Market Briefing For Monday, Aug. 7

Discipline matters - in this kind of an alternating market, with corrections for the most part rotating in various stocks and sectors and even on a daily basis.

Of course Amazon up and Apple down (and then rebounding) typify this.

One common view among analysts is that yields will stay high (and the Fed of course do nothing) so long as the U.S. does not enter a recession. I dispute it in some ways; foremost because most inflation isn't about monetary policy as well as the climate extreme implications that I've often addressed.

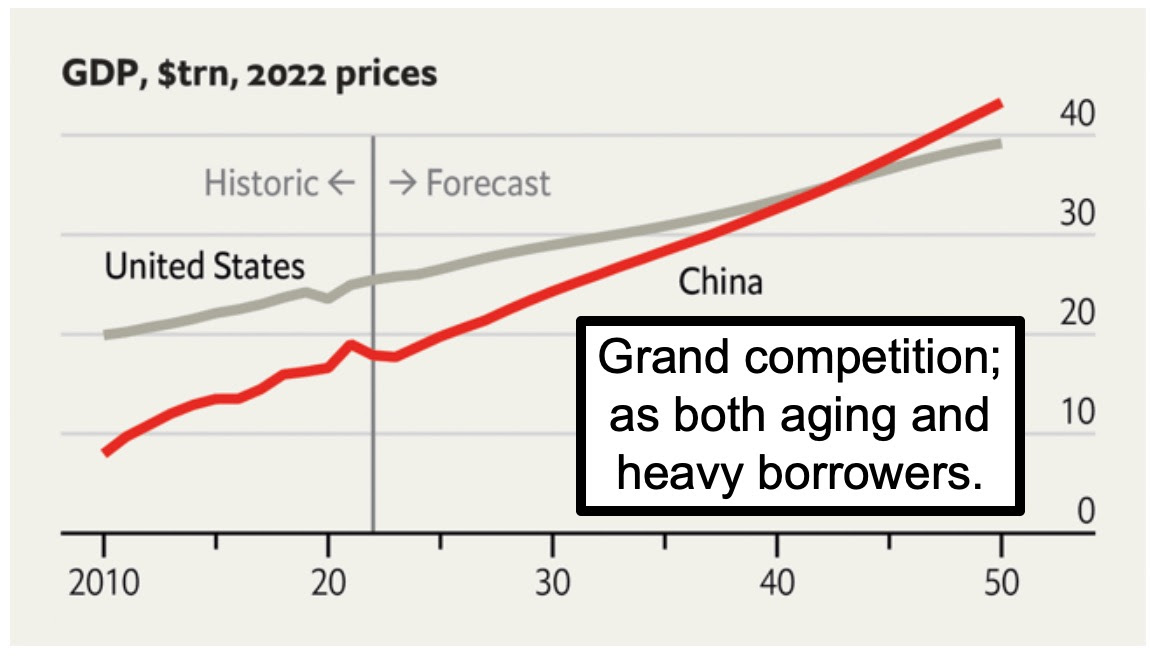

Inflation will be more likely to diminish where it can organically, and stocks will meander in an environment that's more likely to adjust to a ~3% inflation rate. Equity markets should be concerned about China committing to fund growth in a 'better path' to recovery; including supporting their securities industry that few financial media have noted they just announced.

Increased Chinese Oil demand would result, and combine Saudi's production cuts remaining into September, and you have firm Oil for now throttling some consumer spending in the U.S., where average people most conserve since it is necessary to spend money on fuel. Less so in Europe, more reliant on fast trains and urban transit, which are really non-existent in most of the U.S., and fairly dangerous to use for decent people outside of normal rush hour traffic.

Anyway China stimulus is helping tech stocks there and more stimulus will be revealed in the Fall, probably well after most key techs make their low points. Alibaba and Baidu will probably hold; then do better; but we don't invest any money in high-priced stocks already advanced; and especially not Chinese.

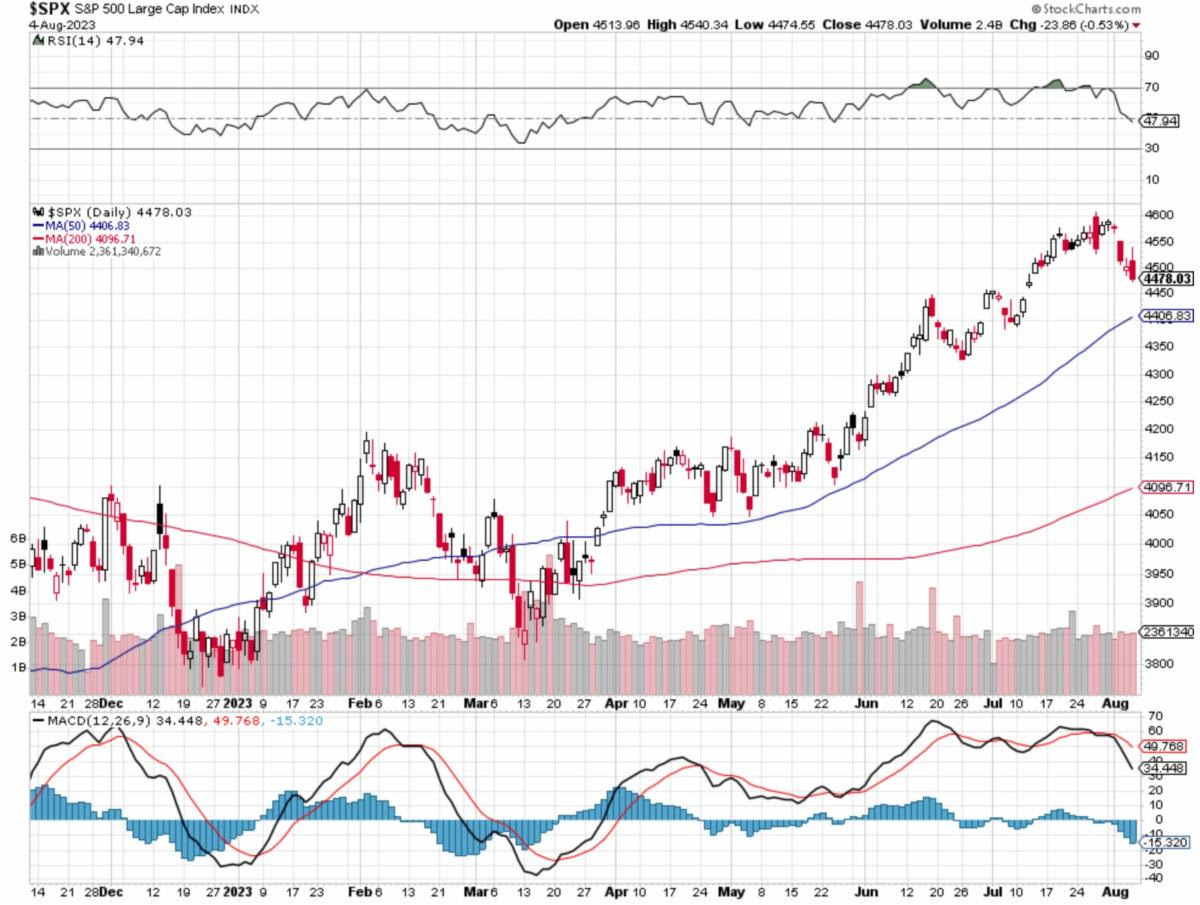

With Apple sort of neutralized for the moment; market action relies on Banks, and even more so Oil and Semiconductors, to sustain a relatively high level in the Indexes, even as they rotate (internal correction if you prefer that term) for the coming weeks. On-tap next week are a few smaller-cap speculations; none of which will probably be profitable, but some will have better guidance.

We might have hit 'peak bearishness' this week; especially in Treasuries for a few reasons you know. I don't know that translates into going the other way as yet; probably premature. But basically nearer the end of that phase. Making a bullish bet (like TLT Calls) would be the opposite of a certain hedge manager I don't want to name again; but he was wrong in late March 2020; so we'll see.

I realize the 'trend is still higher for yields; but I suspect a breakout to a higher yield level would be a 'fakeout breakout'; and set-up playing for a shift... there are factors to delay this a bit; but 'if' the CPI is soft (not sure it can be); then it works in the near-term. Keep in mind Oil & Food were higher during this time; so that's an indication of bigger inversion, before it begins going 'other ways'.

In sum: market did revive Friday, as we suspected Thursday was possible. It is important that some American mega-caps, like Apple or Tesla, are moving somewhat to offshore (and re-shoring) production; to minimize China impacts. I'm not thrilled about either (the former owned since 57 split-adjusted, and the latter we indirectly play by virtue of AEHR, which tests all ON Silicon Carbide wafers among others, and ON and ST Micro provided those 'to' Tesla etc.

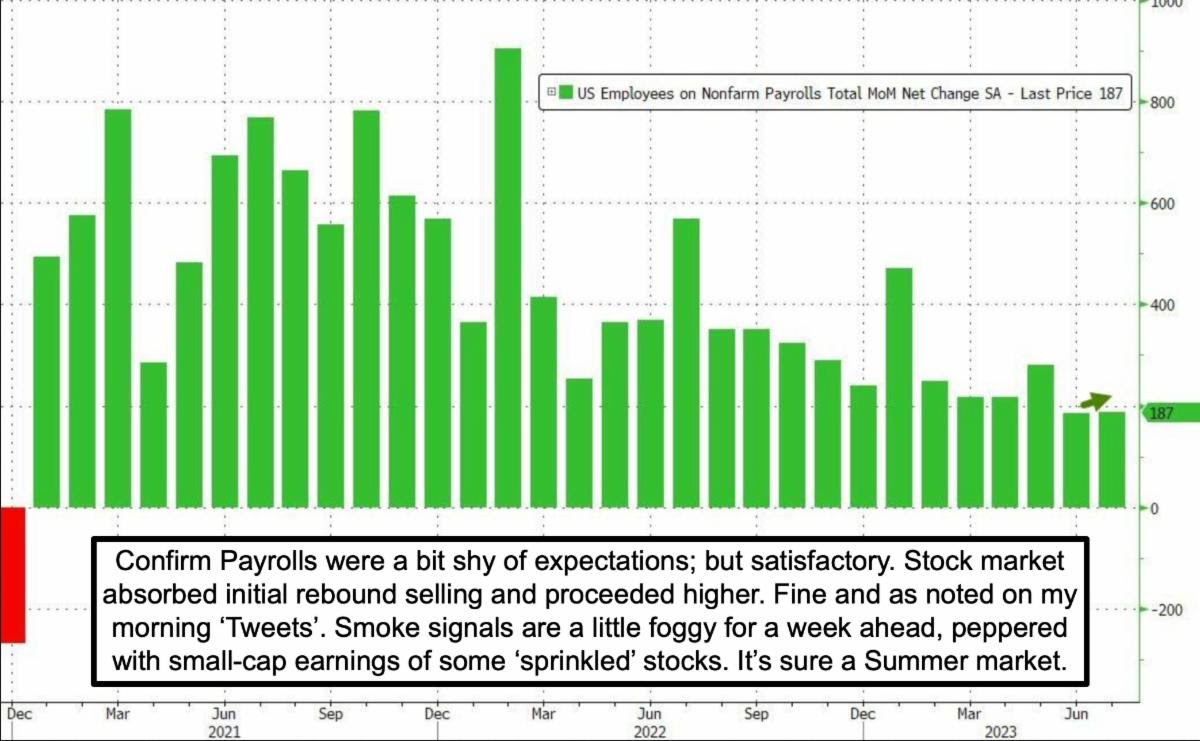

Next week we get CPI, but before that some small-caps report; where their guidance is far more relevant than the preceding Q2 results. S&P remains on the heavy side; and the upcoming 'peace talks' about Russia/Ukraine in of all places Saudi Arabia, will be closely monitored (if nothing else for a grain deal, as the Saudis and most in Africa depend on Black Sea grain shipments).

Right now is basically more about Apple than anything else. Down 9; takes Berkshire Hathaway (BRK-B) down 4; and Apple 'is' the key to the S&P. It's also an inordinate heavy part (allocation) within Warren Buffet's holdings; at the same time as it's been his best investment (we liked it too; years ago..). (I wonder if Warren plays Bridge now with Tim Cook instead of Bill Gates. At this point you'd think it might be Gin Rummy instead.)

Need to be 'just realistic' in this August climate; even though we do believe it is important to focus on the small-and-mid cap stocks that aren't participating, and in some cases have barely recovered from last year's 'crash' that analysts mostly don't yet acknowledge. My view has been you can't crash the crashed.

Of course you can erode the 'already crashed'; but that won't tell you 2024's outcome, which could well be favorable almost regardless of this seasonally typical period of doldrums, correction and boredom; depending on sectors.

What's the next catalyst? Don't need one; although could help or hurt. So long as the economy is fairly strong; the Fed won't back off much and they'll fail to recognize the primary contributors to inflation. But if there is a major calamity, or peace breaks out; you'll get a substantial reaction in markets.

Meanwhile most strategists proclaim this as just 'whistling past the graveyard' for the S&P, when in actuality, the Senior Index is juxtapositioned to the broad market, which is nowhere near extended as a cursory glance at charts infers. But this is a seasonal and yield-based market; hence realizing that high Oil is impacting high Foods; might be an impediment to a softer CPI; but also higher Fuel & Food prices slow consumer spending, so that dings the inflation pace.

Meanwhile . . . lots of small companies with reports in the next two weeks. In most cases, it's not about 'earnings' or profits, but about guidance that newer shareholders who've been bottom-fishing will be eagerly and nervously awaiting.

Bottom line: the coming week will be turbulent, and potentially exciting. From a macro sense the CPI will be 'very' important and determine things like 'TLT' swings. For us, we'll be following several small-cap Q2 Conference Calls. The S&P can meander and clearly respond to the CPI not the small-cap moves.

More By This Author:

Market Briefing For Wednesday, August 2

Market Briefing For Tuesday, August 1

Market Briefing For Monday, July 31 '23

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can follow Gene on Twitter more