Nowcasts And Forecasts Of 2022Q2 GDP Growth

These pertain to advance release numbers coming out tomorrow, recalling that they will be revised two times before end-September, as new data comes in. A slight change in views since 5 days ago.

(Click on image to enlarge)

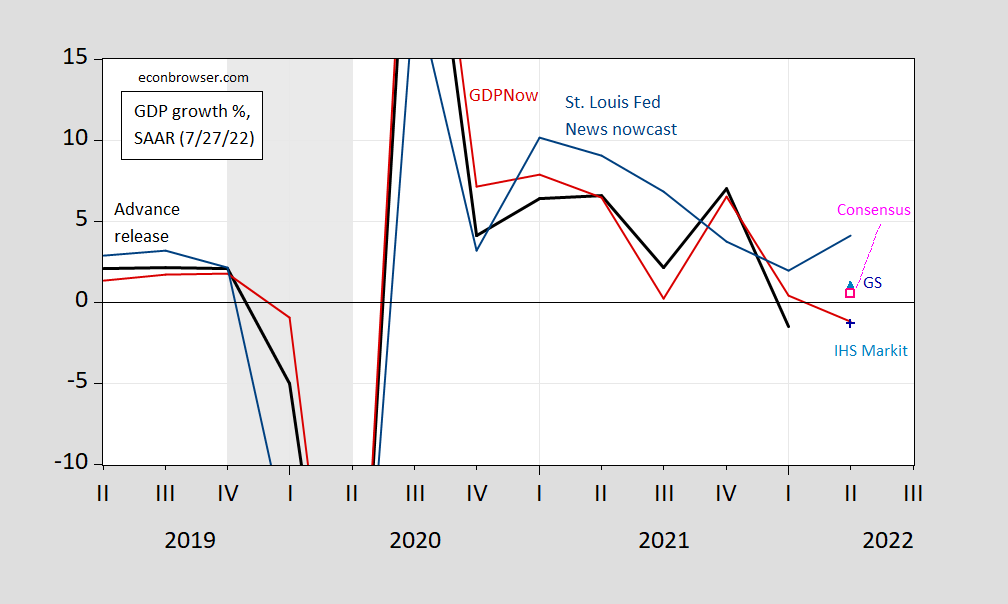

Figure 1: Actual advance GDP growth rate (black), Atlanta Fed GDPNow for 7/27 (red line), St. Louis Fed News index for 7/22 (teal line), IHS Markit for 7/27 (sky blue triangle), Goldman Sachs for 7/27 (blue +), Bloomberg consensus as of 7/27 (pink open square), all in %, NBER defined peak-to-trough recession dates shaded gray. SAAR. Source: BEA via ALFRED, Atlanta Fed, St. Louis Fed via FRED, IHS-Markit, Goldman Sachs, Bloomberg, and NBER.

Since the last post on 7/22, GDPNow has moved up from -1.6% on 7/19 to -1.2% on 7/27. IHS Markit is up from -2% to -1.2%. Goldman Sachs has moved up from +0.5% to +1%. Bloomberg consensus as of this morning was +0.5% (all growth rates Q/Q SAAR).

Bloomberg correctly states, based on Bloomberg consensus, “US Economy Seen Narrowly Averting Back-to-Back Contractions” (rather than “recession”, since NBER could still determine a recession started, depending on what other indicators show).

More By This Author:

The China Outlook from the WEOIMF Downgrades Growth Outlook

Nowcast Errors – Atlanta vs. St. Louis

Disclosure: None.