Fed To Hike 1/4% – Equilibrium Remains – Bears Still Embarrassingly Wrong

Jay Powell and his friends on the FOMC are going to hike interest rates by 1/4% today at 2pm. That is all but certain. Between now and then, the model of the day calls for plus or minus 0.50% in the S&P 500 and then a bigger move after 2pm. Given the strength into the meeting and the fact that the stock market sits at a fresh 52-week high, the odds and edge are somewhat muted and not worth the usual intra-day trade. However, I will add that any and all weakness post-2pm is definitely a buying opportunity for at least a quick trade.

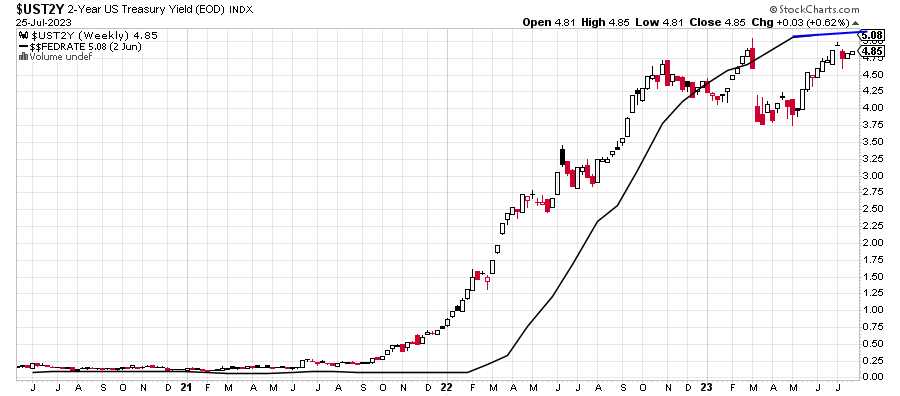

Below is a chart I share at least every 6 weeks when the Fed meets. It shows the Fed Funds Rate with the 2-Year Note. When Jay Powell and the Fed were embarrassingly wrong in 2021, you could see it in the chart below as the 2-Year led the Fed Funds higher. In Q4 2022, the 2-Year finally crossed below the Fed Funds, signaling equilibrium. And except for a few weeks in early 2023, that relationship has stayed constant.

Today, we can see that the 2-Year is only about 0.20% from the Fed Funds. That will change at 2pm when the Fed hikes rates by 0.25% and equilibrium will remain in place. I expect the 2-Year to remain at or below the Fed Funds Rate for weeks, months and longer as the economy eventually softens. Rates hikes are at the end of the cycle and we should see lots of sideways action until the 2-Year eventually begins to decline towards the beginning of the next rate cut cycle.

I couldn’t end without taking more shots at the bears. I am in a tough spot sometimes as some of my close industry friends have been bearish for over a year. And we do text, email and chat. So many of them died on the hill that the bear market absolutely could not end unless and until the S&P 500 re-tested the lows from October. You know those price levels. That’s where I called the new bull market to begin and price laughed out loud.

When the S&P 500 ignored the gloom and doom forecasts, the bears and some friends quickly pivoted to selling any and all moves to 4100. They seem to have totally forgotten a re-test of the lows. When stocks shot up to 4200 in February and did a U turn, the bears began screaming again about the bear market. Today, one of my friends was on TV patting herself on the back for abandoning her bearish position at 4250 and turning neutral. All the while stocks have been on an unimpeded run. The bears remain in deep doo doo. Chase the market now and risk it reversing right in their face. Or, sit tight and hope and pray for a global catastrophe somewhere. Not an enviable place to be.

On Monday we bought EMB. On Tuesday we sold PCY.

More By This Author:

Can Stocks Rally With The Fed Selling Billions?

Happy 9 Month Birthday To The Bull Market

Bears Tortured & Decimated

Please see HC's full disclosure here.