, these figures will not include any information about those rigs operating in other shallow-water environments, such as parts of the Gulf of Mexico. However, the supply-demand dynamic tends to be fairly similar elsewhere and Southeast Asia is the most common market for these rigs so this still works fairly well as a proxy.

We do see some notable differences between the day rate data for these rigs and the day rate data for the ultra-deepwater rigs. In particular, these rigs started to see their day rates increase in late 2020 as opposed to late 2021. We also do not see as much of a slowdown in recent months. This is not surprising though since these rigs tend to lead the rest of the market in this respect. As a jack-up rig is much cheaper to put under contract, they tend to be the first beneficiaries when upstream companies are interested in increasing their offshore investment. In addition, these rigs tend to have shorter contracts than ultra-deepwater rigs so they tend to be the first to see their supply increase when demand starts declining, pressuring day rates downward. Thus, the fact that we are seeing some strength here over the past few months could be a positive sign for the entire industry. We might begin to see ultra-deepwater rigs reverse the recent day rate declines in the near future.

More By This Author:

Oil Fundamentals Remain Very Solid For 2023 And 2024

Could The Short-Term Oil Optimism Be Misplaced?

Chevron Vs. The S&P 500 Index

Disclosure: I have no positions in any stock mentioned in this article and no plans to enter into a position within the next 72 hours.

Disclaimer: All information provided in this article is for ...

more