Market Briefing For Wednesday, Aug. 9

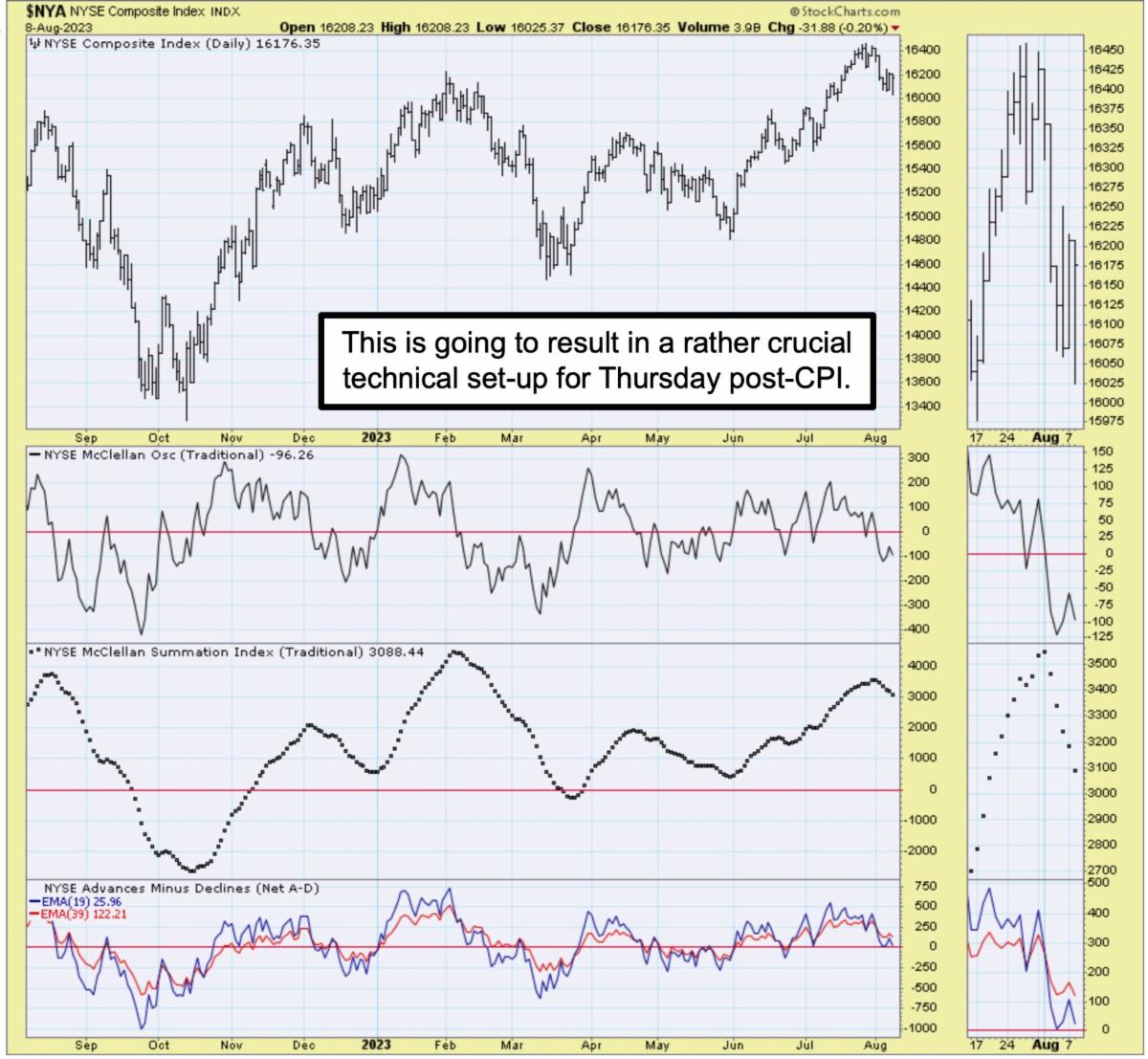

"Macro" uncertainties dominate the chatter, while everything is mostly just as it was, a market waiting for Godot, or in this case Thursday's CPI number, as it is likely to divine whether or not the Fed has an 'excuse' to be done.

We're in the camp that believes that rates are less relevant, and with Moody's downgrading 10 Banks today, it's sort of a sideswipe at Fitch, by going after a number of banks, rather than USA debt directly. I get that and suspect they're really trying to say something similar, but didn't want to 'copy-paste' Fitch.

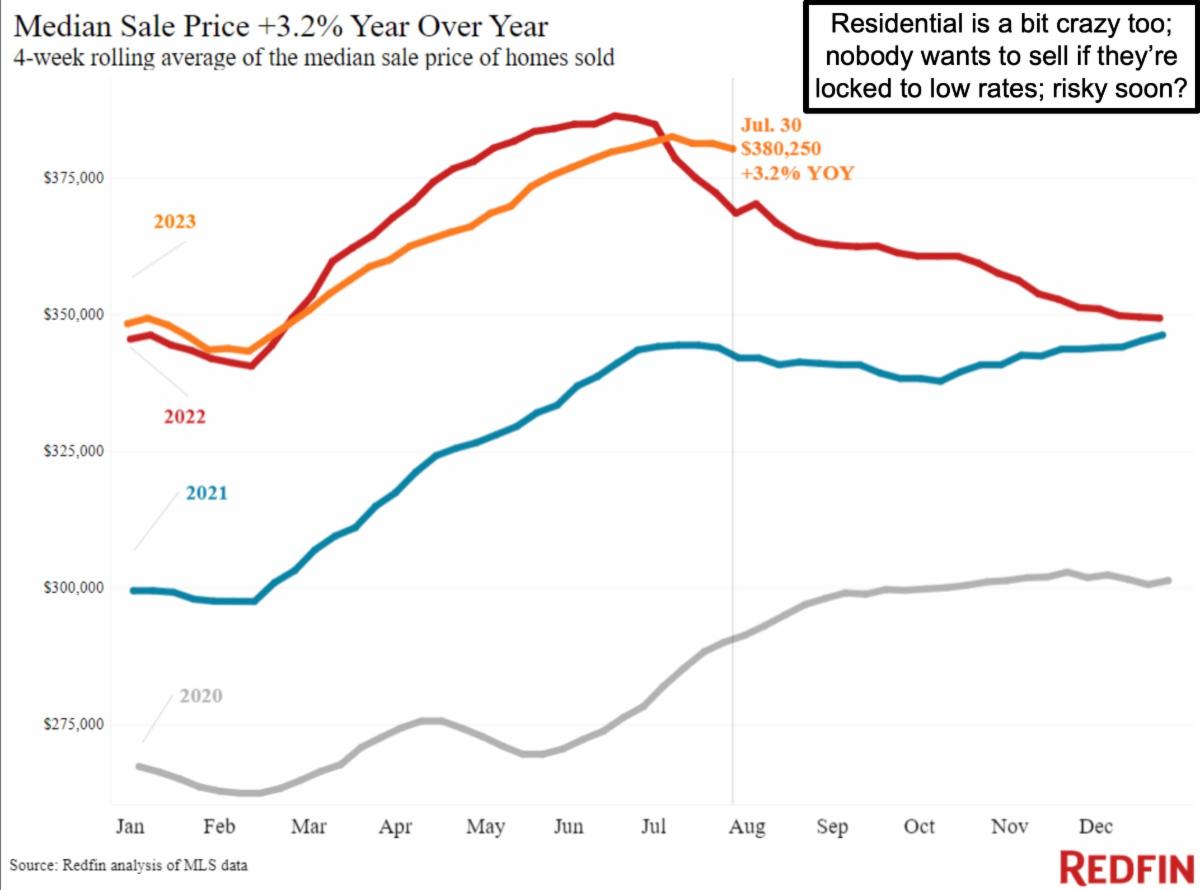

I actually think the Housing/Commercial property picture means more, prices not really easing (only in selected markets) in Homes, and way down in office space, with of course New York and San Francisco the heaviest vacancies. It is the 'delinquency and default' risk that's pending, and that's yet-another tidbit the Federal Reserve should keep in mind before getting any more bizarre.

Additionally, I suspect that a) if the Fed hiked yet-again, it would aggravate the situation beyond containment, and I think they know that (Fitch and now Moody's indirectly infer problems), and b) I suspect the Fed wants 'as much' inflation as Americans will tolerate without seriously breaking 'more' things, a suspicion related to even calling for 2% as not price stability, but much more than 3% could wreck plans including 'paying debt in depreciated Greenbacks'.

This was a day also awaiting small-cap earnings, none of which were showing profits (not expected), but none disastrous either. More on that follows below. As to the overall market, of coure there's inflation, Food & Oil prices still firm.

In-sum:

We'll get CPI on Thursday, so in the absence of more definitive news we got a swoon on the back of Moody's Bank downgrade, then struggled but did recover somewhat as the day wore on. We thought the Index would have a selloff and rebound even last night, but sure didn't know so much drama. In a sense it was anticlimactic, as discussions about bank reserves and such are pretty well known or hashed-over, and they will all mostly say are 'adequate'.

'Meanwhile' . . . it's small-cap controversy time, starting with space and AI.

First up, was BigBear.ai (BBAI) with losing money at a slower pace and while their revenue flow tends to be 'lumpy', it's not bad. Mostly it was US Army contract revenue for Q2. The bankruptcy of one of their former clients, Virgin Orbital, hurt just a bit more, and that's non-recurring.

SG&A was down 37% versus last year, and reflects their internal realignment of operations and expenses, which is what made the shares a reasonable bet. All the space, Ai, and satellite makers, have been volatile, often depressed at the same time 'critical mass' is still ahead (but visibility can be envisioned). As to BBAI, they reaffirmed guidance and that's favorable enough to hold some.

I say it that way because 'if' they obtain any dramatic large contract like before from the USAF, then it tends to move quickly. Nothing urgent, but holding this as 'gross margins' matter, but higher margin contracts are ramping-up per the CEO, Mandy Long. She spoke to new phases with significant contract growth, and seems optimistic. Diluted share count is 155 million, which isn't too huge. Small Ai with mostly military contracts, expanding and retains lots of potential, with contracts back in-line and she says rigorous operating efficiencies. At the end a reference to Generative Ai, and that is probably an add-on for them.

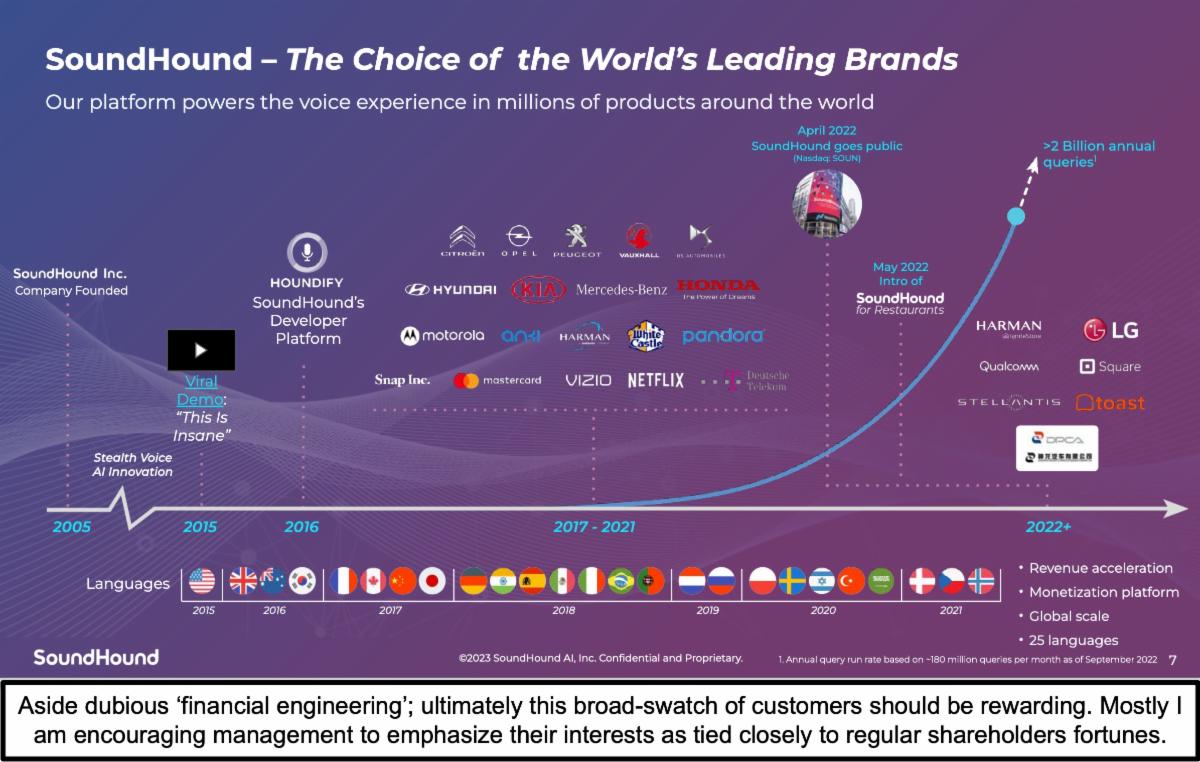

Next up is SoundHound (SOUN), which also performed better on key metric, and was very optimistic about the future. It's hard to say if our interest is very long-term or better put, probably is if SOUN remains on track without confusions. So the Second Quarter Revenue increased 42%, adjusted EBITDA Improved 50%, a strong cash position increase plus Generative AI 'Foundation Model' growth. It is notable that they didn't discuss legacy ownership structure, but did mention that the 'Shelf Offering' does 'not' mean they have to generate funds that way, but that they can if they need to. That was my point about prior overreaction.

One more small-cap comes in the morning, that's BlackSky Technologies (BKSY). I also expect a bit of upside in SOUN, especially if greedy short-sellers depart (there's around 17 million shares short at last month's end, probably more).

Bottom-line:

S&P remains on-hold, small-caps are ok if not terribly exciting (no one expects much in August/September, but individual company news can enliven things), and CPI is pending Thursday. The process continues.

More By This Author:

Market Briefing For Tuesday, Aug. 8

Market Briefing For Monday, Aug. 7

Market Briefing For Wednesday, August 2

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more

thumbs up as always.

Agreed.