Sign up with:

Very good read, thanks.

Sounds liike there's some real potential here.

Nice trade.

$BBY all the way baby!

Nice find.

Only the beginning … $NVDA is gonna be 500$+++ thursday after wednesday ER thats all I know …and want to know. trade accordingly!

Agreed.

Shorts are desperate.

What rally in USD?

Thats bad for usd. Bearish

Article Comments

Latest Comments

Akari Therapeutics' Nomacopan Is A Potential Blockbuster

Very good read, thanks.

SaverOne Gains Rapid Traction With Its DDPS Solution

Sounds liike there's some real potential here.

This Snap Back Trade Could Make Your Entire Week

Nice trade.

Achieve More Income With These 3 Dividend Growth Stocks

$BBY all the way baby!

Adobe Q3 2023: Rising Sentiment And AI Innovation Signals A Prime Undervalued Stock

Nice find.

That’s Enough!

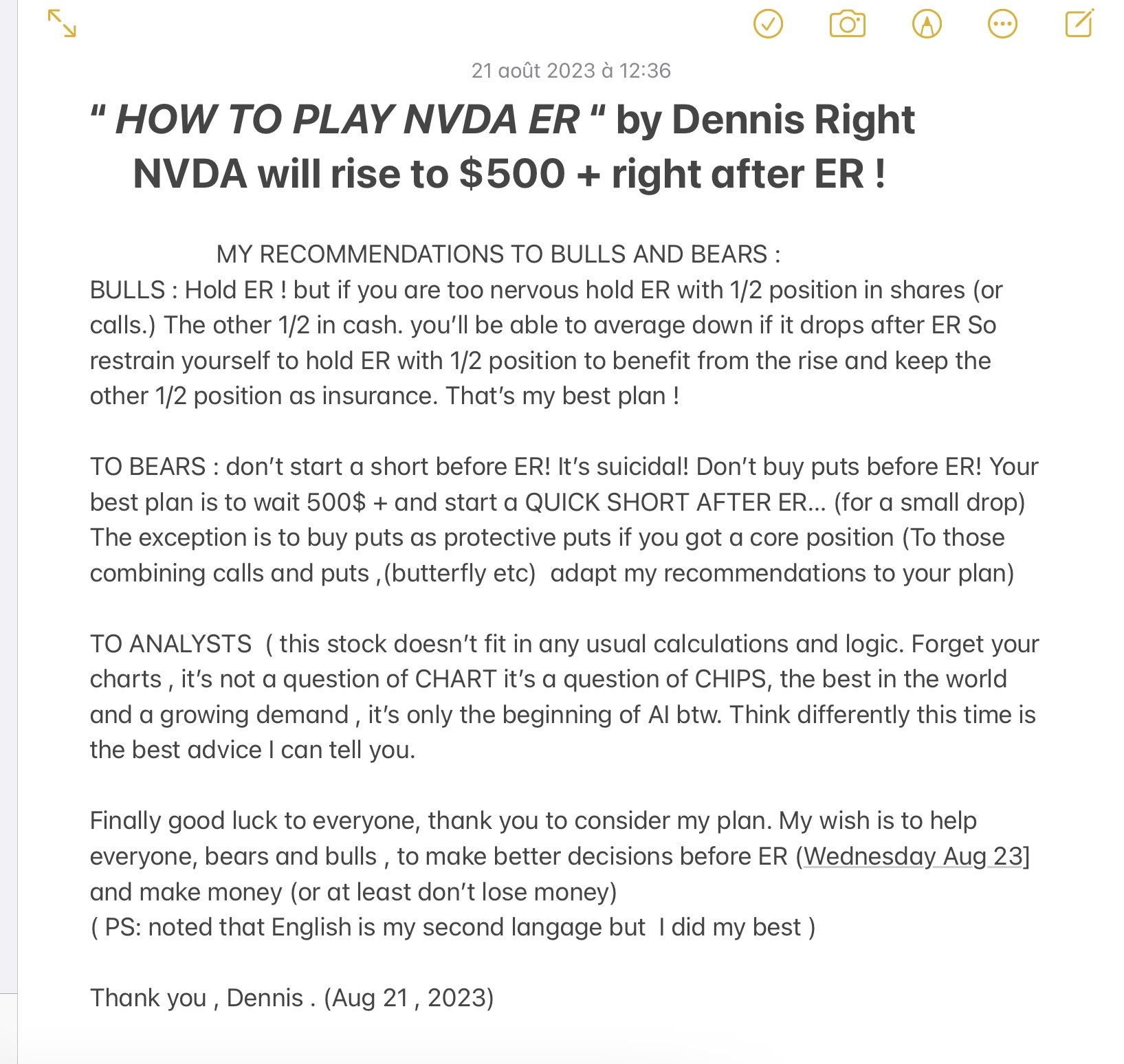

Only the beginning … $NVDA is gonna be 500$+++ thursday after wednesday ER thats all I know …and want to know. trade accordingly!

Market Briefing For Wednesday, Aug. 9

Agreed.

Canoo Stock Price Forecast: Don’t Buy The Dip As Risks Rise

Shorts are desperate.

Metals Report: The Rally In The US Dollar Is A Big Headwind

What rally in USD?

USD/JPY Climbs To Fresh 2023-High Above 136.00

Thats bad for usd. Bearish