Spreads Diverge As Inflation Breakeven Drops

Big daily movement in 10yr, 5yr yields:

(Click on image to enlarge)

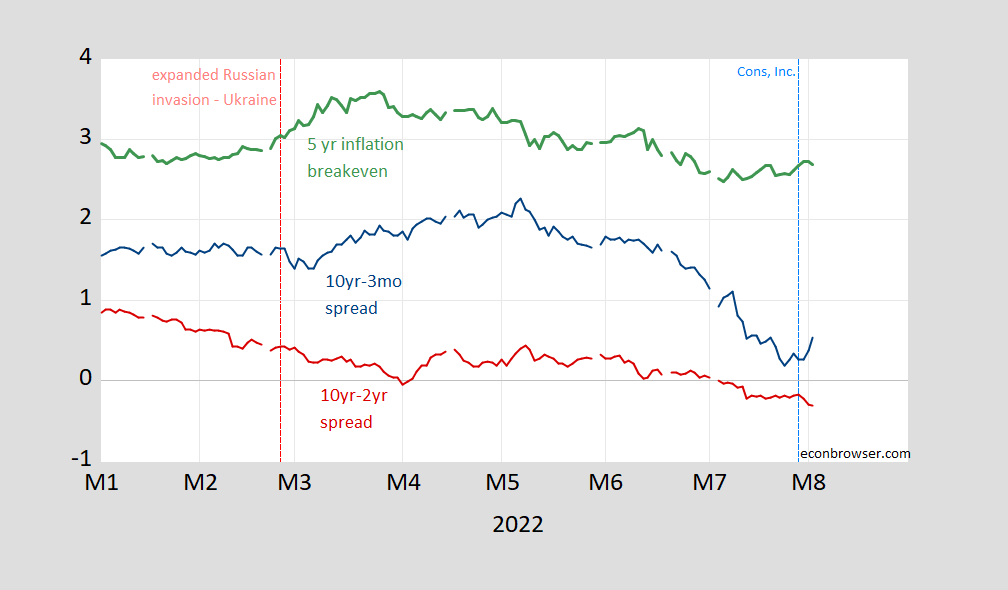

Figure 1: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (red), Treasury-TIPS 5 year spread (green). Light blue dashed line at June income and outlays release. Source: Treasury via FRED, and author’s calculations.

The 10yr-3mo spread rose, while medium-term inflation expectations eased. Five-year real rates are back into the positive region. If risk and liquidity premia were constant, I’d think expectations of economic activity were up; but that would be going a bit far.

More By This Author:

Additional Perspective On The GDP Release

Business Cycle Indicators as of July 27

Nowcasts and Forecasts of 2022Q2 GDP Growth

Disclosure: None.

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!